Bulls will breathe a sigh of relief that on the 33-year-anniversary of Black Monday (when the Dow dropped 22.6% on this day in 1987) futures are sharply higher, at least for now.

Emini futures rebounded from Friday’s drop, undoing most of the late Friday swoon, climbing alongside shares in Europe and most of Asia, on the back of what the media called “renewed optimism” about the progress of fiscal stimulus talks when what really happened is that on Sunday, Nancy Pelosi set a Tuesday ultimatum for more progress with the White House after lengthy discussions at the weekend with Treasury Secretary Steven Mnuchin. In other words, not only was there no progress, but after tomorrow, there may no longer be any “optimism” either until after the election. None of that mattered to algos, which pushed the S&P 0.8% higher, while TSY yields rose, and oil and the dollar declined.

Boeing shares rose 1% in premarket trading as American Airlines Group announced plans to return its 737 Max jets to service by the end of this year depending on certification of the aircraft from the Federal Aviation Administration. American Airlines shares gained 0.9%. Halliburton Co posted its fourth consecutive quarterly loss as this year’s slump in oil prices due to the COVID-19 pandemic hit demand for its services. Its shares, which have lost about half of their value this year, were up 1.2%. American Equity Investment Life Holding Co dropped 2.8% as it said it had entered into a strategic partnership with Brookfield Asset Management and rejected an unsolicited acquisition proposal from Athene Holding and Massachusetts Mutual Life Insurance Co.

Today’s S&P bounce comes after slight gains last week — the third in a row for the S&P 500 and the Dow — as news that a COVID-19 vaccine could be available by November helped offset worries about the elusive federal aid bill. And speaking of that, Pelosi said on Sunday that differences remained with President Donald Trump’s administration on a wide-ranging coronavirus aid package, but she was optimistic legislation could be pushed through before Election Day. Also on the political front, Trump and Biden will hold their final debate on Thursday with about two weeks left until the Nov. 3 presidential election.

“It seems that the market is optimistic that indeed stimulus will follow, whether that is tax cuts under a Trump presidency or spending under a Biden presidency,” Ben Emons, Medley Global Advisors managing director, said on Bloomberg TV.

“A stimulus package is certainly required at the moment with U.S. infections topping 50,000 for a fifth straight day while millions of Americans need aid with rising economic stress,” said Hussein Sayed, chief markets strategist at FXTM.

On the covid front, the U.S. had a fifth consecutive day of infections over 50,000. In Europe, Italy’s cases swelled to a daily record as the government prepares new containment measures.

In Europe, banks and insurers led gains while health care and energy firms lagged. Julius Baer posted one of the biggest jumps after third-quarter inflows accelerated at the Swiss wealth manager, while real estate and financial services shares led gains among sectors while automakers fell the most. The Stoxx Europe 600 was up modestly in early afternoon trading, fading much of its morning gains, after losses of 0.8% last week. Trading in stocks and derivatives on Euronext NV markets, including Paris and Amsterdam, was halted because of a technical issue.

Earlier in Asia, markets advanced toward a recent 2-1/2-year peak on Monday though gains were held back by weaker-than-expected Chinese economic data. The MSCI index of Asia-Pacific shares outside Japan climbed 0.5% for its second straight day of gains, paring back slightly following third-quarter gross domestic product (GDP) data from China. The index has risen in eight of the last 10 sessions amid a rally in risk assets buoyed by hopes of a coronavirus vaccine and expectations of a so-called “blue wave”, which would see the Democrats claim victory in November’s elections.

