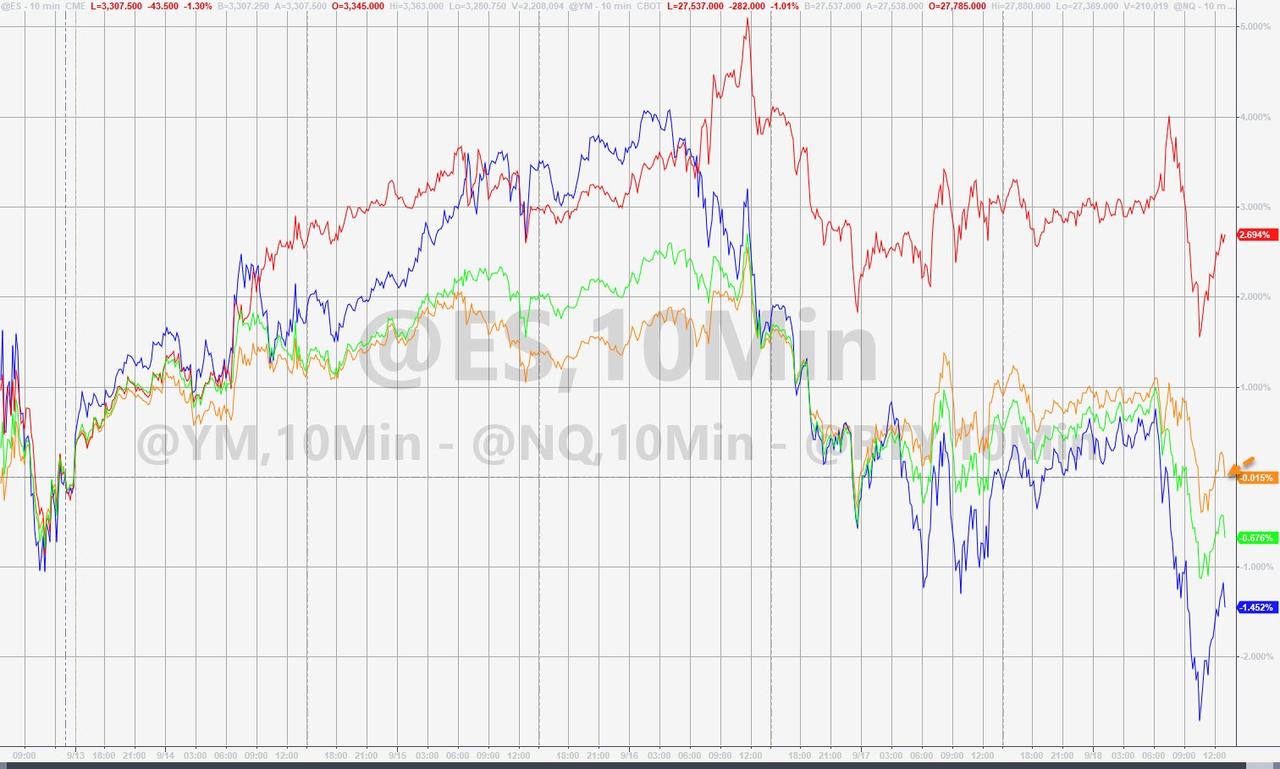

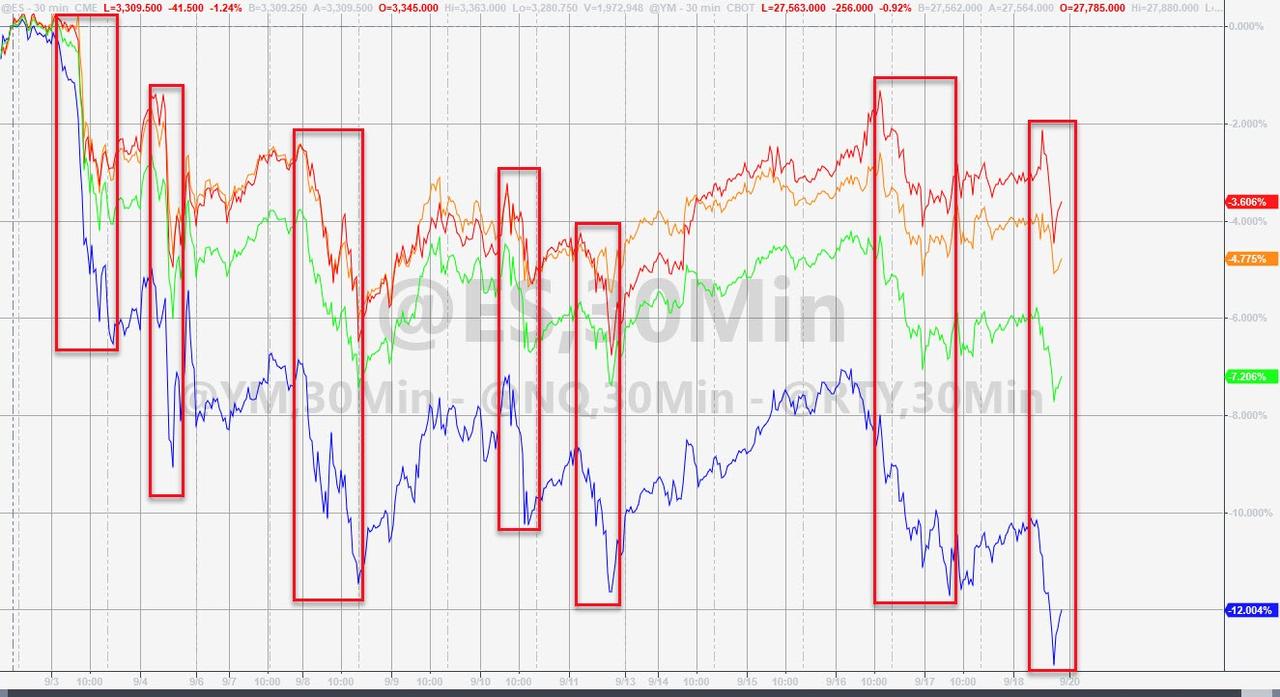

Stocks are down for the 3rd week in a row – yeah we know!!! – leaving levered-call-buying RH’ers facing something they likely haven’t seen in their trading careers (this is the longest losing streak since August 2019)…

The Dow ended the week almost perfectly unchanged.

This leaves The Dow down over 3% YTD and the S&P 500 up just over 2% YTD…

Source: Bloomberg

