Paul wants to steer Timothy away from that trap. In doing so, he tells him the real source of “great gain;” namely, godliness with true contentment (verse 6). Contentment, in a biblical sense, is the recognition that we come into the world with nothing and that everything we have is a gift from God’s hands (verses 7–8). Yet those who desire to be rich (i.e., those who have the “love of money”) are the ones who are led into temptation and fall into a snare (verse 9). Paul concludes the passage by telling Timothy that the love of money leads to all sorts of sin and evil.

A bear market is roaring in Saudi Arabia, as local stock indexes fell sharply on Tuesday, with energy, financials, and basic materials taking the brunt of the selling.

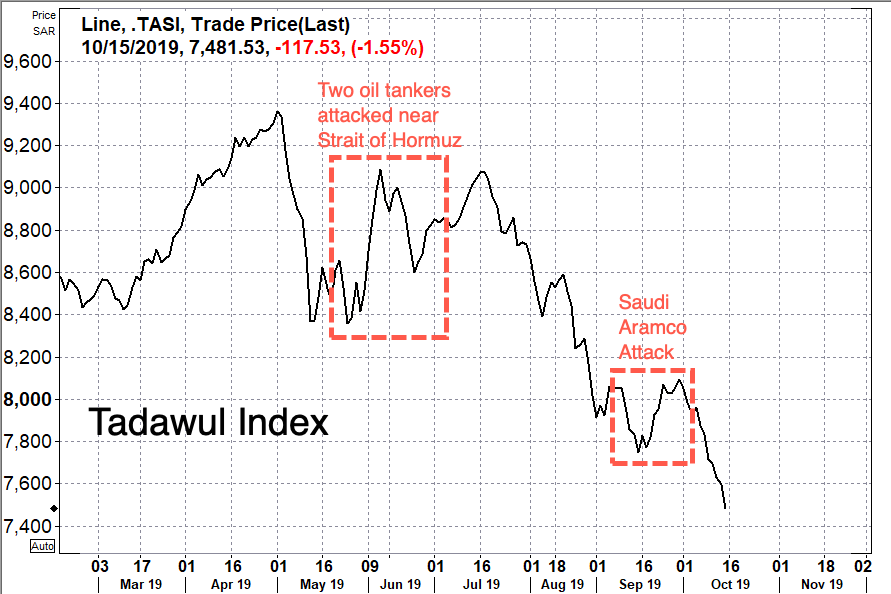

The Tadawul All Share Index fell 1.55% on Tuesday, plunging Saudi Arabia’s top stock index into a bear market, falling 20.5% in the last 24 weeks, or about five months.

Saudi banks are expected to see earnings deterioration in 3Q after two consecutive rate cuts by the Saudi Arabian Monetary Authority (SAMA) in August and September.

“In general, expectations from third-quarter results are muted. Rate cuts are spread negative since a large chunk of their deposits are cost-free anyways & loan growth is not exciting,” Vrajesh Bhandari, senior portfolio manager at Al Mal Capital, told Reuters.