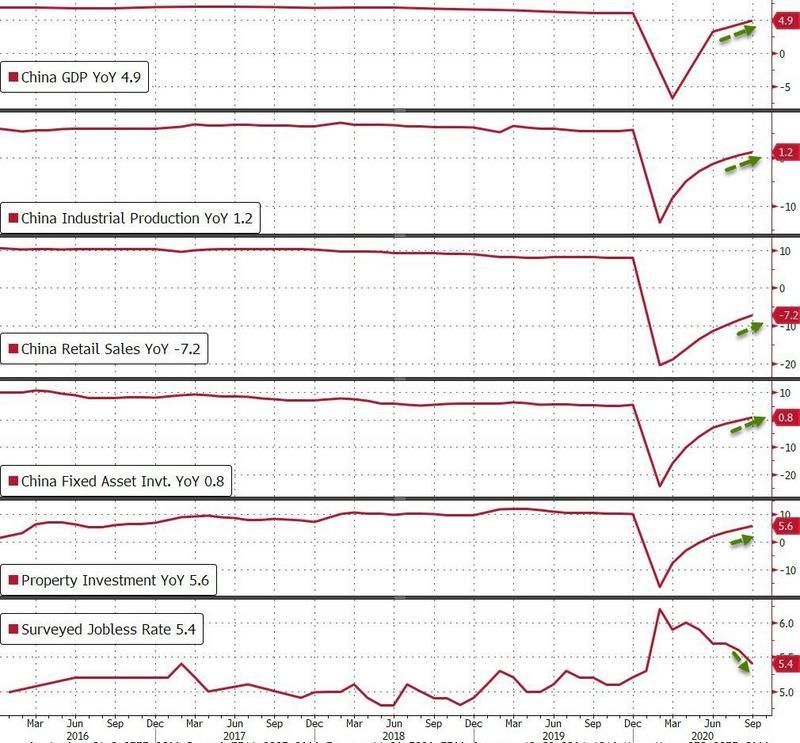

Chinese shares started higher but slipped into negative territory in afternoon trading after China’s third-quarter GDP data rose 4.9%, missing expectations for a 5.2% growth.

In a positive sign, however, separate monthly indicators pointed to an expansion in economic activity. Industrial output accelerated 6.9% in September from a year earlier, when analysts were looking for a 5.8% gain from a 5.6% rise in August. Retail sales edged up 3.3% last month from a year earlier against expectations for 1.8% growth.

“The rebound in Q3 GDP was less strong than expected, but was still a decent 4.9% year on year. September data beat expectations, suggesting a pick-up in momentum towards the latter part of Q3,” said Frances Cheung, head of macro strategy for Asia at Westpac in Singapore.

In FX, the Bloomberg dollar index slumped for a second day as the Norwegian krone led an advance across G10 peers, the pound gained as much as 0.8% to $1.3014 as British officials signalled they were ready to water down controversial lawbreaking Brexit legislation, a move which could reopen talks with the European Union over future trading relationships; the euro rose 0.4% against the dollar to 1.1768. The kiwi also got a lift from a historic win for Prime Minister Jacinda Ardern in New Zealand’s general election although it faded much of the bounce after China’s GDP miss. “The on-and-off chat about U.S. stimulus is the apparent driver today” for the Aussie and kiwi dollar, said CIBC strategist Patrick Bennett.

In rates, Treasury futures were near session lows following declines during Asia session and European morning after U.S. Yields were cheaper by 0.5bp to 4bp across a steeper curve with 2s10s spread wider by ~2.5bp, 5s30s by ~2bp; 10-year higher by 3.2bp at 0.777% with bunds and gilts outperforming by 1.5bp-2bp. In short-term rates, 3M USD Libor dropped -0.97bp at record low 0.20863%. The latest CFTC positioning data showed speculators starting to unwind record bond futures short.

In commodities, oil slipped to around $41 a barrel in New York before an OPEC+ meeting to assess the state of the market as demand comes under pressure from the threat of new virus restrictions. Gold was higher, with spot trading at $1912 and silver just shy of $25.

Looking at the key events this week, focus will be on Brexit trade talks which are likely to continue at least into next week if the U.K. and EU fail to reach an agreement. WE have the final presidential debate on Thursday, while IBM reports earnings later today.

