They’re starting to go after each other…

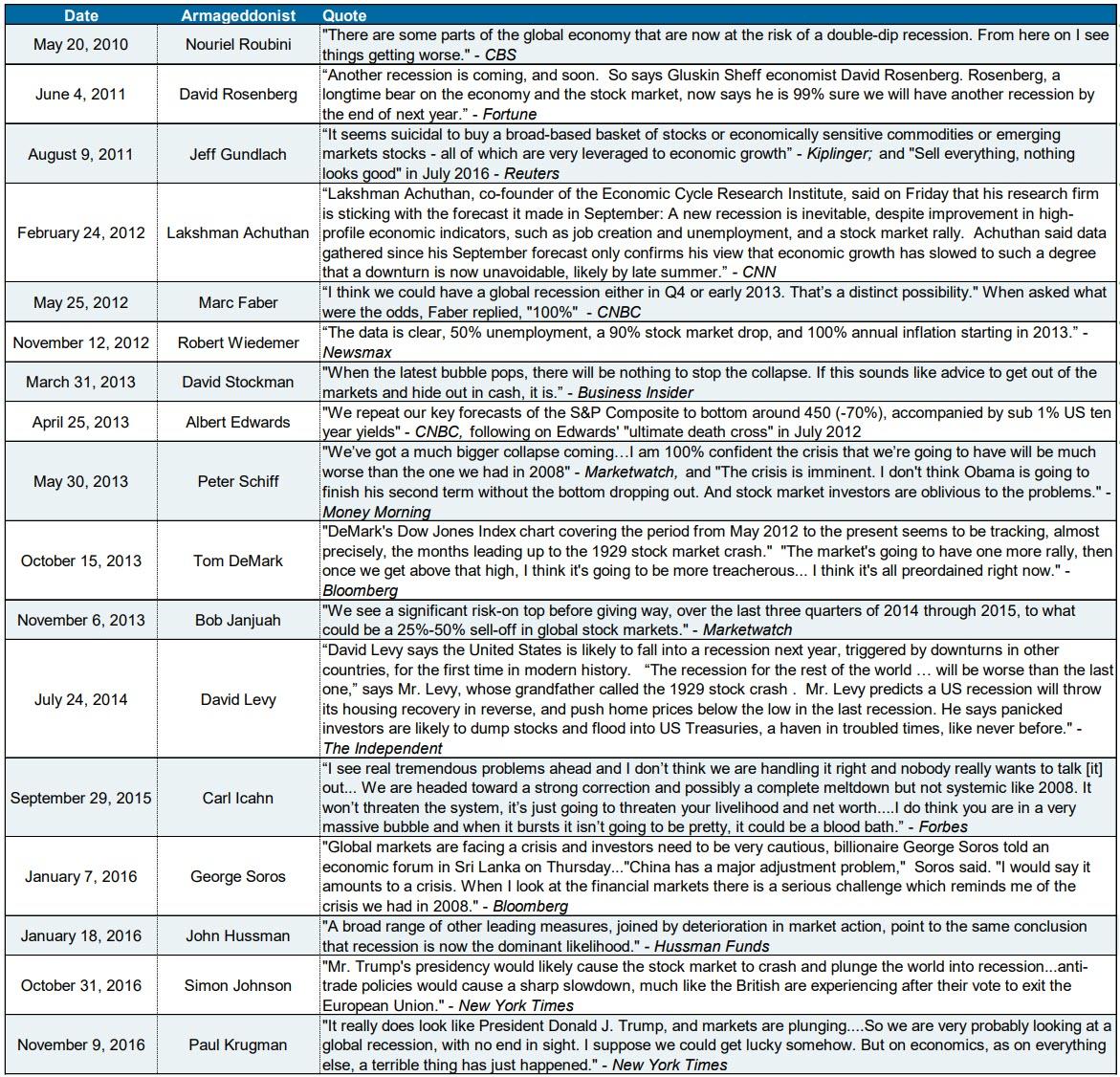

As bearish-biased analysts, strategists, and investors throw in the towel amid the market’s incessant FOMO-driven melt-up in the face of record global policy uncertainty, declining earnings, and a global economy showing anything but ‘troughing’; it seems JPMorgan’s Asset Management group has decided now is the time to name names and call out the last decade’s so-called “Armageddonists”…

