with little or no advance warning…

Banks will be the major contributor to the collapse of the United States economy, banks have become EVIL,SRH.

Usury is, by modern definition, the illegal practice of lending money at unreasonably high rates of interest. Usury is usually carried out with the intention of the lender, or usurer, gaining an unfair profit from the loan.

When Judas Iscariot attempted to return the 30 pieces of silver he had received to betray Jesus, the chief priests said, “It is against the law to put this into the treasury, since it is blood money” (Matthew 27:6). They knew it was not lawful to accept income knowingly used for illegal purposes. The irony, of course, is that the chief priests themselves had paid Judas in the first place (Matthew 26:14–16). Theirs was a selective scrupulousness.

Some situations involve a level of ambiguity. For example, we would define ungodly as “sinful” or “against God.” But many people work in industries or in ways that at times could be considered sinful. If churches were to investigate every gift to determine whether it was earned in a “godly” manner, it would place an unjust burden on the church, as well as create many complicated situations regarding what is defined as godly or ungodly.

Where’d the Bailout Cash Go? It’s a Secret2008-12-22, CBS News/Associated Press

https://www.cbsnews.com/news/whered-the-bailout-cash-go-its-a-secret/

After receiving billions in aid from U.S. taxpayers, the nation’s largest banks say they can’t track exactly how they’re spending it. Some won’t even talk about it. “We’re choosing not to disclose that,” said Kevin Heine, spokesman for Bank of New York Mellon, which received about $3 billion. The Associated Press contacted 21 banks that received at least $1 billion in government money and asked four questions: How much has been spent? What was it spent on? How much is being held in savings, and what’s the plan for the rest? None of the banks provided specific answers. Some banks said they simply didn’t know where the money was going. There has been no accounting of how banks spend that money. The answers highlight the secrecy surrounding the Troubled Asset Relief Program, which earmarked $700 billion … to help rescue the financial industry. Lawmakers summoned bank executives to Capitol Hill last month and implored them … not to hoard it or spend it on corporate bonuses, junkets or to buy other banks.

But there is no process in place to make sure that’s happening and there are no consequences for banks that don’t comply. Meanwhile, banks that are getting taxpayer bailouts awarded their top executives nearly $1.6 billion in salaries, bonuses, and other benefits last year. Congress attached nearly no strings to the $700 billion bailout in October. And the Treasury Department, which doles out the money, never asked banks how it would be spent. No bank provided even the most basic accounting for the federal money. Most banks wouldn’t say why they were keeping the details secret.

Note: Explore key information that the bankers don’t want you to know on the Federal Reserve, which is neither federal, nor a reserve. For many revealing reports from reliable sources on the realities of the Wall Street bailout, click here. For more along these lines, see concise summaries of deeply revealing news articles on the banking bailout from reliable major media sources. Then explore the excellent, reliable resources suggesting major corruption provided in our Banking Information Center.

Iceland has jailed 26 bankers, why won’t we?2015-11-15, The Independent (One of the UK’s leading newspapers)http://www.independent.co.uk/voices/iceland-has-jailed-26-bankers-why-wont-we…

Iceland … has just sentenced five senior bankers and one prominent investor to prison for crimes relating to the economic meltdown in 2008. The nation that gambled so heavily on the markets and lost so disastrously in the consequent crash has [now] sent 26 financiers to jail for combined sentences of 74 years. The authorities pursued bank bosses, chief executives, civil servants and corporate raiders for crimes ranging from insider trading to fraud, money laundering, misleading markets, breach of duties and lying to the authorities. Meanwhile the economy that collapsed so spectacularly has rebounded after letting banks go bust, imposing capital controls and protecting its own citizens over all other losers. This determination to hold people to account for actions that caused intense financial misery contrasts strongly with Britain, most of the rest of Europe and the United States.

Britain never bothered holding a proper inquiry into the financial meltdown that still heavily impacts on public finances. In New York, a couple of minor British bankers have just been convicted of manipulating inter-bank lending rates. In London, the massive HSBC is playing political games … to stave off regulatory pressures. This is the bank, remember, fined Ł1.2bn after a US investigation found it was laundering money for gangsters and rogue nations, then discovered to be helping wealthy clients evade tax in dozens of countries. Its former boss became a government minister and then chairman of the British Museum.

Note: So the one nation that jailed its big bankers and let banks go bust is doing very well. Why are so exceedingly few bankers in other countries being jailed for crimes involving trillions of dollars and bankrupting millions of citizens? For more along these lines, see concise summaries of deeply revealing news articles about corruption in government and in the financial industry.

A Secretive Banking Elite Rules Trading in Derivatives2010-12-12, New York Timeshttp://www.nytimes.com/2010/12/12/business/12advantage.html

On the third Wednesday of every month, the nine members of an elite Wall Street society gather in Midtown Manhattan. The men share a common goal: to protect the interests of big banks in the vast market for derivatives, one of the most profitable — and controversial — fields in finance. They also share a common secret: The details of their meetings, even their identities, have been strictly confidential. Drawn from giants like JPMorgan Chase, Goldman Sachs and Morgan Stanley, the bankers form a powerful committee that helps oversee trading in derivatives, instruments which, like insurance, are used to hedge risk. In theory, this group exists to safeguard the integrity of the multitrillion-dollar market. In practice, it also defends the dominance of the big banks.

The banks in this group … have fought to block other banks from entering the market, and they are also trying to thwart efforts to make full information on prices and fees freely available. Banks’ influence over this market, and over clearinghouses like the one this select group advises, has costly implications for businesses large and small. The size and reach of this market has grown rapidly over the past two decades. Pension funds today use derivatives to hedge investments. States and cities use them to try to hold down borrowing costs. Airlines use them to secure steady fuel prices. Food companies use them to lock in prices of commodities like wheat or beef.

Note: To explore highly revealing news articles on the powerful secret societies which without doubt back these top bankers, click here. For a treasure trove of reports from reliable sources detailing the amazing control of major banks over government and society, click here.

Bank Bonuses Far Exceeded Profits2009-07-30, CBS Newshttp://www.cbsnews.com/stories/2009/07/30/business/main5197668.shtml

Several financial giants that received federal bailout money in the last year paid out bonuses to employees in 2008 that greatly exceeded the amount of profit generated by the banks, according to a study on executive compensation released by New York State Attorney General Andrew Cuomo Thursday. Despite claims by bank executives that bonuses are tied to the company’s performance, the report states that “there is no clear rhyme or reason to how the banks compensate or reward their employees.” Cuomo’s investigation “suggests a disconnect between compensation and bank performance that resulted in a ‘heads I win, tails you lose’ bonus system.” According to the report: • Goldman Sachs, which earned $2.3 billion last year and received $10 billion in TARP funding, paid out $4.8 billion in bonuses in 2008 – more than double their net income. • Morgan Stanley, which earned $1.7 billion last year and received $10 billion in bailout funds, handed out $4.475 billion in bonuses, nearly three times their net income. • JPMorgan Chase, which earned $5.6 billion in 2008 and received $25 billion from the government, paid out $8.69 billion in bonus money. • Citigroup and Merrill Lynch lost a combined $54 billion last year. They received a total of $55 billion in bailouts and paid out $9 billion in combined bonuses. ($5.33 billion for Citigroup; $3.6 billion for Merrill Lynch, which was subsequently acquired by Bank of America.) Bonuses have been a hot-button issue surrounding these federally bailed out banks for months, with company executives facing heat from … local officials like Cuomo angered by the exorbitant compensation plans for the same people widely seen as responsible for the country’s financial crisis.

Note: Click here to read the full report. For lots more on the realities behind the taxpayer bailout of Wall Street, click here.

