Covid-19’s effect on global energy markets has been disastrous. OPEC slashed its oil demand forecast last week, and Goldman Sachs doubled down on its bearish oil take and has cut its oil price target by $10 to $53 for the year, as a result of a “demand shock” that is set to collapse Chinese oil consumption by 20%, or as much as 4 million barrels per day.

The sharp decline in demand in China, which by the way, is the world’s largest oil importer, is now stranding oil cargoes off the country’s coast and across Asia.

Bloomberg’s Stephen Stapczynski records footage of an impressive parking lot of tankers and other vessels off the coast of the anchorages of the port of Singapore, one of the largest freight hubs and busiest ports in the world.

Much of the oil consumption decline is because, as we reported on Friday, China’s economy is faltering as its industrial hubs remain shuttered.

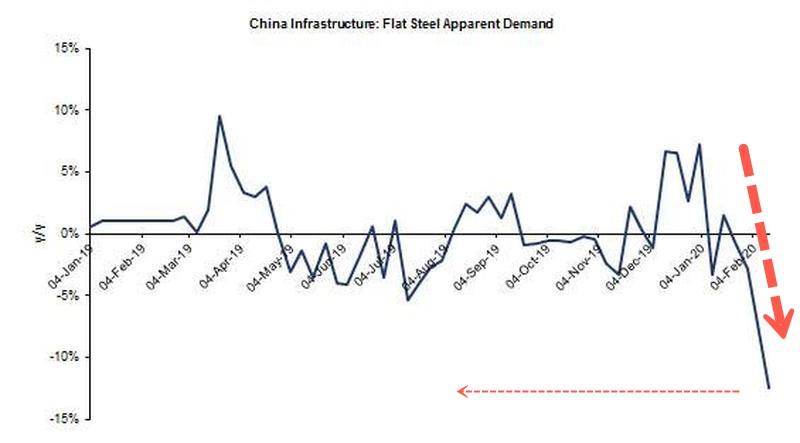

Take a look at the chart below, in the Feb 7-13 week, steel apparent demand is down a whopping 40%, but that’s only because flat steel is down “only” 12% Y/Y as some car plants have ordered their employee to return to work.

