Thanks to a melt-up today, US equities (apart from Trannies) ended the week higher…

But today’s gains were farcically driven by a full-court press of jawboning (5 Fed Speakers, Mnuchin, and Kudlow) to open the US equity markets…

0830ET Jobs Beat – Dow +100

0915ET Fed’s Kashkari dovish: “we’re not at maximum employment.. in free lunch zone” – Dow +20

0920ET Mnuchin: “constructive talks, working hard” – Dow +30

0930ET Fed’s Rosengren hawkish: further monetary accommodation not needed – Dow unch

0935ET Fed’s Clarida neutral: “we will be data-dependent, economy/consumer in good place” – Dow unch

0936ET Fed’s Kaplan dovish: “growth in US is decelerating, need skills-based immigration”

0937ET Kudlow: White House wants tax cuts for middle class, Trump optimistic on trade deal – Dow unch

0945ET Kudlow: “enormous progress on IP theft” – Dow +30.

0950ET Record high for S&P and Nasdaq

0955ET Kudlow: “US-China trade call may be happening now, Ag & FX parts virtually completed” – Dow +20

1000ET ISM Manufacturing MISS, 3rd month of contraction (bad news is good news) – Dow +50

1050ET Mission Accomplished – Dow futs take out post-Powell high stops

1215ET Dow futs stops run and fade begins into EU close

1255ET USTR: “constructive trade talks today” – Dow unch

1300ET Fed’s Quarles dovish: current policy stance “likely to remain appropriate… unless data weakens” – Dow unch

1310ET MOFCOM: “constructive trade talks today, achieved consensus” – Dow +20

1325ET Fed’s Daly neutral/hawkish: “annual wage growth of about 3% is good news” – Dow unch

1450ET Fed’s Williams neutral/hawkish: “economy is in a very good place, it is strong” – Dow -10

1600ET RECORD CLOSE FOR S&P AND NASDAQ

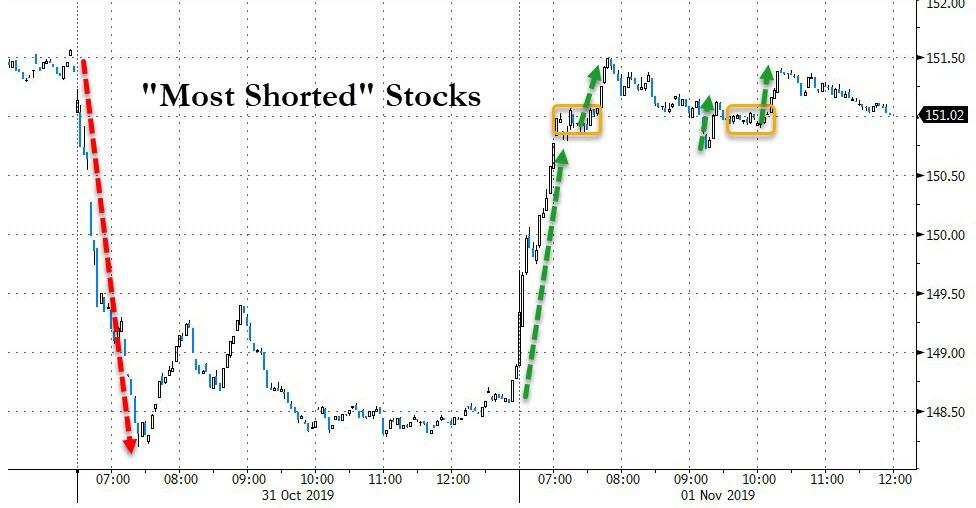

And the headlines seemed perfectly times to rejuvenate a stalled short-squeeze…

Source: Bloomberg

So what did we learn on Friday?

As Bloomberg noted, the labor market remains pretty resilient, which suggests that the angel of economic death isn’t particularly close to knocking on the door. The ISM survey continued to point toward a manufacturing contraction, but there are at least a few pockets of hope from new orders and (believe it or not) exports. And the vice chairman of the Fed gave a nod that an easing bias remains in place by suggesting that economic risks remain skewed to the downside.