The $700 trillion elephant2009-03-06, MarketWatch (Wall Street Journal Digital Network)http://www.marketwatch.com/news/story/The-700-trillion-elephant-room/story.as…

There’s a $700 trillion elephant in the room and it’s time we found out how much it really weighs on the economy. Derivative contracts total about three-quarters of a quadrillion dollars in “notional” amounts, according to the Bank for International Settlements. These contracts are tallied in notional values because no one really can say how much they are worth. But valuing them correctly is exactly what we should be doing because these comprise the viral disease that has infected the financial markets and the economies of the world. Try as we might to salvage the residential real estate market, it’s at best worth $23 trillion in the U.S. We’re struggling to save the stock market, but that’s valued at less than $15 trillion. And we hope to keep the entire U.S. economy from collapsing, yet gross domestic product stands at $14.2 trillion. Compare any of these to the derivatives market and you can easily see that we are just closing the windows as a tsunami crashes to shore. The total value of all the stock markets in the world amounts to less than $50 trillion, according to the World Federation of Exchanges.

To be sure, the derivatives market is international. But much of the trouble we’re in began with contracts “derived” from the values associated with U.S. residential real estate market. These contracts were engineered based on the various assumptions tied to those values. Few know what derivatives are worth. I spoke with one derivatives trader who manages billions of dollars and she said she couldn’t even value her portfolio because “no one knows anymore who is on the other side of the trade.”

Note: Banks and financial firms deemed “too big to fail” were bailed out worldwide at taxpayers’ expense. But what will happen if losses in the derivatives market skyrocket? No government in the world has the resources to save financial corporations from a collapse in their derivatives trading. For a treasure trove of reports from reliable sources detailing the amazing control of major banks over government and society, click here.

100 Years Later, The Federal Reserve Has Failed At Everything It’s Tried2013-12-20, Forbeshttp://www.forbes.com/sites/markhendrickson/2013/12/20/100-years-later-the-fe…

On Dec. 23, 1913, President Woodrow Wilson signed the Owen Glass Act, creating the Federal Reserve. As we note its centennial, what has the Fed accomplished during the last 100 years? The stated original purposes were to protect the soundness of the dollar and banks and also to lessen the jarring ups and downs of the business cycle. Oops. Under the Fed’s supervision, boom and bust cycles have continued. Three of them have been severe: the Great Depression, the stagflationary period of 1974-82, and the current “Great Recession.” Bank failures have occurred in alarmingly high numbers. Depending on what measurements are used, the dollar has lost between 95 and 98 percent of its purchasing power. (Amazingly, the Fed’s official position today is that inflation is not high enough, so the erosion of the dollar continues as a matter of policy.) Having failed to achieve its original goals, the Fed also has had a miserable record in accomplishing later goals. The 1970 amendments to the Federal Reserve Act stipulated that the Fed should “promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates.” In baseball parlance, the Fed has been “0-for-three.”

So, what has the Fed accomplished during its century of existence? Well, it has become adept at bailing out mismanaged banks. In the aftermath of the 2008 financial crisis, the Fed orchestrated the big bailout of Wall Street. Politically, the Fed is repugnant. Its chairman is commonly referred to as the second most powerful person in the country. In a democratic republic, should the second most powerful policymaker be unelected?

Note: How remarkable for Forbes to publish an article chastising the Fed! The times are a changin’! For an essay by noted financial researcher Ellen Brown on this occasion, click here. For more on the collusion between government and the biggest banks, see the deeply revealing reports from reliable major media sources available here.

Here’s why Wall Street has a hard time being ethical2013-11-25, The Guardian (One of the UK’s leading newspapers)http://www.theguardian.com/business/2013/nov/25/wall-street-hard-time-ethical

My first year on Wall Street, 1993, I was paid 14 times more than I earned the prior year and three times more than my father’s best year. For that money, I helped my company create financial products that were disguised to look simple, but which required complex math to properly understand. That first year I was roundly applauded by my bosses, who told me I was clever, and to my surprise they gave me $20,000 bonus beyond my salary. When I did ask, rather naively, if this was all kosher, I would be assured multiple times that multiple lawyers and multiple managers had approved the sales. One senior trader, consoling me late at night, reminded me, “You are playing in the big leagues now. If a customer wants a red suit, you sell them a red suit. If that customer is Japanese, you charge him twice what it costs. ”Being paid very well also helped ease any of my concerns. Feeling guilty, kid? Here take a big check. I was, for the first time in my life, feeling valued for my math skills. Ego and money are nice salves for any potential feeling of guilt.

After a few years on Wall Street it was clear to me: you could make money by gaming anyone and everything. The more clever you were, the more ingenious your ability to exploit a flaw in a law or regulation, the more lauded and celebrated you became. Nobody seemed to be getting called out. No move was too audacious. Traders got more and more audacious, and corruption became more and more diffused through the system. By 2006 you could open up almost any major business, look at its inside workings, and find some wrongdoing.

Note: For more on financial corruption, see the deeply revealing reports from reliable major media sources available here.

The Last Mystery of the Financial Crisis2013-06-19, Rolling Stonehttp://www.rollingstone.com/politics/news/the-last-mystery-of-the-financial-c…

It’s long been suspected that ratings agencies like Moody’s and Standard & Poor’s helped trigger the meltdown. A new trove of embarrassing documents shows how they did it. Everybody else got plenty of blame: the greed-fattened banks, the sleeping regulators, the unscrupulous mortgage hucksters. But what about the ratings agencies? Thanks to a mountain of evidence gathered for a pair of major lawsuits by the San Diego-based law firm Robbins Geller Rudman & Dowd, … we now know that the nation’s two top ratings companies, Moody’s and S&P, have for many years been shameless tools for the banks, willing to give just about anything a high rating in exchange for cash. In incriminating e-mail after incriminating e-mail, executives and analysts from these companies are caught admitting their entire business model is crooked. Ratings agencies are the glue that ostensibly holds the entire financial industry together. Their primary function is to help define what’s safe to buy, and what isn’t. But the financial crisis happened because AAA ratings stopped being something that had to be earned and turned into something that could be paid for.

The Financial Crisis Inquiry Commission published a case study in 2011 of Moody’s in particular and discovered that between 2000 and 2007, the agency gave nearly 45,000 mortgage-backed securities AAA ratings. One year Moody’s doled out AAA ratings to 30 mortgage-backed securities every day, 83 percent of which were ultimately downgraded. “This crisis could not have happened without the rating agencies,” the commission concluded.

Note: This is another great, well researched article by Rolling Stone‘s Matt Taibbi. Why isn’t the major media coming up with anything near the quality of this man’s work? For deeply revealing reports from reliable major media sources on financial corruption, click here.

Cypriot Bailout Sends Shivers Throughout the Euro Zone2013-03-18, New York Timeshttp://www.nytimes.com/2013/03/18/business/global/facing-bailout-tax-cypriots…

Europe’s decision to force depositors in Cypriot banks to share in the cost of the latest euro zone bailout has sparked outrage in Cyprus and fears that a run on deposits over the weekend might spread to larger countries at risk like Spain and Italy. Under an emergency deal reached early Saturday in Brussels, a one-time tax of 9.9 percent is to be levied on Cypriot bank deposits of more than 100,000 euros, or $130,000, effective [March 19]. That will hit wealthy depositors — mostly Russians who have put vast sums into Cyprus’s banks in recent years. But smaller deposits will also be taxed, at 6.75 percent, meaning that the banks will be confiscating money directly from retirees and ordinary workers to help pay the tab for the 10 billion euro bailout or $13 billion. Most of the 10 billion euros will go to bail out Cypriot banks, which took a blow when their substantial holdings of Greek government bonds were written down as part of that country’s second bailout.

