The US stock market continued its freefall last Friday. The Dow lost another 357 points to finish off the worst week since 2008. One would expect a save-haven like gold to thrive in the midst of the massive stock selloff, but it had a bad day on Friday as well crashing through the $1,600 mark and plummeting as low as $1,568.

Gold rebounded Monday and was trading back above $1,600, but how do we make sense of its precipitous plunge? Has gold failed as a safe-haven?

The short answer is no.

The safe-haven bid is there, as evidenced by the rebound on Monday. But as with everything in the economy, there are multiple dynamics driving the gold market.

In the first place, some analysts believe the coronavirus scare is causing a bit of a tug-o-war on gold. On the one hand, we have the expected safe-haven buying. But fear of a sharp economic downturn also raises concern that consumer demand for gold could drop, particularly in big jewelry markets such as India and China. Worry that a longterm economic slowdown could hit consumers in these countries particularly hard could be putting some downward demand pressure on gold. China and India rank as the first and second biggest gold consuming countries in the world and account for about 1,000 tons per year.

But there is a more fundamental reason we saw a big gold sell-off as stock markets crashed, and it is not a good sign for the overall state of the market.

In a nutshell – panic.

Traders and investors were scrambling to liquidate assets to raise capital for margin calls. In other words, they were selling gold to keep afloat. As one analyst told MarketWatch, “Investors are selling anything with a bid and running for cover, and that includes typical hedges like gold.”

We’ve seen this same thing happen before – in the early stages of the 2008 crash. As the MarketWatch article pointed out, there was a rash of gold-selling as the stock market began to tank in ’08.

Once investors understood and appreciated the scope of central bank stimulus coming down the pike, they began buying gold.”

From there, the price of the yellow metal more than doubled.

In a note to clients, RBC Capital Markets reiterated that investors were “cashing out to cover losses and meet margin calls in other markets.”

We do not view this as a loss in faith in gold’s role as a ‘perceived safe haven’ or a fundamental shift in the attitude toward gold.”

More central bank easing is almost certainly in the cards. CME Group’s FedWatch translates Fed funds futures pricing into traders’ monetary policy expectations. As of Friday morning, it was pricing in a 72% chance of a quarter-point rate cut at the Fed’s March meeting, and better than even odds of two more such rate cuts by the end of July. And futures are beginning to point to an even bigger 50 basis-point cut in March.

Federal Reserve Chairman Jerome Powell up expectations with an unusual move Friday, releasing a note saying the central bank will “act as appropriate” to support the economy, raising expectations we could see another cut as early as the March meeting. The Bank of Japan also issued a statement saying it will “strive to provide ample liquidity.”

As Peter Schiff said during an interview on Fox Business last week, gold is in the most “unloved bull market ever.”

We’ve been climbing this wall of worry, so I think too many people look to take profits. They really have no idea how high the price of gold is going to go. And it’s not the coronavirus that’s driving it. It’s Fed monetary policy. And especially the additional easing that I think the markets are correctly starting to price in that is going to result from the coronavirus.”

As the stock market really started selling off, it wasn’t just profit-taking. It was a panic rush to liquidate gold and raise cash. But the rebound Monday indicates the safe-haven bid is not dead. MineLife Pty senior resource analyst Gavin Wendt told Bloomberg gold’s fundamentals “remain overwhelmingly strong.”

Any near-term price corrections aren’t significant in terms of the bigger picture. Bullion’s retreat last week was nowhere as bad as the 10%-plus drubbing equity markets took, so it can be argued gold has passed its safe-haven challenge.” Source

StevieRay Hansen

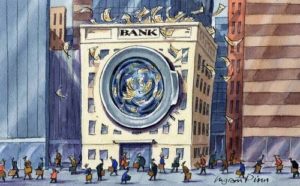

Editor, Bankster Crime

MY MISSION IS NOT TO CONVINCE YOU, ONLY TO INFORM YOU…

The risk of loss in trading futures and options on futures can be substantial. The author does not guarantee the accuracy of the above information, although it is believed that the sources are reliable and the information accurate. The author assumes no liability or responsibility for direct or indirect, special, consequential or incidental damages or for any other damages relating or arising out of any action taken as a result of any information or advice contained in this commentary. The author disclaims any express or implied liability or responsibility for any action taken, which is solely at the liability and responsibility of the user.

Tagged Under: Oil, Fraud, Banks, Money, Corruption, Bankers, Powerful Politicians, Businessmen

The Coronavirus, Pestilence, the hospital will fail–there’s no other word for it. Docs and nurses won’t show up. It’s not their friends or family or kid’s teacher or pastor at risk. While we wouldn’t have liked it, we would’ve risked our health for our community. These professionals are not going to risk their life for a job. The senior management will try to keep it together for the sake of their careers, but the next tier will quickly bag it. Again, it’s just a job. The corporate supply chain is so fragile, and there are now so few community resources that the hospital as a care system will quickly break down.

![]()