Market Snapshot

- S&P 500 futures up 0.9% to 3,492.00

- STOXX Europe 600 up 0.5% to 369.39

- MXAP up 0.7% to 175.91

- MXAPJ up 0.5% to 583.49

- Nikkei up 1.1% to 23,671.13

- Topix up 1.3% to 1,637.98

- Hang Seng Index up 0.6% to 24,542.26

- Shanghai Composite down 0.7% to 3,312.67

- Sensex up 1.1% to 40,422.88

- Australia S&P/ASX 200 up 0.9% to 6,229.38

- Kospi up 0.2% to 2,346.74

- Brent futures down 0.4% to $42.77/bbl

- Gold spot up 0.6% to $1,910.54

- U.S. Dollar Index down 0.2% to 93.54

- German 10Y yield unchanged at -0.621%

- Euro up 0.1% to $1.1734

- Italian 10Y yield fell 4.6 bps to 0.449%

- Spanish 10Y yield rose 1.2 bps to 0.136%

Top Overnight News from Bloomberg

- China growth data were mixed. 3Q GDP y/y printed at 4.9%, short of est. for 5.5%, while September retail sales jumped +3.3% y/y well above est. +1.6%

- Italy is preparing new virus measures in an escalating effort to check the surge in cases. This may include a 10 p.m. closing time for restaurants and changing school times to avoid congestion. This follows stepped-up measures in London and Paris

- Speaker of the House Nancy Pelosi set a Tuesday deadline for more progress with the White House on a fiscal stimulus package

- British officials are prepared to water down controversial, law-breaking Brexit legislation in an attempt to rescue talks with the European Union after they stalled last week

- On Friday, Moody’s Investors Service lowered the U.K.’s sovereign rating by one notch to Aa3 from Aa2, with a stable outlook

Asia-Pac equities traded mostly higher after a mixed Wall Street session on Friday as participants juggled the chances of a pre-election US stimulus bill, rising cases, and increasing US-Sino tensions ahead of the US election in just over a fortnight. APAC risk appetite was underpinned for a large part of the session by US stimulus hopes as House Speaker Pelosi, over the weekend, suggested she is optimistic on a deal and gave the Trump administration 48 hours to reach an accord to pass stimulus before election day, whilst US President Trump said he wants a bigger stimulus deal than Speaker Pelosi is opting for; ES, NQ and YM held onto their advances since the open. ASX 200 (+0.9%) was firmer after Melbourne city relaxed some COVID-related restrictions, with gains in the index led by strength in some cyclical names with IT outperforming, whilst its heavy-weight financial sector is also held up. However, Crown Resorts shares plumbed the depths after AUSTRAC opened a probe into the Co., which led to shares falling almost 10%. Nikkei 225 (+1.1%) conformed to the risk appetite despite less encouraging Japanese September trade data and a relatively caged USD/JPY. KOSPI (+0.2%) pulled back from best levels but remained in the green after finding support at 2,350. Elsewhere, Hang Seng (+0.6%) was propelled higher at the open with upside driven by the banking and gambling names, whilst Sun Art Retail (one of China’s largest hypermarket retailers) shares rose some 20% after Alibaba upped its stake in the group. Shanghai Comp. (-0.7%) was initially firmer amid another PBoC liquidity injection and saw little immediate reaction seen on the Chinese Q3 GDP misses as September economic activity data topped forecasts, albeit Shanghai Comp. erased gains as the session went on with US-China tensions brewing in the background. Finally, 10yr JGB futures track USTs lower amid the constructive risk tone around the market.

