Six Big Banks Forced to Declare $9.3 Billion in Additional FDIC Expenses; Another Reason Their Talons Are Out for FDIC Chair Gruenberg

2 Peter 2:19 ESV

They promise them freedom, but they themselves are slaves of corruption. For whatever overcomes a person, to that he is enslaved.

BanksterCrime:

By Pam Martens and Russ Martens:

The biggest banks in the U.S. that have been serially bailed out by the Federal Reserve since they blew up the financial system in 2008, are ripping mad at the Chairman of the Federal Deposit Insurance Corporation (FDIC), Martin Gruenberg.

The biggest banks in the U.S. that have been serially bailed out by the Federal Reserve since they blew up the financial system in 2008, are ripping mad at the Chairman of the Federal Deposit Insurance Corporation (FDIC), Martin Gruenberg.

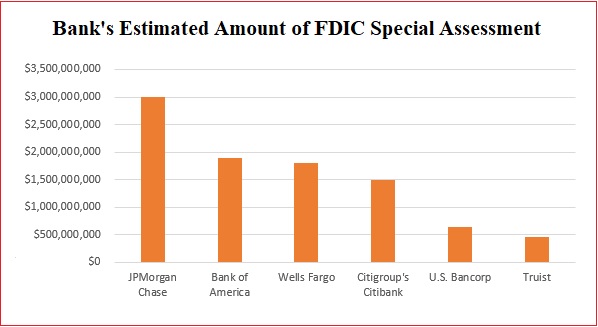

In addition to the FDIC and other federal banking regulators’ proposed rule to increase capital requirements on the largest banks, the FDIC just issued a final rule on November 16 that will force six banks to report an FDIC special assessment expense totaling more than $9.3 billion in the final quarter of this year. (See chart above.)

Jamie Dimon, Chairman and CEO of JPMorgan Chase, is hair-on-fire mad because his bank is getting hit with the whopping figure of approximately $3 billion according to the firm’s most recent quarterly filing (10-Q) with the SEC.

The most recent 10-Q filings with the SEC for the other five banks estimate their FDIC special assessments as follows: $1.9 billion at Bank of America; $1.8 billion at Wells Fargo; $1.5 billion at Citigroup’s Citibank; $650 million at U.S. Bancorp; and $460 million at Truist.

The FDIC’s special assessment results from the failure of Silicon Valley Bank and Signature Bank in March, where banking regulators made a Systemic Risk Determination to cover uninsured deposits at the two banks to stem a spreading banking panic. The FDIC’s Deposit Insurance Fund that protects depositors at the nation’s commercial banks and savings associations experienced a related loss of $16.3 billion attributable to the protection of uninsured depositors. The FDIC’s governing law allows it to impose this special assessment on insured depository institutions to make up for the losses.

What the big banks don’t like is that they are picking up the lion’s share of the losses. The FDIC argues that large amounts of uninsured deposits inherently make the banking system less safe and the banks that had the largest amounts of uninsured deposits as of December 31, 2022 must pay the piper for their imprudent concern for safety and soundness. (See our report: International Bank Study, Using 150 Years of Data, Shows Mega Banks Like the Big Four in the U.S. Produce Financial Instability and More Severe Crises.)

Out of the approximate 4,100 federally-insured commercial banks in the U.S., the FDIC estimates that only 114 banks will be subject to the special assessment. That’s because the vast majority of banks in the U.S. honor the concept of being a federally-insured bank and keep the bulk of their deposits under the FDIC insurance cap of $250,000 per depositor, per bank. (See our report: At Year End, 4,127 U.S. Banks Held $7.7 Trillion in Uninsured Deposits; JPMorgan Chase, BofA, Wells Fargo and Citi Accounted for 43 Percent of That.)

The figures presented in the chart above may actually underestimate the final dollar figures that will be paid by the banks. When the banks published those estimates in their 10-Qs, the FDIC had estimated the losses to the Deposit Insurance Fund at $15.8 billion from covering uninsured deposits at the two banks. As of November 16 when the final rule was passed, those losses had grown to $16.3 billion according to the FDIC.

Another thing that has riled up the mega banks on Wall Street and have them whispering in the ears of their captured members of Congress to sack FDIC Chair Gruenberg, is that the FDIC dismissed out of hand their 12-page letter of objections to the methodology of the special assessment. (What good is paying millions of dollars to lobby if you don’t get what you paid for?)

The letter was sent by the Bank Policy Institute, whose Board of Directors is Chaired by none other than Jamie Dimon and includes the CEOs of the biggest banks in the U.S.

For how the big banks are lobbying on the still-in-the-works capital rule, see our report: Meet the Banking Cartel that Is Planting the Seeds for the Next Banking Panic and Bailout.

As a prime example of just how casino-like the U.S. banking system has become, Goldman Sachs, the “great vampire squid,” is allowed to own a federally-insured bank. (In October 2020, the vampire squid was criminally charged by the Justice Department for looting the Malaysian sovereign wealth fund, 1MDB in a grand bribery conspiracy.)

Goldman Sachs owns the federally-insured Goldman Sachs Banks USA, which is currently ranked by the Federal Reserve as the 7th largest federally-insured bank in the United States. Never mind that Goldman Sachs is also running an octopus of an international Dark Pool trading operation and has $57 trillion (yes, trillion) in opaque derivatives while its CEO, David Solomon, moonlights as a DJ. (You can’t make this stuff up.)

Goldman Sachs was peculiarly silent in its most recent 10-Q filing on how much its bank expects to pay for its share of the FDIC’s special assessment. But its 10-Q filing for the second quarter of this year estimated its tab at “$400 million (pre-tax).”

PNC Bank’s publicly traded parent has also previously reported to the SEC that it estimates that its special assessment expense, to be taken in full in the fourth quarter, will be approximately $370 million after-tax.

Revelation: A Blueprint for the Great Tribulation

A Watchman Is Awakened

Will Putin Fulfill Biblical Prophecy and Attack Israel?

Newsletter

Orphans

Editor's Bio