Over the last several decades, have we ever seen a year start as strangely as 2020 has? Global weather patterns have gone completely nuts, large earthquakes are popping off like firecrackers, it looks like the plague of locusts in Africa could soon develop into the worst in modern history, and a massive plague of bats is severely terrorizing parts of Australia. On top of all that, African Swine Fever is wiping out millions upon millions of pigs around the globe, the H1N1 Swine Flu is killing people in Taiwan, there have been H5N1 Bird Flu outbreaks in China and in India, and the H5N8 Bird Flu has made an appearance at a poultry facility in Saudi Arabia. Of course the coronavirus outbreak which is causing people to literally drop dead in the streets in China is making more headlines than anything that I have mentioned so far, and it could potentially turn into a horrifying global pandemic that kills millions of people.

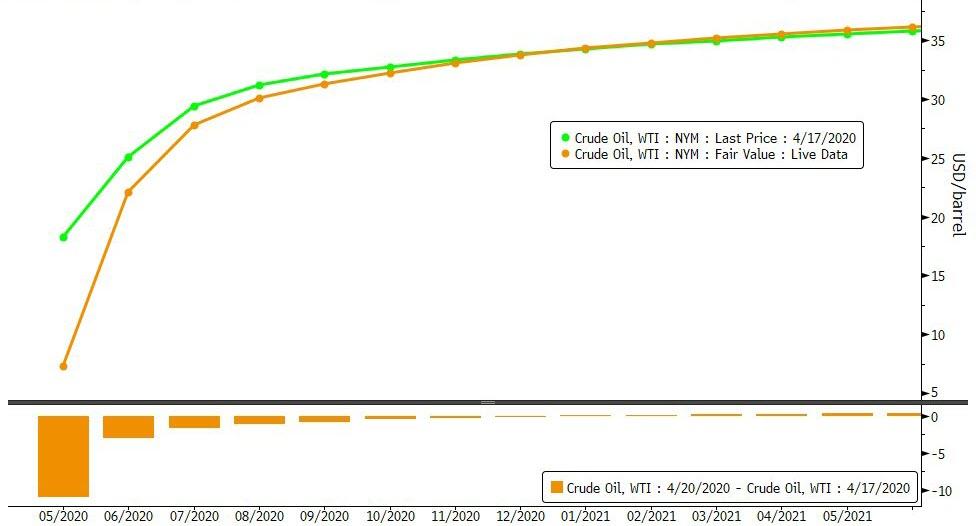

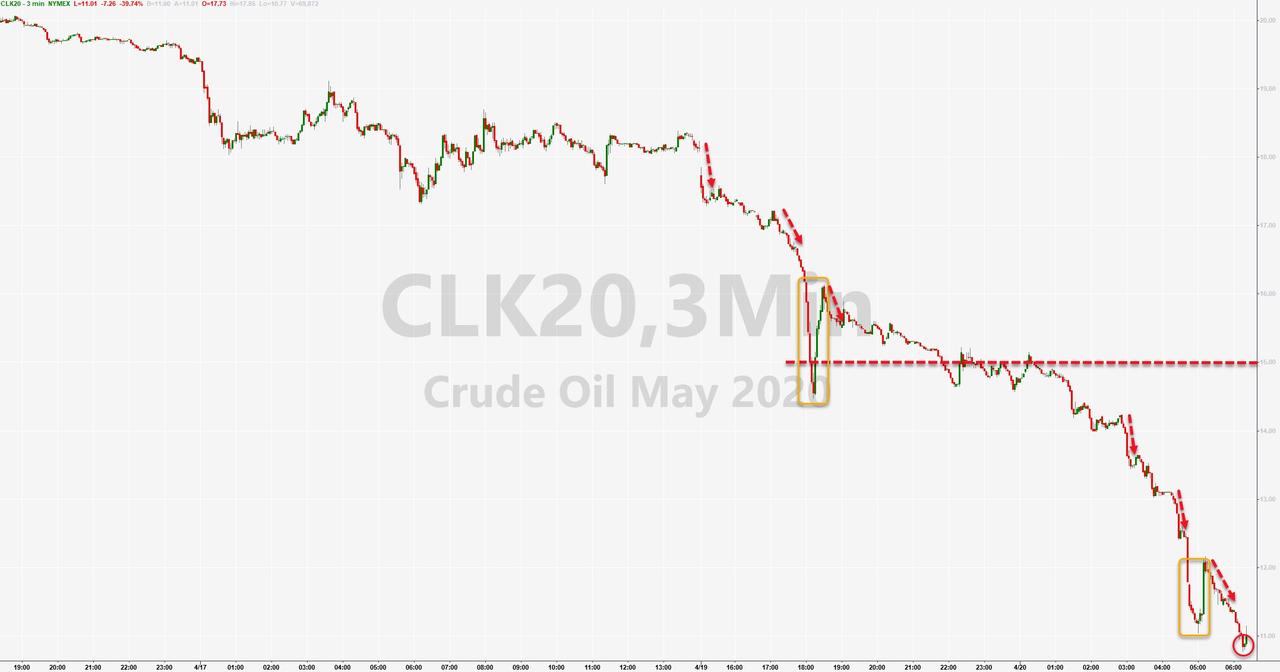

Update (1410ET): And there it is… May WTI just traded below zero for the first time ever (trading -$11.42 per barrel)…

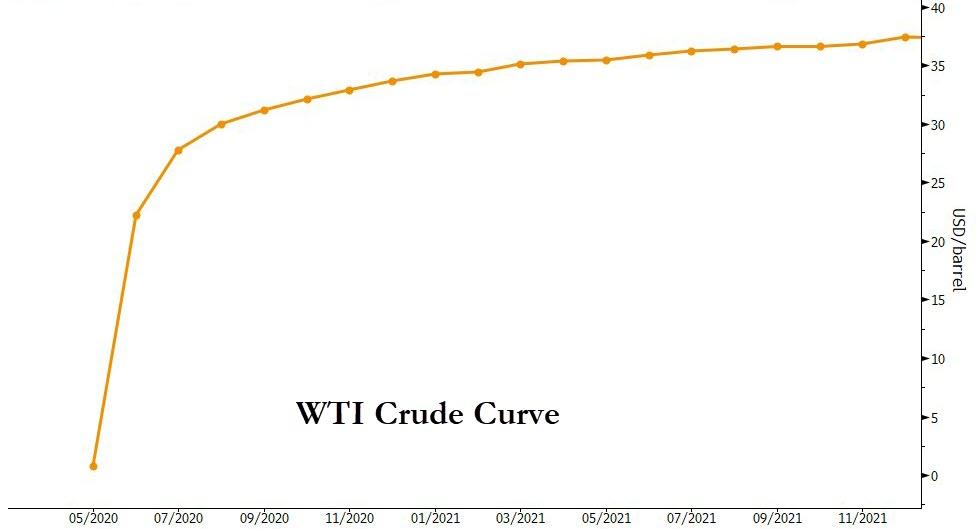

A complete collapse of the curve…

* * *

Update (1355ET): Just stunning – the May WTI contract just traded at 1c…

The May contract – obviously – is down 100%…

The WTI curve is in record contango…

* * *

Update (1350ET): WTF WTI! The May contract just traded below $1…

It was $10 90 minutes ago!