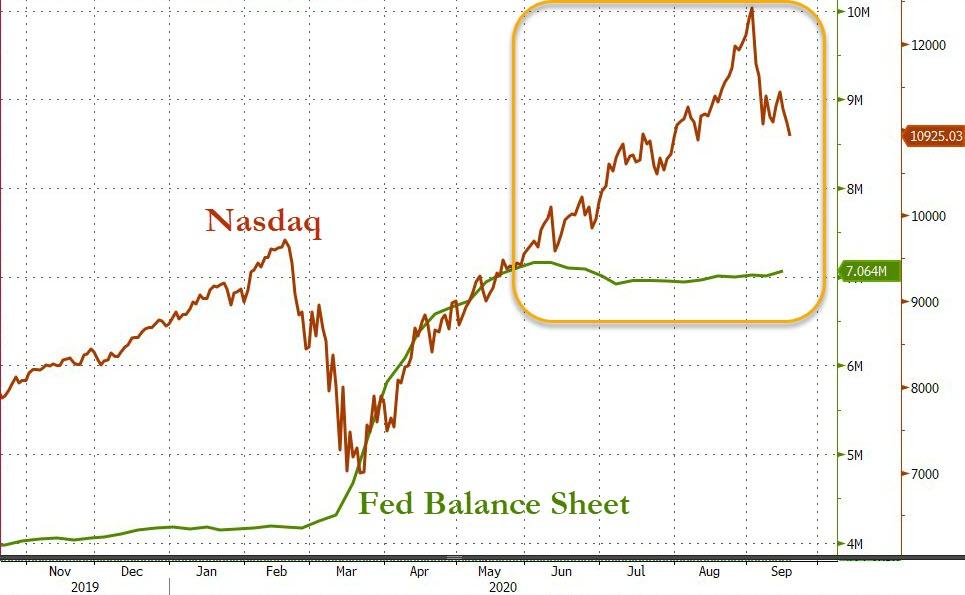

Is it time for The Fed to start “getting back to work” on their balance sheet now that rates are impotent…

Source: Bloomberg

All that ‘work’ and “you get nothing”…

The Nasdaq 100 is down over 12% from record highs (so much for BTFD)…

The S&P 500 and Nasdaq closed below their 40DMAs. Small Caps managed to bounce off the 50DMA (after breaking below) and The Dow bounced perfectly off it…

