Federal Reserve, Any System That Is This Inherently Corrupt Will Eventually Collapse Under the Weight of Its Own Corruption

BanksterCrime:

By Pam Martens and Russ Martens:

FRED is a giant online database at the St. Louis Fed that allows anyone to graph the financial and economic data stored in its repositories. We use the data regularly to bring our readers a crystal-clear snapshot of the increasingly dangerous underpinnings of the U.S. financial system.

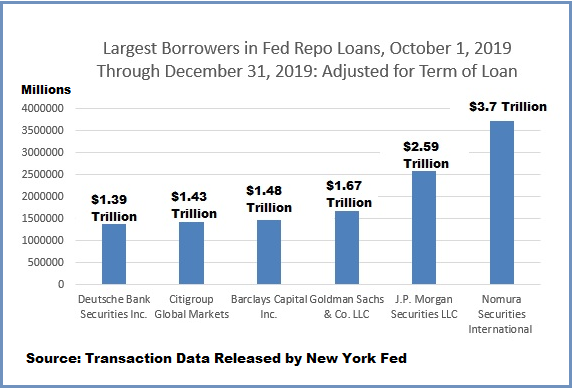

Let’s start with the first chart above. This chart depicts the cash assets held by the 25 largest U.S. commercial banks. The Fed defines the term “cash assets” as “vault cash, cash items in process of collection, balances due from depository institutions, and balances due from Federal Reserve Banks.” Notice that from April 1, 1985 to just before the financial crash of 2008, cash levels at the biggest banks were as steady as a soft breeze on a spring day. But from that point on through today, there have been freakish spikes and plunges in cash levels. Soft-breeze banking has turned into chaotic hurricane banking, with the Fed pumping in trillions of dollars in emergency cash and the mega banks careening from one crisis to the next.

How did this happen? A brief walk through U.S. banking history is in order.

Following the Wall Street crash in 1929, more than 9,000 banks in the United States failed over the next four years. In just the one year of 1933, more than 4,000 banks closed their doors permanently as a result of insolvency.

The 1930s banking crisis came to a head on March 6, 1933, just one day after President Franklin D. Roosevelt was inaugurated. Following a month-long run on the banks, Roosevelt declared a nationwide banking holiday that closed all banks in the United States. On March 9, 1933 Congress passed the Emergency Banking Act which allowed regulators to evaluate each bank before it was permitted to reopen. Thousands of banks were deemed insolvent and permanently closed. There was no federal deposit insurance at that time and it is estimated by the Federal Deposit Insurance Corporation (FDIC) that depositors lost $1.3 billion to failed banks in that era. That would be approximately $25.5 billion in today’s dollars.

To restore the public’s confidence and encourage Americans to place their savings in bank accounts, Roosevelt signed into law on June 16 the Banking Act of 1933, more popularly known as the Glass-Steagall Act after its authors Senator Carter Glass, a Democrat from Virginia, and House Rep Henry Steagall, a Democrat from Alabama. The legislation created federal deposit insurance for bank accounts for the first time in the U.S. while banning banks that engaged in speculating in stocks or underwriting them to own federally-insured banks.

This separation of banking was greeted with broad public approval at the time. Years of Senate Banking Committee hearings following the ’29 crash had informed the Congress of that era, as well as the public, that Wall Street’s casino banks gambling with depositors’ money in wild stock speculations had caused the stock market crash and ensuing run on the banks.

The Glass-Steagall Act protected the U.S. banking system for 66 years until its repeal during the Bill Clinton presidency in 1999. The impetus for its repeal was the announcement in 1998 that Sandy Weill wanted to merge his trading firms, Salomon Brothers and Smith Barney (under the Travelers Group umbrella), with Citicorp, parent of the federally-insured Citibank commercial bank. (The editorial board of the New York Times was a big cheerleader for letting Weill get his way and for repealing the Glass-Steagall Act.)