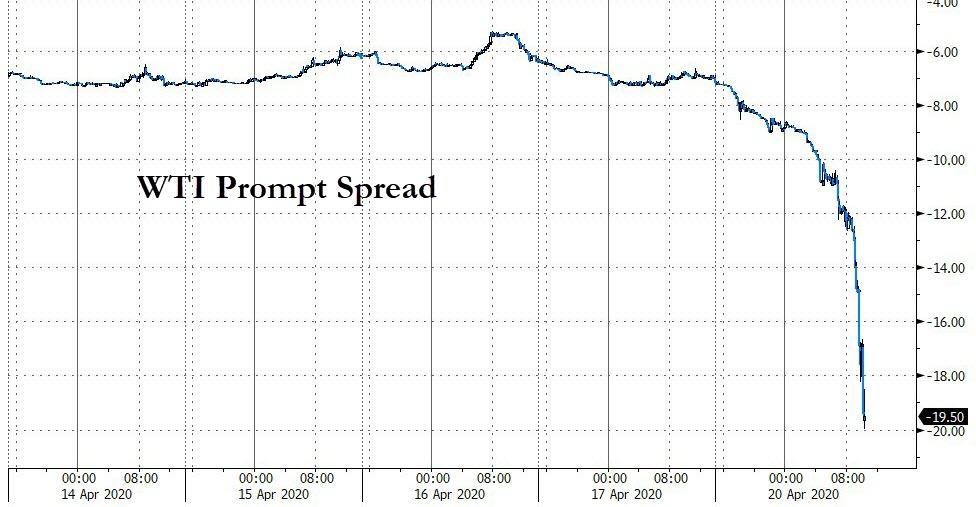

The prompt spread (May-June) is now at a record $20…

And now Alaska, Bakken, and Edmonton are all trading negative

Update (1325ET): And just like that, a $2 handle ($2.24) for May WTI…

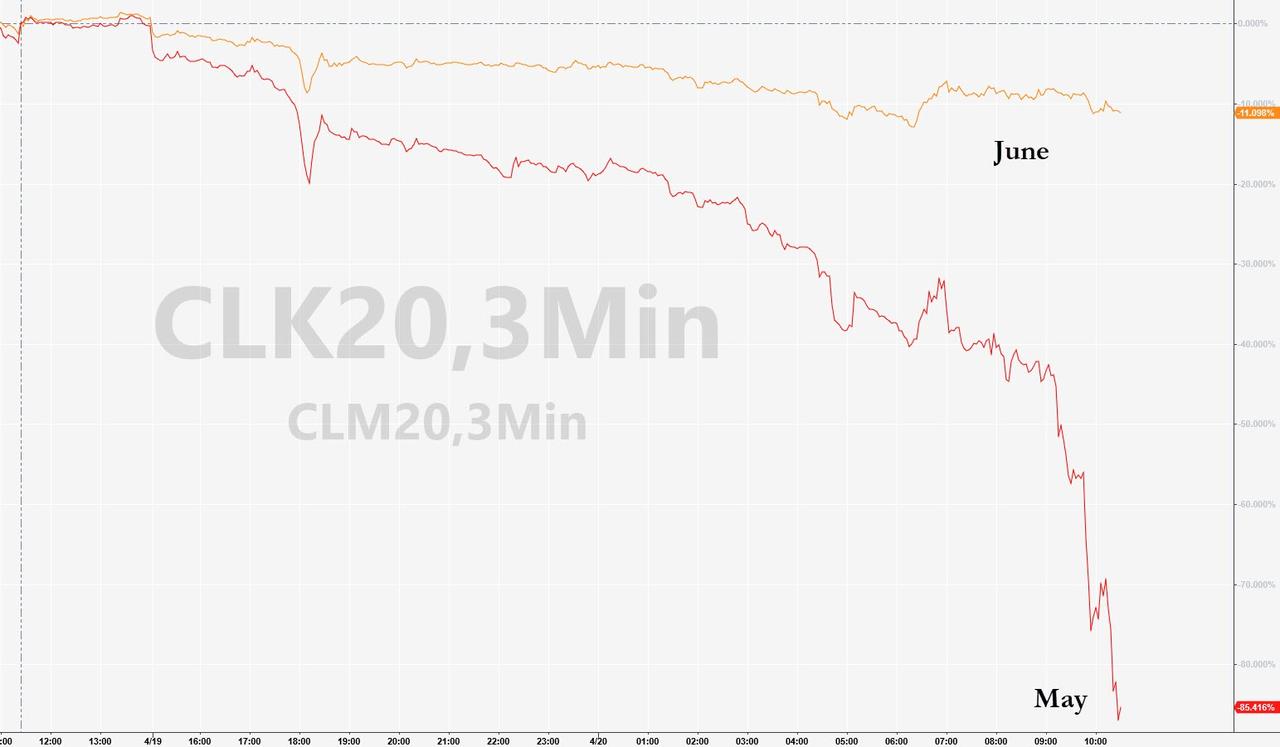

May is down a stunning 86% today while June – also hammered – is down a mere 11%!

