Even before the coronavirus sprang upon an unprepared China the credit cycle was tipping the world into recession. The coronavirus makes an existing situation immeasurably worse, shutting down China and disrupting global supply chains to the point where large swathes of global production simply cease.

The crisis is likely to be a wake-up call for complacent investors, who are content to buy benchmark bonds issued by bankrupt governments at wildly excessive prices. A recession turned by the coronavirus into a fathomless slump will lead to a synchronized explosion of debt issuance for which there are no genuine buyers and can only be monetized.

The adjustment to reality will be catastrophic for government finances, and their currencies. This article explains why the collapse in overpriced financial assets and fiat currencies is likely to be rapid, perhaps giving ordinary people in some jurisdictions an early prospect of a return to gold and silver as circulating money.

My last article suggested that both financial assets and currencies would collapse together. the basis of this supposition is twofold: first, central bank policies are binding together the rise in financial assets with the maintenance of value in fiat currencies. Therefore, if one falls, they both fall. And secondly, there is historical precedent for this when one examines The Mississippi bubble 300 years ago.

The timing for such a collapse appears to be imminent. Every day, more and more data confirm that the global economy is sliding into recession. So far, people have been ignoring this important development, but now that it is becoming hard to ignore, no doubt the coronavirus will be blamed. This is a mistake because of the factors leading to a slump, principally the end of the expansionary credit cycle combining with trade protectionism against Chinese imports by President Trump, echo developments leading up to the Wall Street crash in October 1929. If that point is accepted, then clearly the world could be on the edge of a very deep slump exacerbated but not caused by the virus.

The coronavirus has all but closed down China’s economy. It threatens to become a pandemic with serious consequences for all other national economies and their fiat currencies.

The central issue flowing from the upcoming monetary crisis centers on the rating of government debt. Almost all welfare-driven states are in debt traps. They think price inflation is under control, because their colleagues in the statistics departments tell them so, allowing them to continue to run increasing budget deficits with apparent impunity. Central banks do not realize that very soon they will be the only buyers of their governments’ debt which they will pay for with newly minted money. The irony of repeating the mistakes of Germany’s Reichsbank in 1918-23 will be completely lost to them and the path of escalating failure will only encourage the pace of printing to be accelerated.

The latest bombshell, coronavirus, is a trigger perhaps for the markets to regain control from the statist price riggers. This has to be the first step to fixing broken economies. The Panglossian in the ranks of the banking and investment communities will be rudely awakened to find themselves staring down the barrel of economic reality. Only then is there a chance that neo-Keynesian lies will be discarded by one and all, and a retreat towards sound money commences.

There is unlikely to be much time. Even without the downhill kick of coronavirus a bear market in bonds could be a devastating event on its own in a period of less than a year. Inflation of fiat currencies and interest rate suppression have been the principal agents for ramping bond prices, which tells us that their collapse will undermine currencies as well, giving complacent investors a double hit. But what are we to measure a decline of fiat currencies against? Sound money, of course, gold and silver, with other stores of value, such as bitcoin, favored by tech-savvy millennials, who will be quick to observe and understand the debauchment of fiat money. And the sooner we throw out fiat currencies, the sooner we can revert to sound money, which is gold.

Changing values for government bonds

We shall take as our primary example the US bond market because fiat currency fans believe that other than individual time-values it is the risk-free investment yardstick. The ten-year US Treasury bond yields less than 1.6%, but its future pricing raises some serious issues.

Before addressing risk, we should note that time preference theory tells us that possession of cash is always worth more than its non-possession. The discount of that future value is not significant if you part with it to buy a ten-year UST with a view to trading it out in the next few days. But if you buy it with a view to holding it as an investment, then its discounted future value does become relevant. We cannot know what this time preference is, because it can only be realized in an unfettered market, not a market manipulated by the Fed’s actions. But with history as our guide, an annualized discounted value of about two percent for a 10-year bond can be used as a rough guide.

Figure 1, which is a long-term chart of the yield on this bond, appears to indicate there is a solid floor in the region of 1.4% represented by the horizontal line joining points at July 2012, July 2016 and August 2019. This floor is about half a percent less than our estimated time preference value.

With its yield currently 1.56%, there appears to be very little upside in the price, and we can understand why. And if we accept government estimates of CPI-U all items index rising at 2.5% (year to January) the yield should be closer to 4% and must therefore be heavily suppressed at current levels.

That is not all. While the general level of prices is an economic concept, it is not measurable; a fact which allows the Bureau of Labour Statistics, along with all other nations who use “standardized” CPIs to effectively goal-seek an official figure for its rate of change. Two independent analysts, Chapwood Index, and Shadowstats confirm each other that a more realistic rate for monetary depreciation of the US dollar is not 2%, but about 10% annually.

