We have certainly had our share of dismal fund returns in the past two weeks, in the aftermath of a market crash that is now worse than the Great Depression, so far one thing was missing: a big blow-up, where a fund is margined out and forced to liquidate Friday morning. Think “Duke & Duke.“

Well, no more: according to CNBC’s Scott Wapner, one of the CME’s direct clearing firms were unable to meet its capital requirements on Friday, forcing the exchange to step in and invoke its “emergency protocols” to auction off the firm’s portfolios.

The firm in question: Ronin Capital, which on its website says “seeks the best and brightest people who embrace our Firm’s culture, and can thrive in a dynamic, entrepreneurial trading environment.” Apparently, that also meant being unable to quantify your risk exposure.

Terry Duffy, CME Group’s Chairman, and CEO told CNBC the auction process was completed Friday morning but said the group doesn’t disclose who assumed the portfolios in the auction.

The good news is that unlike that other CME disaster, MF Global when Ronin – which is responsible for trades made on the exchange – no customers were harmed…

Duffy also said that under its clearing agreement, Ronin isn’t allowed to have outside clients so there were no customers harmed in the process.

Or at least not directly: after all, like every other prop trader, Ronin invests outside the capital, and in this case, said capital is about to be much less.

What sparked the collapse? According to Wapner, “Ronin’s problems stemmed from positions in futures tied to the CBOE Volatility Index, or the security that tracks market volatility.” It is unclear what particular move tripped the margin call-inducing stops, but there was an odd move in the VIX this morning which may have been related.

Receive a daily recap featuring a curated list of must-read stories.

The Depository Trust and Clearing Corporation, or DTCC, helped coordinate the auction, later saying it had ceased to act for Ronin Capital, although it did not disclose who assumed the firm’s portfolios.

The biggest irony: in its “About Us” section, the firm writes that “much of Ronin’s success derives from our superior risk management experience. Our unique approach combines sophisticated quantitative market analysis with years of proven trading expertise, across multiple products.”

It’s out that Ronin’s failure will, in turn, derive from its catastrophic risk management experience.

A Revolving Panic: Here Are The Companies That Have Fully Drawn Down Credit Lines This Week