Top Asian News

- SoftBank Hits 20-Year High as Investors Embrace Defensive Stance

- Shadow Bank Recovery Stalls in India as Loan Fears Resurface

- Abu Dhabi’s ADQ Pumps $1 Billion Into Lulu’s Egypt Expansion

European equities (Eurostoxx 50 +0.7%) have kicked the week off on the front-foot in an extension of last Friday’s gains. In terms of the “drivers” of the move, not a great deal has changed from a fundamental standpoint in Europe, with price action in futures seemingly exacerbated by the opening of cash trade. Looking further afield, on the stimulus front, House Speaker Pelosi set a 48-hour deadline for a deal as of Sunday, stating that negotiators must meet to be able to strike a deal on the coronavirus stimulus package ahead of the election. Markets still assume that no deal will be agreed until after the election and therefore it may require more meaningful progress beyond the ambitions of various players involved with the talks before that assumption gets revaluated. Performance across Europe is relatively broad-based with the FTSE (U/C) the main outlier to the downside amid headwinds from a firmer GBP and the energy sector lagging. Note, some trade across the region has been hampered by issues on Euronext. From a sectoral standpoint, all sectors trade firmer across the board with outperformance seen in financial names but energy closer to the U/C mark and as such the mornings slight underperformer. Julius Baer (+5.3%) are the outperformer in the sector after noting an improvement in profitability in the 9M period since the beginning of the year, whilst also highlighting a near 4% increase in net new money. Laggards, albeit still firmer on the session, include basic materials and energy with the latter hampered by downside in crude prices ahead of today’s OPEC+ JMMC meeting. Before being halted for trade (amid issues on Euronext), shares in Philips (+2.8%) were firmer post-Q3 earnings which saw the Co. exceed revenue and EBIT expectations whilst maintaining its outlook for the rest of the year. To the downside, Saab (-12.0%) are a notable laggard after Q3 results posted a decline in operating income with the Co. unable to confirm FY 20 guidance.

Top European News

- U.K. Prepared to Rewrite Lawbreaking Brexit Bill to Get EU Deal

- Lagarde Urges EU to Consider Making Recovery Fund Permanent Tool

- Danone Plans Biggest Shakeup in Years With Portfolio Review

- Sanofi Is Said to Weigh Sale of Some Inflammation Assets

In FX, it may be partly technical and Brexit-related amidst reports that the UK Government may water down the IMB in an effort to revive trade talks with the EU, but Sterling has rebounded across the board after weakness in Asia overnight in wake of Moody’s downgrading the nation’s credit rating from Aa2 to Aa3. Contacts noted buying in Cable through 1.2940 following a retreat to 1.2890 that coincided with the 21 DMA and momentum has subsequently picked up pace to probe 1.3000, while Eur/Gbp has reversed from the high 0.9000 area to take out two DMAs, at 0.9061 and 0.9039 (50 and 100 respectively) as the cross eyes 0.9020 on news that chief negotiators Frost and Barnier will speak at 15.00BST.

- NZD/AUD – The Kiwi remains in the ascendency down under on the back of PM Ahern’s resounding election win that is projected to give her Labour Party a 64 seat majority in parliament, while the Aussie has also regained some poise after recent underperformance due to dovish RBA guidance given a relaxation in Melbourne’s COVID-19 restrictions and the PBoC’s firmest CNY midpoint fix since April 2019 (6.7010) ahead of Chinese data (GDP mixed vs consensus, but retail sales and ip both better than expected). Nzd/Usd is sitting comfortably above 0.6600 as Aud/Nzd hovers around 1.0700 and Aud/Usd is capped on advances over 0.7100 in the run up to NZIER Q3 confidence and minutes to the RBA’s October policy meeting.

- EUR/CHF/CAD/JPY – As the Buck wanes and DXY ducks under Friday’s 93.529 low having topped out ahead of the 93.883 high and lost grip of the 21 DMA (93.755), the Euro is consolidating recovery gains on the 1.1700 handle. However, 1.1750 represents half round number resistance and spreads between Bunds and US Treasuries are still widening to keep the headline pair on a downward trajectory. Elsewhere, the Franc is pivoting 0.9150 following contrasting Swiss sight deposit balances, while the Loonie retains 1.3200+ status before Canada’s BOS and the Yen is sitting tight within a 105.34-50 range following Japanese trade data showing a smaller than forecast surplus.

- SCANDI/EM – The Nok has clawed back some lost ground relative to the Sek and Eur after finding support into 11.0000 against the single currency, while the beleaguered Try has also bounced off worst levels with assistance from the aforementioned Usd retracement and perhaps Turkey’s Black Sea find of natural gas.