But for the moment, investors believe the price inflation lie because they want to. When they begin to realize the official rate is pure fiction, then one would expect government bonds to reflect a far higher redemption yield. In other words, any upside in bond prices is strictly limited while the downside is substantial. As an illustration, a 10-year bond at the current yield would have to fall from par to $47.40 to yield a more realistic gross 10% to redemption.

Clearly, the US Treasury market is badly mispriced. To estimate the likelihood of the Fed losing control of bond pricing, we should also take into account the state of the US Government’s finances, because we have not yet incorporated future currency debasement risks in our calculations. With a starting budget deficit in the current fiscal year estimated by the Congressional Budget Office at $1,027bn, a recession, let alone a slump, will make government finances considerably worse. For the years 2020-2022, the CBO expects real GDP to grow at an average 2% per annum. In the very near future, due to the coronavirus alone that is likely to be revised sharply downwards, if not by the CBO, but by market participants as further evidence of a looming slump becomes too hard to ignore.

All we need to know for now is the revision of economic prospects will be significant, based on recent evidence of recessionary trends and the potential impact of the coronavirus. The current stage of the credit cycle indicates the banks are in the process of withdrawing circulating credit, hitting SMEs particularly hard. Unemployment will rise, along with bankruptcies. And this assumes little or nothing for the effect of coronavirus.

But even if coronavirus is contained to China and East Asia, US corporations’ supply chains will cease to function, requiring both time and bank credit to relocate. Neither are available in the short term and in the current credit climate. And this is an election year, when any president’s financial and economic prudence are at their lowest ebb and his administration is most inclined to throw money at any and all economic problems.

Without a recession, other things being equal to the CBO’s forecasting assumptions and the effect on government debt outstanding might be taken to be credible by gullible investors. But expressed in the economist’s jargon, not all else is equal and we can already see why these forecasts are going horribly wrong. The question then is what the effect on markets will be when these errors are realized and prices for financial assets are adjusted for reality.

The adjustment will follow the current period of complacency. US Treasury bond prices have recently risen, partly on a safe-haven basis, but certainly with an enduring belief in the state’s economic management. Equities are at or close to all-time highs on a relative value to bond yields argument, and an expectation that any recession will be shallow. Further monetary easing is expected to support the economy and maintaining the long-term prospect of a resumption to decent economic growth. Further monetary easing is seen to be bullish.

Concerns about the dollar are broadly absent. There is embedded in investor psychology Part One of Triffin’s dilemma, that concludes otherwise irresponsible fiscal policies will allow the provider of the world’s reserve currency to run deficits to increase its supply to foreigners, always hungry for scarce dollars, which they reinvest in US Treasuries. And if there is a recession, the argument goes, then there will always be a further flight to the safety of dollars and US Treasuries.

Part Two of Triffin’s dilemma ends in crisis, which broadly is what we now face. Investors are yet to take note.

Putting the effects of the coronavirus to one side for the moment, in their private capacity businessmen and their bankers are usually the first to see that economic optimism is misplaced. Businessmen are battling in deteriorating trading conditions, and bankers with their internal market intelligence and its impact on risk assessment. The authorities, particularly the Fed, who have made the mistake of believing in their own statistics, and of falling hook, line and sinker for Keynesian stimulation theories, will be next.

One can envisage the setup: having seen from its own internal information the economy is not performing as hoped, the Fed decides to call in the management of the G-SIB banks to hear their concerns, gather intelligence and reassure them they are on the case. Afterward, we can imagine the following conversation:

Banker A. “Well, what did you make of that?”

Banker B. “The Fed must be worried to feel the need to reassure us. Things must be worse than we thought.”

Bankers A & B. (Thinking) I’ll report back to my Board that the Fed is very worried, and we must urgently reduce our loan book before our competitors do.

It has happened before. None of this would occur in an economy which is based on sound money and free markets, only susceptible to one-off disasters, such as war and the coronavirus. Instead, the US economy is managed on the basis of maintaining the crumbling confidence of consumers and the uninterrupted provision to them of credit. After many years of being bailed out, economic actors have become fully dependent on confidence being maintained and have no alternative plan in the case of its failure. But failure is now becoming evident.

The central question therefore devolves upon the future credit rating of the US Government. Assuming the Fed is losing control of the overall monetary situation and pricing returns to being set by markets, how do you rate a very large borrower with the following credit profile:

- No surplus of income over expenses since 2001. Current trend is for further deterioration with no end in sight.