The island’s banks are also laden with loans made to Greek companies and individuals, which have turned sour as Greece endures its fourth year of economic and financial crisis. The “deposit tax”, which is expected to raise 5.8 billion euros, was part of a bailout agreement … among finance ministers from euro countries and representatives of the International Monetary Fund and the European Central Bank. The Cypriot bailout follows those for Greece, Portugal, Ireland and the Spanish banking sector — and is the first where bank depositors will be touched.

Note: What gives anyone the right to seize the deposits of ordinary bank account holders? Is this the first step towards establishing a precedent for governments to seize anything they want from ordinary citizens? For a report indicating that the Cypriot people may not take this attack lying down, click here.

HSBC, too big to jail, is the new poster child for US two-tiered justice system2012-12-12, The Guardian (One of the UK’s leading newspapers)http://www.guardian.co.uk/commentisfree/2012/dec/12/hsbc-prosecution-fine-mon…

The US is the world’s largest prison state, imprisoning more of its citizens than any nation on earth, both in absolute numbers and proportionally. It imprisons people for longer periods of time, more mercilessly, and for more trivial transgressions than any nation in the west. This sprawling penal state has been constructed over decades, by both political parties, and it punishes the poor and racial minorities at overwhelmingly disproportionate rates. But not everyone is subjected to that system of penal harshness. It all changes radically when the nation’s most powerful actors are caught breaking the law. With few exceptions, they are gifted not merely with leniency, but full-scale immunity from criminal punishment.

Thus have the most egregious crimes of the last decade been fully shielded from prosecution when committed by those with the greatest political and economic power: the construction of a worldwide torture regime, spying on Americans’ communications without the warrants required by criminal law by government agencies and the telecom industry, an aggressive war launched on false pretenses, and massive, systemic financial fraud in the banking and credit industry that triggered the 2008 financial crisis. This two-tiered justice system was the subject of [the] book, With Liberty and Justice for Some. On Tuesday, not only did the US Justice Department announce that HSBC would not be criminally prosecuted, but outright claimed that the reason is that they are too important, too instrumental to subject them to such disruptions.

Note: For deeply revealing reports from reliable major media sources on government corruption, click here.

Goldman Sachs’ Global Coup D’etat2012-11-27, Truthout

http://truth-out.org/opinion/item/12996-goldman-sachs-global-coup-de-tat.html

When the people of Greece saw their democratically elected Prime Minister George Papandreou forced out of office in November of 2011 and replaced by an unelected Conservative technocrat, Lucas Papademos, most were unaware of the bigger picture of what was happening. Most of us in the United States were [equally] ignorant when, in 2008, [Congress] voted “yes” at the behest of Bush’s Treasury Secretary Henry Paulsen and jammed through the biggest bailout of Wall Street in our nation’s history. But now, as the Bank of England … announces that former investment banker Mark Carney will be its new chief, we can’t afford to ignore what’s happening around the world. Steadily – and stealthily – Goldman Sachs is carrying out a global coup d’etat. There’s one tie that binds Lucas Papademos in Greece, Henry Paulsen [and Timothy Geithner] in the United States, and Mark Carney in the U.K., and that’s Goldman Sachs. All were former bankers and executives at the Wall Street giant, all assumed prominent positions of power, and all played a hand after the global financial meltdown of 2007-08, thus making sure Goldman Sachs weathered the storm and made significant profits in the process.

As Europe descends [into] economic crisis, Goldman Sachs’s people are managing the demise of the continent. As the British newspaper The Independent reported earlier this year, the Conservative technocrats currently steering or who have steered post-crash fiscal policy in Greece, Germany, Italy, Belgium, France, and now the UK, all hail from Goldman Sachs. In fact, the head of the European Central Bank itself, Mario Draghi, was the former managing director of Goldman Sachs International.

Note: Once again truth-out.org carries this important article and vital information which no major media has covered. Strangely, the entire website went down for a while not long after the article was published. If the article cannot be found at the link above, click here. For deeply revealing reports from reliable major media sources on financial corruption, click here.

Libor: They all knew – and no one acted2012-07-14, The Independent (One of the UK’s leading newspapers)

http://www.independent.co.uk/news/business/news/libor-they-all-knew–and-no-o…

Regulators on both sides of the Atlantic failed to act on clear warnings that the Libor interest rate was being falsely reported by banks during the financial crisis, it emerged last night. A cache of documents released yesterday by the New York Federal Reserve showed that US officials had evidence from April 2008 that Barclays was knowingly posting false reports about the rate at which it could borrow in order to assuage market concerns about its solvency. An unnamed Barclays employee told a New York Fed analyst, Fabiola Ravazzolo, on 11 April 2008: “So we know that we’re not posting, um, an honest Libor.” He said Barclays started under-reporting Libor because graphs showing the relatively high rates at which the bank had to borrow attracted “unwanted attention” and the “share price went down”. The verbatim note of the call released by the Fed represents the starkest evidence yet that Libor-fiddling was discussed in high regulatory circles years before Barclays’ recent Ł290m fine.

The New York Fed said that, immediately after the call, Ms Ravazzolo informed her superiors of the information, who then passed on her concerns to Tim Geithner, who was head of the New York Fed at the time. Mr Geithner investigated and drew up a six-point proposal for ensuring the integrity of Libor which he presented to the British Bankers Association, which is responsible for producing the Libor rate daily. Mr Geithner, who is now US Treasury Secretary, also forwarded the six-point plan to the Governor of the Bank of England, Sir Mervyn King.

Note: For deeply revealing reports from reliable major media sources on regulatory and financial corruption and criminality, click here. For our highly revealing Banking Corruption Information Center, click here.

Was the petrol price rigged too?2012-07-12, The Telegraph (One of the UK’s leading newspapers)

http://www.telegraph.co.uk/earth/energy/fuel/9401934/Libor-scandal-Was-the-pe…

Motorists may have been paying too much for their petrol because banks and other traders are likely to have tried to manipulate oil prices in the same way they rigged interest rates, an official report has warned. Concerns are growing about the reliability of oil prices, after a report for the G20 found the market is wide open to “manipulation or distortion”. Traders from banks, oil companies or hedge funds have an “incentive” to distort the market and are likely to try to report false prices, it said. Petrol retailers use oil price “benchmarks” to decide how much to pay for future supplies. The rate is calculated by data companies based on submissions from firms which trade oil on a daily basis – such as banks, hedge funds and energy companies. However, like Libor … the market is unregulated and relies on the honesty of the firms to submit accurate data about all their trades.

This is one of the major concerns raised in the G20 report, published last month by the International Organisation of Securities Commissions (IOSCO). In the study for global finance ministers, including George Osborne, the regulator warns that traders have opportunities to influence oil prices for their own profit. It points out that the whole market is “voluntary”, meaning banks and energy companies can choose which trades to make public. IOSCO says this “creates opportunity for a trader to submit a partial picture in order to influence the [price] to the trader’s advantage”.

Note: For deeply revealing reports from reliable major media sources on regulatory and financial corruption and criminality, click here.

Why I Am Leaving Goldman Sachs2012-03-14, New York Timeshttp://www.nytimes.com/2012/03/14/opinion/why-i-am-leaving-goldman-sachs.html

Today is my last day at Goldman Sachs. Over the course of my career I have had the privilege of advising two of the largest hedge funds on the planet [and] five of the largest asset managers in the United States. My clients have a total asset base of more than a trillion dollars. After almost 12 years at the firm … I believe I have worked here long enough to understand … its culture, its people and its identity. And I can honestly say that the environment now is as toxic and destructive as I have ever seen it.