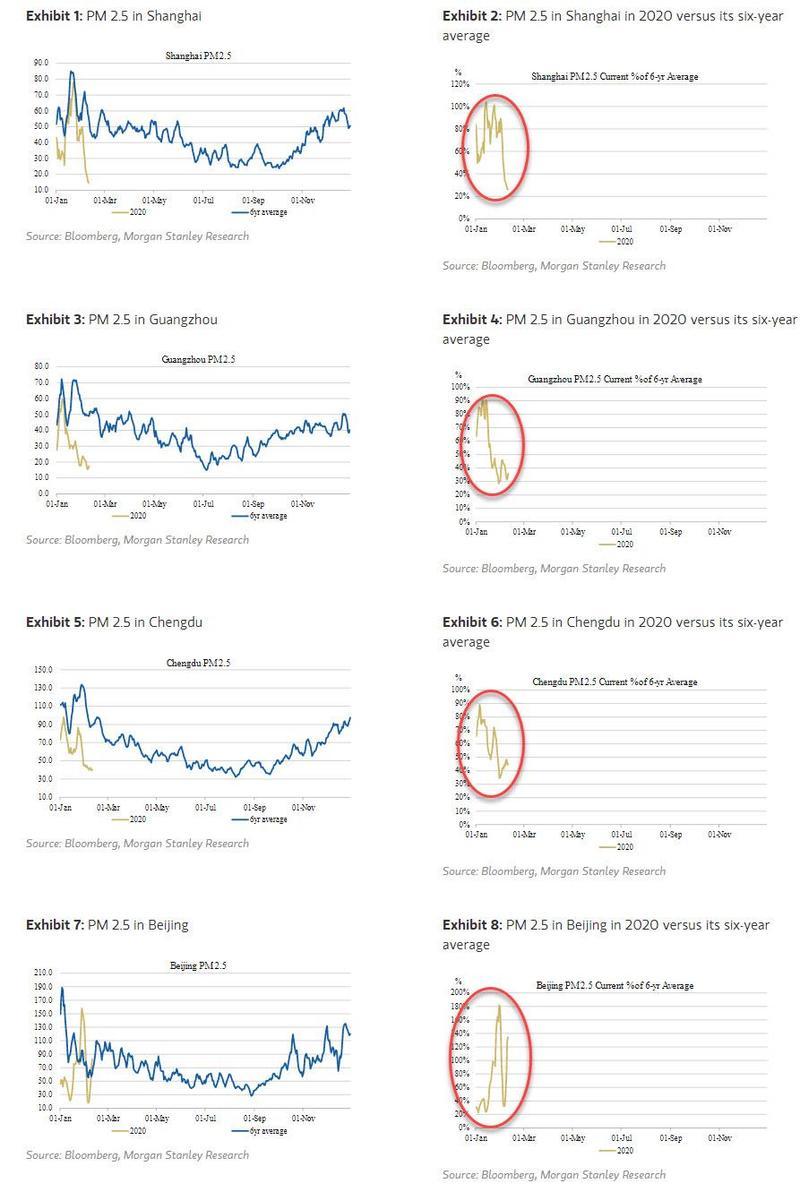

Real-time measurements of air pollution (a proxy for industrial output), daily coal consumption (a proxy for electricity usage and manufacturing), and traffic congestion levels (a proxy for commerce and mobility) suggest that the second-largest economy in the world has frozen. This all indicates the demand for energy products to power machines and vehicles has abruptly stopped.

A significant bottleneck for Very Large Crude Carriers (VLCCs) deliveries to China is developing, forcing some ports to reject new tanker loads, contributing to a parking lot of tankers sitting off the coast and in other regions in Asia.

Some cargos have been diverted to Singapore, Malaysia, South Korea, but even in those regions, tanker traffic jams are building.

Crude storage in China filled up near full capacity last summer, mostly due to declining demand thanks to a decelerating economy.

China’s overall crude storage is around 760 million barrels, versus a peak of 780 million barrels last June.

