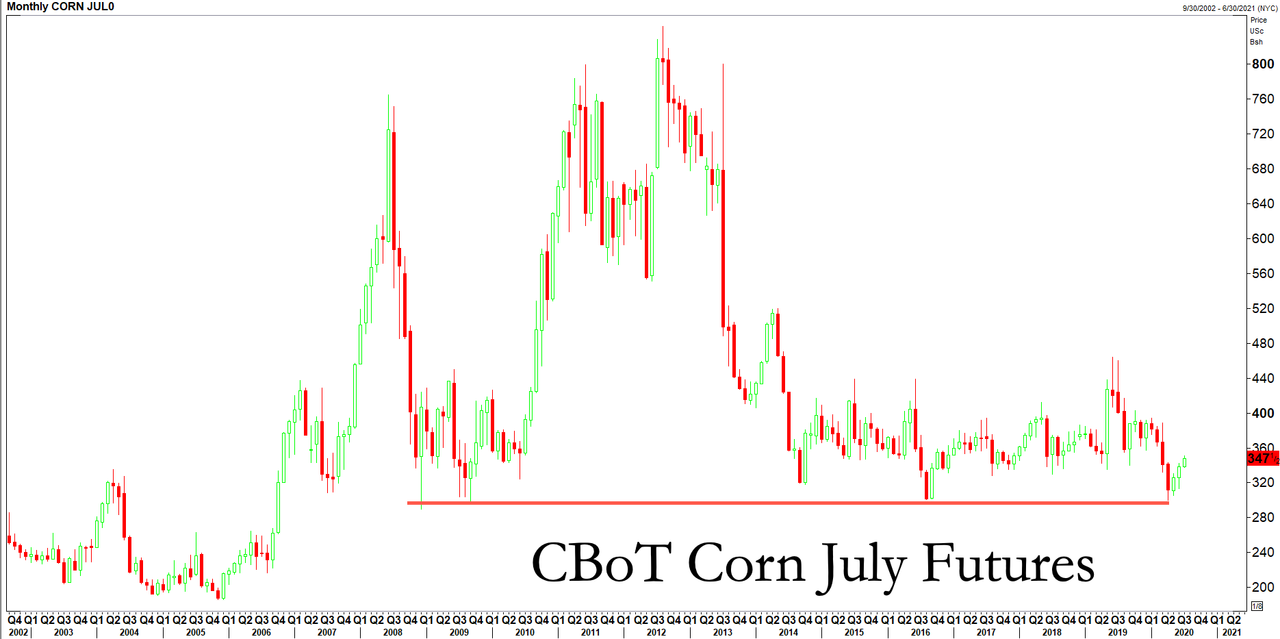

Chicago corn futures surged 8% in the last two sessions after a massive reduction to the U.S. government’s acreage estimate reported Reuters.

The U.S. Department of Agriculture’s (USDA) crop report on Tuesday showed farmers planted 92 million acres of corn in 1H20, which was a huge miss in expectations and 5 million acres below the USDA’s March forecast of 97 million acres.

This was the largest miss in a March-to-June corn acreage crop report since 1983 – just before “Trading Places” hit theaters – resulting in an 8% surge in corn futures trading in Chicago.

Arlan Suderman, the chief commodities economist for StoneX, said the USDA report suggests that farmers are “tightening up their finances and were more conservative than normal in planting this year’s crops.”

“All these lower acreage numbers had people wondering what happened to the acres and to which crop or crops they were reallocated. But the acres were not planted at all,” Karen Braun, a commodity analyst with Reuters, wrote in a note.

Estimates for corn stockpiles are expected to be above average this year as coronavirus pandemic roils demand, USDA noted.

A commodity note via Commerzbank bank said the report “makes it questionable whether a record crop – that had almost been regarded as a dead cert – will be harvested after all.”