Weill had a singular motive for this merger, which created the Frankenbank, Citigroup – and it wasn’t to advance the nation’s interests. Weill told his merger partner, John Reed of Citibank, that his motivation for the deal was: “We could be so rich,” according to Reed in an interview with Bill Moyers.

The repeal of the Glass-Steagall Act in 1999 meant that the casino-style investment banks and trading houses across Wall Street could now own federally-insured commercial banks and use their hundreds of billions of dollars in insured deposits to speculate in stocks and derivatives. Every major Wall Street trading house either bought a federally-insured bank or created one.

What Weill meant by “We could be so rich” was this: If the trading bets won big, the bank CEOs became obscenely rich on stock-option-based performance pay. When the bets lost big, the government would be forced to do a bailout rather than allow a giant, interconnected, federally-insured bank to fail. (You can read about Weill’s Count Dracula stock option/get-rich-quick plan here.)

Just nine years after the repeal of Glass-Steagall, Wall Street blew itself up again and the government had to step in with a massive bailout for the deposit-taking banks that had merged with Wall Street’s investment banks and brokerage firms. In addition to the government bailout, the Federal Reserve, which was supposed to be supervising these mega bank holding companies, morphed into the secret sugar daddy of the mega banks. Without one vote by the legislative branch of government, the Fed secretly funneled $29 trillion in cumulative loans to bail out the casino banks, including their trading operations in London.

The Federal Reserve has been demonstrating this Stockholm Syndrome with the abusive banks it “regulates” ever since. (See our archive of articles on the Fed’s ongoing bank bailouts that began on September 17, 2019, prior to the pandemic, here.)

Both Weill and Reed did, indeed, become obscenely rich. (Weill walked away as a billionaire). Weill’s progeny, Citigroup, meanwhile, received the largest taxpayer bailout in U.S. history in 2008, taking in $45 billion in equity from the U.S. Treasury; a government guarantee on $300 billion on Citigroup’s dubious assets; the Federal Deposit Insurance Corporation (FDIC) guaranteed $5.75 billion of its senior unsecured debt and $26 billion of its commercial paper and interbank deposits; and the Federal Reserve secretly funneled $2.5 trillion cumulatively in low-interest loans to units of Citigroup from December 2007 to at least July 2010 according to a government audit of the Fed’s emergency bailout programs that was released in 2011.

The unprecedented nature of the Fed’s bailouts of these casino banks holding trillions of dollars of insured deposits did not become fully known until 2011 when a media court battle with the Fed won the release of part of the information and a government audit of the Fed released more details. Nor was the official report of the corruption on Wall Street and regulatory failures that had led to the crisis released by the Financial Crisis Inquiry Commission until 2011.

By that time it was too late. Congress had enacted the toothless Dodd-Frank financial “reform” legislation on July 21, 2010. Instead of restoring the desperately-needed Glass-Steagall Act, the bill tinkered around the edges of reform, with Wall Street’s legions of lobbyists confident that Wall Street could steamroll right through any speed bumps – which it did in short order.

So what we have today is a banking system dominated by a handful of mega banks that are “supervised” by the Fed. But instead of actually supervising the banks and preventing them from creating panic and bank runs, the Fed is too timid to actually take on the banks’ legions of lawyers and prefers to simply create never ending bailout programs when the banks inevitably get themselves into trouble.

To underscore that reality, below is a chart showing what brought on the repo crisis that began on September 17, 2019 – months before there was even one announced case of COVID-19 anywhere in the world. (The COVID-19 pandemic, which triggered another huge round of the Fed’s emergency bailout programs, was declared by the World Health Organization on March 11, 2020.)

