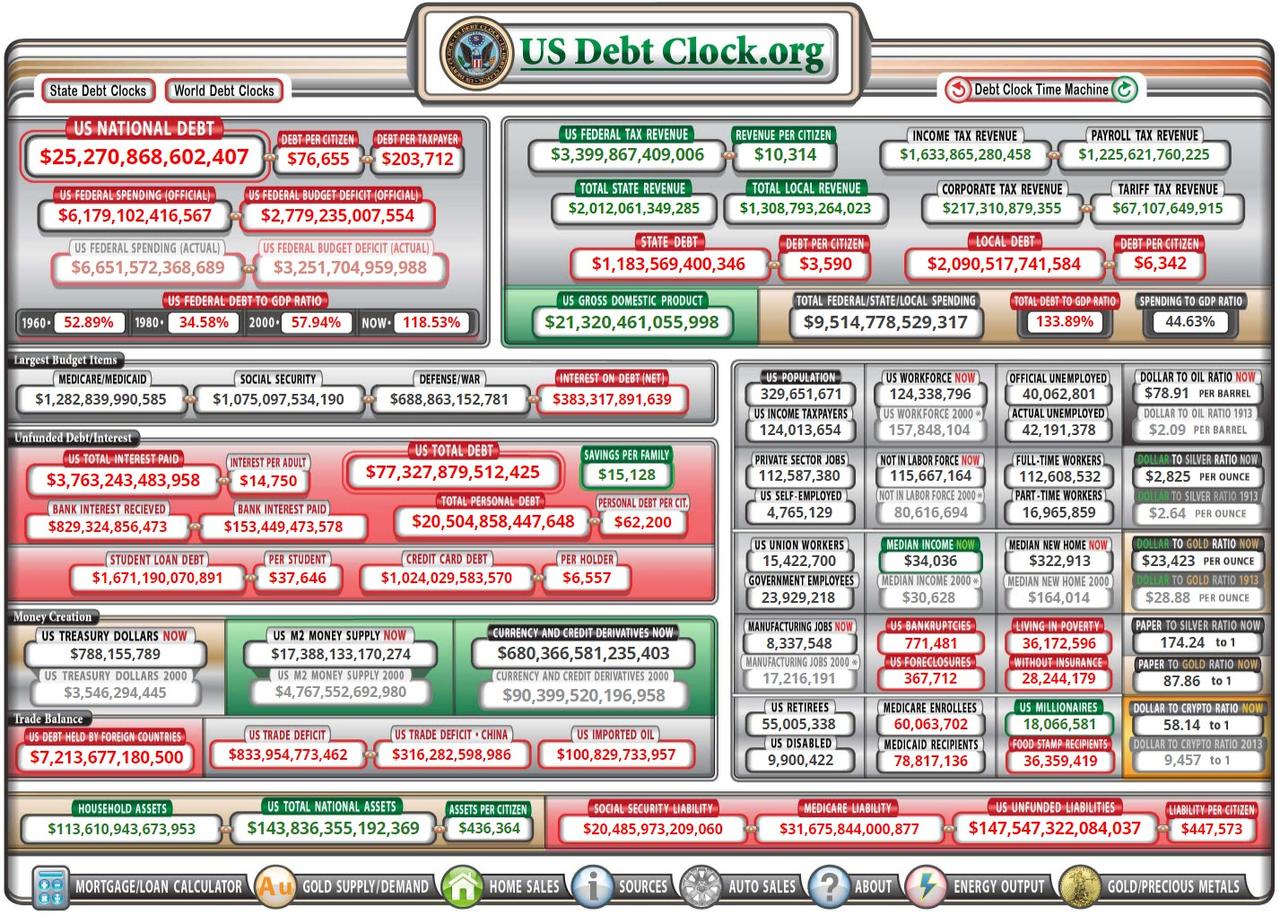

The National Debt Clock is flashing a major warning, Red Alert! this morning while working on another article I happened to glance at this indicator and recoiled in horror. While most people are aware the national debt has exploded, it brought my focus back to this subject. Many of us that watch the economy closely are still trying to get our heads around the rapidly unfolding covid-19 crises and the impact of trillions of dollars flowing into the financial system. America’s debt has soared past 25 trillion dollars and is now expected to leap by several more by the end of the year.

All this, of course, is in play even before it was announced that House Democrats have powered through the House another $3 trillion coronavirus relief bill. It is described as an election-year measure designed to brace a U.S. economy in free fall and a health care system struggling to contain the pandemic.

This debt surge would have been unimaginable just a year ago. The clock provided by US Debt Clock.org provides a great deal of insight and information. a seldom and underused feature appears on the right side of the top line, it is labeled “Debt Clock Time Machine.” When you click on it you are provided with a view of where the debt and a slew of data for several periods in the past. It also provides a view of current expectations four years forward.