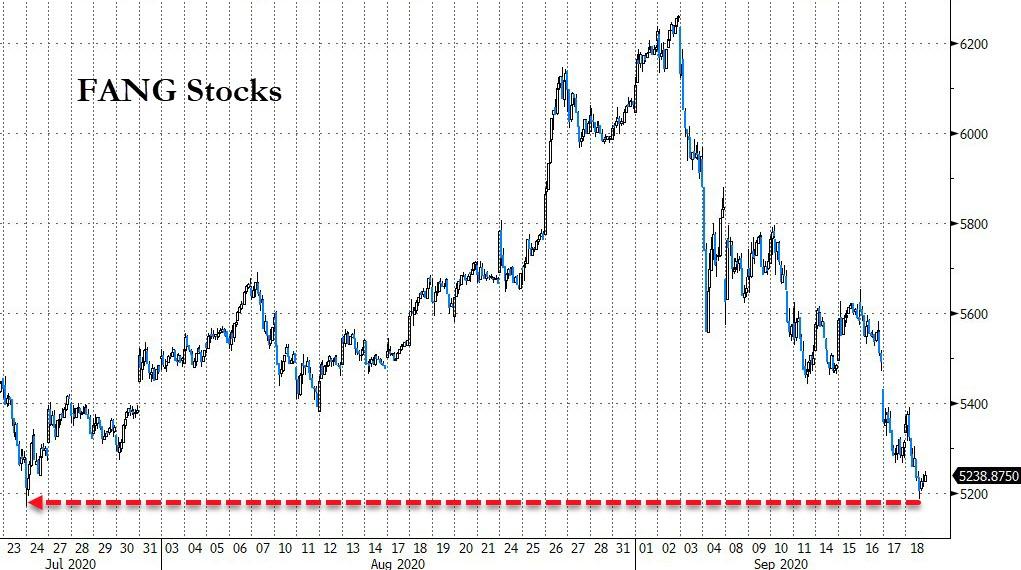

FANG Stocks plunged to their lowest since late July (down 17% from the highs)…

Source: Bloomberg

Very choppy week in quant-factor land with Value and momentum swapping places day after day…

