Back in the late fall of 2014, when Saudi Arabia broke up OPEC for the first time and unleashed a torrent of crude oil on the world despite the protests of its fellow cartel members, oil prices crashed as a result of what then seemed to be a “calculated” move by Riyadh which hoped to put US shale out of business amid a flawed gamble betting that shale breakeven prices were around $60-80. They, however, turned out to be much lower, which coupled with Saudi misreading of the willingness of junk bond investors to keep funding US shale producers, meant that despite a 3 years stretch of low oil prices, US shale emerged stronger than ever before, with the US eventually eclipsing both Saudi Arabia and Russia as the world’s biggest crude oil producer.

Fast forward to March 2020, when Saudi Arabia doubled down in its attempt to crush shale, only to avoid angering long-time ally Donald Trump, the Crown Prince pretended that the latest flood of oil was an oil price war aimed at Moscow not Midland. And this time, unlike 2014, with the benefit of the global economic shutdown resulting from the coronavirus pandemic, the Saudis may have finally lucked out in the ongoing crusade against US oil, because as Bloomberg writes with “negative oil prices, ships dawdling at sea with unwanted cargoes, and traders getting creative about where to stash oil”, the next chapter in the oil crisis is now inevitable: “great swathes of the petroleum industry are about to start shutting down.”

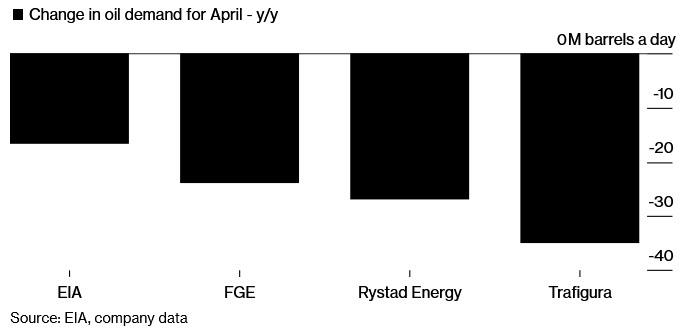

As the recent OPEC summit so vividly demonstrated, the marginal price of oil is no longer determined by supply or cuts thereof (such as the recently announced agreement by OPEC+ for a 9.7mmb/d output cut), but rather by demand, or the lack thereof, which according to some estimate is as much as 36mmb/d lower, or roughly a third of the global oil market every day, as billions of people are stuck at home instead of driving, while major corporations mothball production in a world where major economies have ground to a halt.

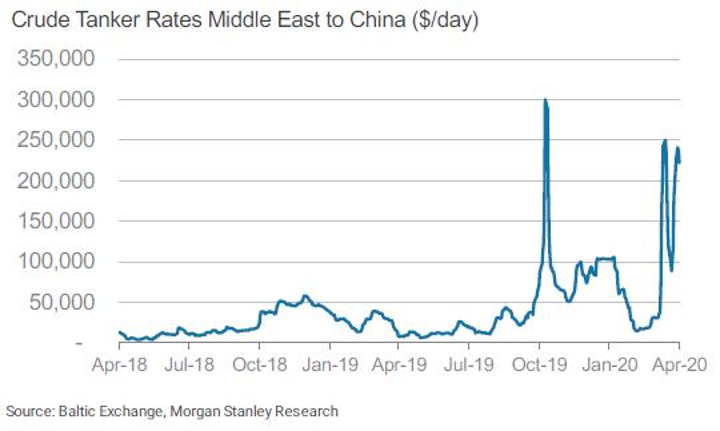

The economic impact of the coronavirus has ripped through the oil industry in dramatic phases, Bloomberg’s Javier Blas writes. First, it destroyed demand as lockdowns shut factories and kept drivers at home. Then storage started filling up and traders resorted to ocean-going tankers to store crude in the hope of better prices ahead.

Now shipping prices are surging to stratospheric levels as the industry runs out of tankers, a sign of just how distorted the market has become.

