This day is here– get ready, the virus WILL spreads throughout the US and Europe, governments will respond the same way China’s government has; martial law and full-blown concentration camp culture. This would lead to civil war in the US because we are armed and many people will shoot anyone trying to put us into quarantine camps. Europe is mostly screwed. The establishment then suggests that paper money be removed from the system because it is a viral spreader. China is already pushing this solution now. Magically, we find ourselves in a cashless society in a matter of a year or two; which is what the globalists have been demanding for years. Everything goes digital, and thus even local economies become completely centralized as private trade dies. “AntiChrist Is On His Temporary Thorne”

StevieRay Hansen

In all of U.S. history, we have never seen the Dow Jones Industrial Average go from an all-time high to a bear market as quickly as we just did. As I keep reminding my readers, the stock market is all about how investors view the future. Early this year, extremely irrational optimism about the future pushed stock prices to the most overvalued levels that we have ever seen, but now things have completely changed. Fear of the coronavirus has many investors fearing an imminent economic crisis, and we have seen volatility on Wall Street that is absolutely insane. On Monday we witnessed the largest single-day point decline in the history of the Dow, on Tuesday stocks came roaring back, and then on Wednesday, we witnessed the second-largest single-day point decline in the history of the Dow. As I have previously explained numerous times, we see huge waves of momentum during any stock market crash, and I am sure we will see many more as this current implosion continues to play out.

On Wednesday, the Dow closed at 23553.22, which represented a 20.3 percent decline from the peak on February 12th.

The bull market that began on March 9th, 2009 has finally ended, and U.S. stocks are off to their worst start for a year since the last financial crisis.

But less than 5,000 people around the globe have died from this virus so far.

If we are seeing this much fear now, what is going to happen if millions of people start dying?

Thankfully, the World Health Organization finally decided to officially label this outbreak a “pandemic” on Wednesday…

World Health Organization Director-General Tedros Adhanom Ghebreyesus on Wednesday declared the coronavirus outbreak a pandemic as the global death toll rose above 4,500 and the number of confirmed cases neared 125,000.

“We have rung the alarm bell loud and clear,” Tedros said at a news conference. “We cannot say this loudly enough, or clearly enough, or often enough: All countries can still change the course of this pandemic.”

Of course, that announcement really rattled investors and the Dow ended up falling 1,464 points. Banking stocks were hit particularly hard.

But then later in the day, we learned that President Trump would be addressing the nation at 9 PM eastern time, and investors were temporarily encouraged.

Unfortunately, investors didn’t seem to like what Trump had to say, and Dow futures immediately plummeted about 1,000 points afterward.

On top of everything else, two major stories broke late Wednesday that shocked the entire nation. We learned that Tom Hanks and his wife have tested positive for the coronavirus, and the entire NBA season was suspended because a Utah Jazz player now has the virus.

Needless to say, every horrifying headline is just going to cause even more chaos for the markets.

At this point, one Goldman Sachs analyst is projecting that the S&P 500 will likely fall quite a bit more in the days ahead…

Goldman Sachs chief equity analyst David Kostin said Wednesday he expects the S&P 500 to hit a low of 2,450, more than 10% below its current closing level of 2,741. Kostin based his new view on a reduced expectation for S&P 500 earnings.

And another analyst believes that we are “only about halfway” to the bottom of the market…

“We can see the panic in the equity market,” said Jerry Braakman, chief investment officer of First American Trust. “The big question for most people is, are we at the bottom yet? I think we’re only about halfway there.”

Of course, both of them are assuming that this coronavirus pandemic will not last for too much longer.

But what if they are wrong?

What if this pandemic lasts into next year or even longer?

As stocks fall, people are gobbling up gold and silver coins like crazy. In fact, millions of Silver Eagles have been sold in recent days…

With the spread of the Global Contagion, the demand for physical precious metals has increased significantly. According to the U.S. Mint’s newest update, another million Silver Eagles were sold over the past two days. This brings to total Silver Eagle sales in March at 2.3 million, more than three times the previous month.

So if you have been waiting all this time for your silver coins to start appreciating in value, it may finally start paying off.

Meanwhile, we are already starting to see workers being laid off as much of the U.S. literally begins to shut down because of this virus. The following comes from the Washington Post…

At the Port of Los Angeles, 145 drivers have been laid off and others have been sent home without pay as massive ships from China stopped arriving and work dried up. At travel agencies in Atlanta and Los Angeles, several workers lost their jobs as bookings evaporated. Christie Lites, a stage-lighting company in Orlando, laid off more than 100 of its 500 workers nationwide this past week and likely will lay off 150 more, according to chief executive Huntly Christie. Meanwhile a hotel in Seattle is closing an entire department, a former employee said, and as many as 50 people lost their jobs after the South by Southwest festival in Austin got canceled.