* * *

Update (1250ET): The CME just issued a statement that May WTI Futures can trade negative, which sent the May contract reeling to a $4 handle (low $4.04)…

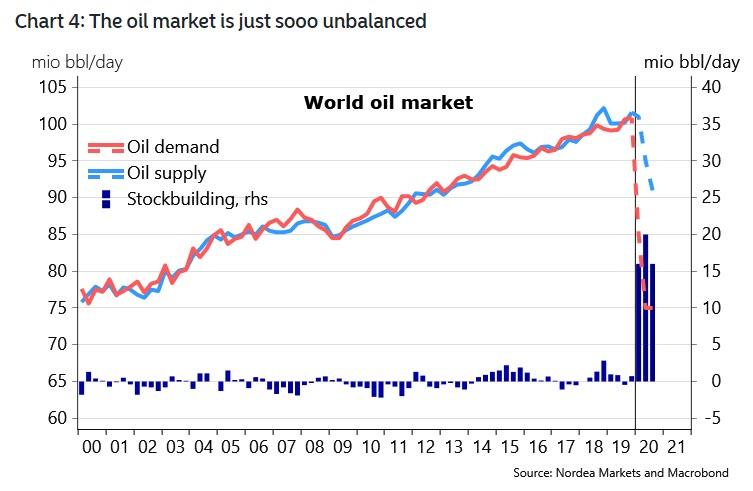

As Nordea notes, oil markets are likely to remain under pressure from huge unbalances in the physical market, like we also highlighted last week.

Saudi Arabia and Russia are whispering about further production cuts, but we have a hard time getting too enthusiastic about the oil price anyways. There is a real risk that the oil storage capacity is filling up, even with the agreed lower pace of production; maybe already within the next six weeks. Therefore, more production cuts could be needed just to prevent the oil price from crashing further. Better data on new corona cases are probably keeping the oil price “alive” for now, but the physical market tend to matter the most in the end.

* * *

Update (1210ET): The May WTI Crude futures contract just crashed to a $7 handle..

* * *

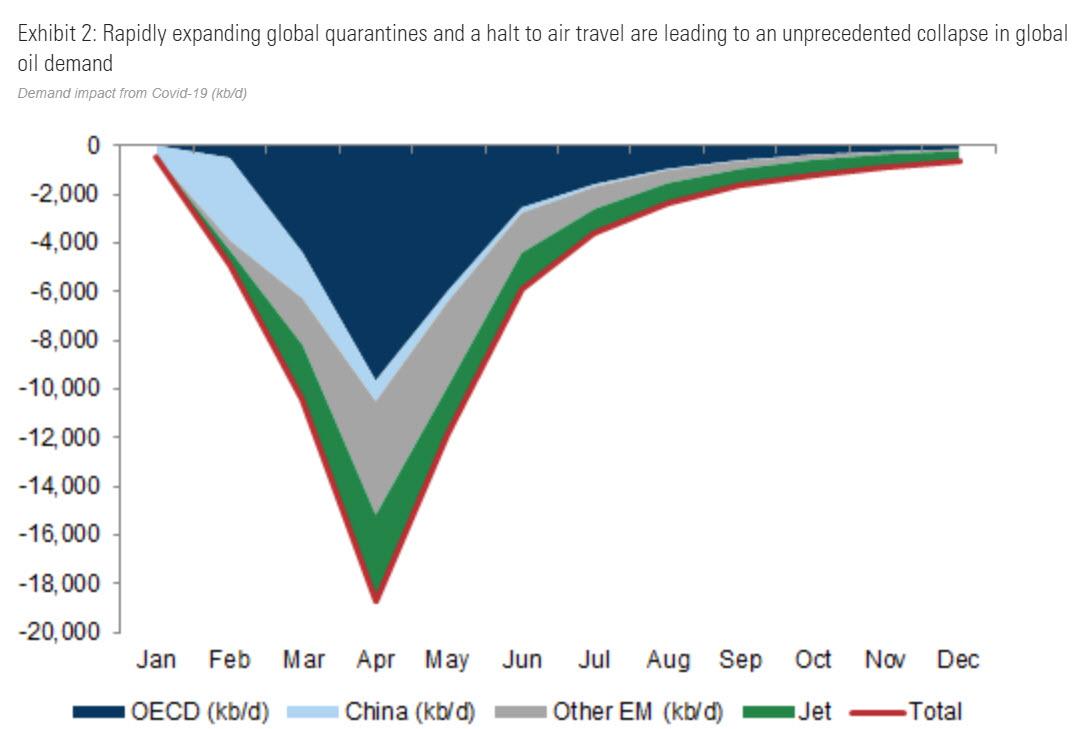

When Goldman’s crude oil analysts turned apocalyptic last month, writing that “This Is The Largest Economic Shock Of Our Lifetimes“, they echoed something we said previously namely that the record surge in excess oil output amounting to a mindblowing 20 million barrels daily or roughly 20% of the daily market…

… the result of the historic crash in oil demand (estimated by Trafigura at 36mmb/d) which is so massive it steamrolled over last week’s OPEC+ 9.7mmb/d production cut, could send the price of landlocked crude oil negative: “this shock is extremely negative for oil prices and is sending landlocked crude prices into negative territory.”

