The Birth Pains Are Growing Stronger….

“Unless God has raised you up for this very thing, you will be worn out by the opposition of man and devils”…

My name is Steve Meyers and I need to share a vision and warning that the Lord showed me back in April 2007….

Many of you will ask why I waited so long to share the warning. I didn’t. I shared the story with everyone that would listen from pastors to friends to family to colleagues. Immediately following the initial vision, I called a close friend. I told him to sit down that I had something to tell him. I needed it documented as I knew this was supernatural and from God. As I witness events unfolding today, I need to share the vision again.

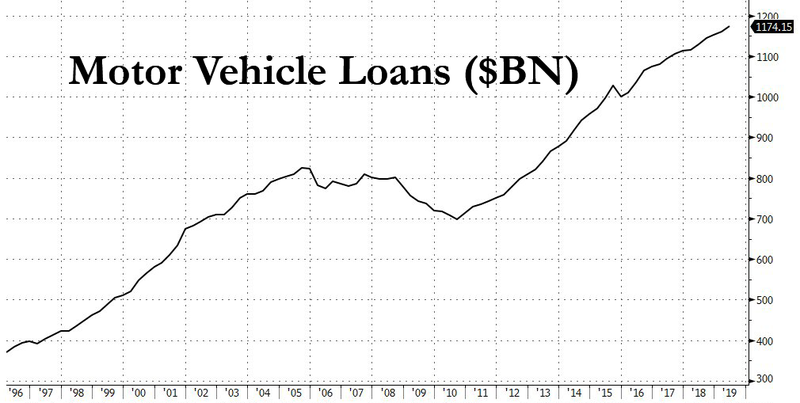

In a recent report, we outlined how the largest subprime auto lender, Santander, is currently experiencing one of the most significant accelerations in subprime auto loan delinquencies, not seen since the dark days of 2008. Now, in a separate report via the Federal Reserve Bank of Dallas, there is new evidence that the epicenter of the next auto loan meltdown could start in Texas.