- The net present value of future liabilities mandated by law is independently estimated (Kotlikoff) to be over $200 trillion. Current income (taxes etc.) of $3.6 trillion gives a ratio of income to future expense of well over 50 times. Tax income will almost certainly decline to raise this ratio further.

- Net interest cost at unrealistically low-interest rates is 38% of last year’s deficit. A more realistic interest rate could have an immediate and catastrophic effect on finances.

- Management seems unjustifiably optimistic that future revenue will pick up.

In the absence of management that agrees to radically alter course, there can only be one answer: do not lend it any money and eliminate all existing exposure. When they wake up, this should, and therefore will be, the reality facing not just the banks but all holders of US Treasuries, including foreigners without sound reasons to be invested in them.

Consequently, the switch from the current state of suppressive control to realistic pricing of government debt will be both vicious and rapid. The only foreigners likely to delay selling existing US Government debt are some governments, either under the US Government’s cosh, or not wishing to exacerbate the situation. With cross-border trade collapsing, others have no good reason to hold dollars and dollar-denominated debt, let alone extend their exposure. Furthermore, in recent years large hedge funds have made hay out of being short euros and yen and long dollars and US Treasury debt through fx swaps. Those trillion-dollar positions need to be unwound as well, which will put additional pressure on the dollar and the bond markets.

At anything close to these yields, the only buyer will be the Fed, which, as well as new issuance will have to absorb foreign sales and those of distressed hedge funds. For these reasons the monetization of debt will almost certainly have to be on a far larger scale than following the Lehman crisis. There is no price for government debt in these circumstances, because the higher the interest rate, the worse the numbers become. Nor will there be any value in the currency used to buy it, because if the government is effectively bust its unbacked currency will also be worthless.

Other governments with substantial future welfare commitments are in a similar position. High debt to GDP ratios will become a debt trap on a combination of recession-fuelled budget deficits and realistic funding costs. In the EU and Japan, government funding costs have even further to travel from under the zero bound.

Meanwhile, there is an air of complacency with a general assumption that the next crisis will lead to yet lower rates, as has been the case with every credit crisis for the last forty years. But as Figure 1, the chart of the ten-year US Treasury above clearly showed, after a long decline in yields the world’s reserve currency benchmark yield is now struggling to go any lower. Zero or even negative dollar rates imposed by the Fed cannot alter that fact.

This is important because central banks have tried everything that they can think of to restore economic growth and have run out of ideas. Led by the Bank for International Settlements, they are now pleading with their governments to borrow more while rates are cheap in the hope that greater budget deficits will stop the world from sliding into recession.

Other central banks are in the same boat

The debt devil tempts, and the weak follow, and debtor hell is the highest reward he can offer. The response by all G20 members to a sliding global economy will obviously be a BIS sanctioned coordinated burst of deficit spending leading to a synchronized expansion of government bond supply and fiat money to pay for it. It is proving impossible, even for a free trader like Boris Johnson, to resist the political imperative to build new hospitals, train thousands of new nurses and policemen and throw money at a new, wildly over-budget railway connecting the North of England to London. Which, incidentally, will probably empty the North of northerners seeking their fortunes in London, instead of spreading London’s wealth northwards. Most of this spending is classified as investment, but the fact is that without a commensurate increase in personal savings it is inflationary spending.

Perhaps the dollar will not be the first to slide, given the shutting down of China’s economy by the coronavirus. The yuan, surely, will be the first to suffer in the foreign exchanges, a process that appears to be starting. But this might galvanize the People’s Bank into positive action to stabilize the currency, which it can do by tying it to gold. In doing so, it would do humanity a favor by leading the way early towards a sound money solution to the unfolding financial and economic crisis, which with the coronavirus threatens to be potentially much worse than anything recorded in modern times.

The reason the dollar is likely to be next to slide is the exposure foreigners have to it, the equivalent of more than one year’s GDP. It is comprised of about $4 trillion in bank deposits, and $19.4 trillion of US securities, according to the last available TIC figures.

For the short-term, perhaps China’s imploding economy, taking Germany’s and others with it, encourages the investor’s myth that the dollar is a safe haven. The trade-weighted index has strengthened in recent weeks on the back of both the yuan and euro weakening, and US Treasury yields have declined as well. It is a situation unlikely to survive deteriorating economic conditions for much longer.

In addition to foreign sellers, speculative positions of perhaps several trillion dollars in currency swaps held by large hedge funds will have to be reversed if and when the dollar is undermined by foreign selling. That would lead to temporary buying of euros and yen. When that short-term effect is over, presumably these currencies will then suffer the combination of collapsing values for government bonds and stockmarket values at the same time as the currencies themselves fall measured against gold, silver, and bitcoin.