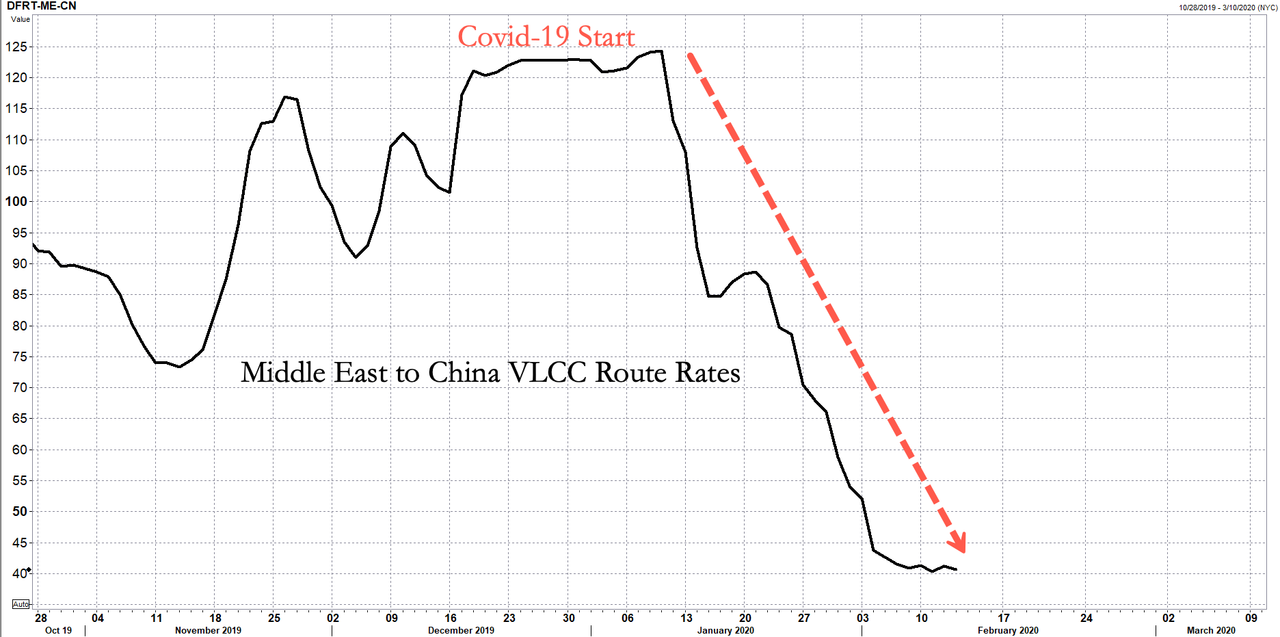

Middle East traders who export crude via VLCCs to China reported weaker demand. VLCC rates from the Middle East to China have plunged since the virus outbreak began early last month.

“In gas markets, a one Chinese company declared force majeure, potentially allowing it to walk away from contractual commitments. The measure was rejected by Total SA and Royal Dutch Shell Plc. There are now 12 empty liquefied gas carriers sitting off the coast of Qatar, one of the world’s biggest producers. While the precise reasons for the idling vessels aren’t known, the timing coincides with ship diversions, cargo cancellations and reduced demand in Asia since the virus took hold. Oil tankers have been dawdling off China,” reported Bloomberg.

The parking lot of tankers developing off the coast of not just China but other countries in the region have forced some traders to transfer crude to less expensive tankers to save on demurrage costs, over the fear cargos could be moored offshore for an extended period as an economic crisis in China unfolds.

And to summarize what we know so far: China’s economy is collapsing, crude consumption is plunging, which has forced refiners to cut runs as a glut is developing, has now led to tanker parking lots moored off the shores of many countries in Asia.

What is also known is that bunker fuel prices at major ports in Asia, including Singapore, Hong Kong, South Korea, Taiwan, and Japan, have been declining since the virus outbreak began early last month.

The world is bracing for a huge virus shock from China, not seen in over a decade – this could easily tilt the world into recession.

What the High-Tech Do-Gooders Have Overlooked, There Are No Laws, No Rules to the World They Have Created, Artificial Intelligence Will Eventually Eat Their Own and Anyone that has Contributed to the Undoing of Humanity, Mad-Mix During the Tribulations, The high tech conglomerates chose to attack God’s children (The Christians) you brought destruction upon yourselves and your high-tech corporations, it’s amazing how wrong you can be when dumb down in biblical truth, God’s word has survived the tyrants for thousands of years, yet you CEOs have missed the most important part of life, God’s plan for humanity, enjoy.

Could it be possible that this coronavirus outbreak will be the trigger that finally bursts the biggest stock market bubble in U.S. history? As I have discussed previously, stock prices in the United States were the most overvalued that they have ever been during the month of January, and our stock market has never been more perfectly primed for a huge meltdown. But stock prices are all about what investors believe will happen in the future, and if they remain convinced that the future is bright then perhaps this stock market bubble could persist for a while longer. Unfortunately for Wall Street, this coronavirus outbreak is starting to create a wave of fear in the financial community. In fact, concern about the coronavirus pushed the Dow Jones Industrial Average down more than 600 points on Friday, and that represented the worst day for the Dow since last August…

Stocks fell sharply on Friday, wiping out the Dow Jones Industrial Average’s gain for January, as investors grew increasingly worried about the potential economic impact of China’s fast-spreading coronavirus.

The Dow dropped 603.41 points, or 2.1%, to 28,256.03 in the 30-stock average’s worst day since August. The S&P 500 had its worst day since October, falling 1.8% to 3,225.52. The Nasdaq Composite dropped 1.6% to 9,150.94.

Up until now, investors were very confident that the Fed and the Trump administration could keep the party rolling, but now that is changing. Just consider what Ilya Feygin just told CNBC…

“The theme coming into this year was the Fed and Trump are going to bail us out of any problems, but the virus is something neither one can do anything about. That’s a reason to become more fearful.”

