Scripture shows us that physical evils—sickness, famine, war, and death—are the result of moral evil. And moral evil is something human beings are all responsible for, on a personal and a communal level. We suffer because of our own sins at times. Other times, we suffer because of the sins of others. In some situations, we suffer from simple cause-and-effect. And we sometimes suffer for a special purpose, in order to bring hope or help—or a warning—to others (see 2 Corinthians 1:4).

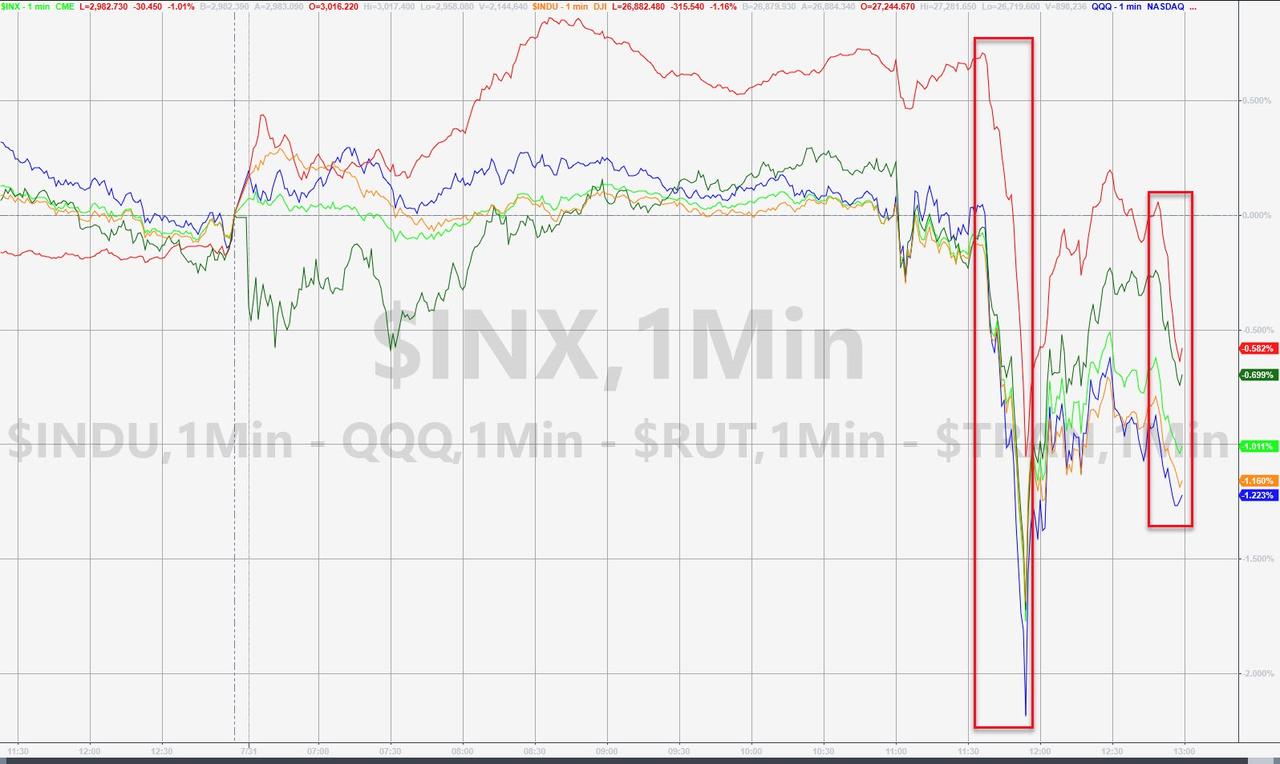

Update (1645ET): Well that didn’t take long. We noted previously that Trump demanded a rate-cut – gets one but the dollar soars and stocks tank – who will be blamed for that?

And now the President has responded by slamming Powell who “let us down”, telling his followers that the market wanted to hear that “this was the beginning of a lengthy and aggressive rate-cutting cycle which would keep pace with China, The European Union and other countries around the world.”