Ironically, in its latest attempt to kill off shale, Saudi Arabia may have gone a step too far, as “the specter of production shut-downs – and the impact they will have on jobs, companies, their banks, and local economies – was one of the reasons that spurred world leaders to join forces to cut production in an orderly way. But as the scale of the crisis dwarfed their efforts, failing to stop prices diving below zero last week, shut-downs are now a reality. It’s the worst-case scenario for producers and refiners.“

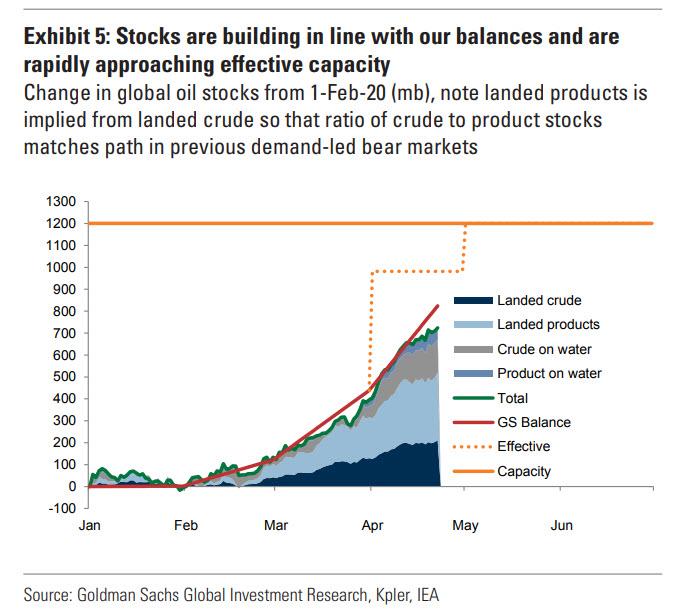

In short, the entire oil production industry is shutting down, not because it wants to – of course – but because it has no choice. According to Goldman, in as little as three weeks there will be literally no place left on earth to store oil, and unless oil producers want to pay “buyers” to hold the oil as happened on that historic date of April 20, they have no choice but to shut in output.

“We are moving into the end-game,” said Torbjorn Tornqvist, head of commodity trading giant Gunvor Group. “Early-to-mid May could be the peak. We are weeks, not months, away from it.”

This brings us back to why in 2020 Riyadh has succeeded where it failed in 2014: as Bloomberg writes “in theory, the first oil output cuts should have come from the OPEC+ alliance, which earlier this month agreed to reduce production from May 1. Yet after the catastrophic price plunge on Monday, when West Texas Intermediate fell to -$40 a barrel, it’s the U.S. shale patch that is leading”

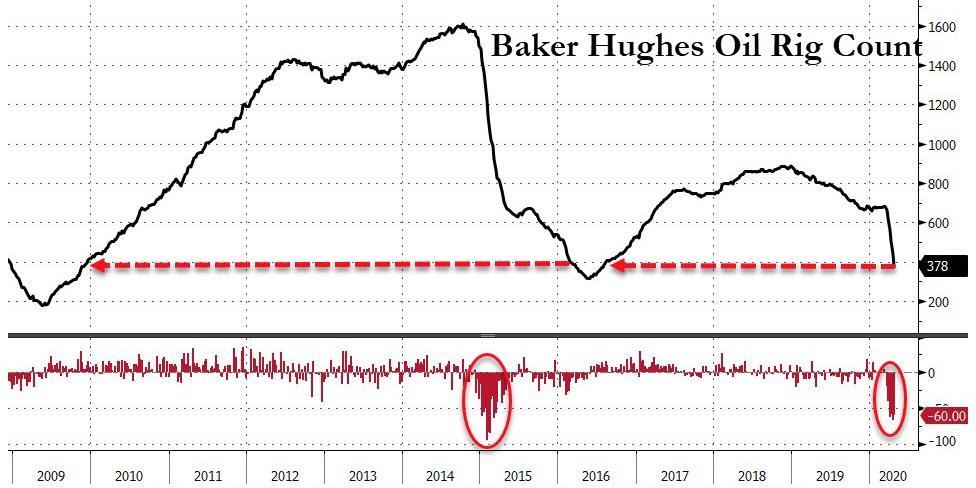

The best indicator of how the shale industry is reacting is the sudden collapse in the number of oil rigs in operation, which last week fell to a four-year low: “Before the coronavirus crisis hit, oil companies ran about 650 rigs in the US. By Friday, more than 40% of them had stopped working, with only 378 left.”

