The following article by David Haggith was published on The Great Recession Blog:

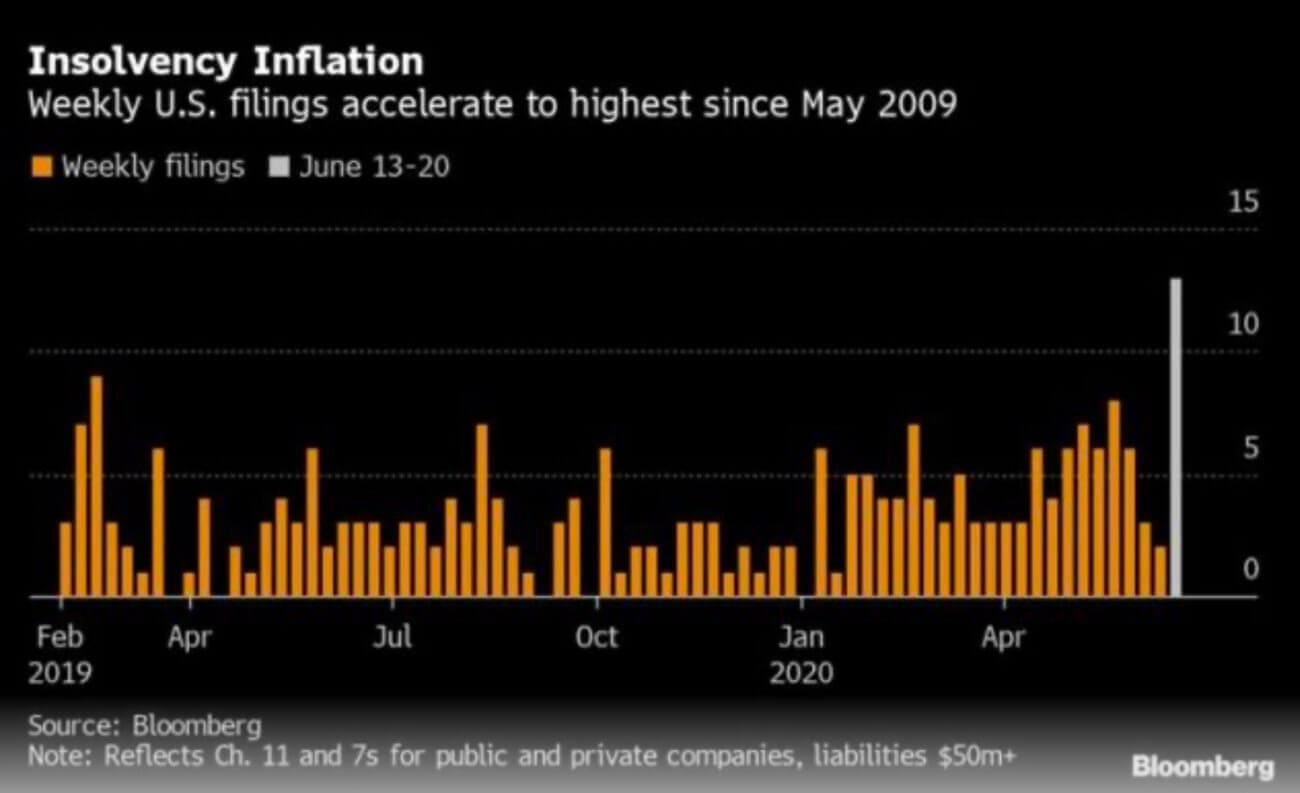

Bloomberg reported this week that thirteen US companies (in the 50-million-plus size) filed for bankruptcy last week.

That brought the total for the big boys and girls this year to 117, which matches the record peak for the first half of a year set in 2009.

The slew of bankruptcies also set a record in the health-care sector which has seen thirteen bankruptcies this year, almost double the seven seen in the same period last year. Ironically a health crisis was not even good for the health of the health-care industry.