To put the problem in the simplest terms, the interests of the client continue to be sidelined in the way the firm operates and thinks about making money. Today, if you make enough money for the firm (and are not currently an ax murderer) you will be promoted into a position of influence. What are three quick ways to become a leader? a) Execute on the firm’s “axes,” which is Goldman-speak for persuading your clients to invest in the stocks or other products that we are trying to get rid of because they are not seen as having a lot of potential profit. b) “Hunt Elephants.” In English: get your clients — some of whom are sophisticated, and some of whom aren’t — to trade whatever will bring the biggest profit to Goldman. c) Find yourself sitting in a seat where your job is to trade any illiquid, opaque product with a three-letter acronym. I attend derivatives sales meetings where not one single minute is spent asking questions about how we can help clients. It’s purely about how we can make the most possible money off of them.

Note: The author of this article, Greg Smith, was a Goldman Sachs executive director and head of the firm’s United States equity derivatives business in Europe, the Middle East and Africa. For an excellent compilation of news articles and government documents showing the huge risk of the derivatives bubble being manipulate by Goldman Sachs and others, click here.

The medieval, unaccountable Corporation of London is ripe for protest2011-10-31, The Guardian (One of the UK’s leading newspapers)

http://www.guardian.co.uk/commentisfree/2011/oct/31/corporation-london-city-m…

It’s the dark heart of Britain, the place where democracy goes to die, immensely powerful, equally unaccountable. But I doubt that one in 10 British people has any idea of what the Corporation of the City of London is and how it works. As Nicholas Shaxson explains in his fascinating book Treasure Islands, the Corporation exists outside many of the laws and democratic controls which govern the rest of the United Kingdom. The City of London is the only part of Britain over which parliament has no authority. This is … an official old boys’ network. In one respect at least the Corporation acts as the superior body: it imposes on the House of Commons a figure called the remembrancer: an official lobbyist who sits behind the Speaker’s chair and ensures that, whatever our elected representatives might think, the City’s rights and privileges are protected.

The mayor of London’s mandate stops at the boundaries of the Square Mile. The City has exploited this remarkable position to establish itself as a kind of offshore state, a secrecy jurisdiction which controls the network of tax havens housed in the UK’s crown dependencies and overseas territories. This autonomous state within our borders is in a position to launder the ill-gotten cash of oligarchs, kleptocrats, gangsters and drug barons. It has also made the effective regulation of global finance almost impossible.

Note: To understand how democracy is easily circumvented, read this full article. For lots more from reliable sources on the hidden background to the control over governments held by financial powers, click here.

Citigroup to Pay $285 Million to Settle Fraud Charges2011-10-20, Wall Street Journalhttp://online.wsj.com/article/SB10001424052970204618704576640873051858568.html

Wall Street’s total price tag on settlements with U.S. securities regulators for allegedly misleading investors about mortgage bonds churned out ahead of the financial crisis surged past $1 billion with a deal by Citigroup Inc. to pay $285 million … to end civil-fraud charges by the Securities and Exchange Commission. The SEC claimed Citigroup sold slices of the $1 billion mortgage-bond deal without disclosing to investors that the bank was shorting $500 million of the deal, or betting its assets would lose value. Several Wall Street firms have settled similar claims by the SEC, which has generally stuck to the strategy used by the agency to get a $550 million settlement last year with Goldman Sachs Group Inc.. And the SEC’s investigation of the Wall Street mortgage machine isn’t over yet.

Lorin Reisner, deputy enforcement director at the SEC, said civil mortgage-related cases against Goldman, J.P. Morgan Chase & Co., Countrywide Financial Corp., New Century Financial Corp. and other companies “read like an index to unlawful conduct in connection with the financial crisis.” The SEC has collected a total of $1.03 billion through mortgage-bond-deal settlements. In addition to Citigroup, the total includes Goldman, J.P. Morgan, Royal Bank of Canada, Wells Fargo & Co. and Credit Suisse Group AG.

Note: For lots more from major media sources on the illegal profiteering of major financial corporations, click here.

Wall Street Aristocracy Got $1.2 Trillion in Secret Loans2011-08-22, Businessweek/Bloomberg News

http://www.businessweek.com/news/2011-08-22/wall-street-aristocracy-got-1-2-t…

Citigroup Inc. and Bank of America Corp. were the reigning champions of finance in 2006 as home prices peaked, leading the 10 biggest U.S. banks and brokerage firms to their best year ever with $104 billion of profits. By 2008, the housing market’s collapse forced those companies to take more than six times as much, $669 billion, in emergency loans from the U.S. Federal Reserve. The loans dwarfed the $160 billion in public bailouts the top 10 got from the U.S. Treasury, yet until now the full amounts have remained secret.

Fed Chairman Ben S. Bernanke’s [actions] included lending banks and other companies as much as $1.2 trillion of public money, about the same amount U.S. homeowners currently owe on 6.5 million delinquent and foreclosed mortgages. The largest borrower, Morgan Stanley, got as much as $107.3 billion, while Citigroup took $99.5 billion and Bank of America $91.4 billion, according to a Bloomberg News compilation of data obtained through Freedom of Information Act requests, months of litigation and an act of Congress. It wasn’t just American finance. Almost half of the Fed’s top 30 borrowers, measured by peak balances, were European firms. Data gleaned [under the Freedom of Information Act] make clear for the first time how deeply the world’s largest banks depended on the U.S. central bank to stave off cash shortfalls. Even as the firms asserted in news releases or earnings calls that they had ample cash, they drew Fed funding in secret.

Note: For a treasure trove of information from reliable sources on the government transfer of public assets to private banks and financial corporations, click here.

The Fed Audit2011-07-21, Official Government Website of U.S. Senator Bernie Sandershttp://sanders.senate.gov/newsroom/news/?id=9e2a4ea8-6e73-4be2-a753-62060dcbb3c3

The first top-to-bottom audit of the Federal Reserve uncovered eye-popping new details about how the U.S. provided a whopping $16 trillion in secret loans to bail out American and foreign banks and businesses during the worst economic crisis since the Great Depression. Among the [Government Accountability Office] investigation’s key findings is that the Fed unilaterally provided trillions of dollars in financial assistance to foreign banks and corporations from South Korea to Scotland, according to the GAO report. The [report] also determined that the Fed lacks a comprehensive system to deal with conflicts of interest, despite the serious potential for abuse.

In fact, according to the report, the Fed provided conflict of interest waivers to employees and private contractors so they could keep investments in the same financial institutions and corporations that were given emergency loans. For example, the CEO of JP Morgan Chase served on the New York Fed’s board of directors at the same time that his bank received more than $390 billion in financial assistance from the Fed. The investigation also revealed that the Fed outsourced most of its emergency lending programs to private contractors, many of which also were recipients of extremely low-interest and then-secret loans.

Note: We don’t normally use the website of a member of the U.S. Senate as a source, but as amazingly none of the media covered this vitally important story other than one blog on Forbes, we are publishing this here. The GAO report to back up these claims is available for all to see at this link. For how the media is so controlled, don’t miss the powerful two-page summary with reports by many award-winning journalists at this link. For another good article on the Fed’s manipulations, click here.

Top lobbying banks got biggest bailouts: study2011-05-26, MSNBC/Reuters Newshttp://money.msn.com/business-news/article.aspx?feed=OBR&date=20110526&id=136…

The more aggressively a bank lobbied before the financial crisis, the worse its loans performed during the economic downturn — and the more bailout dollars it received, according to a study published by the National Bureau of Economic Research this week. The report, titled “A Fistful of Dollars: Lobbying and the Financial Crisis,” said that banks’ lobbying efforts may be motivated by short-term profit gains, which can have devastating effects on the economy. “Overall, our findings suggest that the political influence of the financial industry played a role in the accumulation of risks, and hence, contributed to the financial crisis,” said the report, written by three economists from the International Monetary Fund. Data collected by the three authors — Deniz Igan, Prachi Mishra and Thierry Tressel — show that the most aggressive lobbiers in the financial industry from 2000 to 2007 also made the most toxic mortgage loans. They securitized a greater portion of debt to pass the home loans onto investors and their stock prices correlated more closely to the downturn and ensuing bailout. The banks’ loans also suffered from higher delinquencies during the downturn.

