Global capital markets are not pricing in the growing likelihood that defaults by large corporate borrowers in emerging markets will rise, which will set up another cascade of market events like the downward trajectory we saw in 1997.

Video concealedcarryuniversity

Despite the massive programs that have been swiftly put in place by central banks and fiscal authorities around the world, global capital markets remain extremely fragile. After a long cascade of negative shocks to the global economy, yet another lurks on the horizon. Many investors in the United States and elsewhere have yet to focus on the vulnerabilities faced by emerging market (EM) countries and corporations. Proof of investor complacency is clearly evidenced in the largest emerging markets bond exchange-traded fund (ETF). Currently, that ETF yields just 5 percent, not much higher than it yielded at the beginning of the year.

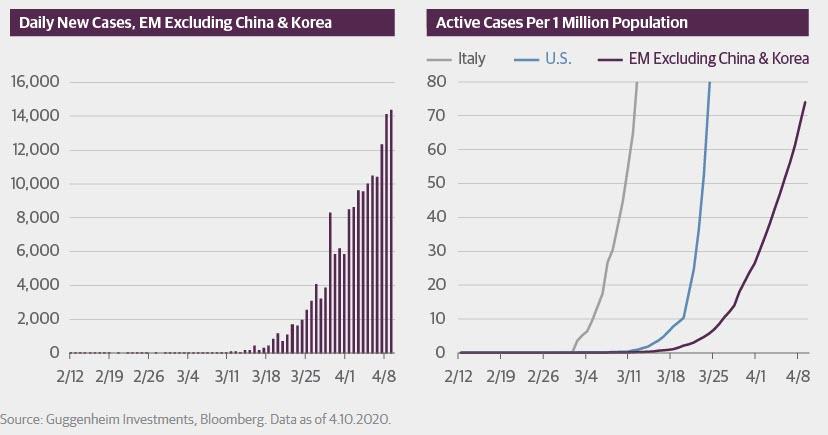

Investors seem to ignore the fact that while the global economic shutdown is synchronized, the spread of the virus is not. Daily new cases of COVID-19 are growing rapidly in EM countries (excluding China and Korea) as they begin to decline in parts of the developed world.

COVID-19 Cases Rising in the Emerging Markets

Source: Guggenheim Investments, Bloomberg. Data as of 4.10.2020.

The emerging markets soon will be hit very hard by the global pandemic. The pandemic will be followed by goods and food shortages, and social unrest. Before the virus hit them directly, EM countries had already been adversely affected by falling commodity prices and the economic impact of the shutdown in China and other parts of the developed world. Most EM countries have very weak healthcare systems, nowhere near enough hospital beds and respirators, crowded cities and slums, and large numbers of workers in the economy who are paid daily wages or work in the informal economy and can’t work remotely. For many EM countries, this pandemic will quickly escalate from a health crisis to a humanitarian crisis, and ultimately to a solvency crisis. Political stability will be the last domino to fall.

An Emerging Markets Crisis Could be the Next Shoe to Drop

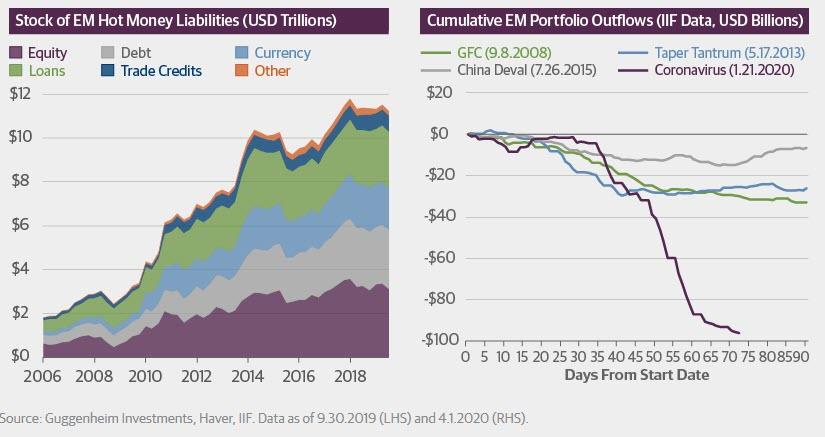

The current mispricing in the face of these challenges and the systemic risk that they pose to global markets is happening despite an unprecedented surge of capital flight from emerging markets. The outflows of hot money capital—equity, debt, currency, loans, trade credits—are weighing on foreign currency reserves holdings, as countries intervene to defend currency pegs, dampen volatility, prevent a spike in the local currency value of foreign currency obligations, and deter further capital outflows as a result of currency depreciation.