Some big names of companies that were already distressed have gone down — Hertz, J. Crew, J.C. Penney and Neiman Marcus.

The Numbers for Small Businesses Are Just as Bleak

The numbers above, however, scarcely compare to the number of bankruptcies for all US businesses from largest to smallest.

On a monthly basis, US bankruptcies jumped by almost half in May due to the pandemic, year on year.

U.S. courts recorded 722 businesses nationwide filing for chapter 11 protection last month, a yearly increase of 48%…. In May 2019, a total of 487 businesses filed for that type of bankruptcy….

On June 9, CBS News reported the next wave in the recession will be in bankruptciesdue to the recent shutdown.

“This is a sign that already weak companies are succumbing to the lockdown recession,” Chris Kuehl, an economist with the National Association of Credit Management … said…. Businesses that were struggling before the pandemic “are starting to get in some real trouble.”

What Do These Bankruptcies Mean for the US Stock Market?

These bankruptcies, it should be noted, have been finalized in spite of all government and Federal Reserve bailouts. So, the stock market should not assume financial aid will prevent further economic damage.

On the contrary, as approved relief packages run out, one can logically expect the bankruptcy rate will go higher.

The stock market has remained oblivious to all of this, foolishly going as far as trading the value of some of these bankrupt companies up only to ride then down again.

But what does logic matter?

If the market keeps moving opposite of the business economy at this rate, shell corporations will soon be trading as trillion-dollar chips in the Wall Street casino.

Bankruptcies for businesses that don’t fully or sometimes even partially pay off their creditors eventually translate into bankruptcies for banks. Then we’re right back where we were in the abyss of 2009.

Yet the stock market is pricing upward to reach (and even beat in the case of the Nasdaq) its previous all-time highs. That is all based on the delusion of a V-shaped recovery from the pandemic.

These bankruptcies contradict that fantasy. Jobs lost in the restructuring of all these bankrupt companies aren’t coming back.

Bankruptcies don’t happen the same month big troubles hit. It takes time to prepare for filing. Many companies have, at least, a small amount of resources to weather through.

That means bankruptcies from the pandemic shutdown are just starting to flow through.

Consumer and Energy Sectors Lead the Bankruptcy Filings

The oil industry has weathered through tough times in recent years but has seen rises in bankruptcies each time, too. As described in this video, many companies in the industry are now preparing to file for bankruptcy.

Christ Atherton, president of EnergyNet states in the video,

I believe there’s 75 to 80 publicly traded oil and gas companies of size right now. Unfortunately, it could be half that number in a year or two.

Those businesses that are left, he says, will only survive by laying off people, and selling of assets.

Receive a daily recap featuring a curated list of must-read stories.

That’s a dire prediction about future bankruptcies from an industry insider for the largest gas companies in the US.

Because of forbearance rules in place during the shutdown, oil companies have been able to forestall bankruptcy, but it is not at all clear that demand for gasoline will return to previous levels before forbearance expires.

Many businesses plan to stay with working remotely, which means less commuting. Most big events that involve a lot of traffic are shut down for the summer and maybe longer. So, Big Oil has a lot of pain to come.

Yet, oil and gas stock prices have gone up 50% in value since their March nadir for the year:

Oil Isn’t the Only Industry Feeling Gas Pains

The same can be said for retail and restaurants where many businesses that shut down during the health crisis have not opened since the economy was officially reopened for business. That means they are probably down for the count.

Many restaurants that have reopened are struggling to survive under 50% occupancy reduction rules required in some states for social distancing. Some are not even filling up to their reduced occupancy limit because customers are afraid to return.

Restaurants run on thin margins and will not remain in business long with revenue down 50% or more.

The stock market has run far ahead of the economy, and the economy does not look like it has any intention of catching up. Instead, we will continue to see wave on wave of bankruptcies resulting in permanent job losses where businesses reopened.

Liked it? Take a second to support David Haggith on Patreon!

Source: ZeroHedge

StevieRay Hansen

Editor, Bankster Crime

![]()