Note: If the above link fails, click here. For lots more from reliable sources on corruption in the government bailouts of the biggest banks, click here.

Speedy New Traders Make Waves Far From Wall Street 2010-05-17, New York Times http://dealbook.blogs.nytimes.com/2010/05/17/speedy-new-traders-make-waves-fa…

Inside the humdrum offices of a tiny trading firm called Tradeworx, workers … tend high-speed computers that typically buy and sell 80 million shares a day. But on the afternoon of May 6, as the stock market began to plunge in the “flash crash,” someone here walked up to one of those computers and typed the command HF STOP: sell everything and shutdown. Across the country, several of Tradeworx’s counterparts did the same. In a blink, some of the most powerful players in the stock market — high-frequency traders — went dark. The result sent chills through the financial world. After the brief 1,000-point plunge in the stock market that day, the growing role of high-frequency traders in the nation’s financial markets is drawing new scrutiny. Over the last decade, these high-tech operators have become sort of a shadow Wall Street — from New Jersey to Kansas City, from Texas to Chicago.

Depending on whose estimates you believe, high-frequency traders account for 40 to 70 percent of all trading on every stock market in the country. Some of the biggest players trade more than a billion shares a day. These are short-term bets. Very short. The founder of Tradebot, in Kansas City, Mo., told students in 2008 that his firm typically held stocks for 11 seconds. Tradebot, one of the biggest high-frequency traders around, had not had a losing day in four years, he said.

Note: For key reports on the dubious practices which underlay the financial crisis and the impoverishment of the public treasury, click here.

For some observers it came as no surprise in 2019 when the US economy suffered a collapse that was much, much worse than what had happened after 9/11; even worse than the Great Financial Crisis (GFC) that began in 2007/8. This is an attempt to pre-empt the conclusions of the President’s Commission on why the collapse could not be foreseen by the fraternity of economists. It is anticipated their conclusion, similar to that of the Commission that met after the GFC, will be that by available statistics, it appeared that the economy was inherently healthy. Then, much out of the blue, a few trends in the economy that initially seemed to be of little consequence combined with global changes and foreign developments to precipitate this new Great Collapse (GC) of 2019, doing so with little or no advance warning.

It must be stated up front that the Commission is unlikely to go back far enough into history to gain full perspective on the causes of the GC. It seems likely that they will look only at the shock of the GFC just more than 10 years ago and its after effects as reasons for the slide into the current economic abyss. And, of course, placing most of the blame for the collapse on the situation in Europe, actions by foreign countries and global factors. As before, this will be the cover for selective blindness by mainstream economists and short sightedness and outright expediency on the part of politicians and their experts who formulate government policy. Government incompetence and intransigence are recurrent over many centuries, as described in Tuchman’s excellent book, “The March of Folly”, to which the history of the GC could be a new chapter.

While this review begins earlier than the GFC, it is restricted in its scope; there is no discussion of the social, demographic and political reasons why the financial system and the economy were allowed – some may prefer to use the term ‘assisted’ – over a number of decades to drift in the direction that eventually made the GC inevitable. Undoubtedly, someone willing to tackle that task will require a keen and inquisitive mind, well able to delve behind the political and other smokescreens obscuring the mismanagement and misgovernment of primarily the post-Kennedy era.

There are many such complex reasons, going back at least to the 1970s, even earlier, that contributed to the climate that firstly made the GFC possible and inevitable and then, subsequently, set the stage for the Great Collapse of 2019. This review of causes of the GC deals predominantly with only one of them, a policy innovation that dates to the first Clinton administration, when much effort went into engineering a strong economy designed to ensure the re–election of Clinton in 1996.

One element in that re-election strategy is without doubt the single most important factor in creating the situation where a major economic collapse became hard wired into the future – with Clinton’s repeal of the Glass Steagall Act having provided the final push towards the 2007/8 financial crisis and then still contributed to the GC.

This preliminary review covers the initial effects of this factor through to the 2013–2014 period, by which time an economic collapse had already become inevitable. A more detailed review to follow will consider the complex developments of the past 6 years, when geopolitical factors intruded more and more to complicate the domestic situation and in effect combined with a worsening internal situation to make the GC that much more severe.

The hedonic CPI

Herb Stein was an economist in the Administration of pres. Reagan. He stated that if something could not continue indefinitely, it will stop. It has since become known as Stein’s law. Some people might think this fact is so self–evident that it is an affront to common sense to call it a Law. However, the evidence from real life shows that most of the brightest minds in the US just did not believe in this Law at all. For a long time they did not believe the housing market bull could become a bear; even longer it was believed credit could continue to fund household wealth indefinitely; they preferred Keynes and Krugman rather than Stein, holding the belief that governments can run up deficits without end. In a sense, it was these firmly held beliefs that were the main drivers for the Collapse of 2019.

Hedonics is the economic principle that if the price of an item – product or service – increases, but the quality of the item in the hands of the buyer is estimated to have improved to the same degree, then the price has suffered no inflation. It is inflation neutral. If, on the other hand, the improved quality is deemed of greater value to the user than the increase in price, then the adjusted price is disinflationary and the item for the purpose of the CPI becomes cheaper than it used to be, sometimes even if in actual price. Despite early evidence that the consequences of an hedonic official CPI had been impoverishing worker households, this fact apparently had failed to shake a widely held belief in the ‘morality’ of the practice. A low official CPI was desirable as that meant interest rates could be lowered to assist economic growth; the real GDP also received an artificial boost that counted in favour of the Administration.

Excessive household credit is one cause of the road to ruin for the economy, but the progressive erosion of purchasing power with the introduction of the hedonic CPI made it increasingly more difficult for households to cope with their debt. A search through available old internet archives for specific early warnings of future troubles in the economy rather than merely general opinion, showed that prior to 2004 there were very few explicit warnings that a combination of too much household debt and reduced household purchasing power was a growing risk.

One of the earliest is an 1999 article on market bubbles that contained a warning on trends in household credit. A long term analysis based on the YoY increases in total US consumer debt relative to increases in total disposable income showed the ratio even then was becoming hyperbolic. In the opinion of the author the trend was not sustainable and if not curbed, would result in a major problem for the US economy. Stein’s Law was not mentioned, but it was clear the trend towards such unbridled use of credit relative to income had to stop at some point in time.

A later series by the same author compared Japan after the collapse of 1990 with the USA in 2006. While explaining the circumstances for the Japanese slump after 1990, it also was a surprisingly good preview of the GFC that had started two years after the series was published – and thereby puts a lie to the conclusion of the Congressional Commission that later found the GFC could not have been anticipated.

While in 2019 debt was again a major contributing factor, as it was in 2007, the root cause of the recent Collapse lies in changes to the CPI that became the vogue during the 1990s. The main, but definitely not only culprits, were hedonically tuned prices of consumer goods and services and, also, an acceptance of the principle of substitution as one justification for this practice.

We leave the subject of substitution out of this discussion, except to mention that it is also subject to Stein’s Law; when its effects are projected well into the future, even for only a few decades, substitution becomes unsustainable. One proponent of hedonics apparently declared that it is acceptable that when people can no longer afford steak they should buy hamburger, known as ‘minced meat’ in other parts of the world. In other words, it was known that the hedonic CPI was bound to have a negative effect on household standard of living. It is not known whether the person who made that comment at any time indicated what kind of protein people could buy when they no longer could afford hamburger – scaling down through all alternatives to fresh meat until only pet food remains affordable. With some elderly people on Social Security already doing so, tainted pet food imported from China sparked a subdued panic.