And while there is a delay between total US oil production and the rig count, it is now obvious that US production is set to collapse next:

“Monday really focused people’s minds that production needs to slow down,” said the co-head of oil trading at commodity merchant Trafigura. “It’s the smack in the face the market needed to realize this is serious.” Incidentally, Trafigura, one of the largest exporters of US crude from the U.S. Gulf of Mexico, believes that output in Texas, New Mexico, North Dakota, and other states will now fall much faster than expected as companies react to negative prices…

… evidence US commercial storage space for physical at Cushing has run out with what inventory is left having been called for -which have persisted for several days last week in the physical market.

Until prices collapsed on Monday, the consensus was that output would drop by about 1.5MM barrels a day by December. Now market watchers see that loss by late June. “The severity of the price pressure is likely to act as a catalyst for the immediate turndown in activity and shut-ins,” said Roger Diwan, oil analyst at consultant IHS Markit Ltd.

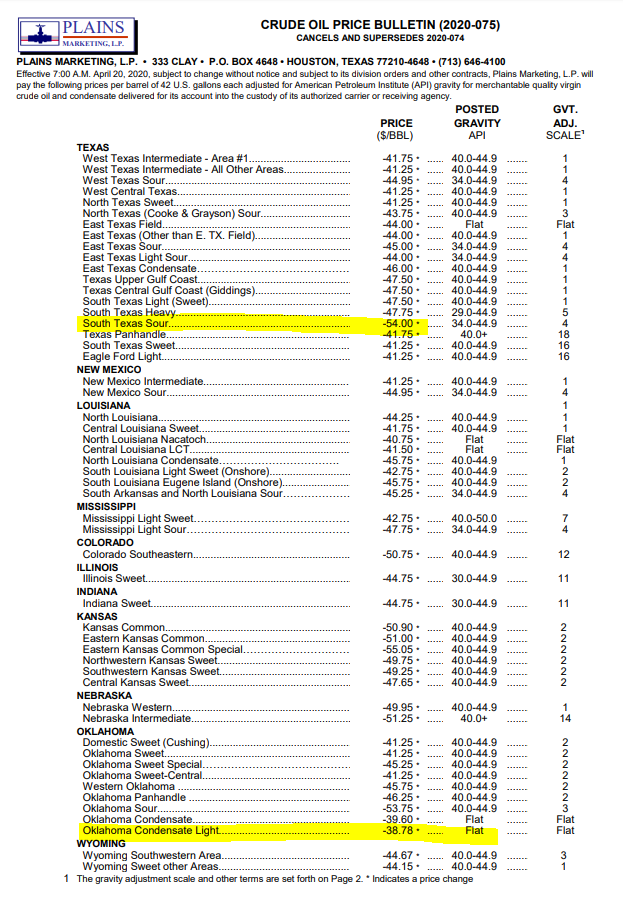

As detailed last week, this price shock has been especially acute in the physical market where producers of crude streams such as South Texas Sour and Eastern Kansas Common had to pay more than $50 a barrel to offload their output last week.

And so the US industry is finally shutting down as ConocoPhillips and shale producer Continental Resources have all announced plans to shut in output. Regulators in Oklahoma voted to allow oil drillers to shut wells without losing leases; New Mexico made a similar decision. Even North Dakota, which for years was synonymous with the U.S. shale revolution, is witnessing a rapid retrenchment, as Bloomberg notes that “oil producers have already closed more than 6,000 wells, curtailing about 405,000 barrels a day in production, or about 30% of the state’s total.”

However, it won’t be just the US: output cuts can be seen from Chad, a poor and landlocked country in Africa, to Vietnam and Brazil, producers are now either reducing output or making plans to do so. “I wouldn’t want to get sensational about it but yes, clearly there must be a risk of shut-ins,” Mitch Flegg, the head of North Sea oil company Serica Energy, said in an interview. “In certain parts of the world, it is a real and present risk.”