Capital Flight Weighing on EM FX Reserves

Source: Guggenheim Investments, IIF, Haver. Data as of 4.10.2020.

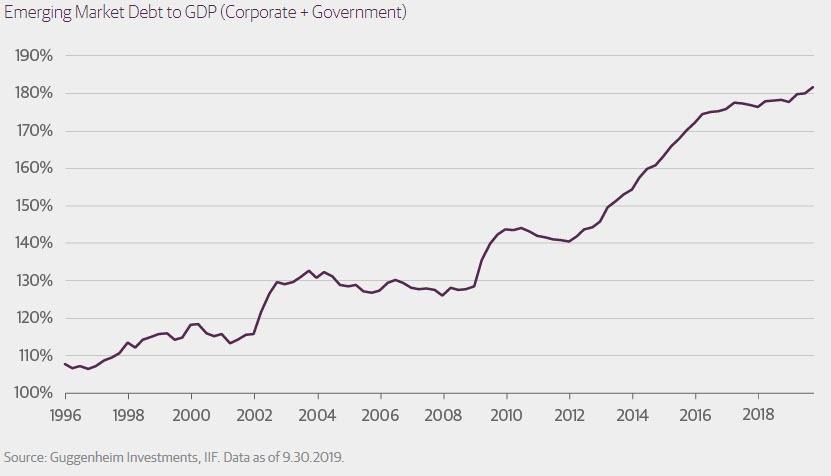

The total debt of EM governments and corporations as a percentage of gross domestic product (GDP) is significantly higher than it has ever been. Collectively it stands at over 180 percent, up from 110 percent during the Asian debt crisis. In recent months, many EM countries—such as Brazil, South Africa, Argentina, Ukraine, Nigeria, and Indonesia—have seen some market pressures reflected in widening credit default swaps (CDS) and cash bond spreads, in addition to currency depreciation.

Emerging Markets Are Highly Vulnerable in this Environment

Emerging Market Debt to GDP (Corporate + Government)

Source: Guggenheim Investments, IIF. Data as of 9.30.2019.

One of the most disturbing aspects of emerging market debt is the record amount of dollar-denominated securities that have been issued by EM corporations during the past decade. This contrasts with the Asian debt crisis, when it was sovereign borrowers and banks that were unable to access hard currency to service debt and fund large current account deficits.

My biggest concern is that this crisis will be much deeper and more prolonged than people anticipate, which leaves a lot of space for another shoe to drop in the global financial crisis. A default or debt restructuring in the emerging markets will likely lead to an increase in borrowing costs just as their economies are contracting. Like in the United States, EM countries will engage in fiscal stimulus, which will cause fiscal deficits to balloon. Borrowing costs in most of these countries have already been rising over the course of the last month or so, and at some point, the debt will become prohibitively expensive. Rising borrowing costs will limit the fiscal flexibility needed to address the public health and economic crises in these countries.

Just as in the United States, EM countries will look to their central banks to monetize the debt, but monetary policy space is also constrained. Rich countries can drop helicopter money on their economies with relatively little consequence, but EM monetary and fiscal solutions will further weaken their currencies, making access to dollars even harder for corporations that are also experiencing a slowdown in cash flows. In time, EM corporate defaults will rise, adversely affecting the ability of other borrowers from the developing world to get access to credit in the global financial markets.