An excellent example of hedonics comes from the computer industry. Using purely imaginary numbers from the early years of computerisation, assume a departmental secretary used a desktop computer that had cost $2500, had 1 Mb of RAM, disk space of 10 Mb and the CPU executed at the rate of 50 MHz. Then, after having used it for a year or two, it was replaced by another desktop that had 10 Mb of RAM, a hard disk of 250 Mb and the CPU executed at a rate of 250 MHz. On applying these factors to its retail price of $1300, the hedonic price of this far more capable computer was only $389 – of course with the desired deflationary effect on the new CPI.

The fact that the calculation of the perceived benefit of this advanced computer to the secretary disregarded the fact that it had little measurable effect on her typing speed nor how long she worked on a document was not really considered – at least until the very rapid advances in technology made these kinds of adjustments so ludicrous that some changes were forced. This hedonic principle also applied to other sectors of consumer goods so that consumer inflation was kept low despite the near consistent increase in the nominal prices of nearly everything, including energy and food.

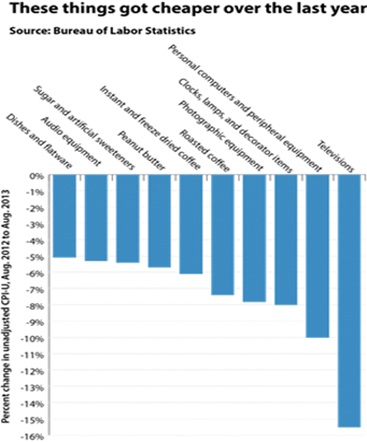

The table below, sourced from an internet archive which credits the Bureau of Labor Statistics, is representative of that era. It lists the negative contribution to the CPI-U of various consumer goods sectors for the period 2012 to 2013. It is not clear whether these were the only sectors making such a disinflationary contribution to the overall inflation number, as expressed in the official CPI at that time.

However, do keep in mind these are annual figures that could be representative of the whole period since the mid-1990s. If so, compounding even approximate rates for various sectors of consumer goods for most of the years since the introduction of CPI hedonics, implies a major difference between the official CPI index and cumulative increases in the actual prices of consumer essentials by 2013 – 2014, which is selected as the base line for this review. Observe the effect of technological improvements on durable consumer goods, which was probably typical of the full period since the mid-1990s, as well as the contribution made by food and other household essentials.

Table 1: Disinflation in product sectors 2012–2013

It is clear that over the period under discussion, from the major implementation of hedonics in the mid-1990s to about 2014, the following must have held true:

- A majority, if not all sectors of consumer goods and perhaps services sectors too, underwent consumer friendly improvements over time that hedonically must have had the effect of reducing the contribution of any price increases to the CPI. Given the high rate of annual hedonic for some sectors, it is possible adjustments for some technology products brought the new adjusted price to below the previously recorded price; if so, the new adjusted price would have been deflationary in actual fact, despite a higher tag price

- Over time and as competitive pressures and improved technology consistently brought about improvements to products and services, the difference between the hedonic CPI and increases in the actual cost of living, as reflected in prices consumers did pay for goods and services, widened substantially

The net effect of these stratagems to keep the CPI low in order to justify low interest rates – which was politically desirable to boost the economy, first during the Clinton administration following the recession of the early 1990s, then again after the shock of 9/11 and even more so after the 2007/8 GFC – is shown in charts produced at that time by John Williams at a website, http://www.shadowstats.com , now long defunct.

Williams calculated a CPI using the methodology employed before 1980, thus before the first tentative changes to the CPI methodology to result in a lower value for the inflation gauge. Later, during the Clinton era, more fancy footwork within the CPI calculation became routine. The initial purpose of the CPI before 1980, to serve as a Cost of Living index, meant that Williams’ SGS CPI corresponded better than the CPI to changes in the true cost of living for US households during the period from 1994 to 2013, and after, when hedonics as illustrated in Table 1 had become the norm.

The disastrous effect of this disparity on households and the economy follows from the well-known but apparently disregarded fact that employers had always used the CoL index as a guide to salary and wage increases. Doing the same with the new CPI that by a wide margin understated the increase in the true cost of living, meant that in time working households had become impoverished to an increasing degree.

Discussion

In many cases parents either refuse or are actually unable to see any flaws or signs of misbehaviour in their children. When they do, they often find excuses in extraneous factors or genetics to absolve themselves of any feelings of guilt. Experts in academic and other intellectual endeavours have similar problems; they are effectively blind to flaws in their pet theories and accomplishments; more so if they themselves played a notable role in formulating a new theory or other significant achievement.

Practitioners of two disciplines, economics and engineering, suffer from the risk that when a pet theory or new concept is put into practice, time might show up the flaws in their ideas in a truly disastrous fashion. Engineers have a saving grace in that their mistakes as a rule are of limited extent when viewed on a national scale.

Economists, on the other hand, when they happen to be successful in promoting their theories to the extent where these receive widespread political support, may find that they have contributed to disasters on a national scale, with severe effects on perhaps all of the population. When that happens, it must be extremely difficult to perform a mea culpa and admit that they were wrong before the disaster had run its full course – hoping perhaps the time of miracles has not passed, or that some other development that can carry the blame for the coming crisis might arise ! It seems in fact economists can be more steadfast and persistent than parents in loyalty to their theories against any and all criticism of their intellectual progeny, disregarding any and all hard facts to the contrary in order to maintain their bias.

Like communism, the concept of hedonic adjustments for perceived improvements in consumer quality sounds beautiful in principle. However, as recent events now have shown, its eventual impact on the economy and on the lives of people does not differ much from what many people in the USSR and in China had experienced after some decades of their new political order.

Proponents of hedonics might be blinded with respect to its consequences. However, the outside observer only has to consider 3 charts, widely available well before 2013, and do so from the perspective of Stein’s Law, to recognise disastrous flaws arising from the hedonic policy and how these became a direct cause of the Great Collapse.

Against a claim that realisation of the extent to which the charts signal the coming of a great collapse can be attributed to hindsight, the first defence is the series of articles from 2006 previously mentioned, in which the negative consequences of the hedonic CPI were already mentioned. Given that the author was not a recognised economist, by 2013 the evidence of the unintended consequences of the official CPI, as evidenced in the charts to follow, surely had to have been clear to any diligent observer. By 2014 the problem of income inequality had become headline material; surely, any serious exploration of possible reasons for this development should have easily recognised the role of the hedonic CPI. However, it still amazes that many economists of stature seemingly remained oblivious of what was happening until far too late.

All three the charts originate from the John Williams’ http://www.shadowstats.com website, but these examples were sourced off archives of the public domain during the period under discussion. At the time, they were therefore generally available for anyone who cared to consider the long term effects of these trends. It needs but little knowledge of how an economy functions to have been able to anticipate the extreme dysfunction that would result if the trends in these charts were to have continued.

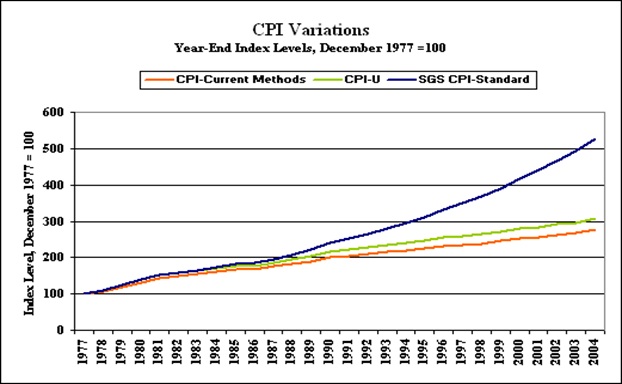

Chart 1: Three versions of the CPI index – 1977–2004

The first chart demonstrates that as early as 2004 implicit evidence was available of important trends that, given adequate consideration and analysis, clearly had to be unsustainable. Competent economists surely must have known that wage increases tended to follow the official CPI, and they should have realised the trends shown in the above chart were a recipe for disaster.