Authored by Michael Cembalest, CIO JPMorgan Private Bank,

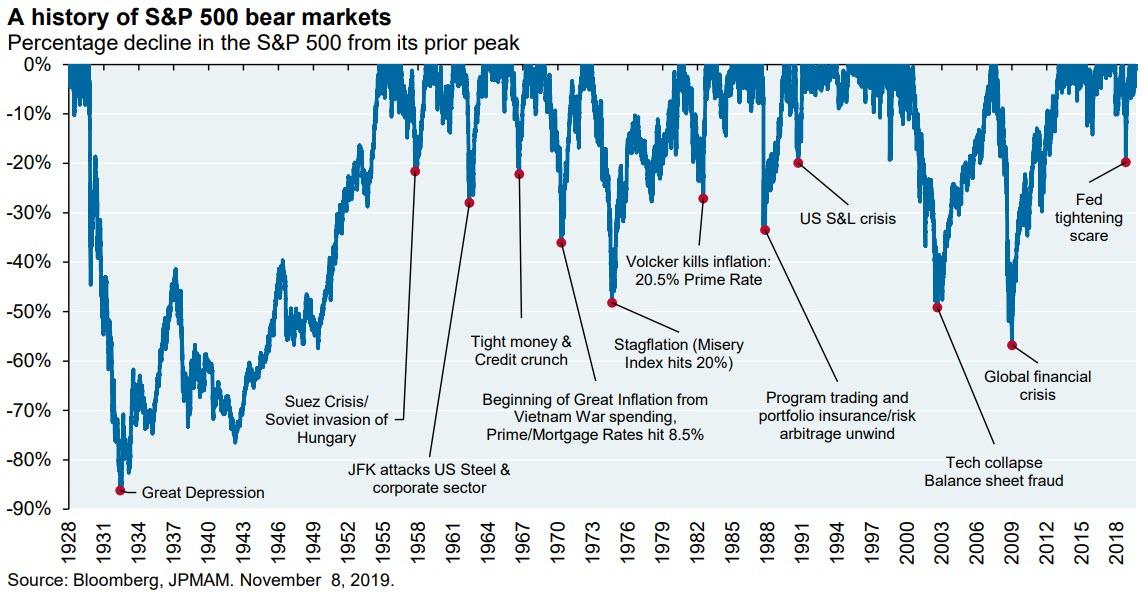

While recessions and bear markets are a fact of life, something peculiar happened after the Global Financial Crisis: the rise of the Armageddonists, which refers to the market-watchers, forecasters and money managers whose apocalyptic comments spread like wildfire in print and online financial news. I understand why: by 2010, investors had experienced two consecutive bear markets, each with equity declines of over 40%. It took several years for equity markets to recover each time, unlike the shallower, faster-recovering bear markets of the 1960’s and 1980’s. The dismal performance of consecutive 2001/2008 bear markets hadn’t been seen in decades, and is only comparable to parts of the Great Depression.

3

I also understand that mega-bearish news appeals to human negativity bias, a topic examined by Nobel Prize winner Daniel Kahneman in his 2011 book on the brain and human survival instincts, by political scientist Stuart Soroka who has illustrated the inverse relationship between magazine sales and the positivity of a magazine’s cover, and in a 2014 experiment in which a city newspaper lost two thirds of its readers on a day when it deliberately only published positive news. That said, what are the consequences for investors that reacted to dire Armageddonist predictions which have flooded the airwaves and internet since 2010?

We pulled together comments made by well known Armageddonists since 2010, a few of whom are on record as having anticipated the prior bear market and recession.

