In recent weeks, many have opined – this website included – that with the US economy careening into a double dip recession (or perhaps depression), it is imperative that Congress and the White House cast aside their differences and pass a substantial, $1.5-$2 trillion stimulus bill or else the US middle class will be hammered as the spending and consumption tailwind from the previous covid rescue bills fades away.

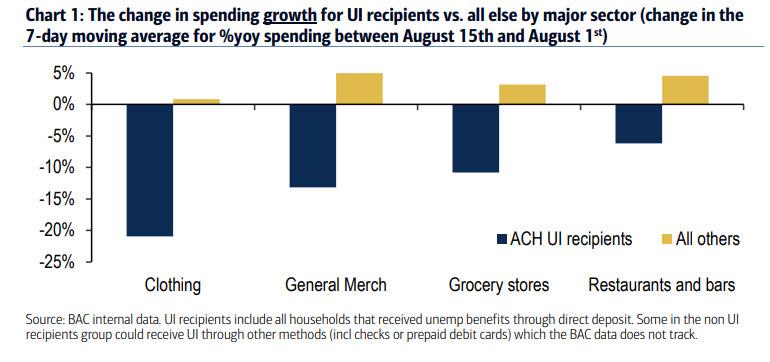

Furthermore as reported previously, there already has been a sharp slowdown in spending among groups who were recipients of expanded Unemployment Insurance benefits – which faded away on July 31 – as the chart from Bank of America shows:

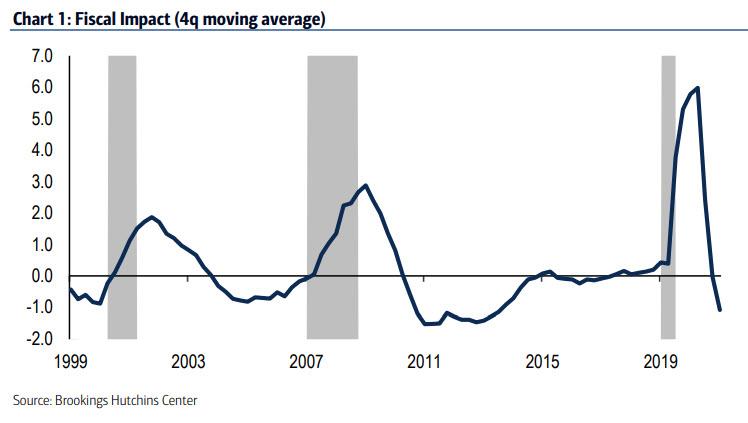

And while there are various other nuances, we concluded several weeks ago that absent a new stimulus, not only will the delayed aftereffects of the existing stimulus come back to haunt the economy…

… but the lack of new spending will result in a massive double whammy crashing the economy in 2021, which averted a full blown meltdown in Q2, but will find itself scrambling in the coming quarters as the mother of all double dips emerges, and which incidentally is also why the market has been sliding for the past two weeks as the reality of an indefinite stimulus-free future looms all too real.

The question, of course, is when will the trapdoor below the US economy open up, resulting in another collapse in output?