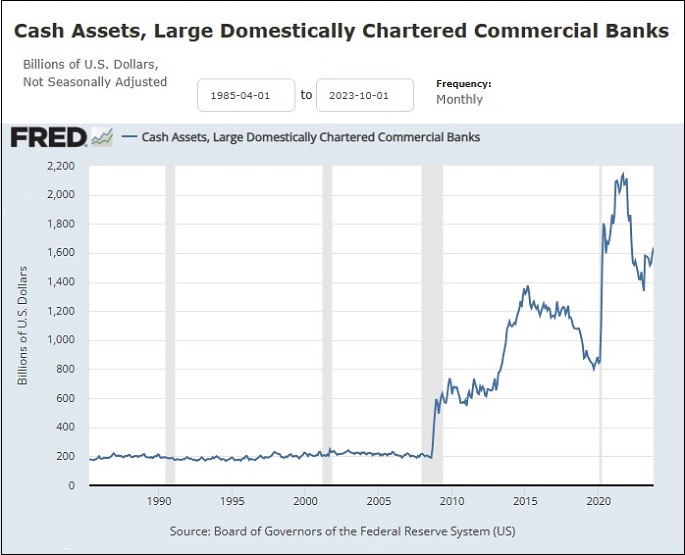

On April 8, 2015, cash assets stood at $1.398 trillion at the 25 largest U.S. banks. By September 18, 2019, cash assets had plunged to $759 billion – a decline of 45.7 percent while Fed bank examiners were apparently snoozing.

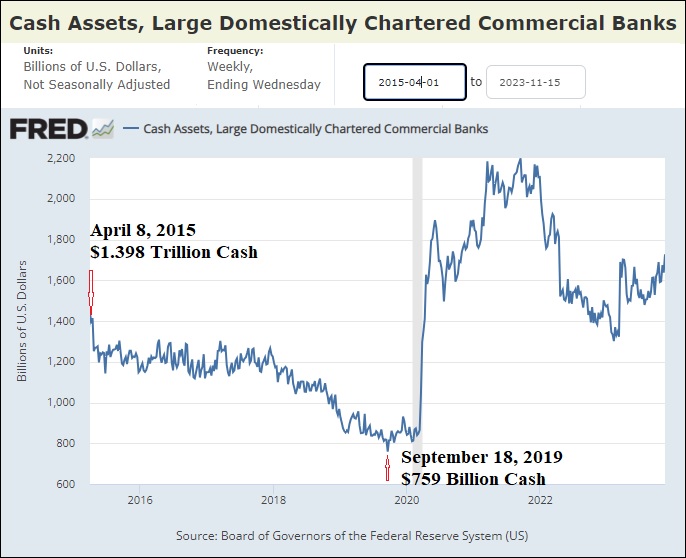

This next chart shows how the Fed responded to this cash crisis in the fall of 2019, making trillions of dollars in revolving repo loans to U.S. and foreign banks.

When the names of the banks that received these trillions of dollars in cheap loans from the Fed were finally revealed two years later, there was a complete mainstream media news blackout on this critically important information about the U.S. banking system’s incompetent supervision by the Fed. (Read our report: There’s a News Blackout on the Fed’s Naming of the Banks that Got Its Emergency Repo Loans; Some Journalists Appear to Be Under Gag Orders.)

Any system that is this inherently corrupt will eventually collapse under the weight of its own corruption. The 2008 financial collapse was the worst economic crisis in the U.S. since the Great Depression of the 1930s. It took six years for jobs to recover; more than 10 million Americans fell into poverty; and more than 6 million families lost their homes to foreclosure.

This past spring the U.S. got another loud warning siren that the U.S. banking system is not being adequately supervised. The second, third and fourth largest banking failures in U.S. history occurred in the span of seven weeks.

How is it possible that Congress and the Senate Banking Committee can’t see that the Federal Reserve has more than ably demonstrated that it is an incompetent and captured regulator of mega banks and must be completely severed from any role in their supervision.

Treat your skin well. Our soaps are gentle and produce a smooth, creamy lather that is nourishing to your skin. They are handmade in small batches. We use only high-quality natural ingredients. No chemicals, no sodium laurel sulfate, no phthalates, no parabens, no detergents. GraniteRidgeSoapworks

Use the code HNEWS10 to receive 10% off your first purchase.

Revelation: A Blueprint for the Great Tribulation

A Watchman Is Awakened

Will Putin Fulfill Biblical Prophecy and Attack Israel?

Newsletter

Orphans

Editor's Bio