A fully financialized, totally debt and speculation-dependent economy is terminal once leverage and debt stop expanding exponentially.

We all know the movie scene in which the character is wounded but dismisses it as no big deal, and then lurches into the closing sequence where we discover the wound was not inconsequential, it was mortal, and the character expires.

That’s a fair depiction of the economy–both the U.S. and the global economy. The rapt audience is assured it’s just a flesh wound and the character will soldier on, teeth nobly gritted, and that sets up our surprise when he/she tragically expires in the climatic scene.

Financial-political authorities and their paid cheerleaders are sparing no expense in assuring us the pandemic-triggered Greater Depression is a mere bump in the road and the recovery will be record-breaking, and they lavish excessive optimism on the triggers of this astounding recovery that’s just waiting in the wings: a covid-19 vaccine, a covid-19 treatment, herd immunity, etc.

What the cheerleaders and authorities cannot dare acknowledge is the extreme fragility and vulnerability of the pre-pandemic economy: the unprecedentedly excessive leverage, debt, speculation, wealth and income inequality, asset bubbles, etc. that had all started to roll over as gravity finally took hold in Q4 of 2019.

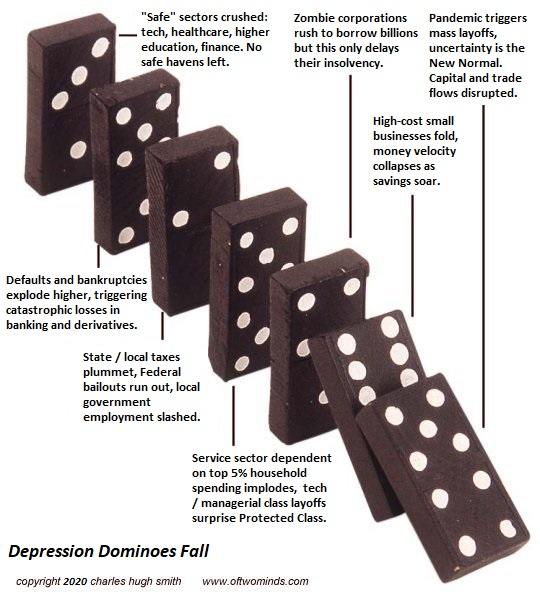

Also missing from the astounding recovery that’s just waiting in the wings narrative is the recognition of second-order effects as the dominoes of fragility and vulnerability continue toppling.

Even super-duper covid-curing space rays beamed at our planet by helpful Martians couldn’t stop the financial conflagration that is now raging, a conflagration that was inevitable given the monetary deadwood that was piled ever higher for 12 long years, a mountain of dry tinder awaiting a random lightning strike or careless match.

As a example of second-order effects, consider a sector we are all familiar with as customers: dining out: restaurants, cafes, bistros, brew-pubs, etc. We all understand that when these establishments close, the owners, managers and employees all lose their livelihoods.

But this isn’t the full extent of the losses. Behind the visible facade of any industry is a long line of dominoes behind what the customer sees.

When 50% of all dining-out establishments close, that immediately causes equivalent losses in sectors that supplied those establishments with clean linens and uniforms, meats, vegetables, culinary supplies, accounting, advertising, marketing, consulting, specialty magazines, etc., in a nearly endless profusion of businesses dependent on the dining-out sector.

And then there’s all the retail real estate landlords that depended on these establishments to pay high rents on costly commercial spaces, and those nearby businesses that depended on the foot traffic generated by concentrations of dining-out establishments.

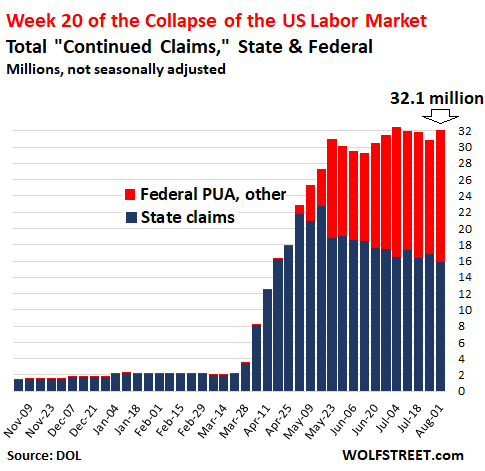

The cheerleaders don’t dare acknowledge the absence of any sectors that can absorb the 32 million workers drawing unemployment, or those who aren’t in the unemployment system, for example sole proprietors who closed and those in the informal cash economy.

The dining-out sector was a haven for marginalized workers seeking the higher compensation of tips, and a major entry point for new workers entering the workforce. There is no substitute sector to absorb the millions of workers who lost their livelihood in the dining-out sector and all those whose jobs were dependent on providing the dining-out sector with goods and services.

source: Wolfstreet.com

A less financialized, less debt and speculation-dependent economy would be more resilient, but a fully financialized, totally debt and speculation-dependent economy is terminal once leverage and debt stop expanding exponentially.

StevieRay Hansen

Editor, BankstersCrime

God often uses men who are not of the best moral character. Pharaoh, Nebuchadnezzar, Cyrus, Herod, and Trump (amongst others), to accomplish His will in events He orchestrates during human history. We either trust the sovereignty of God or we don’t. Nothing happens apart from Him…

The best index to a person’s character is how he treats people who can’t do him any good, and how he treats people who can’t fight back…

The Birth Pains Are Growing Stronger….

One of the signs of ruling class collapse is when they can no longer enforce the rules that maintain them as a ruling class. When the Romans started making exceptions to republican governance, it was a matter of time before someone simply decided the rules no longer applied to them. Perhaps the robot historians will consider Obama our Marius or Sulla. Maybe that person is in the near future. Either way, the rule of law is over and what comes next is the rule of men.

“Don’t piss down my back and tell me it’s raining.” Outlaw Josey Wales

WE NOW LIVE IN A WORLD THAT IS PURE FABRICATION

c

![]()