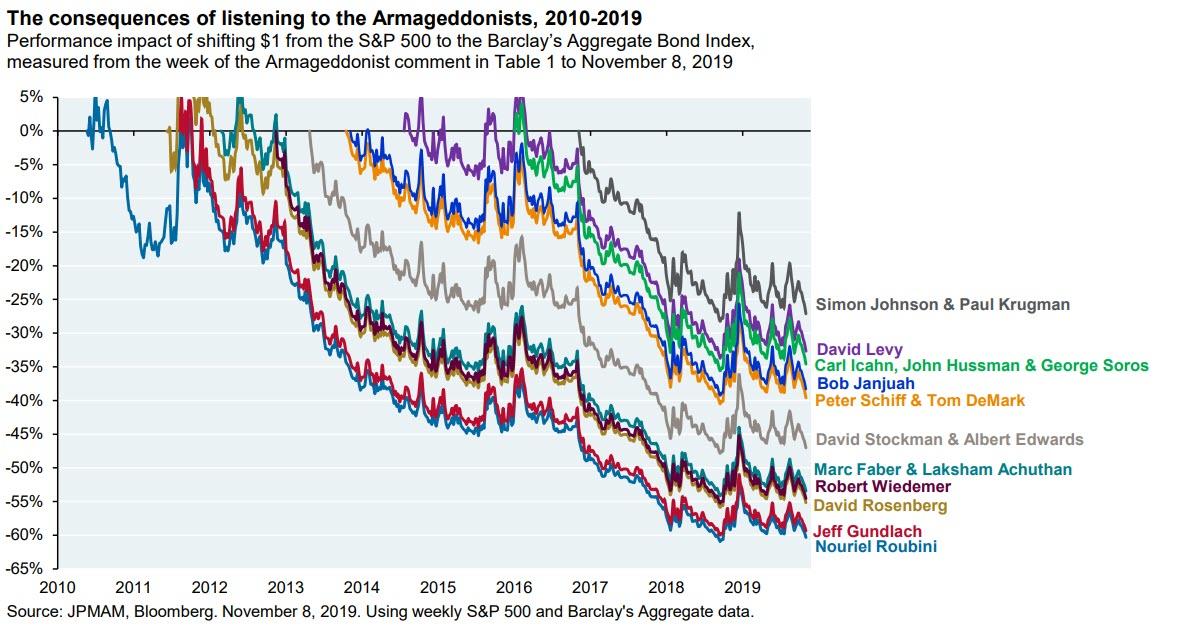

We measured the impact on an investor deciding to shift a dollar from equities to diversified government, mortgage-backed and corporate bonds after reading the post-2010 comments. To be clear, this isn’t about whether the Armageddonist at some point became more optimistic. This chart is about the opportunity loss for investors that acted upon seeing their comments at the time. One example: $1 shifted from equities to bonds in 2014 in response to mega-bearish commentary would have underperformed equities by around 40% as the S&P 500, propelled more by earnings growth than by multiple expansion, rolled on.

[ZH: It seems DoubleLine’s Jeff Gundlach shares the dubious award for ‘worst’ Armageddonist, with none other than Dr.Doom – Nouriel Roubini]

One day, of course, Armageddonists will be rewarded with a recession.

Partly as a consequence of the China-US Trade War, equity outperformance vs bonds reached a peak in early 2018 and has been treading water since; CEO Confidence has plunged to its lowest level since the financial crisis; the US is now in an earnings recession; and 67% of respondents to the Duke CFO Survey believe the US will be in recession by the end of 2020 (despite all of this, institutional investor positioning in equity futures is close to its highest/most bullish level since 2007). I believe that the health of the US consumer, strong labor and housing markets and a modest rebound in manufacturing will prevent a recession from happening in 2020, but I could be wrong. In any case, for investors that reacted to Armageddonist comments, the larger issue is this: the next recession and bear market will have to be quite severe to earn back what was sacrificed along the way. Using rough math, a sustained, multi-year bear market with 35%-45% declines from peak levels would be needed to reverse many of the opportunity losses shown in the chart above.

