Insanity is doing the same thing over and over again, but expecting different results.

Federal Reserve Chairman Jerome Powell announced on Thursday that the Fed will now shift its focus from hitting inflation targets and instead prioritize closing “unemployment shortfalls”.

This gives it the aircover to do “whatever it takes” until the unemployment rate is back down into the low single digits. Inflation can now run hotter than 2%, rates can stay at 0% (or go negative) for the next decade+, more QE…. all is fair game now in the pursuit of lower unemployment.

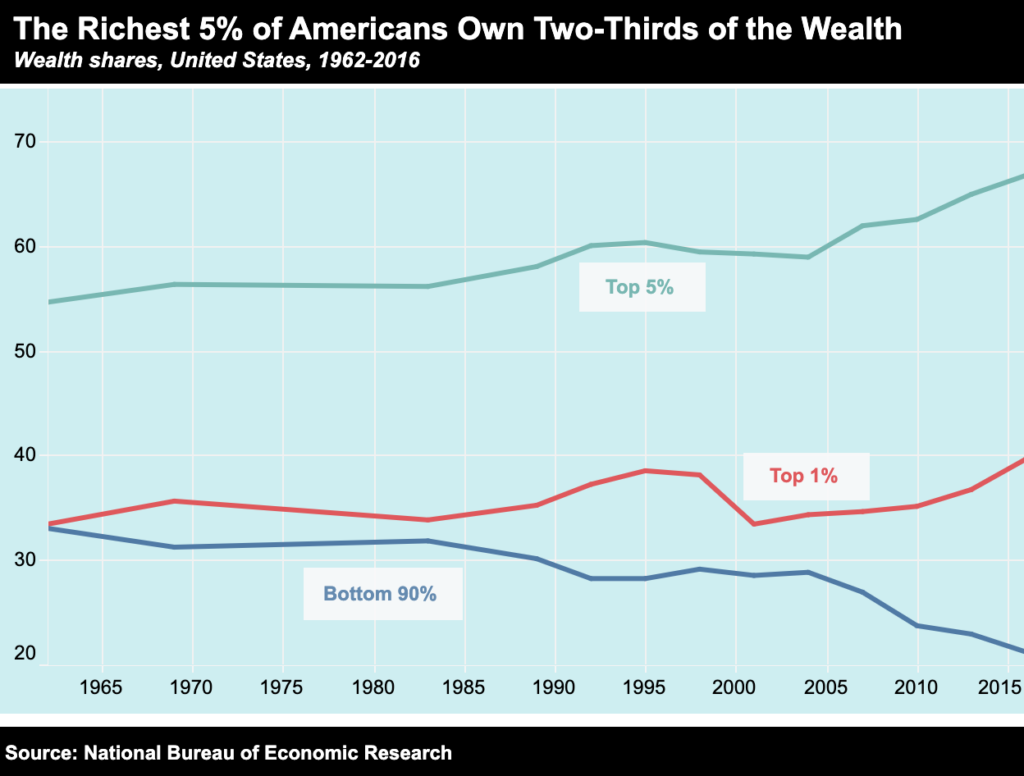

Essentially, the Fed is now tripling-down on the same failed policies that have created today’s zombie economy and the worst economic inequality in our nation’s history.

Perhaps the folks at the Fed are smarter than we think, and there’s actually a grand plan they’re pursuing that’s going to work out to society’s benefit?

Sadly no, reveals this week’s expert guest, Danielle DiMartino-Booth.

Danielle knows the Fed inside and out, as she worked as a consultant for nearly a decade to Richard Fischer, President of the Federal Reserve Bank of Dallas, including helping deal with the Great Financial Crisis. She knows how the organization runs, as well as the specific people running it.

And her assessment is that the Fed is trapped in a nightmare of its own making and is merely playing for time at this point. Everything it throws at the situation is designed to hopefully get the system to limp through the next quarter or two without breaking, at which point they’ll scramble to come up with the next short-term “solution”.

In the video below, Danielle breaks down the important takeaways and repercussions of Chairman Powell’s Jackson Hole speech and vents her frustration at both his duplicity with the public and the media’s cowardly refusal to hold him to account.

As our other recent guest experts have warned, Danielle confirms this is an exceptionally treacherous time in the markets for investors, as the Fed’s intervention has and continues to deform and distort prices far beyond reason:

Receive a daily recap featuring a curated list of must-read stories.

Source: zerohedge.com

Anyone interested in scheduling a free consultation and portfolio review with Mike Preston and John Llodra and their team at New Harbor Financial can do so by clicking here.

StevieRay Hansen

Editor, BankstersCrime

God often uses men who are not of the best moral character. Pharaoh, Nebuchadnezzar, Cyrus, Herod, and Trump (amongst others), to accomplish His will in events He orchestrates during human history. We either trust the sovereignty of God or we don’t. Nothing happens apart from Him…

The best index to a person’s character is how he treats people who can’t do him any good, and how he treats people who can’t fight back…

The Birth Pains Are Growing Stronger….

One of the signs of ruling class collapse is when they can no longer enforce the rules that maintain them as a ruling class. When the Romans started making exceptions to republican governance, it was a matter of time before someone simply decided the rules no longer applied to them. Perhaps the robot historians will consider Obama our Marius or Sulla. Maybe that person is in the near future. Either way, the rule of law is over and what comes next is the rule of men.

“Don’t piss down my back and tell me it’s raining.” Outlaw Josey Wales

WE NOW LIVE IN A WORLD THAT IS PURE FABRICATION

![]()