Sadly, this is just the beginning. If this crisis lasts long enough, eventually we will see layoffs that are absolutely unprecedented.

And the civil unrest that I keep warning about appears to be already starting as well. Just check out what just happened at the University of Dayton…

University of Dayton students took to the streets after the school canceled classes, on-campus events, and gatherings, and closed UD student housing. Over 1,000 students gathered on Lowes Street by late Tuesday, jumping on cars and throwing bottles at police the University of Dayton said in a written statement.

You can see a news report about this incident right here. Of course, if this pandemic continues to escalate the civil unrest will become much, much, much worse in the months ahead.

On Wednesday night, President Trump announced that travel from Europe would be suspended for 30 days.

That is certainly a step in the right direction, but at this point, it isn’t going to make too much of a difference.

The virus is now in over 100 countries, and it is now spreading in almost every U.S. state.

And what most people don’t realize is that this pandemic is far from the only crisis we will be facing. We have entered a time when we will be hit by one thing after another, and most Americans will not be able to handle it.

We are seeing so much fear out there right now, but this is not a time for fear.

This is a time for faith, and it is absolutely critical for you and your family to believe that you can get through this.

Anyone can shine during the best of times, but it is during the worst of times that we discover who we really are.

The days ahead are going to be extremely challenging, but they will also be a great opportunity to make a tremendous difference in a society that has been gripped by fear and that is starting to spin completely out of control.

About the Author: I am a voice crying out for change in a society that generally seems content to stay asleep. My name is Michael Snyder and I am the publisher of The Economic Collapse Blog, End Of The American Dream and The Most Important News, and the articles that I publish on those sites are republished on dozens of other prominent websites all over the globe.

Banking Crisis Imminent? Companies Scramble To Draw Down Revolvers

Earlier today, we reported that Boeing shocked the investing community when it announced that due to “market turmoil”, it would immediately draw down on its full $13.825 revolving credit facility, an unprecedented move for a company Boeing’s size and valuation, and one which was some took as an indication of how frail Boeing’s liquidity state was, ostensibly confirmed by Boeing’s surging default odds measured by its 5Y CDS.

We disagreed: after all, why would Boeing rush to draw attention to its own funding challenges by fully drawing on its revolver when it knew full well that it had access to the money, safe and sound, located at its syndicate banks… unless of course Boeing was in fact worried about the viability of said banks. AS a result, we said that the real reason Boeing did what it did was simple, especially to those who recall what happened in 2008 all too well: Boeing is worried that banks will pull their committed funding, which in turn means that Boeing appears to be worried that a 2008-style financial crisis is imminent, and is shoring up all the liquidity it can, so as not to remain at the mercy of its banks which may refuse to extend it credit at any one moment if their own liquidity is threatened.

Which is why we also concluded that now that Boeing, “one of America’s most valuable companies, has shown which way the wind blows, expect thousands of less creditworthy companies to follow suit as they scramble to cash in on every dollar in available revolver funding before the banks pull it.“

We had to wait just a few hours for this prediction to come true, because later on Wednesday, Bloomberg reported that two of the world’s biggest PE firms, Blackstone and Carlyle, have told their portfolio companies to immediately do what Boeing did earlier in the day: “Do whatever it takes to stave off a credit crunch”, which as in the case of Boeing, is a polite way of saying: your banks may pull their liquidity (i.e., fail), so get whatever cash you can now when you can, and not when you have to.

According to the report, the dozens if not hundreds of businesses – all smaller than Boeing of course – controlled by the PE titans are joining a growing wave of corporations drawing down bank credit lines to help prevent any liquidity shortfalls amid signs of mounting stress in markets. At Blackstone, which has weathered a variety of crises in its 35 years, the focus is on sectors hurt by the coronavirus, such as the hospitality industry, as well as energy firms facing a slump in oil prices.

At Carlyle, the measures aren’t quite as widespread yet, although the firm has been having broad discussions with management teams at portfolio companies and recommended drawing credit lines in certain instances, with the “decisions are based on industries, regions and other factors.”

Besides Boeing, Blackstone, and Carlyle, other companies that announced plans to drawdown on their full revolver were Hilton Worldwide and Wynn Resorts, all reflecting the uncertainty coursing through corporate America as the US economy hurtles into recession.