In commodities, WTI and Brent are subdued this morning, but the magnitude remains minimal, after a modest bid higher around the European cash equity open in-spite of sparse fundamental updates (see Equities wrap above). Most recently, benchmarks dipped off those earlier highs and since then have largely been in proximity to the unchanged mark; albeit, with a slight negative bias – currently lower by USD 0.20/bbl. Focus for the session is on today’s OPEC+ JMMC gathering which is due to commence from 14:30BST/09:30ET. The meeting which will be closely watched for commentary around undercompliance in September, particularly from Russia; alongside the evolving demand & supply situation given COVID-19 and Libya respectively, among other factors. While participants are focused on such updates from the Committee, particularly given increasing calls for an alteration to the current easing schedule from OPEC re. production cuts, it’s worth bearing in mind the JMMC does not have the power to implement new policy only to make recommendations. As such, after today’s gathering focus will turn to the 30th November/1st December full OPEC+ meeting to see what, if any, changes are made. Returning to Libya, the countries Abu Attifel (70k BPD) facility is reportedly expected to commence a restart from October 24th bringing more of the nation’s supply back on-line ahead of the next OPEC+ gathering. However, while the increasing supply will draw the attention of OPEC, at present Libya is still someway off their production figure from late last year of 1.2mln BPD – as of Friday output was around 500k BPD. Moving to metals, spot gold is modestly firmer this morning with action once again driven by USD movements which has featured the DXY dropping throughout the session to fresh lows on multiple occasions. Currently, the precious metal is in proximity to the USD 1910/oz mark with gains just in excess of USD 10/oz.

US Event Calendar

- 10am: NAHB Housing Market Index, est. 83, prior 83

DB’s Jim Reid concludes the overnight wrap

A small microcosm of how much more difficult it is to control the virus in the West than across various parts of Asia came to me over the weekend via an email from my golf club. There is a monumental change to global golf handicaps coming through on November 2nd that will give everyone a globally unified and consistent handicap. However with just two weeks to go, the English Golf Union has just said that to ensure everyone gets their new handicap, and is therefore allowed to play competitive golf of any kind, they require an email address and other details like date of birth etc from all golf club members. However thousands of golfers are apparently up in arms about data privacy issues and don’t want to provide this. If golfers don’t want to give away their email addresses to the people in charge of administering golf in this country it hints at how tough it is to have a highly efficient track and trace system.

One country that has seemingly quashed the virus is China and this morning their 3Q GDP print came in at +4.9% yoy (vs. +5.5% yoy expected) alongside the main September activity data which surprised on the upside. Retail sales for the month came in at +3.3% yoy (vs. +1.6% yoy expected) while industrial production was also strong at +6.9% yoy (vs. +5.8% yoy). The surveyed jobless rate came in one tenth lower than expectations at 5.4%. Although the GDP print was slightly disappointing it’s a remarkable YoY contrast to that we will see from the west in Q3 in spite of a strong quarterly comeback. The other problem is that China is still growing strong in Q4 but the West will likely see a setback as the virus spreads again.

We also saw fresh US fiscal stimulus headlines overnight with the House Speaker Nancy Pelosi saying that she has set a Tuesday end of the day deadline for more progress with the White House on a fiscal stimulus deal before the November 3 election. This came after her lengthy discussions with Treasury Secretary Steven Mnuchin over the weekend and President Trump’s renewed offer to go beyond the current amount on the table. Meanwhile, in a sign of a softening stance at the Senate on a larger stimulus bill, McConnell said that, “If Speaker Pelosi ever lets the House reach a bipartisan agreement with the Administration, the Senate would of course consider it. But Americans need help now.” So a bit of market hope in what has become a bit of a dance in recent weeks.

Chinese markets – the CSI (-0.30%) and Shanghai Comp (-0.33%) – are trading down this morning on the GDP miss but the declines are limited due to the September data beat. Other markets in the region like the Nikkei (+1.23%), Hang Seng (+0.69%) and Kospi (+0.65%) are up however on the back of the more positive fiscal stimulus news coming out of the US. Futures on the S&P 500 are also up +0.67% while yields on 10y USTs are up +1.2bps to 0.758%.