How severe will the next bear market be?

I believe it won’t be as bad as the prior two, due to the following:

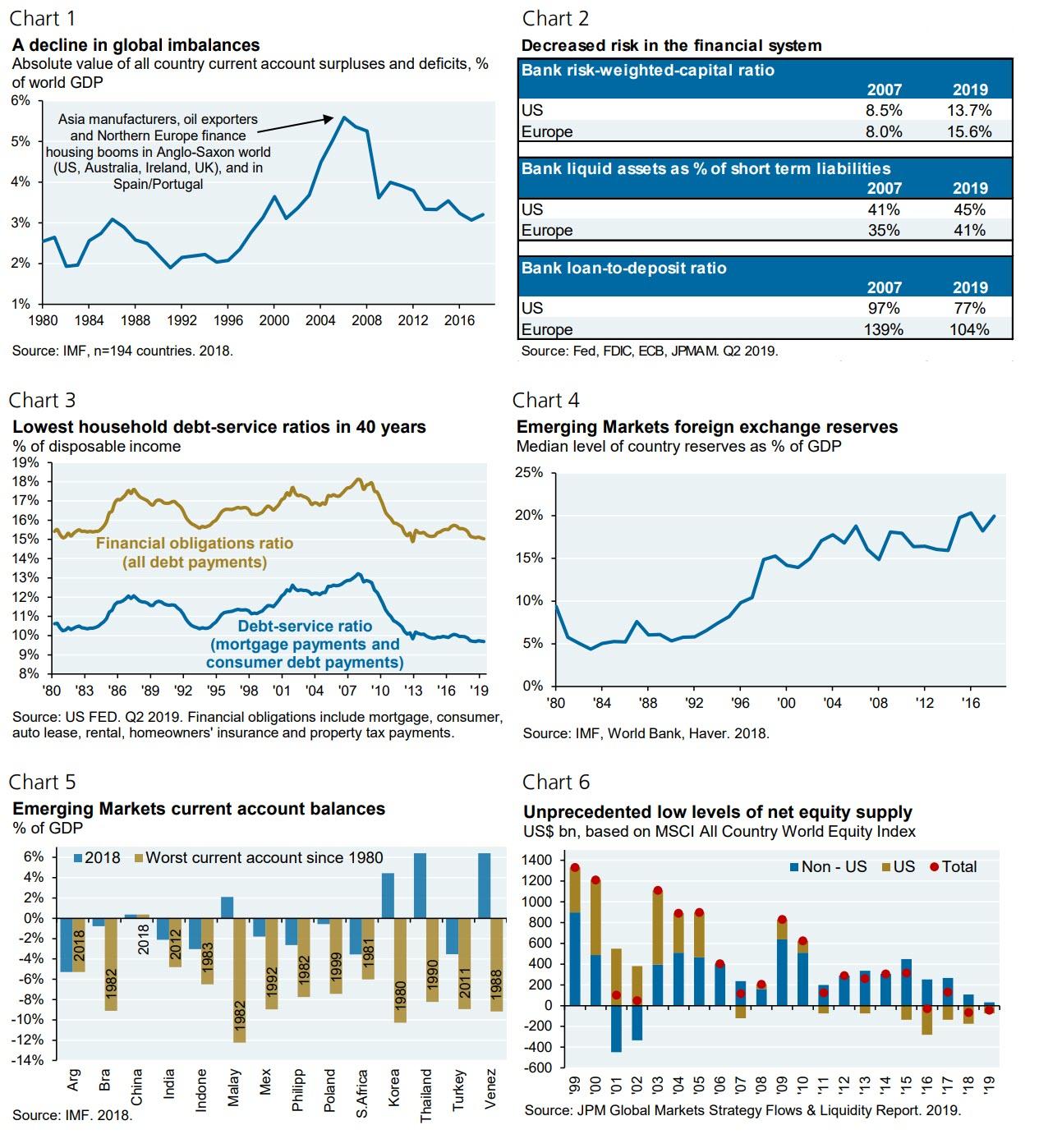

- a reduction in global economic imbalances,

- higher levels of capital and decreased funding risks in US and European banks,

- stronger balance sheet fundamentals of US households,

- reduced risk in most Emerging Markets due to higher levels of foreign exchange reserves and less reliance on foreign capital,