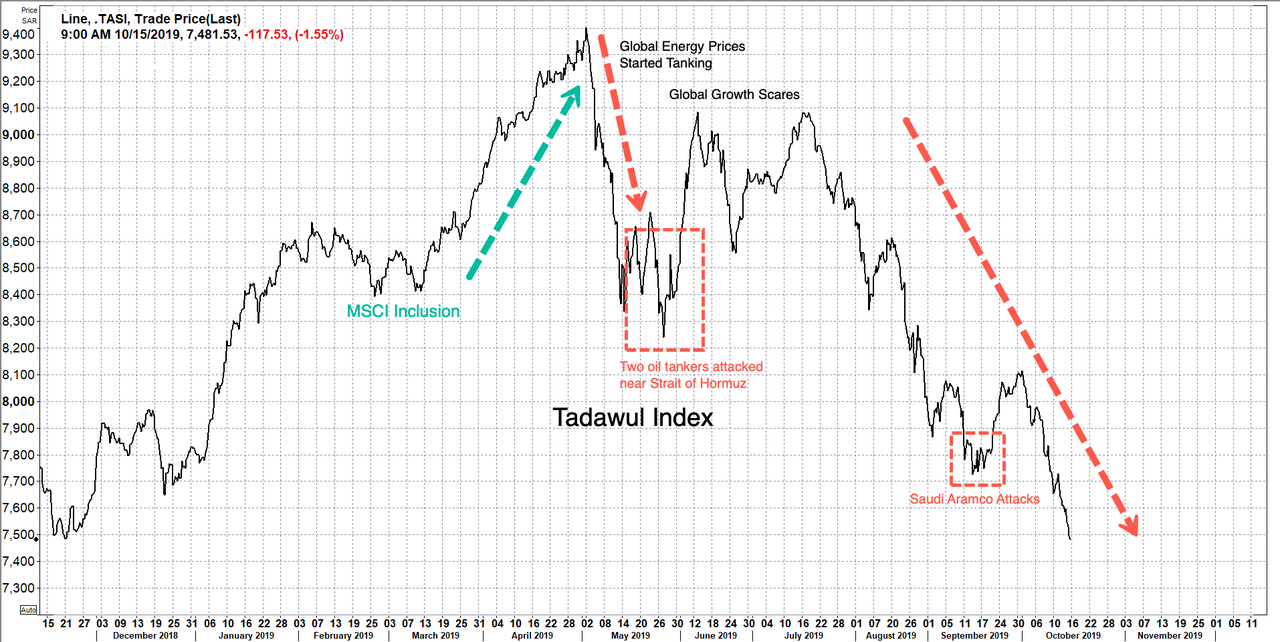

Escalating tensions between the US and Iran in the Strait of Hormuz has forced a mass exodus of global investors from Saudi stocks since summer.

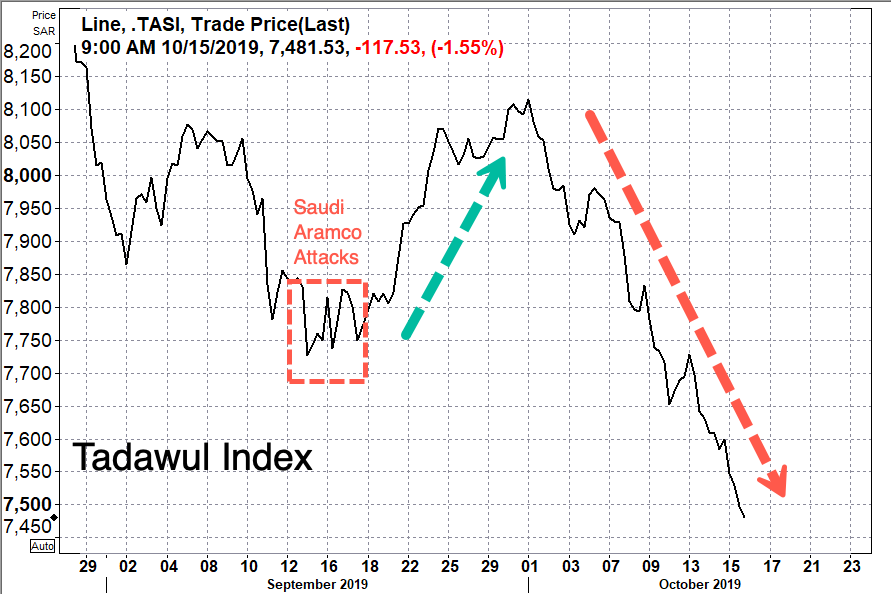

Saudi Aramco, a Saudi Arabian national petroleum and natural gas company based in Dhahran, experienced a drone and cruise missile attack on September 14, likely orchestrated by Iran, sent the Tadawul stock index initially tumbling 3.5% at one point. The index then rallied 7% from mid-September to early October, where the index then reversed and has since sunk 8% in the last ten days.

Naeem Aslam, the chief market analyst at ThinkMarkets in London, told Bloomberg that investors had been spooked out of Saudi stocks “given the geopolitical uncertainty at the moment.”

Asked what #SaudiCrownPrince #MohammedbinSalman thought would motivate Iran to strike the Saudi Aramco plants in the Sept. 14 attack he replied “stupidity” https://cutt.ly/Per06NB 269:00 AM – Sep 30, 2019Twitter Ads info and privacy34 people are talking about this

The unraveling of the Tadawul stock index comes a month before Aramco is preparing to IPO. The new listing could make its debut on public markets as soon as November.

Saudi Crown Prince Mohammed bin Salman has made it a top priority to list Aramco on the Tadawul exchange, as other listings across the world would follow in 2020.

Tadawul stocks were included in the MSCI Emerging Markets Index and the MSCI ACWI Index in March, allowing passive funds across the world to soak up Saudi stocks — but it seems the buying spree ended in early May when energy prices plunged on global growth fears.

And with the IMF lowering it’s global growth estimate for 2019 to 3% this year, down from 3.2% in July, with the 2020 forecast reduced to 3.4% from 3.5% – the lowest since 2009, energy prices will likely remain in a lower trajectory through 2020, which could prolong the bear market in the Tadawul stock index.

StevieRay Hansen

Editor, Bankster Crime

The people spreading concrete information on the dangers of globalism are accomplishing far more than those sitting around buying bitcoin or passing around Q-cult nonsense.

MY MISSION IS NOT TO CONVINCE YOU, ONLY TO INFORM…

#Fraud #Banks #Money #Corruption #Bankers

“Have I, therefore, become your enemy by telling you the truth?”

Tagged Under: Anti Christ, Bible, Blame Game, California, deception, demonic, fascism, free speech

![]()