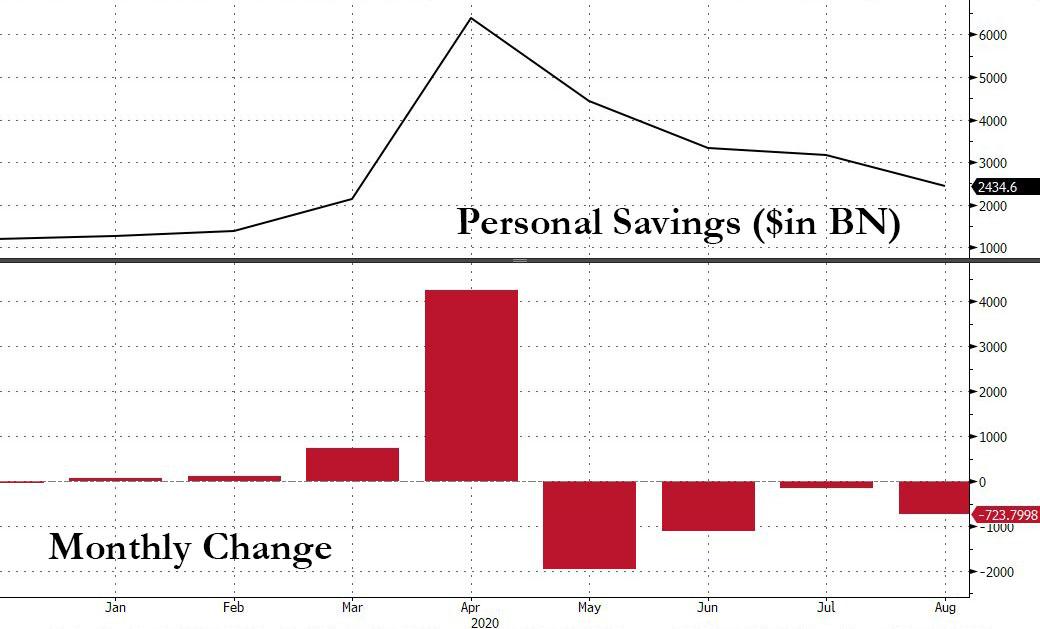

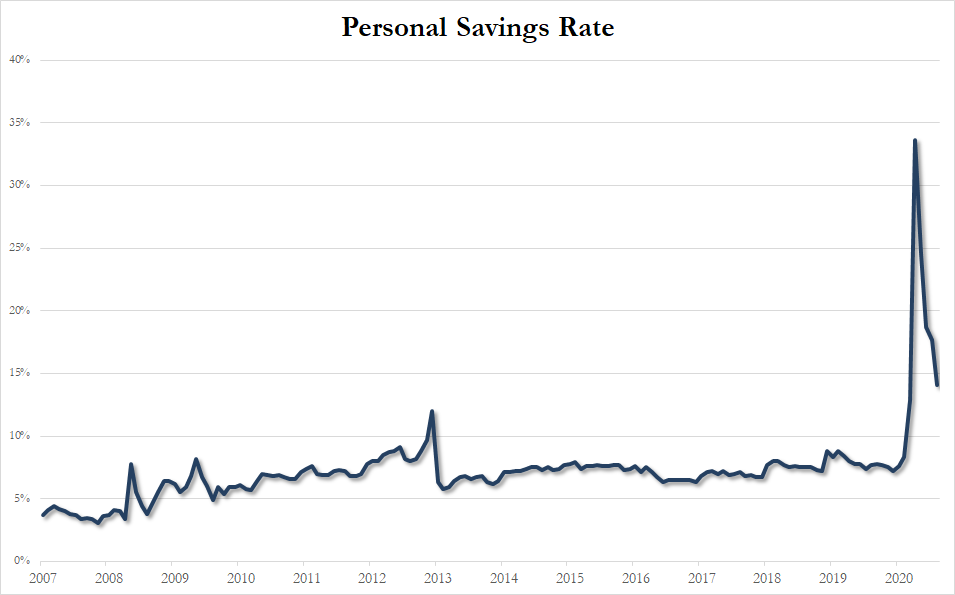

In a subsequent post following the latest personal income and spending data, we noted that in August – the month when the fiscal cliff hit – US consumer spending actually rose even as personal income contracted largely due to the end of the $600/week supplemental unemployment insurance benefits. As a result of this pick-up in spending coupled with shrinking incomes, US personal savings tumbled by an annualized $723 billion to $2.435 trillion, the lowest since March and far below the $6.4 trillion peak in annualized personal savings hit in April.

And while this meant that the personal savings rate declined sharply once again to 14.1% from a high of record 33% in the immediate aftermath of the covid crash, meaning that a whopping 60% of the personal savings built up in the aftermath of the covid fiscal stimulus tide have now been used up, it meant that Americans still have several months of accumulated savings to last them for the next several months.

We then said that as Congress continues to debate and pretend that a new fiscal stimulus bill is just over the corner, the massive savings buffer that was built up in the aftermath of the covid crisis, and which funded much of personal consumer spending in the past two months is now shrinking fast and at this rate personal savings will be back to pre-covid levels in 2-3 month. At that point we concluded that “it is safe to say that unless a new fiscal deal is in place, US consumption will crater unless somehow the millions of unemployed workers who still desperately rely on government stimulus find a job.”

