The equity-ification of the bond market has been closely followed by Bloomberg News and other financial journalists. Unfortunately for the big banks, it’s a trend that has largely been led by fintech firms like TradeWeb and Bloomberg. Many corporate bonds from investment grade to deep in the speculative territory can be found trading on-the-run on both platforms.

This trend virtually guarantees that even as trading volume increases (thanks to the growing prevalence of HFT “market makers”) banks’ trading revenue will likely continue to decline, though in its early years in the pre-crisis days some believed the pullback in bank trading revenue might be temporary.

Trading revenue has been sliding since the financial crisis. According to BBG data, trading revenues at the largest banks have fallen for six out of the past seven quarters to their lowest levels in decades, with 2019 expected to set a new low.

Last year’s $110 billion revenue haul at the 12 largest global banks was down from $149 billion in 2010, and the biggest firms are down more than 5% through the first nine months of 2019. If we add the expected slide from 2019, that’s roughly equivalent to Goldman and JPM disappearing from the market.

In its story, BBG contends that the loss of some of the most lucrative pre-crisis products, like synthetic CDOs and their ilk, is another factor driving the fall in trading revenues among the big banks. But although markets for these securities are much smaller, and the products themselves slightly less lucrative, we’ve written extensively about their slow, creeping return (albeit in a “safer” packaging guaranteed to not spark the implosion of the global financial system).

It’s only a matter of time before banks really ratchet up the marketing of these products. Investors’ reaction to bank earnings this season proved once again that they’re not ready to simply accept the drop in trading revenues as a secular trend affecting the entire industry. No, the big banks will face tremendous pressure to do whatever they can to revive the business. Some might try to buy their way out of it by gobbling up some of the smaller firms that BBG says account for one-third of the $39 billion drops in banking revenue mentioned above (BBG blamed lower fees and spread-compression driven by electronic trading for the other two-thirds of the drop).

Larry Tabb, the founder of research firm Tabb Group, told BBG that the buy-side is, in many cases, taking advantage of new regulatory restrictions on SIFI (systemically important financial institutions) banks to muscle in on their territory.

“Their business model is being attacked from multiple directions,” Tabb said.

Of course, the one-way momentum of QE-driven markets over the past decade, which has artificially depressed interest rates, has hurt both fixed-income and equity trading, while squeezing banks’ all-important net interest income, a key variable that tracks how much banks can earn from lending.

The Trump Administration could make their jobs a whole lot easier by finally relaxing Dodd-Frank, particularly the provisions banning proprietary trading, a practice that once brought in as much as $5 billion in revenue a year on some trading desks.

Passive investing hasn’t only hurt the wealth-management and fund-management industries, it’s also contributed to the drop in banks’ trading revenue by triggering the decline of the hedge fund industry. Hedge funds once were banks’ largest clients. But in recent years they’ve suffered outflows while trying and often failing, to outperform significantly cheaper passive funds. Risk constraints are also making this a big problem for banks. At Goldman Sachs, the regulatory limit for value-at-risk – i.e. the measure of how much a bank’s traders can theoretically lose in a day – was just $55 million during the first nine months of the year, making large trades impossible.

Moreover, new financial regs that put restraints on bank capital, QE, a near-zero interest rate environment, political uncertainty and the ongoing debate about whether it is too much, or not enough, volatility, are also choking banks’ trading revenues. Job cuts in those areas have followed, as banks like Citigroup, DB, HSBC & SocGen have slashed thousands of positions.

“There’s a lot of things going on in the world,” Marty Chavez explained in a Bloomberg Television interview shortly after announcing he was stepping down from his role as co-head of Goldman Sachs’s trading business. “I would say regulatory change is a part of it; interest rates; quantitative easing for very long periods of time; the cleanup, the aftermath of the financial crisis; the rise of technology — one of the most deflationary things that exists; the availability of data, broadly disseminated, to everybody; and derived data or analytics on the data. All of these things have combined.”

To be sure, there are some signs that one or two of the largest banks might end up with the bulk of market share as its rivals exit. Just look at JPM’s Q3 earnings report.