In emergency board meetings last week, oil companies small and large discussed an outlook that’s the most somber any oil executive has ever witnessed. For the small firms, the next few weeks will be all about staying afloat. But even for the bigger ones, like Exxon Mobil Corp. and BP Plc, it’s a challenge. Big Oil will offer an insight into the crisis when companies report earnings this week.

Then on Friday, May 1, Saudi Arabia, Russia, and the rest of OPEC+ will join the output cuts, slashing their output by 23%, or 9.7 million barrels a day. Saudi Aramco, the state-owned company has already cut production, and Russian oil companies have announced exports of their flagship Urals crude would drop in May to a 10-year low.

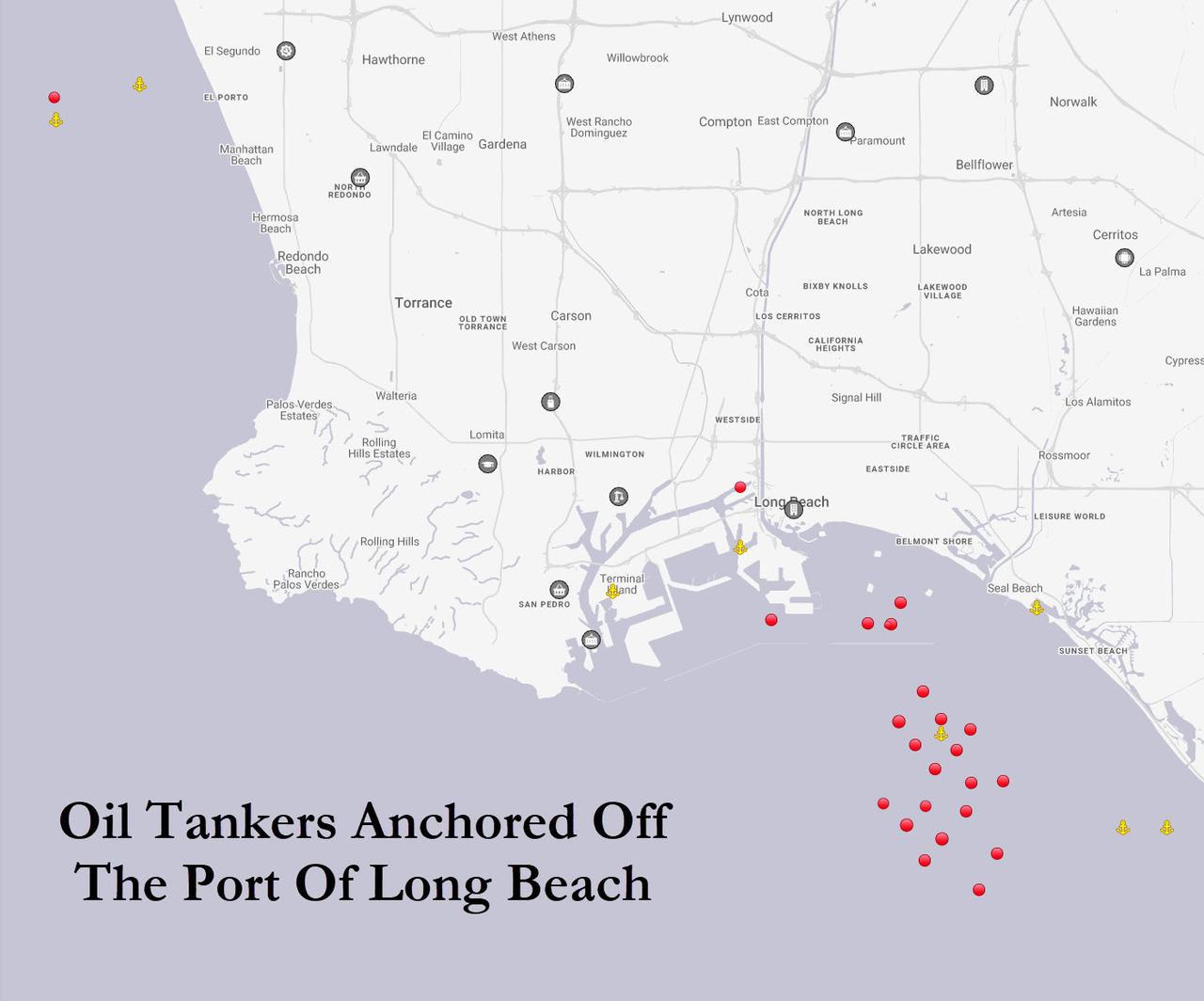

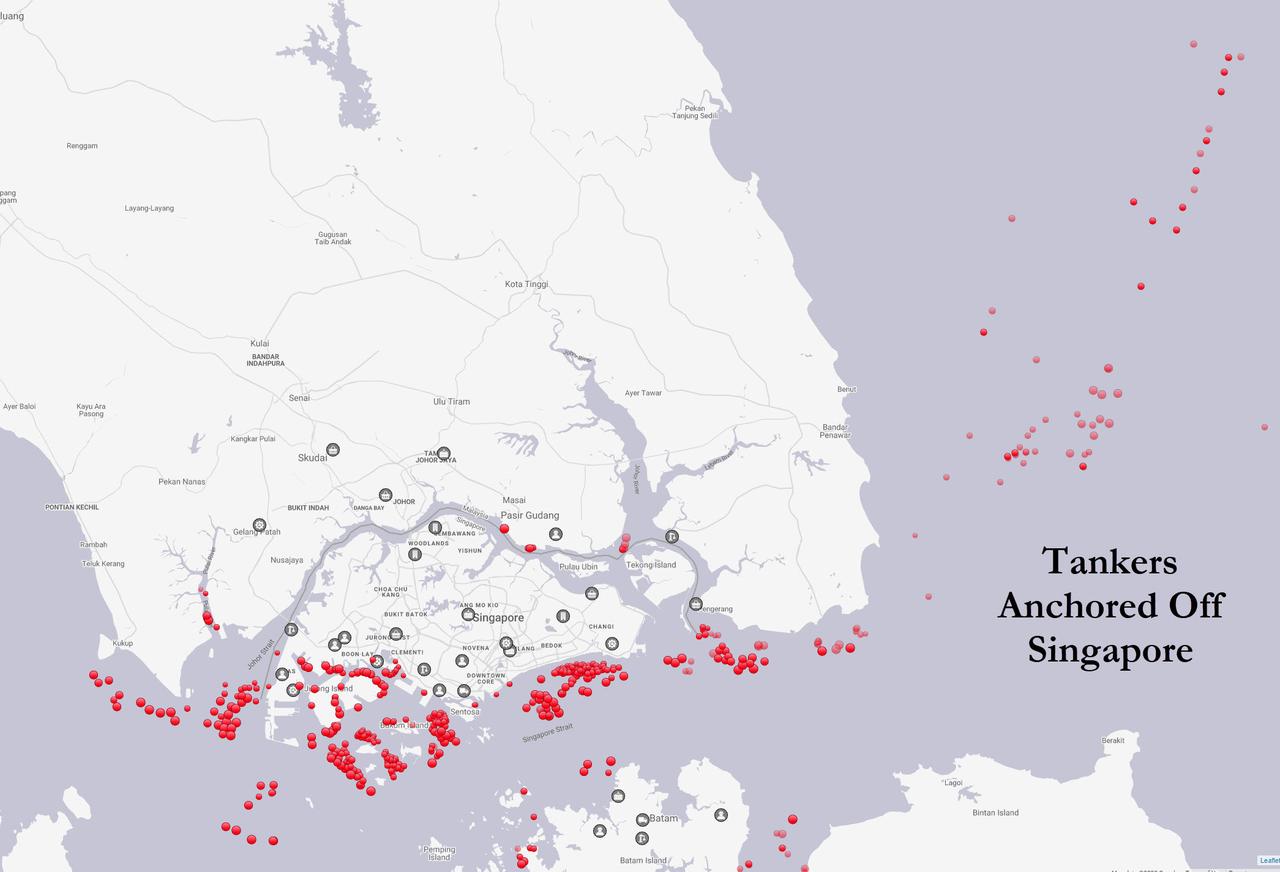

And yet, as warned here repeatedly, it may still not be enough, as every week, another 50 million barrels of crude are going into storage, enough to fuel Germany, France, Italy, Spain, and the U.K. combined, with estimates that the world will run out of land-based storage sometime in late May or early June. Meanwhile, what’s not stored onshore, is stashed in tankers. As Bloomberg’s Blas points out, the U.S. Coast Guard on Friday said there were so many tankers at anchor off California that it was keeping an eye on the situation.

