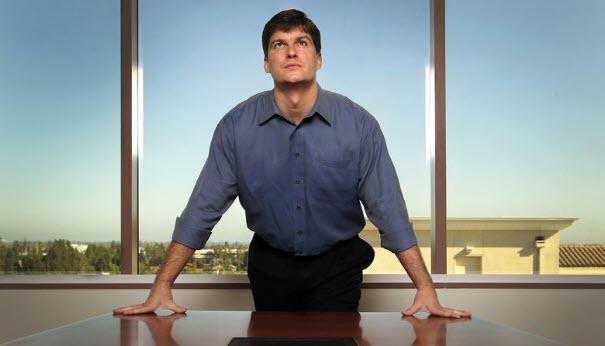

Infamous for his painful but ultimately profitable “big short” bet against mortgage-backed securities during the 2008 financial crisis, Michael Burry, the doctor-turned-hedge-fund-manager has been on a multi-day Twitter rant claiming that the lockdowns intended to contain the COVID-19 pandemic are worse than the disease itself.

Echoing the thoughts of many, Burry opined in a series of tweets over the past two weeks that the government-enforced lockdowns and business shutdowns across America may trigger one of the country’s deepest-ever economic contractions, and further still, are not necessary to contain the epidemic (on March 22nd).

COVID-19 policy cannot be settled by CYA politicians career ID docs. Too much hammer/nail and too little common sense.

POTUS must reflect the interests of the working class and small business here – the economy cannot crash 30% to save the 0.2%.

Set America Free!

If COVID-19 testing were universal, the fatality rate would be less than 0.2%.

This is no justication for sweeping government policies, lacking any and all nuance, that destroy the lives, jobs, and businesses of the other 99.8%.

Furthermore, Burry – who earned his M.D. at the Vanderbilt University School of Medicine – has also dared to say that some controversial treatments for COVID-19, such as the malaria drug hydroxycloroquine, should be made more widely available (on March 24).

Prudent plan:

1) Standardize on chloroquine and azithromycin -cheap and available

2) Sick and elderly voluntarily shelter in place.

3) Americans lead their normal lives with extra hand washing and special care if around elderly.

Saving the economy means life, not murder.

Additionally, in an email to Bloomberg News, Burry wrote that “universal stay-at-home is the most devastating economic force in modern history… And it is man-made. It very suddenly reverses the gains of underprivileged groups, kills and creates drug addicts, beats and terrorizes women and children in violent now-jobless households, and more. It bleeds deep anguish and suicide.“

Receive a daily recap featuring a curated list of must-read stories.

Additionally, as Bloomberg’s Reed Stevenson reports, Burry responded to questions via email to offer more thoughts on the pandemic and the response to the outbreak…

How the Pandemic Happened

“This is a new form of coronavirus that emanated from a country, China, that unfortunately covered it up. That was the original sin. It transmits very easily, and within the first month it was likely all over the world. Very poor testing infrastructure created an information vacuum as cases ramped, ventilator shortages were projected. Politicians panicked and media filled the space with their own ignorance and greed. It was a toxic mix that led to the shutdown of the U.S., and hence much of the world economy.”

“In hindsight, each country should have immediately ramped up rapid field testing of at-risk groups. But as I understand it, the CDC was tasked with some of this, and botched it, and other departments were no better. The bureaucracy failed in a good number of countries. Turf wars and incompetence has ruled the day. So the political cover for that failure on the part of the technocrats and politicians is a very harsh stay-at-home policy.”

The U.S. Policy Response

“If there was ever a time for the government to stimulate with fiscal and monetary policy, it is now. Unfortunately, the U.S. has been adding $3 for every $1 of new GDP over a very long time, and interest rates were already near zero. Still, nothing is more important now that loans to small and mid-sized businesses, and the U.S. Treasury, backed by the Fed, is providing that liquidity, which is vital.”

Potential Treatments

“It’s pretty clear that hydrochloroquine is doing something good for many Covid-19 patients. The standard in medicine is a placebo-controlled double-blind study. But there is no time for that. The technocrats at the top are getting this wrong. Do the studies, make the vaccines, but allow doctors to have what they feel is working now. Don’t take tools or drugs out of the treating doctors’ hands. Trump should use the Defense Production Act more liberally in this area.”

“A more nuanced approach would be for at risk groups — the obese, old and already-sick — to shelter in place, to execute widespread mandatory testing, and to ID and track as necessary while allowing society to function. Again, Trump should get the massive contract manufacturers like Flextronics to make testing machines.”

Getting Back to Normal

“I would lift stay-at-home orders except for known risk groups. We already know certain conditions that are predictive of severe disease. Especially since young healthy lungs tend to be resistant, I would let the virus circulate in the population that is not likely to get severe disease from it. This is the only path that comes close to balancing the needs of all groups. Vaccines are not coming anytime soon, so natural immunity is the only way out for now. Every day, every week in the current situation is ruining innumerable lives in a criminally unjust manner.”

“When it comes to vaccines, coronaviruses are not known for imparting enduring immunity, and this will be one big challenge. It seems the genetic code is relatively conserved, and this will help the development of the vaccine. But we’re still looking at the end of the year. In the meantime, the world is an innovative place, and I expect many effective treatments — both new and repurposed — shortly. The question then will be regulation, expense and availability.”

“Medically, the new normal will be the old normal. As long as innovation continues, medicine will conquer everything in our way.”

Japan’s Response

“I believe Prime Minister Shinzo Abe is trying his best to manage through the situation without shuttering the economy. He sees what it has done to the U.S., and would rather not force a shut in, but instead asks for common sense. Japan has certain features — such as a largely lawful and well-educated society — that make this more possible. As do Taiwan, Singapore, Korea.”

Business Recovery

“Economically speaking, we have to realize the policy-driven demand shock will be resolved by 2021. But Japan and the U.S. are putting more than 20% of the GDP into new fiscal stimulus, and easy money will be the rule. Those things will all bring stock and debt markets back.”

“Countries will also look to bring supply chains home, and many employees will need retraining with higher cost. When we start working and playing again, inflation may be in store. The other big point is that consumers have learned new behaviors, which will drive business churn.”

Finally, on the investment side, Burry told Bloomberg News last month that he placed a “significant bearish market bet that is working out for now,” without providing details except to say it was a trade of a “good size” against indexes. He said the pandemic could unwind the passive investment boom, which he has compared to purchases of collateralized debt obligations that fueled the pre-2008 mortgage bubble.

StevieRay Hansen

Editor, Bankster Crime

MY MISSION IS NOT TO CONVINCE YOU, ONLY TO INFORM YOU…

https://bankstercrime.com/coronavirus-triggers-biggest-shock-to-oil-markets-since-lehman-crisis/

“Have I therefore become your enemy by telling you the truth?”

Oil Drop, Coronavirus, Fraud, Banks, Money, Corruption, Bankers

This Pestilence Is Spreading: Stock Market In Trouble

![]()