The green curve is the official CPI. The red curve is a recalculation of the official CPI by Stewart and Reed, done as if all the adjustments in use by 2004 had been in effect from 1977, which would have made their inflation curve lower than the official CPI. The blue curve is the SGS CPI as calculated by Williams, employing the methodology of before 1980, i.e. without the effects of hedonic adjustments and other stratagems that had the effect of resulting in a lower figure for the CPI. Originally, the CPI had served as a Cost of Living index (CoL) and the SGS CPI therefore is an approximate rendition of the change in the cost of living of households between 1980 and 2004.

By as early as 2004, the SGS CPI index was already about 65% higher than the official CPI index. It is a well-known fact that wage and salary increases generally keep pace with the official measure of the rate of inflation. Prior to 1980, this practice meant that the income of households adjusted over time so as to sustain their standard of living . The widening gap between the official CPI, as an approximate measure of increases in wages and salaries, and the SGS as a measure of the increase in the cost of living, means that households were losing purchasing power, becoming impoverished and thus increasingly unable to maintain a constant standard of living.

By hindsight, by 2004 the warning bells should already have been ringing loudly for anyone with an open and questioning mind and willing to listen. Obviously this did not include the majority of economists and their political allies in Congress. Yet, by then it really was already too late to rescue the economy; in terms of the above chart, even as early as 2004, a solution that could rectify the damage that had been done to household finances must have ++become politically and economically impossible.

While the worsening situation of households must have been evident to an objective student of economics, those people who were committed to the new CPI could point to growth in the economy as evidence that all was well with the economy. A positive trend was of course assisted by using a much lower CPI to discount nominal growth, but also by the fact that households were compensating for reduced real income. The number of single income households dropped sharply as increasingly both partners had to seek employment. Alternatively, the working partner had to take on a second job, else they could not make ends meet.

Thus, throughout the period under discussion there was no easily apparent reason to question the CPI methodology in the academic world or in the media. In fact it was the opposite that happened; academia embraced hedonic principles as a new gospel of inflation. Among politicians, president Clinton appreciated that the low inflation made a low interest rate possible during the run-up to his re-election. Later, during concerns for the date change in 2000 and subsequently, after 9/11 and the aftermath of the GFC that erupted in 2007, it was not politic at all to question anything that may disturb the low interest regime, even if the household dilemma had been recognised.

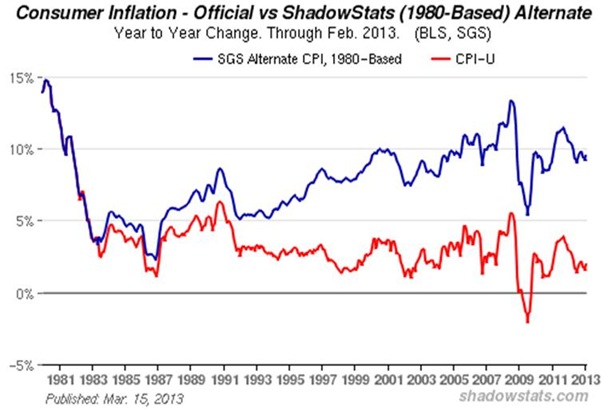

In the years after 2004 and through the period of the GFC, the hedonic calculation of the CPI remained essentially unchanged. Chart 2, below, shows the official CPI as a red curve and the SGS version in blue, from 1980 to 2013. The constant high degree of divergence between the two CPI curves since the late 1990s leaves no doubt that the difference between the actual cost of living and the picture of inflation presented by official CPI, already evident by 2004 as shown in Chart 1, had remained very wide for most of the next decade.

Chart 2: Consumer inflation – Official vs ShadowStats

Initially, the adjustment to the CPI had relatively little effect. However, after 1991 the curves started to diverge more and then the gap widened even more during the first Clinton administration. By the late 1990s the difference had reached approximately 6-8% p.a., which then remained quite constant until the end of the chart in 1913.

Assuming, as was implied earlier, that employers during this period continued to grant wage and salary increases that were generally in line with and probably a little higher than the official rate of inflation, there can be no doubt that as income lagged the cost of living by quite a margin, employees were losing purchasing power.

Historically, the CPI in its role as cost of living index was of vital importance during the high inflation of the 1970s, as a guide to what level of wage increases would keep employees able to maintain their standard of living. Given that since 1998 inflation officially only rarely exceeded 3%, general wage and salary increases of 2% above the official CPI may have seemed generous. On this assumption, the average difference between wage increases and the increase in the cost of living during this period of 15 years would have amounted to about 4–6% p.a. Such a rate, compounded for more than 15 years, means that by about 2013 the average employee had lost perhaps half of his purchasing power.

The decline in purchasing power since 1980, from Chart 1 already evident by 2004, accelerated after the mid-1990s. Initially, households could adjust to this trend when the income of the primary wage earner was augmented by the partner also seeking employment, either part time or full time. However, the accelerated erosion of their purchasing power as compounding took effect, soon had many people working at two jobs, generally with one of the jobs being part time, or the household had to seek for relief by applying to the SNAP food stamp program.

It is therefore no wonder that participants in this program increased from 6 million in 2000 to almost 50 million by 2014 out of the population of just more than 300 million. This increase should be viewed as an indictment of government policies and surely must also have waved red flags for economists and politicians alike. If the red flags were in fact noticed, there is no evidence from that time that the real reason for such a major dislocation in the economy, one that compelled one out of seven Americans to seek food assistance, was correctly identified. Over time, instead, the problem was addressed by the introduction of even more subsidies and grants to keep households financially afloat – another trend that was later found to be unsustainable.

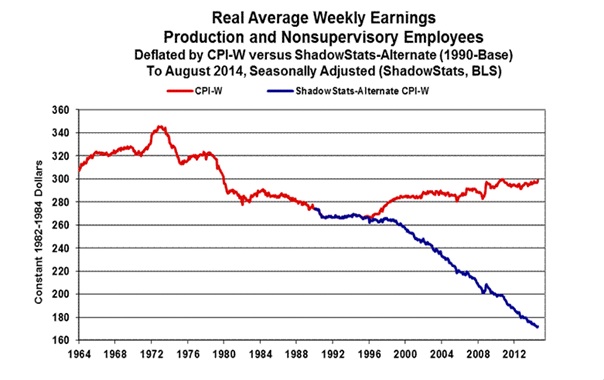

While not every household devolved into a state where food stamps and other forms of government subsidies or charities became necessary for survival, there can be no doubt that working households suffered severe budgetary pressures. Chart 3 shows the direct effect on the purchasing power of working America in terms of real wages earned by production and non–supervisory workers.

Chart 3: Real average weekly earnings – discounted by official and SGS CPI

Chart 3 shows the real average weekly earnings of production and non–supervisory employees from 1964 to 2014, discounted by using the official CPI and the SGS CPI, the latter serving as an equivalent of changes in a Cost of Living index. It is clear that by 2014 the purchasing power of average working households had declined almost 50% relative to what it had been prior to 1980. It can be safely assumed that this also applied to supervisors and at least lower level management, even if perhaps not to the same degree.

The chart also shows that real wages peaked in 1973 and then declined. This means that even during the period of high inflation in the later 1970s increases in wages had failed to keep pace with the increase in the cost of living. What later developed after 1994 was therefore not new. However, the deliberate change in CPI policy was much more severe in its effect on working households, as can be seen from the divergence between the red and blue lines in Chart 3 after 1966.