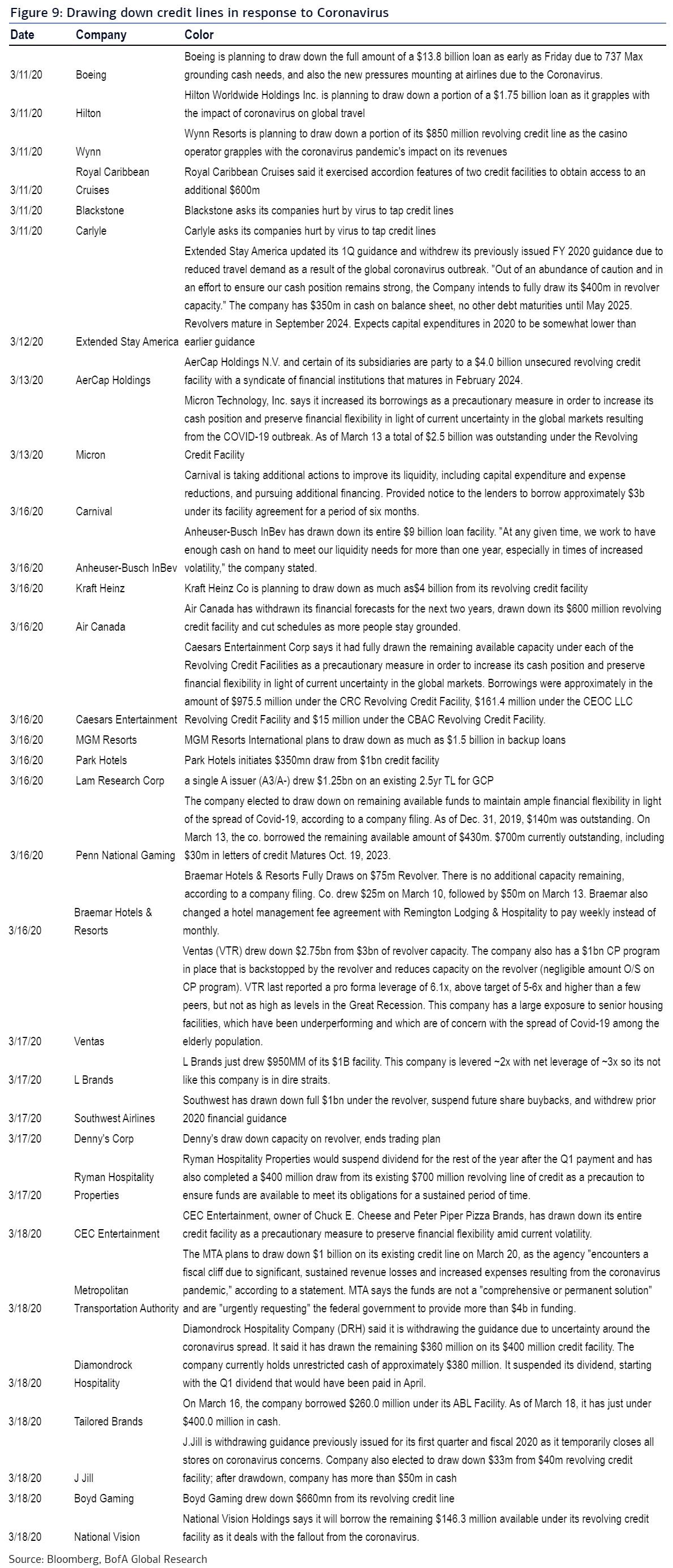

In the aftermath of the great Commercial Paper panic of 2020, which erupted over the past two weeks when initially the Fed failed to launch a Commercial Paper backstop facility, something it did with a two-day delay on Tuesday, countless blue chip (and less than clue chip) companies found themselves with gaping liquidity shortfalls, and to bridge their funding needs, they rushed to draw on their existing credit facilities (also a hedge in case the banking system imposes a lending moratorium similar to what happened in the 2008 crash).

As a result, corporate borrowers worldwide, including Boeing, Hilton, Wynn, Kraft Heinz and dozens more, drew about $60 billion from revolving credit facilities this week in a frantic dash for cash as liquidity tightens.

On Wednesday alone, another seven more companies – CEC Entertainment, Metropolitan Transportation Authority, Diamondrock Hospitality, Tailored Brands, J Jill, Boyd Gaming, and National Vision – announced intentions to draw down credit lines.

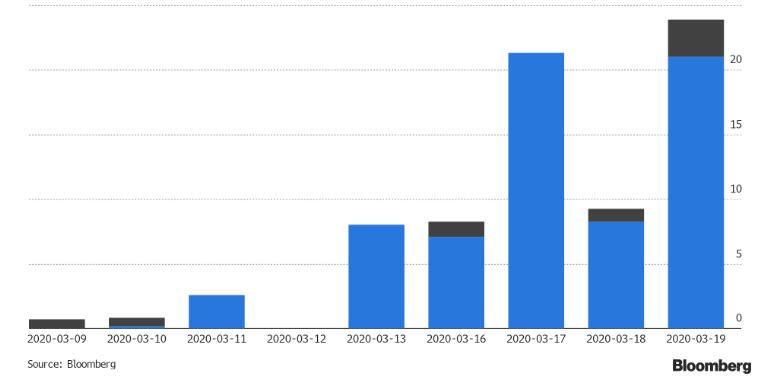

As of Friday morning, the week recorded $58BN of drawdowns, more than a five-fold jump from the $11BN for the whole of the previous week, according to Bloomberg data. The total drawdown would bring the utilization ratio above 24%, double from 12% as of 4Q19 for US Investment Grade companies.

Thursday alone saw $21BN of facilities drawn, just short of the $21.3BN recorded on Tuesday, with Ford ($15.4BN), Kohl’s ($1BN), TJX ($1BN) and Ross Stores leading the revolving charge.

What is concerning is that despite the Fed’s CP backstop, companies continue to draw down on revolvers, whether because the rate on their CP is too high, or they simply do not trust banks.

The BofA table below summarizes all the companies that have drawn down on their revolver in response to the Global Corona/Crude Crisis…

NEVER MISS THE NEWS THAT MATTERS MOST

ZEROHEDGE DIRECTLY TO YOUR INBOX

Receive a daily recap featuring a curated list of must-read stories.

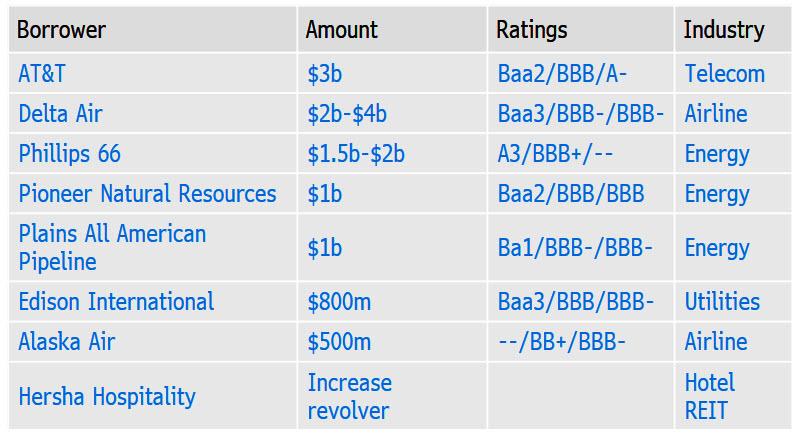

… and here is a pipeline of upcoming deals, via Bloomberg.

StevieRay Hansen

Editor, Bankster Crime

MY MISSION IS NOT TO CONVINCE YOU, ONLY TO INFORM YOU…

https://bankstercrime.com/coronavirus-triggers-biggest-shock-to-oil-markets-since-lehman-crisis/

“Have I therefore become your enemy by telling you the truth?”

Oil Drop, Coronavirus, Fraud, Banks, Money, Corruption, Bankers, Stock Markets Crash, Unable To Meet CME Capital Requirements

This Pestilence Is Spreading: Stock Market In Trouble

![]()