Watchman Expects Many Bank Failures: Accredited Weiss Research Predicts That 5,274 U.S. Banks Will Fail

BanksterCrime:

“The underlying financial weaknesses in the U.S. banking industry are widespread, and the FDIC’s newly expanded guarantee of all deposits does nothing to protect shareholders in bank holding companies, who could still lose most or all of their money,” the group said.

Weiss Research Inc., one of the most accredited and well-respected independent rating agency, is sounding-off that an astronomical number of American banks will collapse because they are insolvent.

According to this rating firm, after analyzing the books and balance sheets of the Federal Reserve and banking institutions, Weiss Research claims that a monstrous 5,274 banks and credit unions have the potential to collapse. To put the number into perspective, there is are 9,457 banks and credit unions in total exist in the United States. This is almost 56% of all the financial institutions in the U.S.

According to a press release published on May 15th, which received next to no coverage, the ratings group reported that 4,243 had the potential to fail. The group wrote:

Weiss Ratings, the nation’s only independent ratings agency that regularly evaluates the relative safety of U.S. banks and credit unions, has warned that 4,243 could be vulnerable to failure.

Among them, 1,210 institutions (or 12.8%) got a red warning flag, signaling risk of imminent failure, while 3,043 received a yellow warning flag, indicating risk of failure in a financial crisis or recession. In sum, 45% of all banks and credit unions were deemed vulnerable.

Dallas Brown, Weiss Ratings CCO, says,

The underlying financial weaknesses in the U.S. banking industry are widespread, and the FDIC’s newly expanded guarantee of all deposits does nothing to protect shareholders in bank holding companies, who could still lose most or all of their money.

Moreover, if the U.S. Treasury cannot even pay its own bills, it could be hard-pressed to cover the expanded liabilities of the FDIC.

Since 2008, among the 539 banks that have failed, Weiss Ratings has provided advance warning on 535, or 99.3%.

To check the current Weiss rating of their bank or credit union, depositors and investors can go to https://weissratings.com/en/banking.

Days following Gavin Magor for the group wrote, “Some 45% of depository institutions could find themselves destined to follow in the failed footsteps of Silicon Valley Bank, Signature, Silvergate, First Republic and their international counterpart, Credit Suisse.”

We fully expect to see further downgrades following our analysis of the first-quarter data. That’s because these “too big to fail” institutions may be sitting on risks that are getting too big to ignore.

One of those names was PNC Bank, whose safety rating dropped from a “B” to a “B-” in our latest review.

The question now is not whether the bank failures are over but, rather, which one is next?

But then that number got reupdated to 5,274 on June 5th.

Martin D. Weiss, Ph.D., acknowledged that their first estimate was controversial enough, but now their newest number is even more jaw dropping. Weiss defends this metric by clarifying: “The data comes from the FDIC. They’re the ones who collect quarterly reports from the banks and then provide the data to research or ratings firms like ours.” He added, “Then our computer models crunch the data and generate the ratings. No bias. No second-guessing or cherry-picking. It is what it is.”

So, if we’re going to err (a human quality), we want to err in their favor. Not in favor of the banks.

Weiss furthermore summarizes their new forecast:

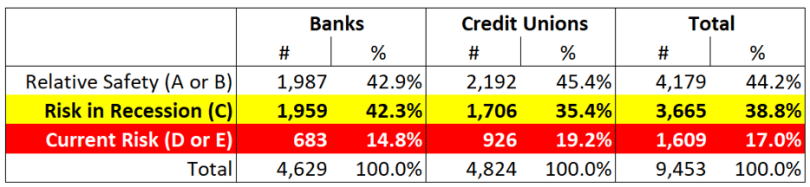

The key takeaways:

• We’re issuing a yellow-flag warning on 3,665 banks and credit unions, or 38.8% of the depository institutions we rate. These get C ratings (C+, C or C-), which means they will be at risk of failure in a recession or a deeper financial crisis.

• We’re issuing a red-flag warning on 1,609 banks and credit unions, or 17% of the institutions we rate. These get D and E ratings, which means they’re currently at risk of failure.

• In total, 5,274 banks and credit unions (55.8% of all institutions) are, or could be, at risk.

Important: At risk of failure does not mean “will fail.” In fact, in normal times, most at-risk banks do not fail, either thanks to their own efforts or government intervention.

If [a bank] gets one of our C ratings, consider moving to a safer institution, especially if you’re in agreement with our forecast that the economic and financial environment is bound to worsen from here.

If it gets one of our D or E ratings, I recommend moving your funds to a safer institution now.

Meanwhile this week other notable rating agencies downgraded some banks in the United States. Moody’s was one of them listing the banks they have now just downgraded:

Moreover, Standard & Poors (S&P) also downgraded five banks as well, according to Investment Executive.

