Crypto down! Silver up?

We think a growing forward trend is a combination of pressure on crypto currencies, particularly Bitcoin (Ethereum has software applications that work and becoming more popular so isn’t just a one trick pony like Bitcoin) with some of that flowing into precious metals, particularly silver.

Why? If in fact there has been crypto currency substitution for precious metals to some non quantifiable and therefore non verifiable extent, then that certainly allows for reverse substitution on a crypto drawdown in a similar scale. There have been three 70% crashes in crypto. As Aristotle said in his Metaphysics, “If it happened before, it can happen again.”

So surely if something has happened three times, it can happen a fourth time. If crypto represents a flight from fiat currency, then a move out of crypto should lead into the ultimate non fiat currency: gold (and gold’s playmate, silver).

Remember! Gold and silver are not substitutes for fiat currencies. Fiat currencies are substitutes for gold and silver. As readers know, we like precious metals and we like copper. Palladium made a new high the other day. Between deficit spending, upcoming yield curve control, opening up of the economy, and the U.S. infrastructure spend, inflation havens should work, to gold and silver’s benefit.

Furthermore, because of electric vehicle and solar panel production growth, silver has additional demand drivers that should push it to new recovery highs. So, now we see an additional reason to play long precious metals: a potential kick in the pants for Bitcoin.

SLV Silver is breaking out to the upside. SLV broke above the 50 day moving average on 163% average volume on Wednesday…

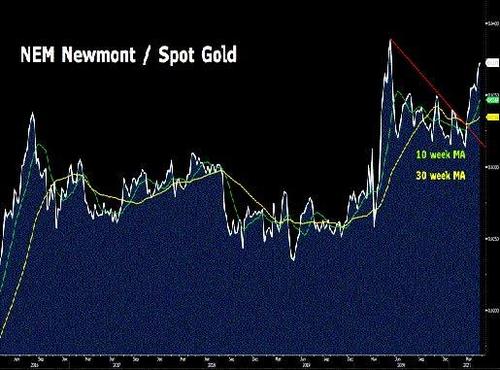

After peaking in early June (shortly before gold peak), the ratio of Newmont to gold is breaking out to the upside. Gold miner out-performance is a sign of a healthy precious metal bull market.

Source: ZeroHedge BanksterCrime

![]()

“Red Flags Galore”: Companies Sold A Mindblowing $113 Billion In Stock In Q2

When it comes to bearish market flow red flags, aggressive selling of stock by corporate insiders is traditionally viewed as the biggest red flag –…

Read More