Donald J. Trump✔@realDonaldTrump

What the Market wanted to hear from Jay Powell and the Federal Reserve was that this was the beginning of a lengthy and aggressive rate-cutting cycle which would keep pace with China, The European Union and other countries around the world….48.7K3:41 PM – Jul 31, 2019Twitter Ads info and privacy14.7K people are talking about this

Donald J. Trump✔@realDonaldTrumpReplying to @realDonaldTrump

….As usual, Powell let us down, but at least he is ending quantitative tightening, which shouldn’t have started in the first place – no inflation. We are winning anyway, but I am certainly not getting much help from the Federal Reserve!47K3:41 PM – Jul 31, 2019Twitter Ads info and privacy16.3K people are talking about this

Powell over-promised and under-delivered to a market that will “take a mile when given an inch”…

“His comment about an ‘adjustment’ probably means that those looking for an aggressive easing cycle over the next six to nine months are not going to see it. What it means is that there was a divergence between what investors were saying and what they were pricing in.

Investors wanted Powell to say that he’s cutting, but they really wanted to see the Fed embarking on a rate-cutting cycle. The consensus belief on what the Fed would do was correct. It’s just that the markets pricing in an aggressive cycle of rate cuts were way off.” – Matt Maley, equity strategist at Miller Tabak + Co.

“The catalyst for sell-on-the-news was that phrase. He made it explicit — basically, that’s what that phrase means. An insurance cut implied ‘Hey, it’s just an insurance policy. It’s a one-time premium and we’re done.’ And then he made it explicit with that sentence and the market figured it out.” – Charlie Smith, founding partner and chief investment officer at Fort Pitt Capital Group in Pittsburgh.

And the result… (Is Powell the lady on the rope or Stallone trying to save us all?)

This should help..

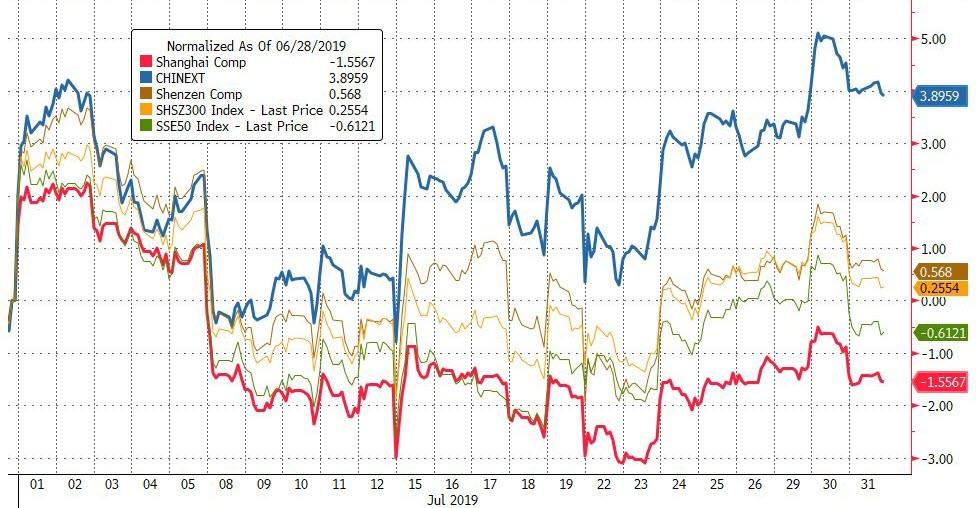

China ends the month mixed with tech-heavy ChiNext performing well but the broader Shanghai Comp in the red…

European stocks were also mixed with UK’s FTSE best (as the pound collapsed) and Spain and Germany weakest…

US stocks were all positive on the month with Small Caps worst and Nasdaq best (even with today’s ugliness)…

Bonds and the dollar held gains as stocks and gold sank post-Powell…

This is the 10th time out of 12 press conferences that Powell has done that stocks have tanked – not great!!

VIX spiked up to 16.5 intraday, dipped and then pushed back above 15 into the close…

Credit spreads spiked notably…IG spreads ended the month wider!