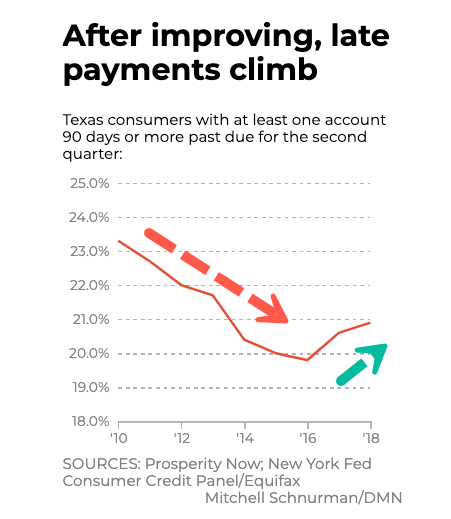

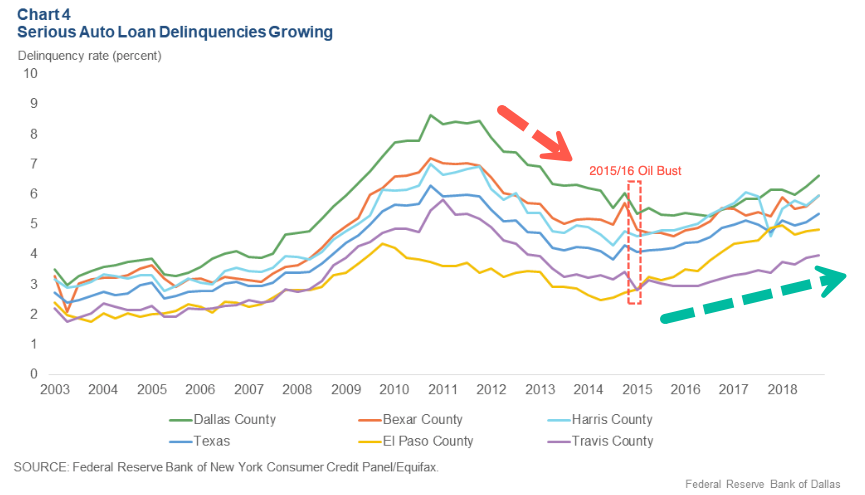

The Texas auto subprime market began experiencing a troughing event in serious auto delinquencies in 2015, with a rapid turn up in 2016. By the end of 2018, the serious auto delinquency rate was at 16.7%, approaching 2010 levels of 18.2%. Despite the “greatest economy ever,” the Dallas Fed admits rising wealth inequality could be responsible for the growing delinquencies in Texas.

“It’s clear something is going on,” said Emily Ryder Perlmeter, an adviser for the Dallas Fed and one of the report’s authors. “The economy may not be working as well for everyone.”

Michael Carroll, an economist at the University of North Texas, suggests the report is a clear indication that consumers in easy money times took on too much auto debt. Carroll also said consumer distress in Texas could be a bellwether for the broader economy and a warning sign that the consumer is weakening.

Perlmeter said rising auto loan delinquencies across the country is a severe problem, but the meltdown unfolding in Texas is much worse than any other major metropolitan area.

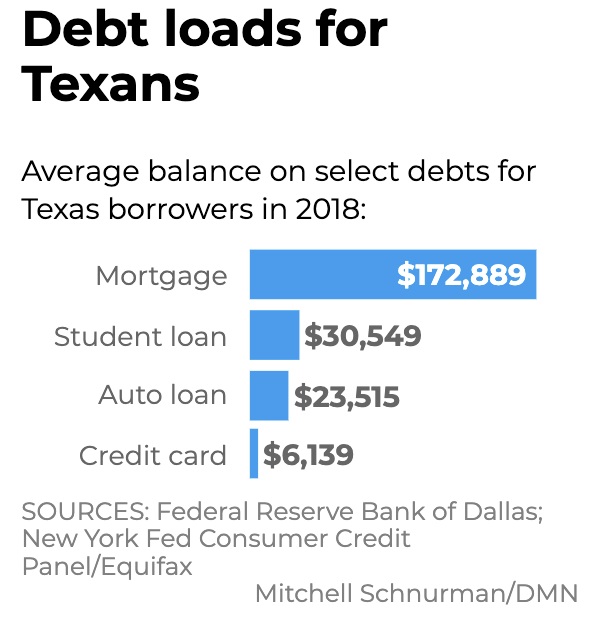

The Dallas Morning News noted the average auto loan in the state is $23,500 as of late 2018.

“The reality is we have too many low-paying jobs,” said Woody Widrow, executive director of Raise Texas, a nonprofit group that lobbies for anti-poverty policies. “Just because we have a low unemployment rate doesn’t mean that people have enough money to pay for the things they need.”

For all of 2017, nearly one-third of the jobs in the state paid less than $24,300 per year, which is about the poverty line for a family of four.