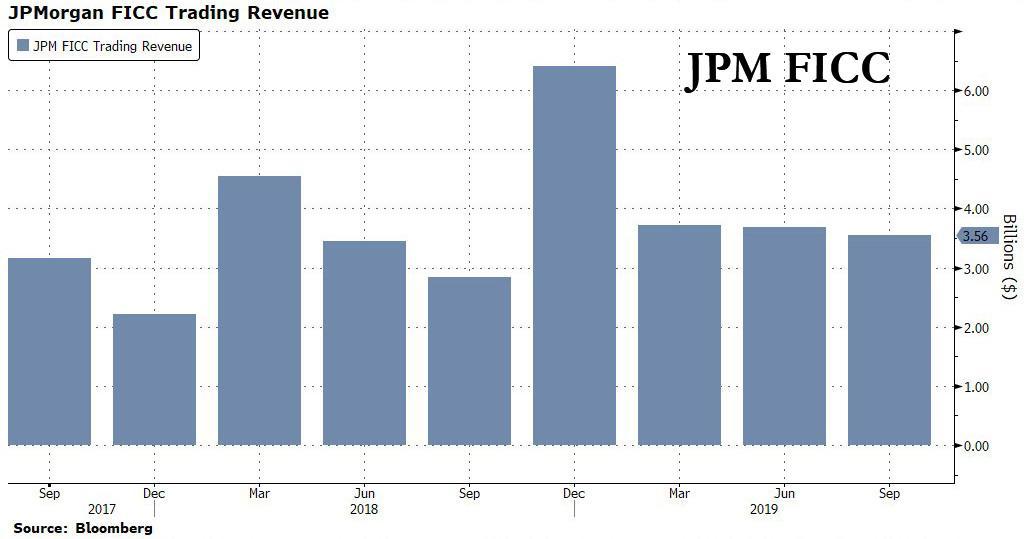

Focusing on JPM’s Corporate and Investment Bank, it is here that the bank surprised with an impressive FICC revenue print, which rose a whopping 25% Y/Y to $3.56BN, up to $713MM compared to the year-ago quarter “which reflected less favorable market conditions.”

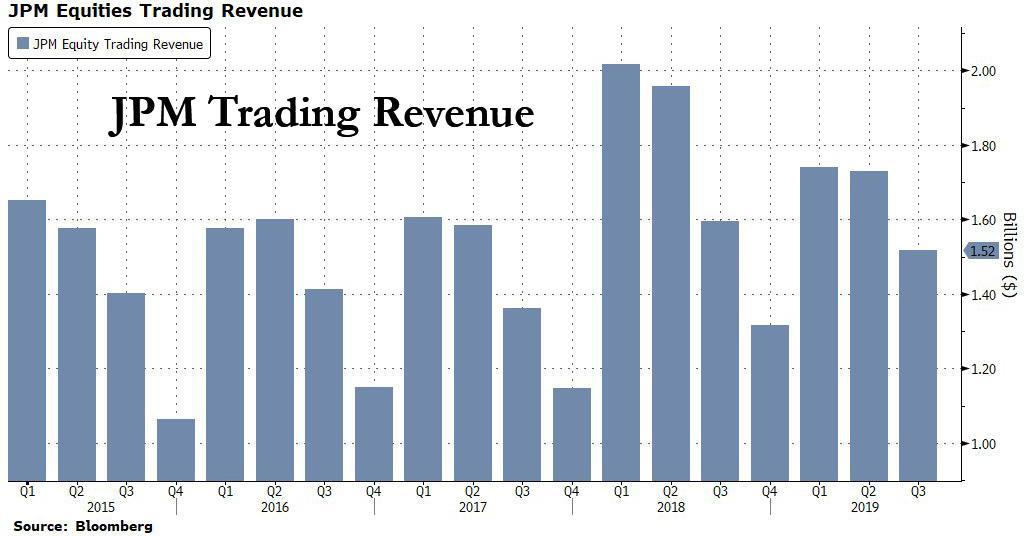

At the same time, JPM reported Equity Markets revenue of $1.52BN, missing expectations of $1.66BN and down 5% compared to a strong prior year, “reflecting lower revenues in derivatives, partially offset by higher Cash Equities.”

Meanwhile, several major banks, including Goldman, announced plans to pull back from FICC (fixed income, currencies and commodities) trading this year. Source

StevieRay Hansen

Editor, Bankster Crime

MY MISSION IS NOT TO CONVINCE YOU, ONLY TO INFORM YOU…

The Birth Pains Are Growing Stronger….

“Unless God has raised you up for this very thing, you will be worn out by the opposition of man and devils”…

My name is Steve Meyers and I need to share a vision and warning that the Lord showed me back in April 2007….

Many of you will ask why I waited so long to share the warning. I didn’t. I shared the story with everyone that would listen from pastors to friends to family to colleagues. Immediately following the initial vision, I called a close friend. I told him to sit down that I had something to tell him. I needed it documented as I knew this was supernatural and from God. As I witness events unfolding today, I need to share the vision again.

The risk of loss in trading futures and options on futures can be substantial. The author does not guarantee the accuracy of the above information, although it is believed that the sources are reliable and the information accurate. The author assumes no liability or responsibility for direct or indirect, special, consequential or incidental damages or for any other damages relating or arising out of any action taken as a result of any information or advice contained in this commentary. The author disclaims any express or implied liability or responsibility for any action taken, which is solely at the liability and responsibility of the user.

Tagged Under: #Fraud #Banks #Money #Corruption #Bankers,#Powerful Politicians, #Businessmen

![]()