And yet, not everyone agrees that lack of a stimulus would be dire (at least in the immediate term).

While conceding that last week’s developments effectively answered “no” to the question whether a new fiscal stimulus would emerge in the short term, Morgan Stanley wrote on Sunday that “it’s possible that a stimulus delay wouldn’t fully develop into the economic challenge it has the potential to be” and adds that the bank’s economists “now see evidence that US consumption can carry on for longer without fiscal support, given built-up excess household savings.”

Maybe… maybe not. After all, this was precisely the issue we discussed two weeks ago when we concluded that the rate at which savings are being burned is too high and may not last more than 2-3 months, before US consumers face anew crisis.

However, for Morgan Stanley that may be sufficient, and as the bank’s chief US policy strategist Michael Zezas wrote, “this is good news as there are many viable political paths towards stimulus over the next three months. We see three out of the four most likely post-election party configurations delivering stimulus by early 2021.”

Picking up on this, MS’ chief economist Ellen Zentner wrote last week that “progress in the Congress on stimulus negotiations has stalled, and to borrow the words of our policy strategists: inaction speaks louder than words – our strategists no longer see a proactive stimulus in 2020 in the base case.”

Yet in the face of fading fiscal support, “the savings cushion built up from April-July should help smooth consumption, putting real PCE on track to reach pre-Covid levels in 2Q21. We estimate from April through July the US consumer built up a cumulative $12.5tr (annualized) in excess savings (savings above the monthly pre-Covid average).” That said, “the willingness of consumers to draw upon these savings in the coming months is yet to be known, but we believe it will provide an important stop-gap to the loss of government transfers.“

Receive a daily recap featuring a curated list of must-read stories.

Zentner underscored this point in a Bloomberg interview in which she said that the US economy would certainly “take a hit” without further federal stimulus, but will not head into an “economic armageddon” because while fiscal benefits expired in July spending increased in August and September, thanks to the long tail of the stimulus.

Why is all of this relevant? Because now the biggest question of all is how long can US consumers survive (in some cases literally) without more stimulus, a question whose answer may determine the next president. And while excess savings may allow US households to continue recent spending levels into November and December, it is only a matter of time before these tumble and Congress is forced to pass another stimulus, regardless of their animosity toward Trump and Republicans, even in a contested election context, even if there is no Blue Sweep.

Perhaps the biggest take home here is that Trump, who judging by his latest tweets is suddenly desperate to pass a stimulus deal even if it means meeting the Democrats’ ask of $2.2 trillion, may want to slow down. After all, bailing out insolvent pensions in blue states may generate far more resentment and have much more dire consequences for Trump’s re-election chances than asking Americans to wait an extra month or two before the next inevitable stimulus round is agreed upon by Congress and the next president, whoever he may be (or she, in the case of Kamala Harris). Ironically, the odds of Trump being that president may rise if he refuses to concede to Democrat demands for a giga stimulus, and merely holds firm until after the election.

Source: ZeroHedge

StevieRay Hansen

Editor, BankstersCrime

God often uses men who are not of the best moral character. Pharaoh, Nebuchadnezzar, Cyrus, Herod, and Trump (amongst others), to accomplish His will in events He orchestrates during human history. We either trust the sovereignty of God or we don’t. Nothing happens apart from Him…

The best index to a person’s character is how he treats people who can’t do him any good, and how he treats people who can’t fight back…

The Birth Pains Are Growing Stronger….

One of the signs of ruling class collapse is when they can no longer enforce the rules that maintain them as a ruling class. When the Romans started making exceptions to republican governance, it was a matter of time before someone simply decided the rules no longer applied to them. Perhaps the robot historians will consider Obama our Marius or Sulla. Maybe that person is in the near future. Either way, the rule of law is over and what comes next is the rule of men.

“Don’t piss down my back and tell me it’s raining.” Outlaw Josey Wales

WE NOW LIVE IN A WORLD THAT IS PURE FABRICATION

![]()