While it can be difficult to sort out much of this information, it is very helpful in identifying trends. With this in mind, it is important to note that the number of people living on government transfers of wealth has grown over the decades. Since the massive disruption in the economy resulting from the government’s response to covid-19 is likely to lead to a deep recession or depression marked by reduced dividends, an end to buybacks, and softer growth. The Trump administration’s decision to jump into the breach by signing the CARES Act, a $2.3 trillion relief package, is another indication that his answer to such an economic disaster is mega-spending on hand-outs and social projects.

Sadly, because of the political environment, we are experiencing, Congress rapidly gave near-unanimous approval casting aside concerns about the deficit or the unintended social consequences it might usher in. A theory exists that during a situation such as we are facing, the Government’s efforts to intervene are useless and may make things worse. Sometimes when the economy is melting down, it is best to do little or nothing because the free market will over time self-correct and return to a healthy balance. The problem at this time is two-fold, first, Trump doesn’t view deficit spending as a problem and second, he touts the stock market as an indicator of his ability to return America to its days of glory as promised when he ran for office. Unfortunately, much of his economy is generated using this old trick of deficit spending.

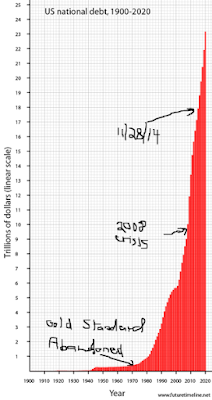

The chart above shows how the deficit has exploded over the last three years. This indicates the Trump economy is a mirage based on deficit spending. Expect this not only to continue but get substantially worse. In the past, this spending coupled with market manipulation fueled by changes in the tax laws has caused stock buybacks to explode. The bottom-line is that we entered this crisis in the midst of a “false economy” and it is only by the grace of this huge deficit spending that we are not languishing at the bottom of a deep economic pit. Deficit spending is not a silver bullet without consequences and is a poor substitute for the free market when allocating capital to where it is most effective. It is not economic growth but simply a method of borrowing from the future.

Trump has displayed a strong tendency to boost the stock market at every opportunity. He often accomplishes his goal of rocketing the market higher even if only temporarily by “tweeting” what he views as market positive blips or banging away at Federal Reserve chairman Powell. Many are centered around, the idea of “trickle-down economics” and how lower tax rates trickle down to benefit the overall economy. It appears that Trumps sees a higher stock market as proof he is on the proper track but he is blind to how distorted markets have become. I contend that while Trump touts a fondness and respect for hard-working Americans his policies will continue to create a great deal more inequality.

Low-interest rates, coupled with printing money and deficit spending has always come with huge hidden costs. They include increasing speculation, distorting prices, and allowing boondoggles to be built while reducing income to savers. This money flows to big business and Wall Street first and less so to small local merchants. In short, it reeks of crony capitalism and fuels a false economy full of boondoggles. As for the economic concept of “trickle-down economics,” the problem is that those at the bottom share only a few drops of the benefits while those at the top swim in a pool.

Circling back to the crux of this article, America’s debt is soaring and small businesses and stores are closing in record numbers. Do not underestimate the importance of small businesses. Last year businesses with under twenty employees totaled some 30 million, employed over 54 million workers, and contributed 44 percent of all sales in the country. The economic scenarios before us include growing inequality, massive long-term unemployment, and propping up zombie companies. The Japanification of America is well on its way. Stagflation or run-away inflation is also a good possibility as history indicates that a soaring national deficit is never a free lunch. Trump may refer to the campaign against the coronavirus as a “war” but it is just a battle. The real war is still before us as we begin to deal with the carnage the politicians in Washington have unleashed upon us.

The President did not get us here on his own, he was assisted by a willing and complacent Federal Reserve and Congress. The combination of Nancy Pelosi and President Trump has been toxic to anyone interested in holding government spending at a reasonable level. It will be interesting how this plays out as the election draws closer. Trump’s salvation may be that he faces an even greater free-spending Democrat as he argues that things would have been far worse if he had not taken us down this path. It is incredibility ironic that after criticizing Obama and the Democrats for taking us down this road we find Trumponomics is a little different. Please forgive me for pointing out the obvious, the next Presidential election is currently not set to bring about an answer to this ugly dilemma.

StevieRay Hansen

Editor, Bankster Crime

MY MISSION IS NOT TO CONVINCE YOU, ONLY TO INFORM YOU…

https://bankstercrime.com/coronavirus-triggers-biggest-shock-to-oil-markets-since-lehman-crisis/

“Have I therefore become your enemy by telling you the truth?”

Oil Drop, Coronavirus, Fraud,Banks,Money,Corruption,Bankers

This Pestilence Is Spreading: Stock Market In Trouble

![]()