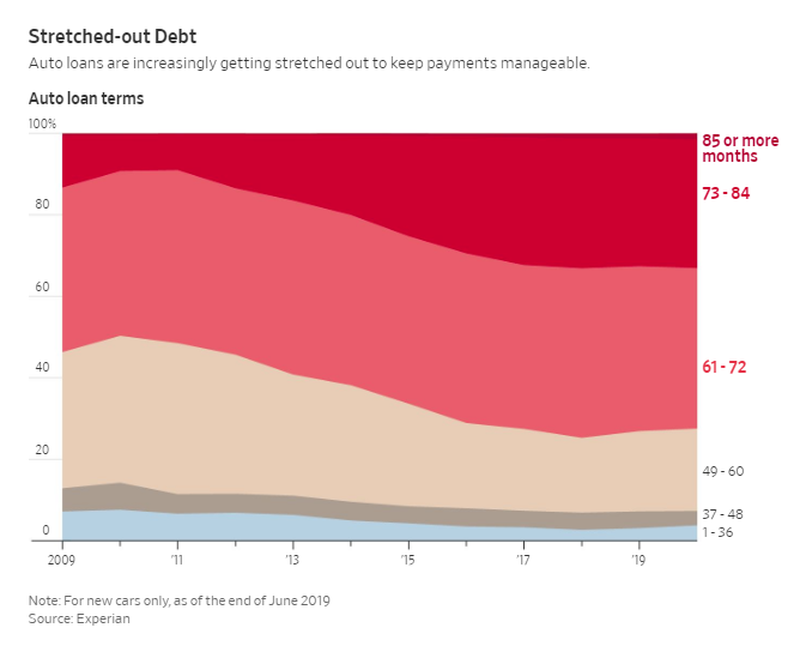

Average auto loans have been extended past 69 months to make it more affordable for the lower-income part of the population.

But what happens when the economy falters, and the oil and gas industry in Texas plunges? Consumers lose their jobs, develop a credit crunch, and are unable to service their insurmountable debts.

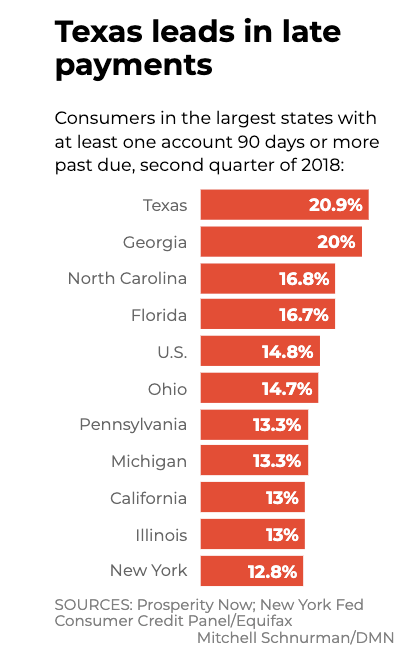

About 21% of Texans in 2018 had one credit account that was 90 days past due, said Prosperity Now. That was a one percentage point increase from 2017 and is the highest level among large states.

Rising auto loan delinquencies in Texas stem from the 2015/16 oil bust, Perlmeter said.

Many Texans have insurmountable debts (auto loans, credit cards, student debts, and mortgages), depressing incomes, no savings, and are working in the gig economy, can barely make ends meet in an economy that is rapidly slowing. So when the next recession strikes, could be as early as next year, consumers in Texas could be very screwed.

Residents in El Paso will likely be the most screwed in the next economic downturn. Already, the county’s delinquency rate on auto loans doubled from 2014 to 2018 and broke to new highs not seen since the last financial crisis. Other counties have also seen a meteoric rise in auto delinquencies since the oil bust.

“Of the Texas counties in this report, El Paso County experienced a particularly steep rise in serious auto debt delinquencies, with its rate nearly doubling from 2014 to 2018. Unlike other counties and the state at large, El Paso’s serious delinquency rate is currently past its peak during the Great Recession. A few possible factors are at play. First, the average car loan carried in El Paso County is higher than the other four counties, despite El Paso’s relatively low median household income. Secondly, since mid-2017, the performance of auto debt for prime borrowers in El Paso has worsened, while prime performance in other counties has remained relatively stable,” Dallas Fed wrote.

Consumer credit trends in Texas are an eye-opener of what’s to come for the broad consumer in the US. The next recession will especially leave the millennial, which is currently strapped with insurmountable debts, financially paralyzed for a generation to come.

StevieRay Hansen

Editor, Bankster Crime

MY MISSION IS NOT TO CONVINCE YOU, ONLY TO INFORM YOU…

#chilssextrade #pedophiles #lawlessness #mexican #children #molested #kill #badbusiness

Tagged Under: #Fraud #Banks #Money #Corruption #Bankers,#Powerful Politicians, #Businessmen

![]()