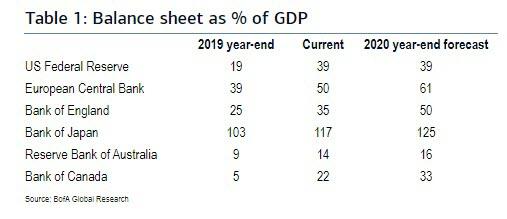

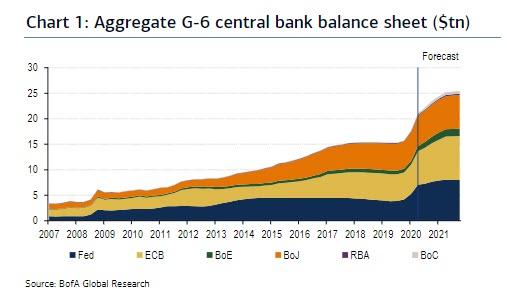

On Friday, we relayed the latest observations from BofA chief investment officer, Michael Hartnett who concluded that there is just one bull market to short – namely credit – “and the Fed won’t let you” by which he means all central banks. As the following table shows, the balance sheet of the G-6 central banks has exploded, with the Fed’s total asset expected to double in 2020 amid an avalanche of money printing.

And visually:

Recommended VideosBolsonaro Wins Brazilian PresidencyPauseUnmuteDuration 0:30/Current Time 0:03Loaded: 100.00% FullscreenUp Next

NOW PLAYINGBolsonaro Wins Brazilian PresidencyNo breakthrough as EU divisions remain over €750bn COVID-19 recovery planWatch live: Will European leaders agree a COVID-19 recovery plan on Friday?European leaders fail to agree €750bn COVID-19 recovery planWill European leaders agree a COVID-19 recovery plan on Friday?How the ECB Hopes TLTROs Revive LendingEurogroup chief Mario Centeno says no political reason behind quit decisionWirecard’s $2.1 Billion Hole Deepens After Forgery Claim

Of course, it’s not just central banks: as Hartnett also explained there is also the 2020 fiscal bazooka which has a way to go, with the massive fiscal stimulus unleashed post-covid taking 3 forms in 2020: spending, credit guarantees, loans & equity.

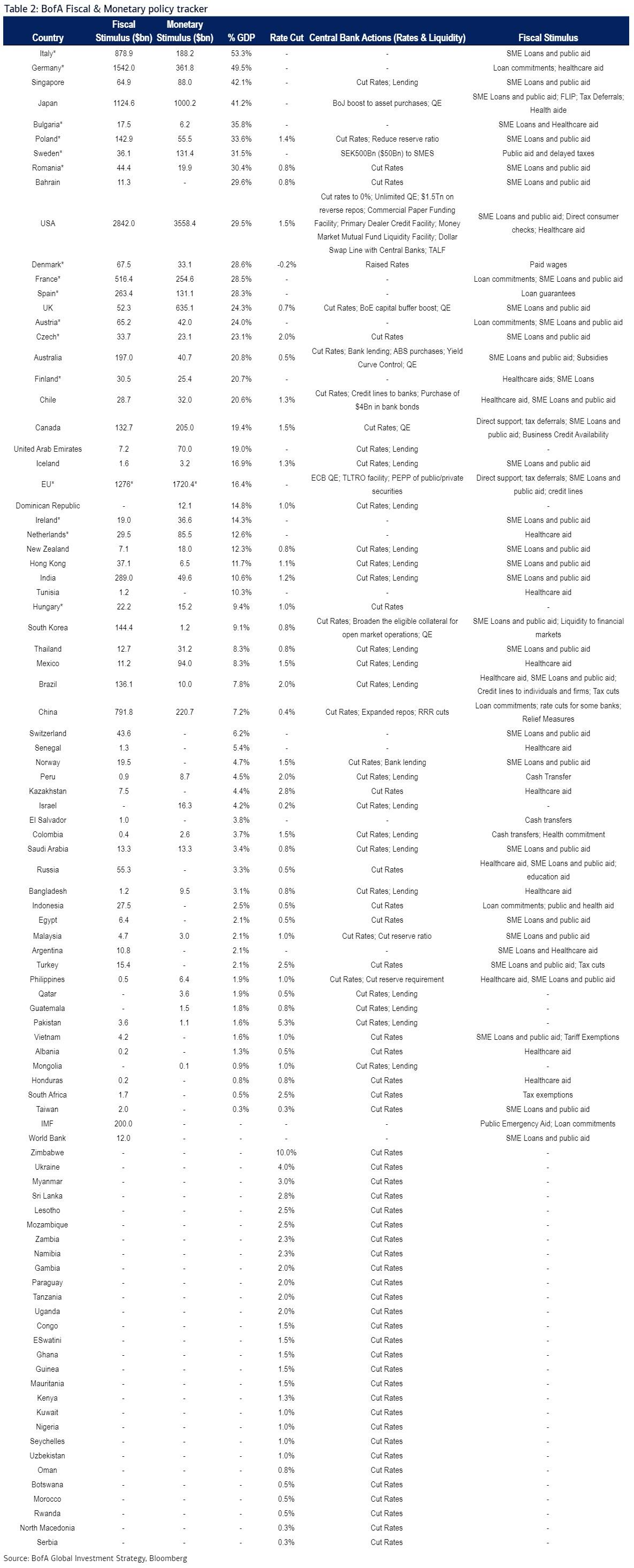

Hartnett also noted that according to BIS data, US & Australia lead spending (>10% GDP), Europe is using aggressive credit guarantees (e.g. Italy 32% GDP), while Japan/Korea are stimulating via government loans/equity injections.

But the most staggering fact was when one puts it all together.

According to BofA calculations, in addition to the record 134 rate cuts YTD, the amount of total global stimulus, both fiscal and monetary, is now a “staggering” $18.4 trillion in 2020 consisting of $10.4 trillion in fiscal stimulus and $7.9tn in monetary stimulus – for a grand total of 20.8% of global GDP, injected mostly in just the past 3 months!

And to think none of this would have been possible if officials had not collectively decided to shutdown the global economy in response to the coronavirus pandemic.

For the interested, here is a full breakdown of all the fiscal and monetary stimulus as compiled by BofA:

Source: ZeroHedge

StevieRay Hansen

Editor

![]()