- and the low level of new US equity supply since buybacks and M&A have exceeded new equity issuance for the last five years.

What are the mega-bearish counterpoints?

US equity valuations are well above median, underwriting standards in the leveraged loan market have declined to disturbing levels, and deficits are financing a large part of US growth this late in the cycle. And, as discussed in our October Eye on the Market, there could be a seismic shift in Washington in 2020 that imposes substantial taxes, bans on share repurchases and regulatory costs on tech, energy, healthcare, financials, biotech, wireless, chemicals and more. Too soon to assess in terms of probabilities, but chances of a fundamental re-ordering of the US economy are rising.

All things considered, I think the next recession and bear market will not be as severe or long-lasting as the worst ones shown above. If that’s the case, it would ratify the approach of money managers that maintained normal exposures to risky assets in diversified portfolios since 2010, even as the business cycle aged and apocalyptic commentary swirled around them.

NEVER MISS THE NEWS THAT MATTERS MOST

ZEROHEDGE DIRECTLY TO YOUR INBOX

Receive a daily recap featuring a curated list of must-read stories.

* * *

Having said all that, who could have seen this coming?

Source: Bloomberg

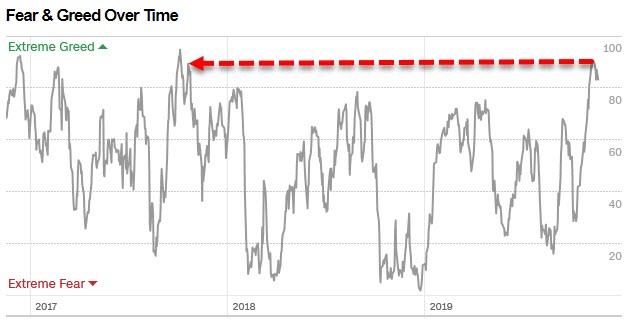

Of course, we suspect the fact that Michael Cembalest has decided to issue this report, “outing” the Armageddonists, will only fuel the calls for a top in complacency… just remember if greed is good, extreme greed must be awesome for everyone…

Source: CNN

StevieRay Hansen

Editor, Bankster Crime

MY MISSION IS NOT TO CONVINCE YOU, ONLY TO INFORM YOU…

The Birth Pains Are Growing Stronger….

“Unless God has raised you up for this very thing, you will be worn out by the opposition of man and devils”…

My name is Steve Meyers and I need to share a vision and warning that the Lord showed me back in April 2007….

Many of you will ask why I waited so long to share the warning. I didn’t. I shared the story with everyone that would listen from pastors to friends to family to colleagues. Immediately following the initial vision, I called a close friend. I told him to sit down that I had something to tell him. I needed it documented as I knew this was supernatural and from God. As I witness events unfolding today, I need to share the vision again.

The risk of loss in trading futures and options on futures can be substantial. The author does not guarantee the accuracy of the above information, although it is believed that the sources are reliable and the information accurate. The author assumes no liability or responsibility for direct or indirect, special, consequential or incidental damages or for any other damages relating or arising out of any action taken as a result of any information or advice contained in this commentary. The author disclaims any express or implied liability or responsibility for any action taken, which is solely at the liability and responsibility of the user.

Tagged Under: #Fraud #Banks #Money #Corruption #Bankers,#Powerful Politicians, #Businessmen

![]()