Source: Bloomberg

Notably, Quad Witch sparked some shenanigans in the vol-stock complex today…

Source: Bloomberg

And the Gamma pivoted around 270 Strike for Nasdaq QQQ…

Despite equity weakness, Treasury yields rose very modestly on the week…

Source: Bloomberg

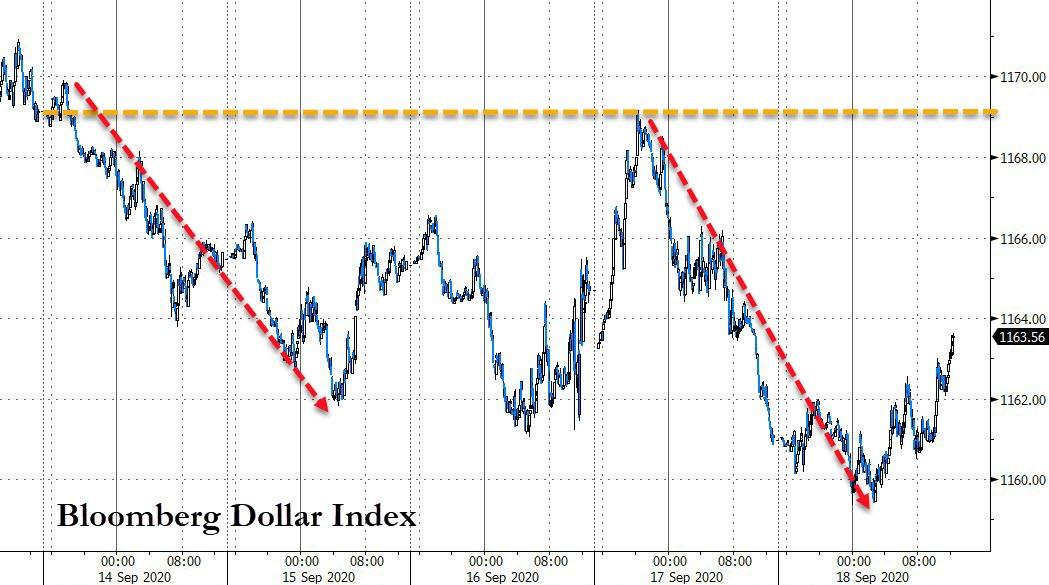

The Dollar Index fell this week, after two weeks of gains…

Source: Bloomberg

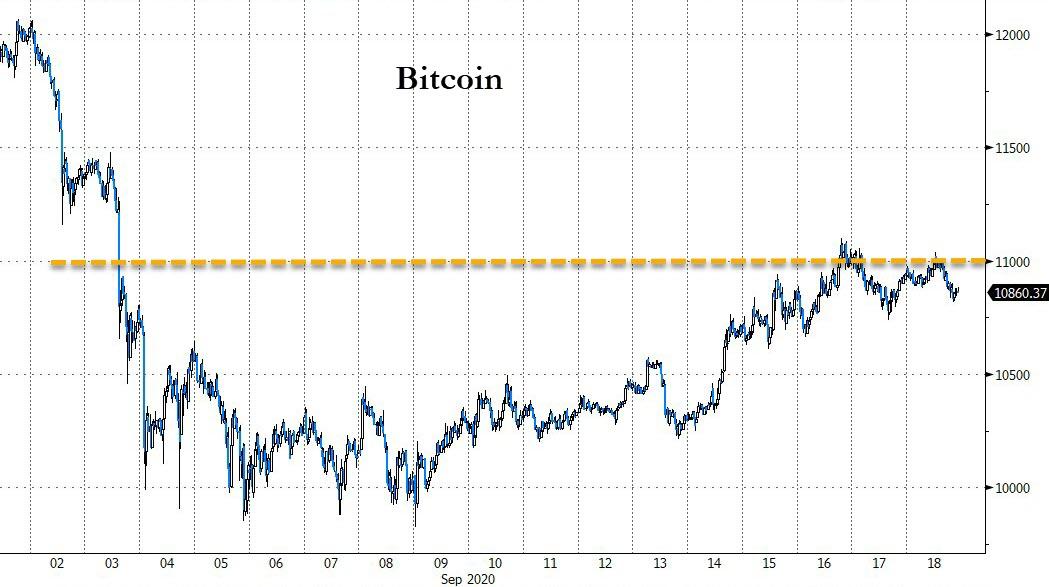

Cryptos were largely higher on the week (Litecoin lower), led by Bitcoin

Source: Bloomberg

Bitcoin was, however, unable to hold on to $11k…

Source: Bloomberg

Oil dominated commodity-land with copper also higher and PMs marginally so…

Source: Bloomberg

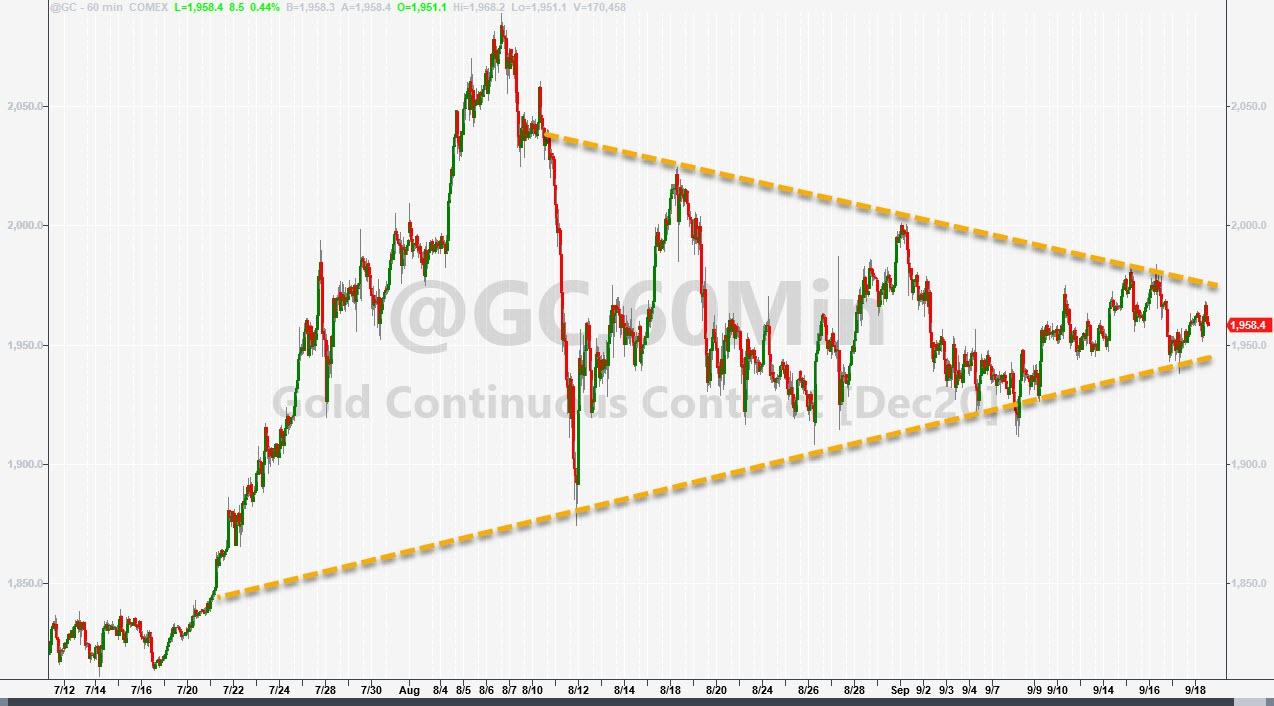

Gold remains increasingly range bound…

And a big reversal in WTI (back above $41)…

Ags had a huge week as Corn, Soybeans soared on China chatter…

Source: Bloomberg

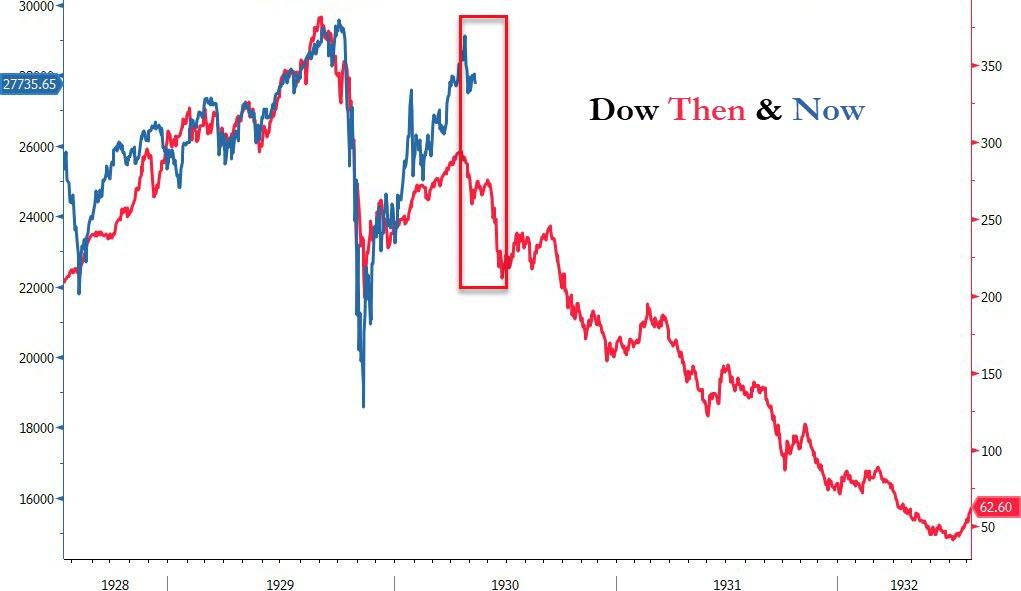

Finally, 1930 called again…

Source: Bloomberg ZeroHedge

StevieRay Hansen

Editor, BankstersCrime

God often uses men who are not of the best moral character. Pharaoh, Nebuchadnezzar, Cyrus, Herod, and Trump (amongst others), to accomplish His will in events He orchestrates during human history. We either trust the sovereignty of God or we don’t. Nothing happens apart from Him…

The best index to a person’s character is how he treats people who can’t do him any good, and how he treats people who can’t fight back…

The Birth Pains Are Growing Stronger….

One of the signs of ruling class collapse is when they can no longer enforce the rules that maintain them as a ruling class. When the Romans started making exceptions to republican governance, it was a matter of time before someone simply decided the rules no longer applied to them. Perhaps the robot historians will consider Obama our Marius or Sulla. Maybe that person is in the near future. Either way, the rule of law is over and what comes next is the rule of men.

“Don’t piss down my back and tell me it’s raining.” Outlaw Josey Wales

WE NOW LIVE IN A WORLD THAT IS PURE FABRICATION

![]()