The latest on the virus is that it is continuing to increase its grip on Europe with Italy reporting a record 10,925 on Saturday. Overnight, Italy’s PM has signed a new decree urging mayors to close piazzas and streets at 9 pm to stop crowds gathering, while imposing a limit of six people per table at restaurants which must close at midnight. He also banned amateur and school competitions for contact sports. Meanwhile, Slovenia declared a renewed “state of epidemic,” as it posted record infections on Saturday at an all-time high positivity rate of 19%. France also reported another 29, 837 cases yesterday and PM Jean Castex said that, “The challenge is to face up to it without resorting to a broad lockdown, across the whole country and for a long time.” Here in the UK, Sir Jeremy Farrar, a scientific adviser to the government said that Britain needs an immediate three-week national lockdown as opposed to more limited regional restrictions as “the current tiered restrictions will not bring the transmission rates down sufficiently or prevent the continued spread of the virus”. The country reported 16,994 cases yesterday. Across the other side of Atlantic, the US reported 45,589 cases yesterday after reporting more than 50k cases for five consecutive days in a sign of a fresh wave there. For more, on how the virus is spreading see the table below.

In terms of Brexit, both sides are still talking which is good news but the recent rhetoric indicates that we’ve reached an impasse. After PM Johnson’s downbeat remarks on Friday, the phone call between Barnier and Frost early this week will be crucial as to whether formal talks can continue. So a lot riding on that. I hope the phone connection is good.

Staying with this subject attention will turn to the House of Lords, as they begin debate on the government’s Internal Market Bill. It’s gone a bit quiet on this recently but Bloomberg flagged overnight that the government may look to water it down to help it’s passage and to ease tensions with the EU. The bill has already passed through the House of Commons, but has created controversy since it would seek to override parts of the already-agreed Brexit Withdrawal Agreement between the UK and the EU. Indeed, the European Commission has already sent the UK a letter of formal notice regarding the bill, which is the start of a formal infringement process.

This all follows a Moody’s downgrade of the U.K. on Friday night to Aa3. They cited weaker economic growth, an erosion of fiscal strength and interestingly a weakening in institutions and governance. Although this is a blow, markets aren’t really too fussed about ratings at the moment (Sterling is actually up +0.10% overnight on the above mentioned Bloomberg news) with central banks seemingly underwriting all core sovereign debt. Interestingly EM is a little different on this front as bank have taken down the majority of extra government financing in 2020 not central banks. If you’re looking for future financial crises in the making this could be one to familiarise yourself with. See the CoTD we did on this on Friday here and email [email protected] if you want to get this directly every day in your inbox towards the end of U.K. lunchtime.

It’s a busy week ahead with the final presidential debate of the US election (Thursday), the flash PMIs (Friday), and earnings season moving into full flow with 90 S&P 500 companies reporting. As well as this, there is an array of central bank speakers as usual.

In terms of the final presidential debate on Thursday, the format will feature six 15-minute segments, with the topics expected to be announced in advance. Otherwise, investors will be paying close attention to the Senate polls, since the question of whether we have united or divided government in the US next year will determine the likelihood and composition of different stimulus packages. FiveThirtyEight’s model currently puts the chance of Biden winning the presidency at 87%, though the odds of Democratic control of the Senate are at a lower 74% with a few important tight races evident.

Earnings season moves into full swing this week, with 90 of the S&P 500 companies reporting and 78 in the Stoxx 600. In terms of the highlights, we’ll hear from IBM on today, before tomorrow sees releases from Procter & Gamble, Netflix, Texas Instruments, Philip Morris International, Lockheed Martin and UBS. Then on Wednesday, there’ll be announcements from Verizon Communications, Abbott Laboratories, Thermo Fisher Scientific, NextEra Energy and Tesla. Thursday then sees releases from Intel, Coca Cola, AT&T, Danaher and Union Pacific. Finally on Friday, there’s American Express, Daimler and Barclays.

On the data front this week the October flash PMIs from around the world on Friday will be closely watched as ever especially with economic restrictions mounting again, especially in Europe. There’ll also be some attention on the weekly initial jobless claims from the US after last week’s unexpected increase to a 7-week high. Another deterioration would raise further concerns about the state of the US labour market. The rest of the data, including Central Bank speakers can be found in the day-by-day calendar at the end.

Recapping last week now and markets continued to react to a mix of rising Covid-19 cases, slowing economic data and politics on either side of the Atlantic. The start of earnings season gave market participants yet another narrative to weave into their decision making. Risk sentiment generally waned across asset classes, especially in Europe where many of the largest countries are seeing coronavirus caseloads at the highest levels of the pandemic so far. And while testing is at a much higher level than early on, positivity rates of testing is rising quickly as well. With various governments enacting restrictions in response, the Stoxx 600 ended the week -0.77% lower (+1.26% Friday) with the IBEX (-1.46%), FTSE 100 (-1.61%%), and DAX (-1.09%) all falling back on the week.

