BanksterCrime:

By Peter Tchir of Academy Securities

I’ve been doing a lot of thinking about “kicking the can.” Not because “kicking the can” has been effective, but because we seem to have hit the point where a wall is in the way, stopping us from “kicking the can” much further. This is more apparent on the geopolitical front, where the Middle East seems to need serious, long-term solutions. While we aren’t there yet with China and Taiwan, it seems that solutions like “one country, two systems” will be tested sooner rather than later.

But, since it is the holiday season in the U.S. and much of the world, let’s stick to a more positive message.

From Stalemate to Victory – the Fed

As you can tell from the immediate post-FOMC reaction and Thursday’s T-Report – Unthinking the Fed, I’m struggling to process the shift in tone. Much of that came out during Thursday’s Bloomberg TV interview (Academy’s section starts at the 41 minute mark). We did focus on my “pet theory” that the Fed is far less interested in creating a recession during an election year, than they were, say, in 2023. Also, they might not need to.

Maybe that is the problem, I’ve been arguing that the Fed has done too much already. That they should be on pause and thinking about cutting. Not every analyst has had that view, and until Wednesday, it didn’t seem like the Fed did either. Sure, they had slowed the hiking process rather dramatically, but they were still portraying a Fed that could hike or cut with equal probability. That does not seem to be the case. It is telling that they didn’t trot out multiple speakers to dissuade the market from their exuberance.

So maybe I’m just too jaded to accept that the Fed might actually be on the same page as we are. Maybe I have some self-destructive tendencies that make me want to snatch defeat from the jaws of victory (I am a contrarian, after all).

While it is difficult to love a market at or near all-time highs, we can always go higher. Just because August didn’t follow trend and everyone seems to be betting on a rally into year-end, doesn’t mean it can’t happen.

Maybe it is simply time to accept that the stalemate is over, victory conditions have been achieved, and we can move on? Maybe this applies beyond the battle with the Fed?

From Stalemate to Victory – Russia/Ukraine

While there is no sign of the stalemate ending, it seems that most people involved, directly and indirectly, have to face the reality that some form of “absolute” victory is unlikely. If that acceptance occurs, should we be thinking about what a victory looks like?

What opportunities and risks are there if Russia and Ukraine agree to some sort of serious ceasefire/peace agreement in 2024? Are we (or your company) prepared for the opportunities that rebuilding Ukraine would create? That impact could be immediate and large if the agreement includes the use of some or all of Russia’s frozen dollar reserves.

One of the things that also prevents “rebuilding” is the availability of funds – it seems plausible that there will be readily available funds for this rebuilding as it is in the interest of not just Ukraine, but Europe too! Europe, more than the U.S., needs to get Ukraine up and running as quickly as possible so it can export commodities again, and more importantly, so that displaced Ukrainians can return home.

I’m now spending more time thinking about what a peace agreement could mean for markets and the global economy, than I am thinking about how the war can progress.

From Stalemate to Victory – China Trade

I’m still looking for some attempt to create better relationships between the two countries.

- Whether we like it or not, incumbents do best in elections when the economy is doing well. Almost anything done with China will help in that direction, at least in the near-term, which is what may be directing the actions of many incumbents looking to get re-elected. My apologies if this sounds too cynical, but my view is that most politicians view their jobs as being politicians, so to keep their jobs, they need to get re-elected. Cynical or not, that is my working assumption and shapes why I think that we can get something in the headlines in the next month or two (Treasury Secretary Yellen heading back to China seems good on this front).

- Many economic advisors to the Democratic party were very vocal about how detrimental tariffs were for the economy. There must be some who are still prodding the administration to ease back on tariffs. Whether it is cutting tariffs or just creating a “pathway” to reducing tariffs, the markets would likely respond well. At the very least, there is an argument to be made, depending on how it is done, that easing tariffs should reduce prices, and in turn reduce inflation.

- Chips. Clearly defining what is mission critical for the U.S. with respect to the military and AI could help the chip sector, as it would reduce uncertainty about which chips may or may not come under scrutiny. Just some clarity could help markets.

- While nothing to do with the U.S., China itself seems overdue for some more aggressive stimulus.

- Food. That is one area where (hands down) the U.S. dominates China and could create some good bargaining positions for the U.S. in any negotiations.

So, rather than being worried about what has gone on, maybe it is time to think about what happens next.