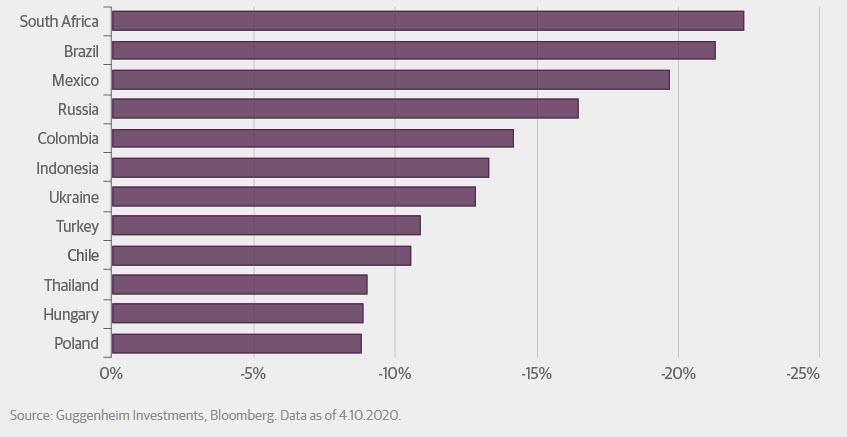

EM Currencies Have Been Battered by COVID-19, With More Pain to Come

Year-To-Date Currency Performance Versus the U.S. Dollar

Source: Guggenheim Investments, Bloomberg. Data as of 4.10.2020.

Multilateral institutions like the International Monetary Fund (IMF) were very effective during the Asian crisis because they were able to funnel dollars to governments that needed help when their local currencies collapsed, conditional on countries pursuing needed economic reforms. This time, however, it will be harder for the IMF to reach the entities in need of assistance because it doesn’t directly interact with EM business communities. The IMF will need to work with EM governments to build the infrastructure enabling corporate borrowers to obtain foreign currency, including dollars, as needed. Stabilizing economies and balance of payments dynamics will be much more challenging in light of the sudden stop in economic activity caused by COVID-19.

The scale of action required at this time is far greater than any of us would have contemplated even a few weeks ago. The global contraction in output will be very similar to the contraction during the second world war when a significant percentage of output was wiped out due to the destruction in Europe. Easily a 20 percent decline in the approximately $10 trillion in GDP outside G20 countries will result in a demand gap of about $2 trillion that will need to be filled to keep these economies functioning at their current levels. By comparison, in the United States we have about a $22 trillion economy, so the estimated 10–15 percent contraction in GDP will mean that a demand gap of about $2 trillion to $3 trillion will need to be offset with government stimulus.

Currently, the demand gap in the United States is being partially filled by aggressive fiscal and monetary policy. But it will be a challenge to fill the demand gap in emerging markets. I believe it will take a coordinated effort on the scale of Bretton Woods to develop a monetary infrastructure that will enable emerging market countries to manage through this and future crises. The IMF and World Bank, which were established at Bretton Woods, are well-situated to play a leading role in this effort, but they will need the rich countries of the developed world to coordinate and provide the resources. This is a huge challenge, not least because growing nationalism in various parts of the world, the rise of China as a geopolitical counterweight to the United States, and domestic fiscal strain at home will result in even less willingness to engage in international policy coordination.

In the short run, policymakers—including the IMF, which holds its Virtual Spring Meetings this week—are already discussing possible steps to address this looming problem. Some solutions have been tried in past sovereign debt crises, to varying degrees of effectiveness, while others are new ideas. For example, details are being worked out on an arrangement for the G20 countries to offer relief on bilateral loan repayments to 76 of the world’s poorest nations. It is a start, but this kind of debt moratorium will likely need to be expanded. Other possible remedies for addressing an EM debt crisis include governments and other supranational agencies providing credit enhancement and loan guarantee programs for corporate borrowers, or expanding the IMF’s Flexible Credit Line (FCL) to meet the demand for crisis-prevention and crisis-mitigation lending.

Fragile credit markets will be supported by the right policy measures, but the more important beneficiaries of these programs are the people of the developing world. They are at the mercy of a rampaging pandemic and an economic system that is not prepared to cope with it. The spread of the coronavirus is showing us how our interconnected world renders us all vulnerable to common health and economic risks. If policymakers in China, Europe, Japan, and the United States are well-informed about how damaging a collapse in the developing world would be, not only to themselves but to the rest of the G20, there would be greater support for building a framework to help stabilize and rebuild from the devastation we are about to experience. Source: ZeroHedge

StevieRay Hansen

Editor, Bankster Crime

![]()