‘S&P downgraded Associated Banc Corp., Comerica Inc., KeyCorp, UMB Financial Corp., and Valley National Bancorp each by one notch. The rating agency cited tougher conditions for the industry, among other factors, in its decisions,’ the paper reported.

Investment Executive for noted, ‘For example, in its rating action on Comerica, S&P noted the bank has experienced “large deposit outflows and significant margin declines in recent quarters,” and said that industry pressures and interest rate expectations “have reduced the predictability and business stability” of its business model.’

AUTHOR COMMENTARY

[26] Be not thou one of them that strike hands, or of them that are sureties for debts. [27] If thou hast nothing to pay, why should he take away thy bed from under thee?

Proverbs 22:26-27

And yet this is the problem plaguing the banks right now. As regular WinePress readers have heard me say may times over, the problems that plagued Silicon Valley Bank (SVB) are infecting them all. That was FAR from an isolated incident, and now you have this well-respected rating firm saying that OVER HALF of the country’s banking sector has the potential to fold. And even if 2% collapsed, the chain reaction that would cause still bring down hundreds, if not thousands more.

In March mainstream media allowed Americans to know that 190 banks could collapse in the wake of SVB’s demise; to which I said if the media was willing to publicize that, then that meant a whole lot more banks are insolvent; which Weiss has proven that to be.

Since January, 2021, longtime readers will recall I was emphatically warning that they needed to pull their money out of the banks, because they are too volatile and toxic. They are underwater. Keep only the minimum amounts needed to keep the account open, make online purchases, and pay bills.

The current banking crisis has well surpassed 2008.

Then you have the consider the auto loan apocalypse that’ll really begin to unfold soon enough, and already is, because rates are killing the consumers because so many people bought new cars with stimulus while rates were at 0 and everything was in forbearance; the housing bubble that is starting to lose some air but is still insanely overvalued, and again with homeowners dealing with elevated mortgage rates; and then commercial real estate and an office building bust, landlords overturning their vacant properties back to the banks, while other properties are getting eaten alive by interest rates, as people don’t want to work and real wages can’t keep up with inflation; which all that I have listed leads to the banks and they’ll be forced to at all of this, while they are all insolvent and are holding onto toxic bonds and debt because they bought so many in 2020 because of 0% rates, that are now worth far less than they are now.

All of this is going to create the biggest banking bust the likes of which has not been seen before.

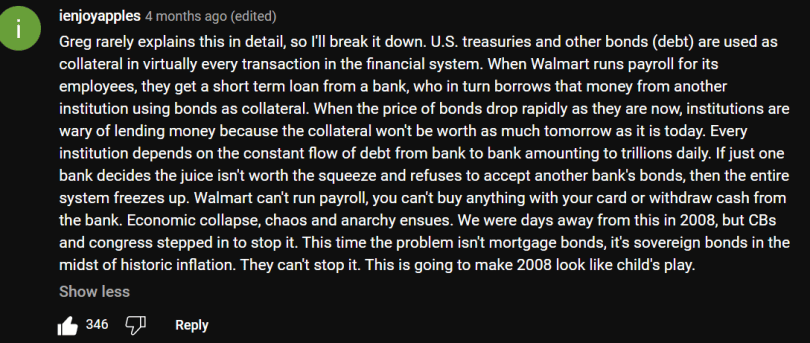

The availability of credit and lending are running dry, and all of these problems and more I have listed are all going to eventually lead to a massive credit freeze, an entire locking up of the entire financial system.

SEE: What An Implosion In The Debt Market Would Look Like – And It Isn’t Pretty

If you are new here, I encourage you to peruse my other economic articles I have done. They are not done in vain. This is serious. False prophets, hirelings, are not interested in telling you the dirty details you need to know. Pretending it does not exit does not change the problem: it just causes you to be further enslaved.

Many more banks WILL collapse, no question about it, and that will flip this country on its axis; but that is what the Federal Reserve wants. It’s a consolidation of power. And YOU and I get to pay for it. Treasurer Janet Yellen has already said this publicly.

This consolidation will help them to enforce their CBDCs and the government digital IDs, and get everyone on their social credit system.

Stay sharp and prepare yourself, and make the necessary preparations needed.

SEE:

9 Signs That The U.S. Consumer Is About To Break

The United States Is Facing An Impending Commercial Real Estate Timebomb

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

CLICK HERE TO DONATE

Source: WinePress

Beef in Bulk: Half, Quarter, or Eighth Cow Shipped to Your Door Anywhere within Texas Only

We do not mRNA vaccinate our cattle, nor will we ever!

Grass Fed, Grass Finished Beef!

Here is a discount code for HNewsWire readers to get 20 percent off first order:

HNEWS20

From Our Ranch to Your Table

Revelation: A Blueprint for the Great Tribulation

A Watchman Is Awakened

Will Putin Fulfill Biblical Prophecy and Attack Israel?

Newsletter

Orphans

Editor's Bio