Sound money alternatives signal the fiat crisis

An unfolding crisis from the combined effects of the turn of the credit cycle and the coronavirus can be expected to hit individual fiat currencies both sequentially and generally. This article has made some suggestions over a likely sequence: yuan, dollar, euro, and yen. But how things actually unfold is for the moment a matter of speculation. From the turmoil ahead of us, the clear winners are likely to be gold and silver, and supply-constrained hedges such as bitcoin.

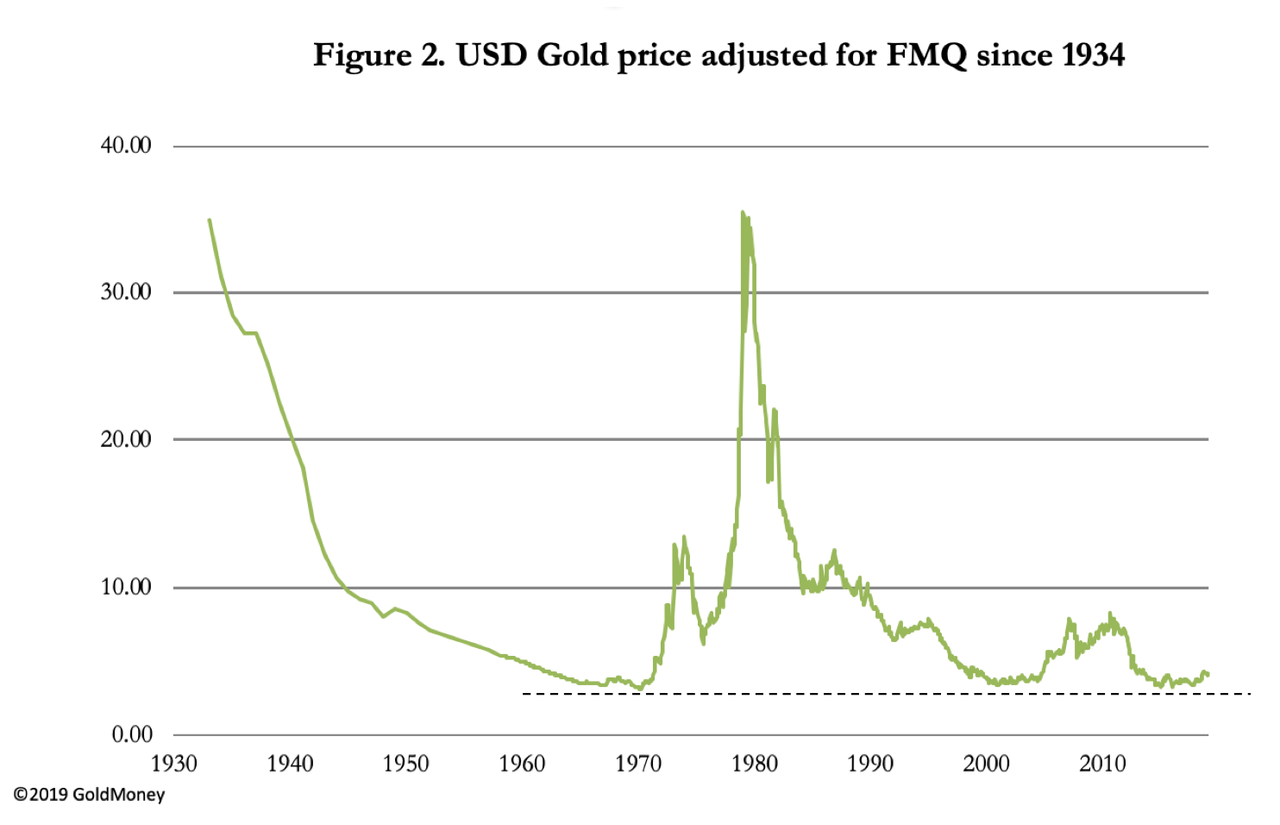

In real terms, gold is still underpriced relative to the dollar, based on their relative quantities. This is illustrated in Figure 2, which is of gold adjusted by the increase in the fiat money quantity.

This chart should contradict any thoughts that the recent increase in the price of gold might be overdone. The truth is that the devastating bear market in the gold price following the spike in 1980 has almost eliminated gold from investment portfolios in favor of inflation beneficiaries. If that long period is coming to an end, investors will attempt to switch their allocations from inflation beneficiaries and bonds with rising yields in favor of inflation protection. For this reason, the rise in the dollar gold price could be very dramatic, particularly when a further acceleration of global monetary debasement is taken into account. And this is before we see official CPI measures move much above their 2% goal-sought targets.