With the USDA crop report behind traders – the market will soon focus on weather trends in the northern hemisphere as the most critical part of the growing season is ahead:

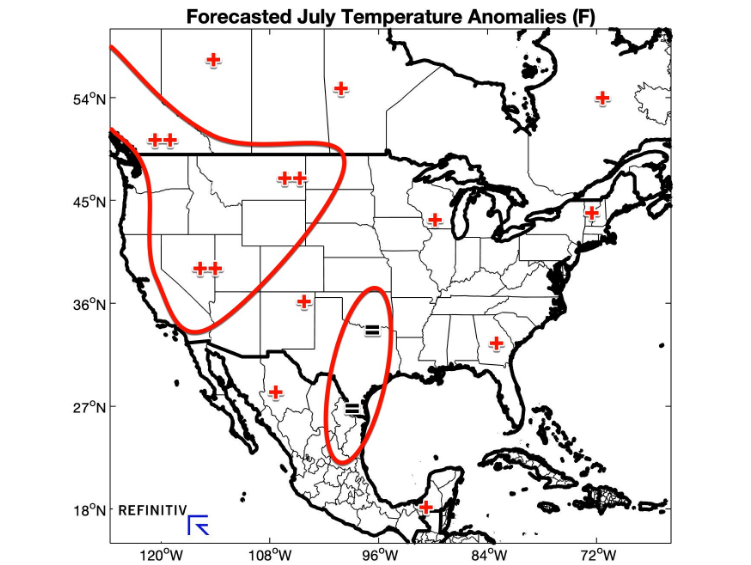

“With the USDA reports out of the way, traders will focus on weather forecasts and Chinese demand for the next direction,” commodity research firm Allendale said in a note, adding that, “July promises to be a warmer than usual month with more limited rainfall resulting in net drying and the dryness that evolves in July will set the tone for crop development the remainder of summer.”

New weather models suggest warm and dry conditions for much of the US.

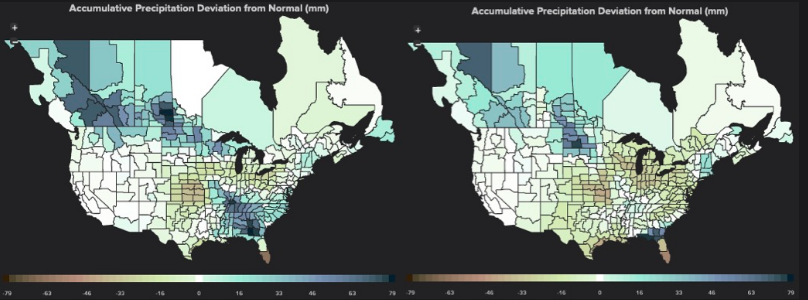

“As the first month of meteorological summer closes, we assess early season weather and crop conditions during June. The most significant warmth stretched from the Central U.S. Plains across to the Upper Midwest, where temperatures averaged between 2-8 °F above normal for the month. Only portions of the Southeast U.S. and Canada were moderately cooler than normal, but unlikely hurt crops at this point. Rainfall for the month was mixed but likely was more biased to the dry side than the wet, with only pockets of the U.S. Deep South and Great Lakes receiving 1-2 inches of rainfall surpluses. Portions of the Plains and eastern Midwest have experienced similar rainfall anomalies to the downside. Nonetheless, crop impacts are (so far) negligible for corn and soybeans, as good-to-excellent condition scores from USDA bumped up this week to 73% and 71%, respectively, and remain close to most recent years. Spring wheat conditions dropped for the second consecutive week, with good-to-excellent scores at 69%, and the second-lowest at this time of year over the last 5 years, only second to 2017. While scores are still elevated, warmth and dryness may already be impacting spring wheat conditions in particular and will need to be monitored into July for continued impacts,” Tom Walsh, head of weather research at Reuters, wrote in a note.

Walsh said, “warm and dry conditions appear to be looking into the forecast” for July.

“Cool and wetter than normal weather has been quite favorable for the Midwest as of late, but a warming trend is expected over the next 10-14 days according to most numerical model guidance,” he said.

USDA report bounces corn futures from a near-decade low.

The next big fundamental move in corn will be upcoming weather reports in the coming weeks. Source: ZeroHedge

![]()

Banks Are In Trouble: Wells Tumbles As Revenues Plunge, NIM Hits Record Low, Warns On Payment Deferrals

If there is one constant during earnings season, it is that no matter what the other banks do, Wells Fargo will always shit the bed,…

Read More