Think of it, as companies lining up at their favorite ATM machine to pull all the money that is in the account. It works until suddenly it doesn’t.

And here is Bloomberg confirming, through clenched teeth, what we said earlier: “A sudden and sustained increase in companies tapping credit lines could eventually strain banks if conditions become so dire that borrowers won’t be able to meet their obligations.“

See, it’s not market conditions, but a loss of faith in the banking sector, and the reason why it was so difficult for Bloomberg to admit it is that while toilet paper runs do not lead to a collapse of the financial system, fiat paper runs to, and all that would take for those to begin is a loss of faith in the US banking system…. just like that exhibited by Boeing and some of the smartest financial professionals in the world.

The big irony, of course, is that by pulling down on revolvers en masse, US companies can trigger just the liquidity crunch they are seeking to protect themselves again because as we noted earlier, liquidity in the US financial sector is already dismal and getting worse with every passing day, hence today’s latest expansion to the Fed’s repo capabilities among a surging FRA/OIS spread.

As Bloomberg explains, “lenders offer revolving credit lines to strengthen relationships with companies and don’t typically intend for them to be drawn upon en masse.”

In normal times, revolvers serve as the corporate equivalent of credit cards, giving companies room to borrow as needed and repay when shortfalls ease. Under normal circumstances, the lines are seldom maxed out. Extensive use can be seen as a harbinger of distress.”

The fact that everyone is drawing down on their revolver, however, shows three things:

- these are not normal circumstances

- the US financial situation is on the verge of distress, and

- they remember what happened in 2008 when one bank after another collapsed the availability on their revolver to troubled companies and sectors, and this time it will be the banks left with holding the short stick.

That said, oil and natural gas companies are under particular focus as they tend to suffer a spike in funding stress when prices fall, because their credit lines are periodically updated based on market prices, motivating companies to tap them early.

But why Boeing? The company’s cash flow is one of the most stable in the world… except of course when a global viral pandemic and its ongoing 737 MAX fiasco have sent its cash flow plunging to the most negative levels in decades.

Meanwhile, Blackstone’s private equity operation is the firm’s largest business by assets, at $183 billion, of which energy accounts for almost 10% of the total portfolio.

Blackstone won’t be the last as rival private equity firms – many of which have purchased shale companies in recent years funded with staggering levels of junk debt – also are weighing similar actions.

“From an economic perspective, the virus has created dislocation in the market and fear among the people,” Blackstone co-founder Stephen Schwarzman said in an interview in Mumbai last week. “Once that starts, one has to find the impact of negative consequences. But the turbulence can also have an upside for firms with a war chest, he said.

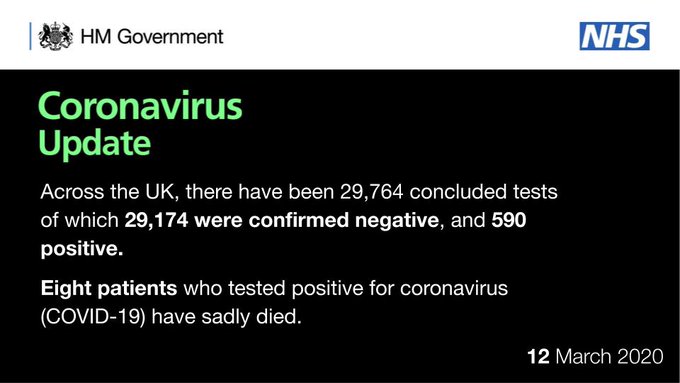

Department of Health and Social Care✔@DHSCgovuk

UPDATE on coronavirus (#COVID19) testing in the UK:

As of 9 am 12 March 2020, a total of 29,764 people have been tested:

29,174 negative

590 positive

8 patients who tested positive for coronavirus have sadly died.

The digital dashboard will be updated later today.

1,7859:22 AM – Mar 12, 2020Twitter Ads info and privacy1,811 people are talking about this

“It creates a substantial opportunity to buy assets and give credit.” Or, in the case of Blackstone’s portfolio companies, to take it. Source zerohedge

StevieRay Hansen

Editor, Bankster Crime

MY MISSION IS NOT TO CONVINCE YOU, ONLY TO INFORM YOU…

https://bankstercrime.com/coronavirus-triggers-biggest-shock-to-oil-markets-since-lehman-crisis/

“Have I therefore become your enemy by telling you the truth?”

This Pestilence Is Spreading: Stock Market In Trouble

Oil Drop, Coronavirus, Fraud, Banks, Money, Corruption, Bankers

![]()