On the other hand the US has not seen a material rise in restrictions and saw the S&P 500 rise +0.19% (+0.01% Friday) on the week. It was the index’s third weekly gain, after falling every week in September. Tech outperformed on a week that saw Amazon ‘Prime Day’ and Apple release their latest iteration of the iPhone. The NASDAQ rose +0.79% (-0.36% Friday) and is now ‘only’ -3.19% from its all time highs from early September. Even with the marginal improvement in equity prices, equity volatility picked up as the VIX index rose +2.4pts to 27.4, the largest weekly jump since the first week of September.

With risk sentiment softish, the dollar rose +0.67% on the week, tied for the second largest weekly rise over the last six months. Core sovereign bond yields dropped as investors turned toward less risky assets last week. US 10yr Treasury yields fell -2.8bps (+1.3bps Friday) to finish at 0.746% and 10yr Gilt yields fell -9.8bps (+0.2bps Friday) to 0.18%, while 10yr Bund yields were down -9.5bps (-1.2bps Friday) to -0.62%. Peripheral sovereign debt yields did not fall as far with the spread of Italian (+2.2bps), Spanish (+4.3bps), Portuguese (+2.6bps) and Greek (+8.6bps) 10yr bond yields to bunds widening.

In terms of data released on Friday, September’s retail sales in the US rose +1.9% (vs +0.8% expected). It was the fastest pace in three months and a significant jump from the prior month’s +0.6% rise. Elsewhere industrial production declined unexpectedly, falling -0.6% (vs +0.6% expected) after a +1.2% rise in August. And lastly for the US, the University of Michigan sentiment indicator for October came in at 81.2pts (vs 80.5pts) slightly up from August’s 80.4 but still well below the 90-100 range seen over the three years prior to the pandemic. In the Euro Area, the final CPI reading for September remained at the flash reading level of -0.3%.

Source: ZeroHedge

StevieRay Hansen

Editor, BankstersCrime

God often uses men who are not of the best moral character. Pharaoh, Nebuchadnezzar, Cyrus, Herod, and Trump (amongst others), to accomplish His will in events He orchestrates during human history. We either trust the sovereignty of God or we don’t. Nothing happens apart from Him…

The best index to a person’s character is how he treats people who can’t do him any good, and how he treats people who can’t fight back…

The Birth Pains Are Growing Stronger….

One of the signs of ruling class collapse is when they can no longer enforce the rules that maintain them as a ruling class. When the Romans started making exceptions to republican governance, it was a matter of time before someone simply decided the rules no longer applied to them. Perhaps the robot historians will consider Obama our Marius or Sulla. Maybe that person is in the near future. Either way, the rule of law is over and what comes next is the rule of men.

“Don’t piss down my back and tell me it’s raining.” Outlaw Josey Wales

WE NOW LIVE IN A WORLD THAT IS PURE FABRICATION

The World Is In Big Trouble, for Those That Believe We Will Go Back to Some Sense of Normal Life Here on Earth, You Will Be Sadly Disappointed, Seven Years of Hell on Earth Which Began January 1, 2020

“Our courts oppose the righteous, and justice is nowhere to be found. Truth stumbles in the streets, and honesty has been outlawed” (Isa. 59:14, NLT)…We Turned Our Backs On GOD, Now We Have Been Left To Our Own Devices, Enjoy…

While Mainstream Media Continues to Push a False Narrative, Big Tech Has Keep the Truth From Coming out by Shadow Banning Conservatives, Christians, and Like-Minded People, Those Death Attributed to the Coronavirus Is a Result of Those Mentioned, They Truly Are Evil…

![]()

You completed several nice points there. I did a search on the subject matter and found most folks will agree with your blog. Anna Bastian Jaquith

Please stop by the internet sites we comply with, like this one, as it represents our picks in the web. Philomena Allie Stegman