VIDEO: US Coast Guard says it’s keeping an eye on 27 oil tankers anchored off the coast of Southern California. Another great example of floating storage build-up as demand for oil and refined products plunge | #OOTT #Contango video via @USCGLosAngeles pic.twitter.com/B7pjWIsdnp— Javier Blas (@JavierBlas) April 24, 2020

But if the two dozen or so tankers piled up off the coast of California is bad…

NEVER MISS THE NEWS THAT MATTERS MOST

ZEROHEDGE DIRECTLY TO YOUR INBOX

Receive a daily recap featuring a curated list of must-read stories.

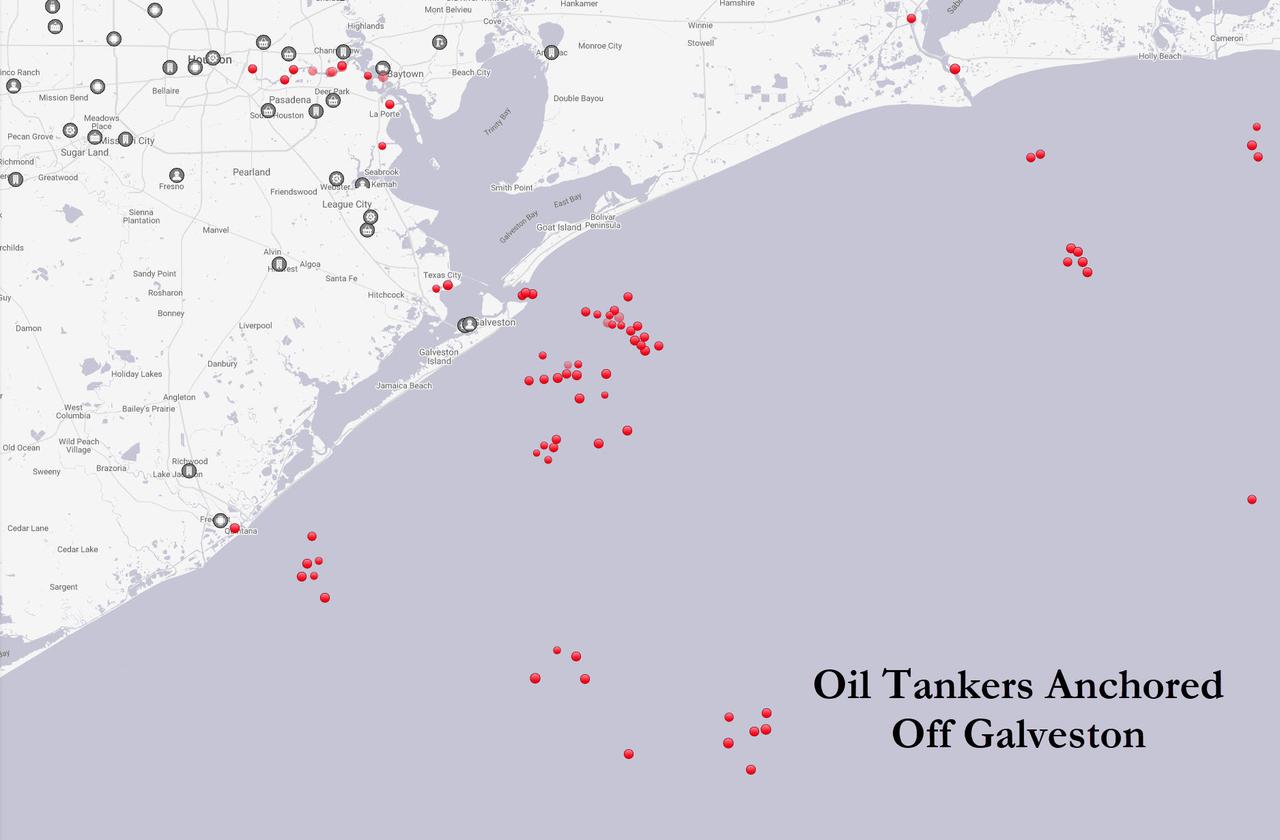

… and those next to Galveston, TX is worse…

… what is going on in that tanker parking lot off of Singapore is absolutely insane.