A reason “to become more fearful”?

That certainly doesn’t sound good for stocks.

And this coronavirus outbreak has also been pushing down the price of oil…

Oil prices have also suffered from the virus outbreak, because China is a big consumer of the commodity.

US oil prices are on track for their worst month since May last year, when the US-China trade war and high inventory levels weighed on prices.

Ultimately, the economic impact of this crisis will be determined by how bad this outbreak eventually becomes, and that is very uncertain at this point.

But without a doubt, the coronavirus is already having a substantial impact on the Chinese economy. The following comes from CNN…

The economic impact of the virus is still impossible to determine, but one state media outlet and some economists have said that China’s growth rate could drop two percentage points this quarter because of the outbreak, which has brought large parts of the country to a standstill. A decline on that scale could mean $62 billion in lost growth.

Goldman Sachs is warning that this outbreak will also cause the U.S. economy to slow down this quarter, but the bank is still convinced that next quarter will be better…

The fast-spreading coronavirus could slow first quarter growth of the United States economy, according to a new report from Goldman Sachs.

Analysts at the firm forecast a 0.4 percentage point decline on US annualized growth through March. But it’s not all doom and gloom: Goldman Sachs (GS) also predicts that growth will rebound in the second quarter by roughly the same amount.

Of course, the analysts over at Goldman Sachs are assuming that this coronavirus outbreak is not going to turn into a horrifying global pandemic.

But what if they are wrong?

During the last two weeks of January, the number of confirmed cases got 236 times larger, and if this outbreak continues to grow at an exponential rate it is going to be absolutely catastrophic for the entire global economy.

Quite a few experts are now recognizing this reality, and that includes Tuomas Malinen…

Global recession, a European banking crisis and a crash in the U.S. capital markets will produce a global economic collapse which will almost certainly overwhelm any attempts—massive and coordinated as they may be—to turn the tide by over-stretched central banks and over-indebted governments.

This is, why the coronavirus outbreak should be treated for what it is: a potential harbinger of human and economic calamity.

Whether such a scenario materializes in the weeks ahead all depends on how widely this virus spreads.

Personally, I am hoping that this outbreak fizzles out as rapidly as possible. This virus has an incubation period of up to 14 days, and wondering who might have the virus is going to drive a lot of people completely nuts.

Unfortunately, it looks like things are only going to get worse. According to a study that was just released, we could soon have “independent self-sustaining outbreaks in major cities globally”. The following comes from Natural News…

A new, urgent study just published in The Lancet warns that “independent self-sustaining outbreaks in major cities globally” may be “inevitable” due to the “substantial exportation” of symptomless carriers of coronavirus. That same study also calculates that 75,815 individuals are infected right now in mainland China, where the official government numbers are currently under 10,000.

Titled, “Nowcasting and forecasting the potential domestic and international spread of the 2019-nCoV outbreak originating in Wuhan, China: a modelling study,” the study is authored by Professor Gabriel M. Leung, MD and Kathy Leung, PhD.

Coming into this year, so many of us felt such a sense of urgency, but I don’t know anyone that thought we would potentially be facing a horrific global pandemic by the end of January.

The worse this outbreak becomes, the more pain the global economy is going to feel.

And there is no way that this stock market bubble is going to survive a severe global economic downturn.

The only way anyone ever makes money in the stock market is if they get out in time. And unfortunately, the ridiculously elevated prices that we have been witnessing may not last too much longer if this outbreak continues to spiral out of control.

Source: ZeroHedge HNewsWire themostimportantnews.com

StevieRay Hansen

Editor, Bankster Crime

MY MISSION IS NOT TO CONVINCE YOU, ONLY TO INFORM YOU…

https://bankstercrime.com/coronavirus-triggers-biggest-shock-to-oil-markets-since-lehman-crisis/

“Have I therefore, become your enemy by telling you the truth?”

Oil Drop, Coronavirus, Fraud, Banks, Money, Corruption, Bankers

![]()