For both gold and silver, we can expect initial moves reflecting their eventual replacement of failing fiat as the trusted money in circulation. In the case of silver, it is worth mentioning that its original price relationship under bimetallic standards only become discarded when silver was generally dropped as money in favor of gold alone in the 1870s. When fiat fails, it is likely that silver will regain a secondary monetary role, and its remonetization will have a substantial impact on its purchasing power. From a current gold/silver ratio of 87 times, a move towards the old ratio of approximately 15 times means that for speculators buying into the sound money argument, silver is likely to be the catch-up form of sound money.

Bitcoin

During previous currency hiatuses, the problem of failing fiat money has always been evidenced in the rising prices of precious metals. Since the last financial crisis, there has arisen a new category of the store of value in thousands of different cryptocurrencies. While most of them appear to be akin to quack monetary remedies, the first cryptocurrency to be devised with its innovative blockchain technology is sufficiently understood by a growing band of followers to be firmly established as a form of money.

Bitcoin is currently not ideally suited as a means of settling transactions, or for making value comparisons between one good against another. Settlements are severely restricted relative to the superior scalability offered by credit and debit cards. Where bitcoin scores are as a store of value.

In learning about bitcoin and why it works, a new generation of tech-savvy millennials has become aware of the way their governments debauch their currencies as a means of secretly transferring wealth from them as individuals to the state, the banks, and their favored borrowers. Bitcoin supporters are an intelligent, educated mob angry at their governments’ abuse of their fiat currencies.

In all populations, there is, therefore, marginally greater recognition of the fragility of state currencies, and therefore the abandonment of them by the general public is likely to develop over a shorter time period than the experience of previous instances would suggest.

Conclusion

The straws in the wind listed in this article point to a more rapid collapse of financial asset values and currencies than generally thought by sound money theorists who have long anticipated this outcome. Doubts about the timing have been settled to a degree by the sudden development of the coronavirus, which has already imploded China’s economy, disrupting global supply chains and the provision of consumer goods.

To the extent, the coronavirus has had a hand in the forthcoming destruction of fiat currencies and Keynesian mythology, we can take some comfort that it will have brought forward the eventual reintroduction of gold and gold standards. The path is not straightforward. There will be the destruction of financial asset values and the economic consequences for ordinary people will be dire. We can expect widespread civil unrest and political instability.

Western governments and their advisers are not familiar with the arguments in favor of gold, having spent half a century dismissing it. This fact favors the new economies which have not discarded gold, which include Russia, China, and many other Asian nations. Some governments, such as India, might attempt to confiscate their citizens’ gold, but in general, the collapse of western economic fallacies could lead to Asia’s economic superiority.

It will be a rough ride for the rest of us.

StevieRay Hansen

Editor, Bankster Crime

“debtors are hostage to their creditors.”

MY MISSION IS NOT TO CONVINCE YOU, ONLY TO INFORM YOU…

The Birth Pains Are Growing Stronger….

“Unless God has raised you up for this very thing, you will be worn out by the opposition of man and devils”…

My name is Steve Meyers and I need to share a vision and warning that the Lord showed me back in April 2007….

Many of you will ask why I waited so long to share the warning. I didn’t. I shared the story with everyone that would listen from pastors to friends to family to colleagues. Immediately following the initial vision, I called a close friend. I told him to sit down that I had something to tell him. I needed it documented as I knew this was supernatural and from God. As I witness events unfolding today, I need to share the vision again.

The risk of loss in trading futures and options on futures can be substantial. The author does not guarantee the accuracy of the above information, although it is believed that the sources are reliable and the information accurate. The author assumes no liability or responsibility for direct or indirect, special, consequential or incidental damages or for any other damages relating or arising out of any action taken as a result of any information or advice contained in this commentary. The author disclaims any express or implied liability or responsibility for any action taken, which is solely at the liability and responsibility of the user. Steve Meyers, StevieRay Hansen

People’s hearts are troubled, their minds are in a state of confusion, the Bible tells us a time of great delusion that will come upon the people, that time has arrived, the politicians must come up with more significant and more believable lies in order to bring on the antichrist, we have entered the doorstep Tribulation.

“Unless God has raised you up for this very thing, you will be worn out by the opposition of man and devils”…

Bitcoin, CoronaVirus, GOLD, Fraud, Banks, Money, Corruption, Bankers, Powerful Politicians, Businessmen, gold, silver

![]()