BanksterCrime:

By Pam Martens and Russ Martens,

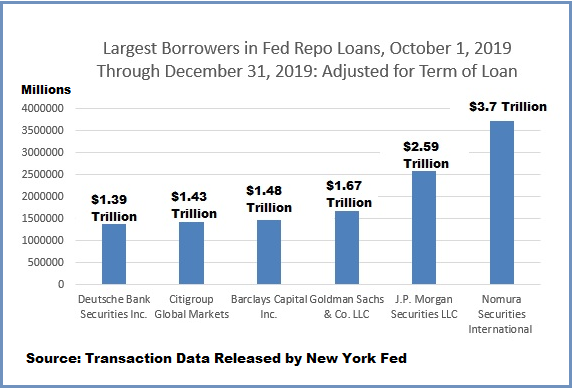

Remember the Repo Crisis in the fall of 2019 when the Federal Reserve had to jump in with both feet and make billions of dollars in revolving emergency loans each weekday to the megabanks on Wall Street? And remember when Wall Street On Parade was the only media outlet that named the banks that got the money and graphed the largest borrowers when the Fed released the granular loan data two years later?

Well, guess what. Two of the financial firms that played a starring role in the repo crisis of 2019 appear to be part of the cast in the current trading debacle in Japan that’s spilling into global markets – if their share price performance is any indicator.

The graph above shows that the Japanese financial firm, Nomura, and the giant U.S. megabank, Citigroup, are trading in eerie correlation to the trading debacle in Japan. The graph below shows that Nomura was the largest borrower from the Fed in the 2019 repo crisis, borrowing a stunning $3.7 trillion in term-adjusted revolving loans, while Citigroup ranked fifth. (Citigroup ranked as the number one largest borrower of emergency loans from the Fed during the 2008 financial crisis, taking $2.5 trillion in revolving loans from December 2007 through July 2010, according to the Government Accountability Office.)

Much of the blame for the recent stock selloff has been characterized by the media as the unwinding of the “yen carry trade.” (Clearly, geo-political factors are also playing a role.) Providing false comfort to investors, Bloomberg News had a top headline early this morning that declared that “JPMorgan Says Three Quarters of Global Carry Trades Now Unwound.”

Unless JPMorgan Chase has an omnipotent crystal ball, it has zero chance of knowing what every global hedge fund is doing, what its megabank competitors are doing, what international asset managers, life insurers, and sovereign wealth funds are doing. Recall the spring of 2021 when the supposedly smartest trading houses on Wall Street didn’t know they were being conned by family office hedge fund Archegos until it blew up in their face, leaving some of the megabanks with billions in losses? (See Archegos: Wall Street Was Effectively Giving 85 Percent Margin Loans on Concentrated Stock Positions – Thwarting the Fed’s Reg T and Its Own Margin Rules.) Or how about the $6.2 billion in losses JPMorgan suffered in the London Whale scandal because it couldn’t keep tabs on what its derivative traders in London were doing? Or what Bernie Madoff was doing in his business account at JPMorgan Chase? Or what Jeffrey Epstein was doing in his multitude of related accounts at JPMorgan Chase as they facilitated an international sex-trafficking operation.

The problem with attempting to analyze the unwinding of the yen carry trade and who is getting caught up in a destructive cycle of selling securities to meet margin calls is that there are a vast number of ways that large traders could be losing money and an equally vast arena of related exposures. There could be related currency losses; related derivative losses; related stock portfolio losses and related shaky counterparties.

Let’s say, hypothetically, that traders had made wrong-way leveraged bets on the Japanese yen or U.S. Dollar or U.S. tech stocks – or all three. Attempting to unwind that tangled mess is unlikely to be resolved in a week’s time.

According to the Office of the Comptroller of the Currency (OCC), as of March 31 of this year, JPMorgan Chase Bank held $966 billion in spot foreign exchange contracts; Goldman Sachs Bank USA held $952 billion; Bank of America held $523 billion; and Citigroup’s Citibank held $442 billion. Those four commercial banks’ holdings of spot Forex accounted for 90 percent of spot Forex at all 4,568 federally-insured commercial banks and savings associations in the United States at the end of the first quarter, according to the most recent OCC report. (See page 17 at this link.) That level of concentration is equally frightening at taxpayer-backstopped financial institutions.

Related Article:

A Nomura Document May Shed Light on the Repo Blowup and Fed Bailout of the Gang of Six in 2019

![]()