Closing comments

The evidence presented in the three charts makes it clear that by 2013 and perhaps as early as 2004, well before the GFC, the situation had deteriorated to where a collapse had become near certain. By 2013 the impoverishment of most consumer households made a collapse inevitable. The counter measures needed for a timely prevention of a collapse would have had to be a combination of a substantial increase in real wages and salaries for working households and some form of price controls to reduce prices of essential goods, or at the very least to keep them constant – both of these measures would have been essentially impossible on political and economic grounds.

By 2013 it would not have been possible to return to a more correct calculation of the CPI – the increase in interest rates in response to much higher true inflation by itself would have killed the economy to precipitate a recession, or depression. Hindsight teaches that if the collapse could have happened earlier – better still, if there had been no rescue of the financial system after the GFC had started in 2007 – the turmoil and misery that would then have followed would have been vastly less than what we had to experience last year and the terrible aftermath, which is still raging.

The complexities of what happened after 2013, when global factors cross pollinated with a struggling economy, until the final Great Collapse happened in 2019, will be reviewed and discussed in a second report. During these last 6 years it was attempts by the government to treat the domestic consequences of a manipulated CPI by any means available, while trying to protect US hegemony and interests internationally, that sucked the financial health out of the country and depleted the ability of the US to cope with a worsening global situation, right up to the point of final collapse.

The reaction of officialdom seemed to have followed in the footsteps of governments of the past after they had committed to a foolish policy. As so eloquently described by Tuchman in her book, “The March of Folly”, at the hand of historical examples, it seems the typical reaction of rulers and governments is that they do nothing more to avoid the consequences of their mistake than use blinkers to avoid seeing what lies ahead – and when they do try something new it just worsens the existing situation.

Approaching and into 2018, a disgruntled and often desperate populace engaged in often widespread disorder and turmoil, with frequent incidents of civil disobedience and inner city rioting, adding to the problems faced by government. The measures that were taken to retain the semblance of control on occasion tended to the extreme and are continuing as the state tries to cope with the aftermath. No doubt there will be discontent and hardship for most people for perhaps a number of decades.

A discussion of what happened during 2019 and the ongoing situation will have to wait until everything has become more settled, nationally and globally. By then the colloquium of top economists, brought together by the president this past month to review why they gave no timely warning of an imminent Great Collapse, may have made known their conclusions. It is near certain however that – as had previously happened after the 2007/8 Great Financial Crisis – the Commission will conclude it was not possible to foresee the collapse until after it was happening.

0 0 0

Postscript

The reader of this piece of fiction, in effect looking at the past from a position where the Collapse already had become fact, needs to consider three questions:

- Are the trends described here an adequate representation of key features of the situation as it was by 2013-2014?

- Are these trends, should they be maintained for the near to medium term, as indications seem to be, of sufficient magnitude in their total effect – including the impoverishment of US worker households, the need for the government to increase household subsidies in various forms, subsidised job creation, a long term effect on the budget deficit, etc. – to induce a major economic collapse?

- Is there a rational explanation why these trends as a reason for concern seem to receive such little attention? Inequality of income has become a buzzword, but it is as if it is a fact without cause that has to be addressed in some manner in order to alleviate the problem, but not to identify and rectify its cause. That is, other than blaming it all on the 1% and thus as an insoluble problem?

Can it be that the concept of a hedonic CPI sounds so moral and with such strong logic – like Communism and Democracy and Capitalism – that it blinds adherents to any negative effects until it is far too late? That is the one explanation that does make sense to me.

********

Background

My interest in market behaviour began in the early 1980s when I developed a course in technical analysis in support of technical software I had developed. For what I had termed ‘Market Psychology’ I developed a model that described how the players in a market reacted to changes in the price as it went through a complete bull-bear cycle.

The model was widely tested and proved quite accurate at anticipating major trend reversals after significant bear or bull trends. Other aspects of technical analysis had assumed more priority and this model was not pursued to any degree.

Over time, as I became interested in aspects of the economy, initially the process of bubble markets – this was after all during the raging 1990s – was fascinating. But it seemed there were trends in the US economy in particular that carried the seeds of recession or worse unless the trends changed. The articles referred to in the above tale, namely the developing hyperbolic trend between increases in household debt and income as well as the comparative study of Japan (1990) and the US (2006) are expressions of this interest.

Usury is, by modern definition, the illegal practice of lending money at unreasonably high rates of interest. Usury is usually carried out with the intention of the lender, or usurer, gaining an unfair profit from the loan. A modern slang term for a usurer is loan shark. Somewhat complicating the matter is the fact that, before the creation of usury laws, usury could refer to interest in general. Now, usury refers to exorbitantly (and illegally) high interest rates. The King James Version uses the word usury in its now obsolete sense. For example, in Exodus 22:25, the basic rule regarding interest is “If thou lend money to any of my people that is poor by thee, thou shalt not be to him as an usurer, neither shalt thou lay upon him usury” (KJV). However, in the English Standard Version, the same verse reads, “If you lend money to any of my people with you who is poor, you shall not be like a moneylender to him, and you shall not exact interest from him.”

In the Old Testament, the Israelites were forbidden from charging “usury,” or interest, on loans to fellow Jews (Deuteronomy 23:19), but they were allowed to charge interest on loans to foreigners (Deuteronomy 23:20). The earlier iterations of this law in Exodus 22:25 and Leviticus 25:36–36 make it clear that it deals with loans made to fellow Israelites who were experiencing poverty. Having to pay back the loan with “usury,” or interest, would only put them further into debt and was not beneficial to the economy. Loans to foreigners, however, were considered more of a business deal—such loans were seen as international commerce and therefore allowed. This law served as a reminder to the Jews that helping those in need is something that should be done without expecting anything in return.

Many of the loans we are familiar with in modern times come from banks, and the Bible doesn’t say much about this. While the Bible does not prohibit the charging of interest, it does warn against becoming too concerned with money, telling us that we cannot serve both God and money at the same time (Matthew 6:24). We are reminded that the desire to be rich leads to destruction and that the love of money is the root of all sorts of evil (1 Timothy 6:9–10).

In addition, God’s wisdom includes a warning not to take advantage of the plight of the poor. “Sharks” who gouge the needy in the time of their distress will not enjoy their spoils for long: “He that by usury and unjust gain increaseth his substance, he shall gather it for him that will pity the poor” (Proverbs 28:8, KJV), or, in another translation, “Whoever increases wealth by taking interest or profit from the poor / amasses it for another, who will be kind to the poor” (NIV).

StevieRay Hansen

Editor HNewsWire

MY MISSION IS NOT TO CONVINCE YOU, ONLY TO INFORM…

It is impossible to find anyone in the Bible who was a power for God who did not have enemies and was not hated.

Preach the gospel with BOLDNESS AND STRENGTH! It’s better to follow God and be judged by the world, than to follow the world and be judged by God!

Jack H. Kirkland

Jesus come quick, there is nothing left in society that’s sacred….

The World Is In Big Trouble, for Those That Believe We Will Go Back to Some Sense of Normal Life Here on Earth, You Will Be Sadly Disappointed, Seven Years of Hell on Earth Which Began January 1, 2020

“Our courts oppose the righteous, and justice is nowhere to be found. Truth stumbles in the streets, and honesty has been outlawed” (Isa. 59:14, NLT)…We Turned Our Backs On GOD, Now We Have Been Left To Our Own Devices, Enjoy…

While Mainstream Media Continues to Push a False Narrative, Big Tech Has Keep the Truth From Coming out by Shadow Banning Conservatives, Christians, and Like-Minded People, Those Death Attributed to the Coronavirus Is a Result of Those Mentioned, They Truly Are Evil…

![]()

1 COMMENTS