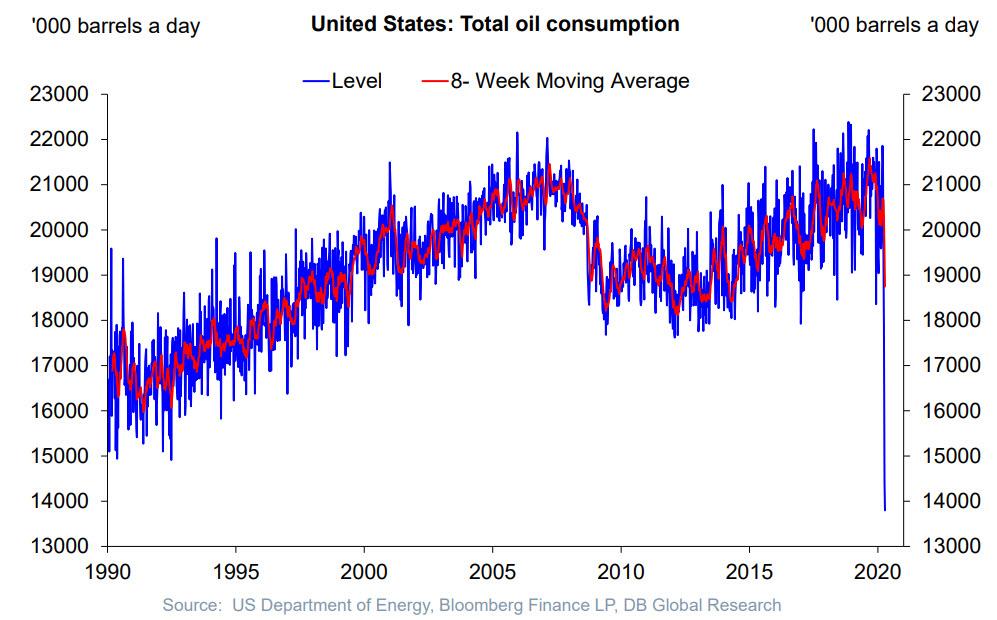

There is some good news: oil traders say after plunging by a third, US oil consumption has probably hit a bottom and will start a very gentle recovery, although that also depends on how fast the US economy can reopen from the coronavirus coma.

But before even a modest recovery takes hold, the great shutdown will spread through oil refining too. Over the past week, Marathon Petroleum, one of the biggest U.S. refiners, announced it would stop production at a plant near San Francisco. Royal Dutch Shell has idled several units in three U.S. refineries in Alabama and Louisiana. And across Europe and Asia, many refineries are running at half rate. U.S. oil refiners processed just 12.45 million barrels a day on the week to April 17, the lowest amount in at least 30 years, except for hurricane-related closures.

The closures have already sent thousands packing: the oil and gas industry shed nearly 51,000 drilling and refining jobs in March, a 9% reduction that will only get worse in April. March’s job losses rise by 15,000 when ancillary jobs such as construction, manufacturing of drilling equipment and shipping are included, according to BW Research Partnership, a research consultancy, which analyzed Department of Labor data combined with the firm’s own survey data of about 30,000 energy companies.

“We’re looking at anywhere between five and seven years of job growth wiped out in a month,” Philip Jordan, the company’s vice president said in an interview. “What makes it sort of scary is this really is just the beginning. April is not looking good for oil and gas.”

And so, as the oil industry shuts down – at least for a few weeks (or perhaps months) – more refinery shutdowns are coming, oil traders and consultants said, particularly in the U.S. where lockdowns started later than in Europe and demand is still contracting. Steve Sawyer, director of refining at Facts Global Energy, said that global refineries could halt as much as 25% of total capacity in May.

“No one is going to be able to dodge this bullet.” Source: ZeroHedge

StevieRay Hansen

Editor, Bankster Crime

![]()