For clarity, Academy’s Geopolitical Intelligence Group is adamant that China remains the number one concern in D.C. on the National Security front. We will not, as a nation, jeopardize the nation’s future in our dealings with China. Having said that, there is plenty of room to come up with a deal that is (or at least seems to be) more economic in nature – which is what I’m betting on.

From Stalemate to Stalemate

It is unclear how we get to “victory” by almost any definition in the next few weeks (or even months) in the Middle East or with respect to the tensions surrounding China and Taiwan, especially with Taiwan heading into a crucial election. Those both seem to fit the “kicking the can into a wall” metaphor, but today, we are erring on the positive side.

Bottom Line

Rates. Difficult to like here, so slightly bearish bias. The rising debt, the growing percentage of our budget spent on interest, etc. were (and are) real. It shouldn’t have pushed 10s to 5%, but it makes sub-4% somewhat untenable.

Equities. Difficult to like here, but slightly bullish bias, favoring the “laggards.” My inclination is to step away from the punch bowl, but am I just snatching defeat from the jaws of victory? I cut positions but am buying dips. So, a timid bullishness, even with the laggards, which I continue to favor.

While I’m cautious about leaving early, it has been one heck of a party!

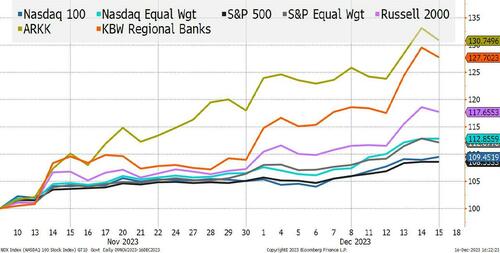

Since November 9th, the Nasdaq 100 and the S&P 500 have underperformed the equal weighted indices. They got beat up pretty badly by the Russell 2000 and have been left in the dust by Regional Banks and ARKK. I use ARKK as a proxy for “disruption” and early in the year it was performing more or less in line with the Nasdaq 100, which surprised me. I view it as very high beta and would have expected it to trounce the Nasdaq 100 in such a strong market (it is finally doing that).

When I look at this chart, it gives me optimism for the IPO market and for M&A coming into 2024 – typically good for stocks!

Credit. It is tight by recent measures, but I think that it can go tighter. People seem to want to fight the spread tightening. While it is difficult to pound the table for credit, especially since M&A activity could result in an even bigger (and longer duration) calendar than expected, I wouldn’t fade it just yet.

For once, let’s enjoy the victory and keep on enjoying it for a little longer.

I’m looking to add more risk on dips, as whatever ranges we thought applied to markets at the start of the week have materially moved with the Fed Put back in play!

Be gentle with your skin. Our soaps are kind to your skin and create a creamy, silky lather that is nourishing. Small batches are made by hand. We only use the best natural ingredients. There are no chemicals, phthalates, parabens, sodium laurel sulfate, or detergents. GraniteRidgeSoapworks

Revelation: A Blueprint for the Great Tribulation

A Watchman Is Awakened

The Future Has Already Been Written

Will Putin Fulfill Biblical Prophecy and Attack Israel?

The New York Fed Has Extended Its Half Trillion Dollar Bailout Facility to a Sprawling Japanese Bank You’ve Never Heard Of

By StevieRay Hansen | December 15, 2023

Wall Street CEOs Want the Line Between a Federally-Insured Bank and a Wall Street Trading Casino Erased; Regulators Want Higher Capital to Prevent That

By StevieRay Hansen | December 14, 2023

Fed’s Vice Chair for Supervision Says Another Financial Crisis Could Cost U.S. $5 Trillion to $25 Trillion – Potentially as Much as 100 Percent of GDP–It’s Tribulation In Full View

By StevieRay Hansen | December 13, 2023

Smoke and Mirrors. FDIC Scheme–Smoke and Mirrors. FDIC Scheme–a Key Driver of the Failures of Silicon Valley Bank and Signature Bank Were Their Over Reliance on Uninsured Deposits

By StevieRay Hansen | December 12, 2023

Banks in Trouble: The 25 Largest U.S. Banks Are Seeing the Largest Fall in Deposits in 38 Years With No Signs of Letting Up

By StevieRay Hansen | December 11, 2023

Professors Point to JPMorgan Chase as Poster Boy of a Financial System Dependent on Corruption to Sustain Itself

By StevieRay Hansen | December 10, 2023

![]()