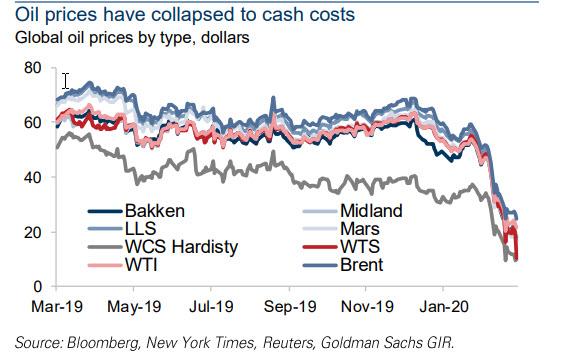

We didn’t have long to wait, because while oil prices for virtually all grades have now collapsed below cash costs…

… today’s historic plunge in WTI – the biggest on record – which sent the price of the front-month future freefalling 40% to just $10/barrel…

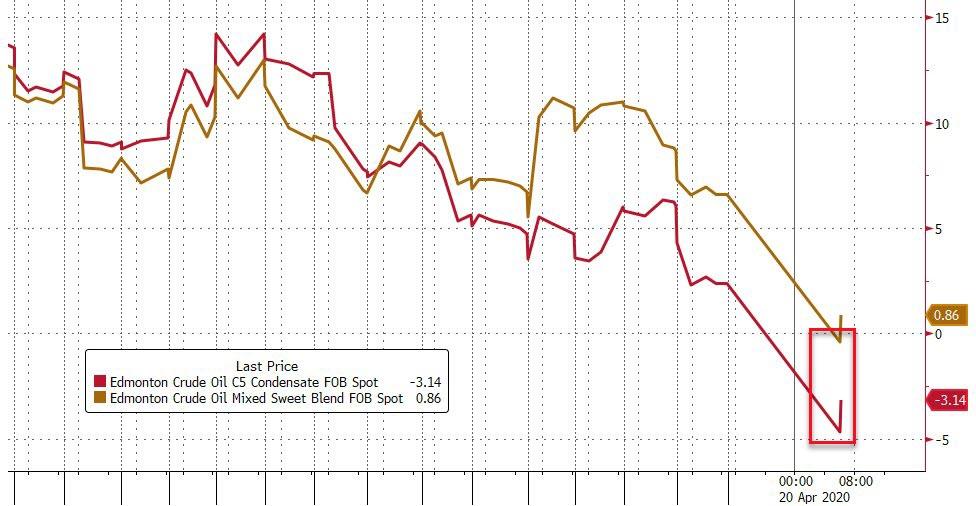

… has resulted in selected Canadian crude oil prices now officially turning negative with Canada’s Edmonton C5 Condensate deep in the red…

… while the Edmonton Mixed Sweet Blend dipped briefly negative for the first time ever before fractionally rebounding in the green.

In other words, landlocked Canadian oil prdeucers – who don’t have easy access to expandable tanker storage – are now paying their customers to take the oil off their hands!

Why the historic plunge in the front-end? Simple: it shows the real demand and how much storage capacity there is for actual physical oil (virtually none), as opposed to speculating on future oil prices and hopes for a recovery, which however with every passing month will get dragged to the catastrophic spot (current-month) price. As such, where the May contract – which matures tomorrow – prices will show what the market for physical delivery looks like but as Adam Button notes, “the June contract is also increasingly ugly as it approaches the cycle low” adding that “so far retail keeps buying the dip but I think there’s a rising chance they puke it in the days ahead.”

And while retail keeps hoping that the Fed will somehow start buying crude next, Button is absolutely correct.

StevieRay Hansen

Editor, Bankster Crime

![]()