This isn’t a Goldilocks economy by any stretch, because the caution in the business sector remains very real. Then again, perhaps it doesn’t need to be for risky assets to rally if familiar FOMO themes start coming into play.

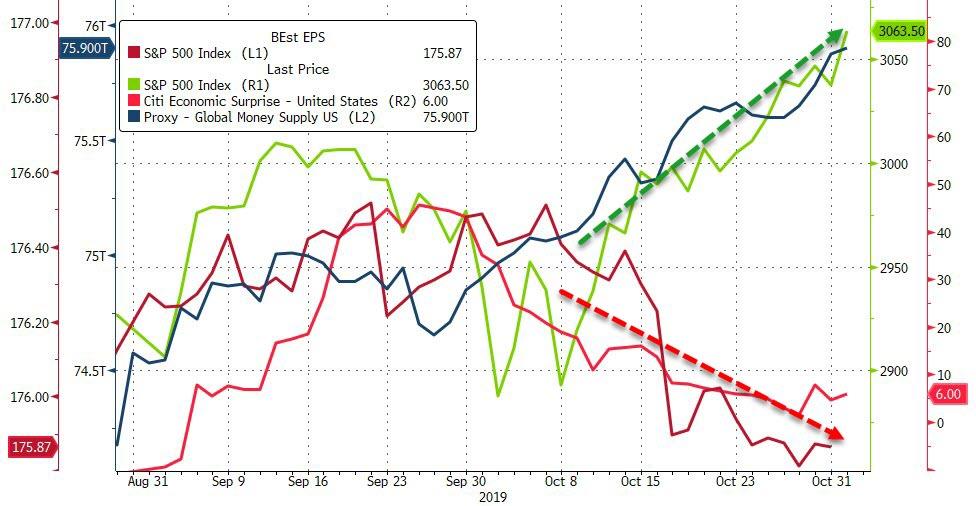

And the equity gains happened as US macro data disappointed notably…

Source: Bloomberg

However, since Powell’s dovish promise on raising rates without major inflation, gold is the leader…

US equities bucked the trend of weaker economic data and declining earnings expectations thanks to one simple thing – liquidity…

Source: Bloomberg

Chinese markets ended the week in a buying panic…

Source: Bloomberg

Europe ended more mixed with Spain worst and Italy best…

Source: Bloomberg

European bank stocks and credit have dramatically decoupled (thanks to Draghi’s idiotic schemes)

Source: Bloomberg

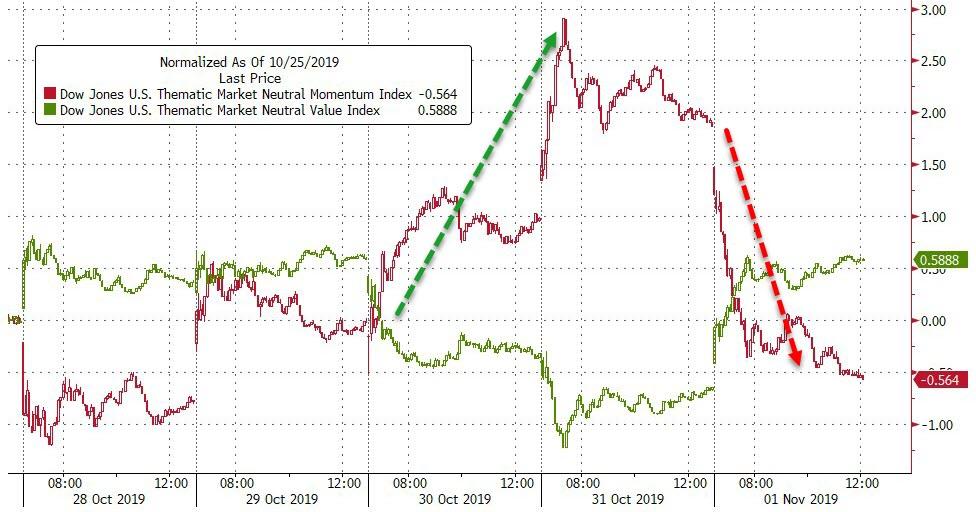

Momo ended the week lower…

Source: Bloomberg

As cyclical were panic bid today….

