It has happened again. On Thursday the Dow Jones Industrial Average fell 2,352 points, which was the largest single-day stock market point crash in history. Of course, the old record only lasted for three days, because on Monday the Dow dropped 2,013 points. And on Wednesday, we actually witnessed the third-largest single-day stock market point crash in history. So the three worst days in the history of the U.S. stock market (on a point basis) have all happened this week. On a percentage basis, the stunning decline that we witnessed on Thursday was the worst day for the Dow since the horrifying market crash of 1987. Wall Street is in a tremendous state of panic right now, and nobody is quite sure when this will end.

Needless to say, this frenzy of selling is being driven by fear of the coronavirus…

“The coronavirus is scary and people don’t know what to expect,” said Kathy Entwistle, senior vice president of wealth management at UBS. “It’s like the tsunami is coming. We know it’s going to hit any day and nobody knows what the outcome is going to be.”

In the last 48 hours, the NBA, the NHL, Major League Baseball and Major League Soccer have all suspended their seasons because of COVID-19. Public gatherings of all sorts are being canceled or postponed all across America, and we are seeing “panic buying” at major retailers like Costco that is absolutely unprecedented.

But we still don’t know if this is going to evolve into a major pandemic that is going to kill millions of people. Right now there are less than 1,400 confirmed cases in the U.S. and less than 100 deaths.

If we are witnessing this much panic now, what will happen if millions of people do actually start dying?

Stocks should not be falling this rapidly yet, but of course, they should have never gotten so high in the first place.

And even after all the carnage that we have already witnessed, stocks are still extremely overvalued.

In order for stock valuation ratios to return to their long-term averages, we would need to see the market fall another 20 to 30 percent.

But if this coronavirus pandemic does eventually become what many are fearing, stock prices will eventually go way below their long-term averages.

These are very strange times, and I have a feeling that they are about to get a whole lot stranger.

Maybe the Fed’s repo bazooka was just a water pistol?

Less than an hour after the Fed announced a massive expansion to its repo facilities, adding one $500 billion 3-month repo today, following by an identical repo tomorrow and subsequent weekly $500BN repos (in addition to officially expanding NOT QE to a coupon monetizing QE-5), many are asking if the Fed applied the wrong medicine for two reasons:

The first, and obvious one, is that you can’t fix a viral pandemic with monetary easing… but let’s pretend that’s not an issue for now.

The less obvious, but just as important reason is that after the Fed announced the results of the first half a trillion-dollar repo today, the uptake was a tiny 15.7%.

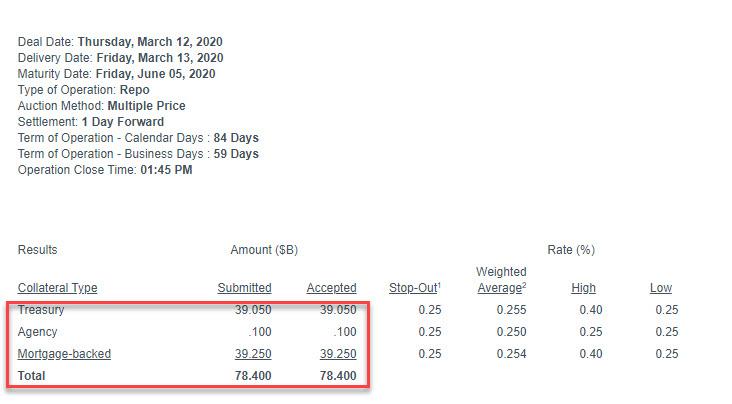

Indeed, as shown below, dealers only submitted $78.4 billion in securities for today’s massively upsized 3-month repo operation…

… which it appears will not be the panacea the Fed may have expected it to be.

As a result, even though today’s total liquidity injection between the two-term and one overnight repos earlier, and the 3-month mega repo just now, the Fed has injected a total of $276.5 billion in liquidity, and yet stocks have tumbled back to session lows…

… as traders realize that what is ailing the market is not accessible to the Fed’s balance sheet, but an overall recession that will collapse revenues, profits, and cash flow, and which the Fed’s liquidity injections are powerless to prevent.

But wait, there’s more: because as stocks sold off, a far more ominous development is that judging by the surge in the FRA/OIS, a closely followed indicator of interbank funding, following the Fed’s repo operation the liquidity shortage had nothing to do with extra repo access and is about to get much worse especially with the Fed having already fired its bazooka.

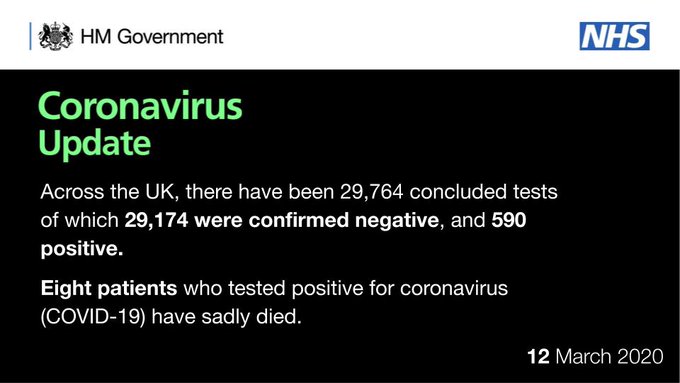

UPDATE on coronavirus (#COVID19) testing in the UK:

As of 9 am 12 March 2020, a total of 29,764 people have been tested:

29,174 negative

590 positive

8 patients who tested positive for coronavirus have sadly died.

The digital dashboard will be updated later today.

Department of Health and Social Care

@DHSCgovuk

UPDATE on coronavirus (#COVID19) testing in the UK:

As of 9 am 12 March 2020, a total of 29,764 people have been tested:

29,174 negative

590 positive

8 patients who tested positive for coronavirus have sadly died.

The digital dashboard will be updated later today.

In other words, the Fed tried to fix whatever is causing the structural problem at the heart of the market’s illiquidity and has so far failed, which means that absent another emergency bailout attempt, we may very soon have a market – and bank – holiday.

Finally, for those asking just what kind of bailout attempt, recall that recently both Eric Rosengren and Janet Yellen said the Fed will have to buy stocks during the next crisis. Well, this is a crisis, and the market collapse will not relent until Powell finally turns Japanese and starts monetizing single names and/or ETFs. Source themostimportantnews.com ZeroHedge

StevieRay Hansen

Editor, Bankster Crime

MY MISSION IS NOT TO CONVINCE YOU, ONLY TO INFORM YOU…

“Have I, therefore, become your enemy by telling you the truth?”

Oil Drop, Coronavirus, Fraud, Banks, Money, Corruption, Bankers

This Pestilence Is Spreading: Stock Market In Trouble

![]()