Global stock markets plunged Friday as tensions between the US and China spiral out of control.

Stocks in Hong Kong and mainland China tumbled after Beijing ordered Washington to cease all operations at its consulate in the city of Chengdu. This came days after Washington ordered the Chinese consulate in Houston, Texas, to close.

Investors are becoming fearful the tit-for-tat spat between the US and China will escalate into August. Today’s equity selling in Asia, Europe, and the US is evident in derisking.

We must note, derisking has been stealthily occurring under the surface for two months. While President Trump and Barstool Sports’ Dave Portnoy pump stocks, the smart money has been quickly dumping US-listed firms that do business in China because of increasing tensions.

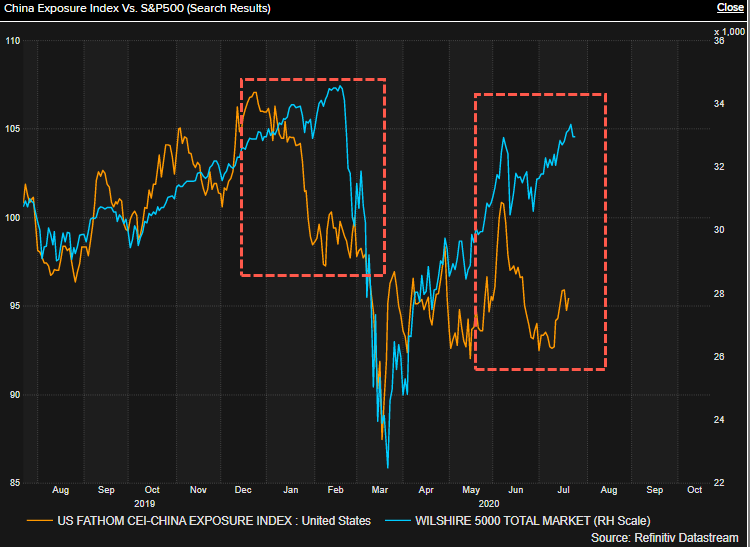

Fathom’s proprietary China Exposure Index (CEI) tracks US-listed firms that have 15% and 85% of their revenues from China. The CEI shows investors have been dumping these companies since the start of June.

Readers may recall, a plunging CEI in early February preceded the stock market crash that started later in the month.

Read: In Latest Sign Of Imminent Market Collapse, Investors Dump Everything’ China’

So the question we ask today: Is today’s CEI plunge hinting the stock market is set to tank again?

The Plandemic Tracking

Source: ZeroHedge

StevieRay Hansen

Editor, BanksterCrime

God often uses men who are not of the best moral character. Pharaoh, Nebuchadnezzar, Cyrus, Herod, and Trump (amongst others), to accomplish His will in events He orchestrates during human history. We either trust the sovereignty of God or we don’t. Nothing happens apart from Him…

The best index to a person’s character is how he treats people who can’t do him any good, and how he treats people who can’t fight back…

The Birth Pains Are Growing Stronger….

One of the signs of ruling class collapse is when they can no longer enforce the rules that maintain them as a ruling class. When the Romans started making exceptions to republican governance, it was a matter of time before someone simply decided the rules no longer applied to them. Perhaps the robot historians will consider Obama our Marius or Sulla. Maybe that person is in the near future. Either way, the rule of law is over and what comes next is the rule of men.

“Don’t piss down my back and tell me it’s raining.” Outlaw Josey Wales

![]()