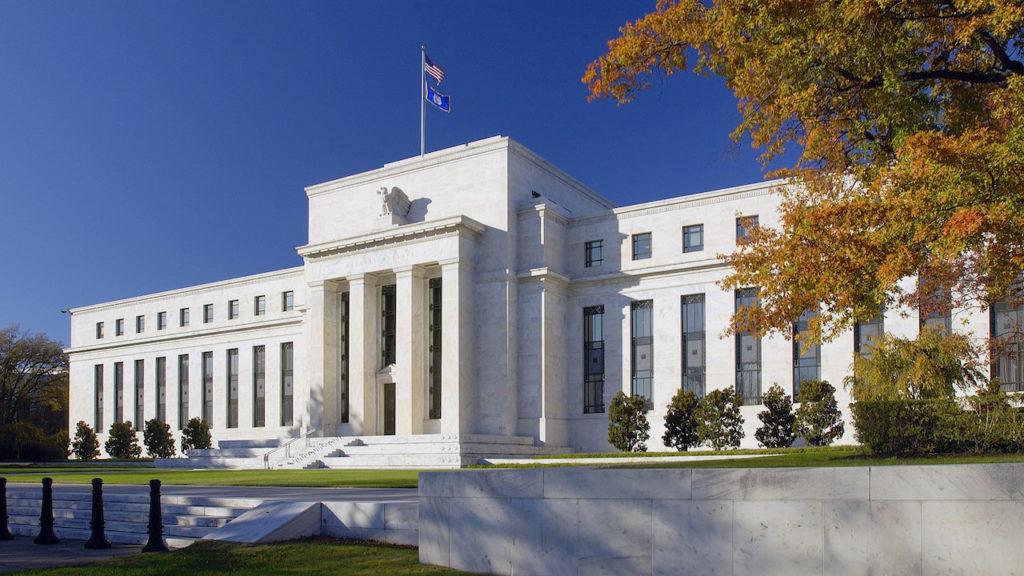

Peter Schiff delivered a key-note speech at the Virtual Investor Day Conference. He walked through the history of the Federal Reserve’s monetary policy over the last several decades and explained the inevitable outcome. Peter’s recap of Fed history leads you to an undeniable conclusion: the Federal Reserve has never been right. And it has set us up for an even bigger crisis.

Peter opened his talk saying that he thinks we are entering the final chapter of the book Alan Greenspan started to write.

And I have a feeling he had an understanding of how badly it was going to end. But unfortunately, a lot of people who have been adding pages or chapters to that book since Greenspan resigned really don’t have any idea what’s coming.”

Greenspan started the book by unleashing the loose money policy that blew up the dot-com bubble.

When that bubble popped, instead of admitting his mistakes, Greenspan ignored them and tried to revive the economy by inflating a bigger bubble in the real estate market than the bubble that had just popped in the stock market. And the Fed succeeded in inflating that bubble. But that was not a success. It was a failure.”

Peter reminds us that he warned that the Fed policy was distorting the economy. He knew that it was creating a bubble economy. People were using the inflated value of their homes as ATMs and that drove consumer spending. People were living beyond their means. Nobody was saving.

So, the whole economy was distorted by the malinvestments and bad decisions that were being made as a result of artificially low interest rates.”

When the Fed tried to normalize, the bubble popped, the mortgage market blew up, and that gave us the Great Recession.

In the wake of the 2008 financial crisis, the Federal Reserve repeated the process, dropping interest rates to zero and launching quantitative easing. Ben Bernanke promised QE was just temporary – that the Fed was not monetizing the debt. He promised the Fed would shrink its balance sheet once the crisis passed. At the time, Peter said it was impossible. He said even if the Fed tried to normalize rates and shrink its balance sheet, it would fail.

Everything the Fed said about their ability to normalize rates and shrink the balance sheet was wrong. I said they were wrong as they were saying it. They never were able to normalize interest rates. They never came close to returning the balance sheet to pre-crisis levels.”

In Q4 2018, the Fed abandoned rate hikes at about 2.5% – not even close to normal. They called off quantitative tightening. By 2019, the Fed was back to rate cuts and the launched QE, all the while claiming it wasn’t QE. The Fed told us the pivot back to loose monetary policy was only temporary, calling it a “midcourse correction.” But Peter said we were going back to zero and that’s exactly what happened.

And here we are today with the central bank running QE infinity and saying rates will stay at zero for years.

We are now the banana republic that Ben Bernanke assured us we would never become.”

Peter said he went through the history of Fed failures to make a point that should be pretty obvious.

The Federal Reserve has never been right. Everything they have said about the efficacy of their policies, what their policies would create, and their ability to reverse them or unwind them, has been wrong. And it’s amazing how consistently wrong they have been.”

And now they are pushing toward the logical conclusion.

NEVER MISS THE NEWS THAT MATTERS MOST

ZEROHEDGE DIRECTLY TO YOUR INBOX

Receive a daily recap featuring a curated list of must-read stories.

We are headed for a US dollar crisis and a sovereign debt crisis. The magnitude of this crisis will be unlike anything we’ve ever experienced. Because this is not just mortgages blowing up. This is the credit of the United States government. This is the risk-free asset becoming the most toxic asset on the planet. And it’s not just US Treasuries that are going to collapse, but it’s the entire US-denominated bond market which is built on top the foundation of US Treasuries. So, Treasuries go — it all goes — corporate bonds, muni bonds, mortgages. Any debt instrument that is denominated in US dollars is going to collapse.”

So where will people run?

Gold.

The world is going to return to gold-backed paper money.”

Source: ZeroHedge

StevieRay Hansen

Editor, BankstersCrime

God often uses men who are not of the best moral character. Pharaoh, Nebuchadnezzar, Cyrus, Herod, and Trump (amongst others), to accomplish His will in events He orchestrates during human history. We either trust the sovereignty of God or we don’t. Nothing happens apart from Him…

The best index to a person’s character is how he treats people who can’t do him any good, and how he treats people who can’t fight back…

The Birth Pains Are Growing Stronger….

One of the signs of ruling class collapse is when they can no longer enforce the rules that maintain them as a ruling class. When the Romans started making exceptions to republican governance, it was a matter of time before someone simply decided the rules no longer applied to them. Perhaps the robot historians will consider Obama our Marius or Sulla. Maybe that person is in the near future. Either way, the rule of law is over and what comes next is the rule of men.

“Don’t piss down my back and tell me it’s raining.” Outlaw Josey Wales

WE NOW LIVE IN A WORLD THAT IS PURE FABRICATION

![]()

Day-Traders Send US Producer Prices Soaring In July

US Producer prices were expected to rise MoM following four declines in the last five months and they did, rising 0.6% MoM (double the expected…

Read More