Thanks to today’s turmoil in the bond market, 30Y Yields ended the month lower and the short-end higher in yields…

The yield curve (3m10Y) very briefly un-inverted but tumbled on the day – staying back inverted…

And the 2s30s curve crashed most since Brexit (June 2016)…

The dollar surged 2.5% in July – its biggest monthly gain since Nov 2016 (Trump election)

Cable crashed over 4% in July – its worst month since Oct 2016 – with the lowest monthly close since 1985

Bitcoin bounced back above $10,000…

But cryptos have been ugly on the month…

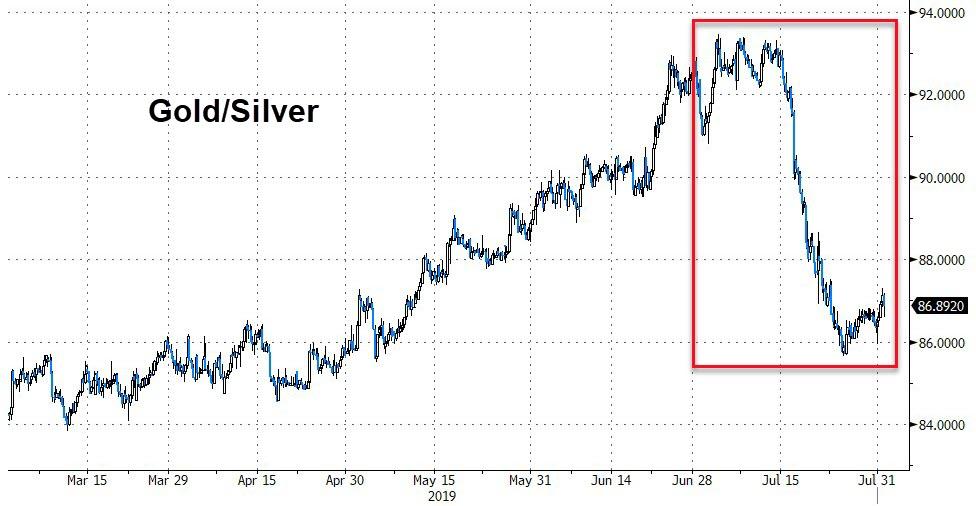

Commodities were broadly lower today as the dollar spiked but Silver massively outperformed for the month…

Silver surged back above $16 intra-month – its best month since Dec 2018…

And this was silver’s best month relative to gold since Brexit (June 2016)

Finally… Trump demanded a rate-cut – gets one but the dollar soars and stocks tank – who will be blamed for that?

Today’s market summary6042:56 PM – Jul 31, 2019Twitter Ads info and privacy190 people are talking about this

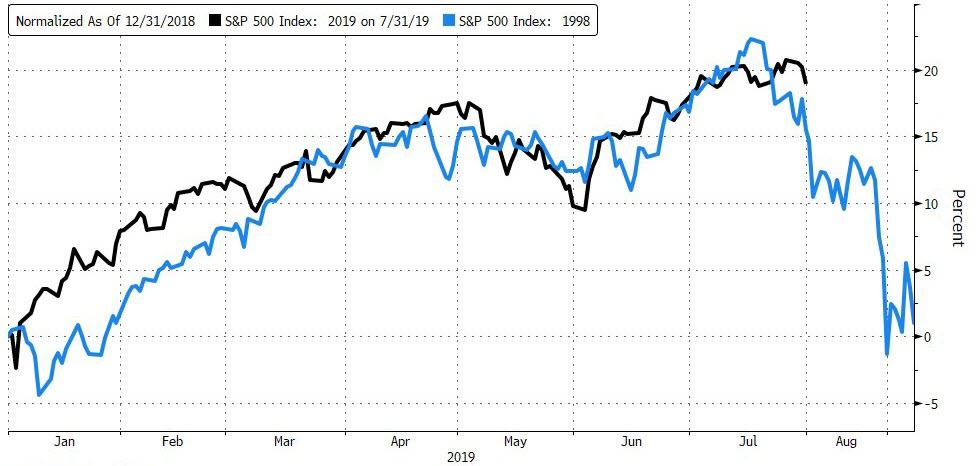

And what happens next?

![]()