Source: Bloomberg

As the odds of a trade deal surged back today after TSY, USTR, MOFCOM, and Kudlow comments…

Source: Bloomberg

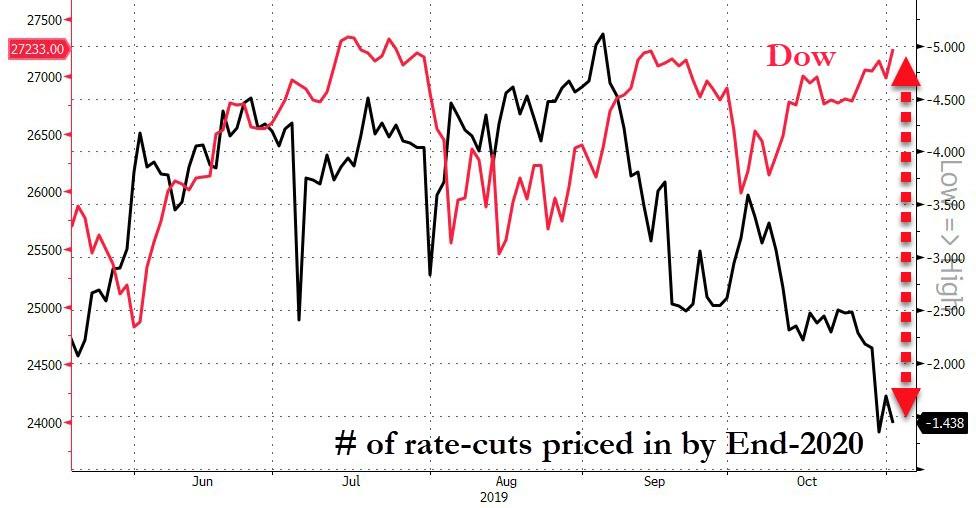

Stocks are notably decoupled from the relative hawkishness priced into fed fund futures…

Source: Bloomberg

Treasury yields ended the week lower (down between 6 and 8bps)…

Source: Bloomberg

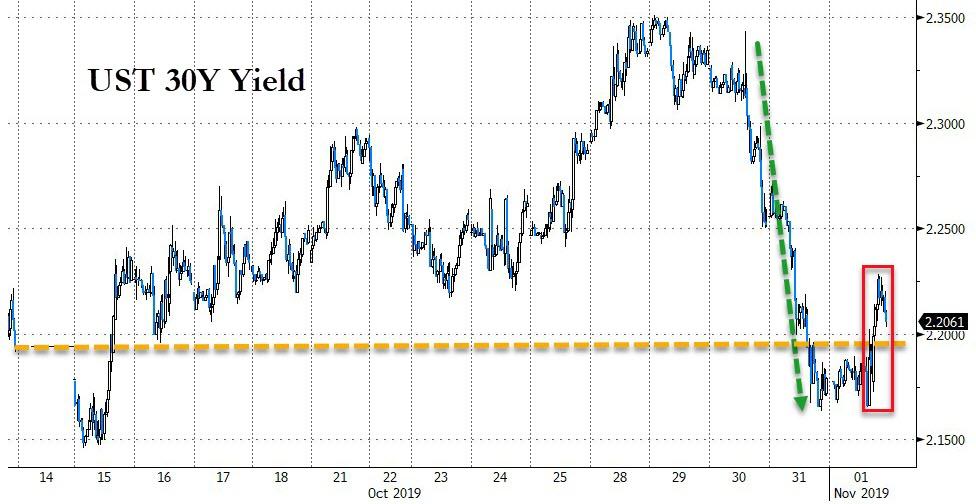

30Y Yields fell notably on the week (first drop in yields for 4 weeks)…

Source: Bloomberg

And global negative-yielding debt jumped most since August…

Source: Bloomberg

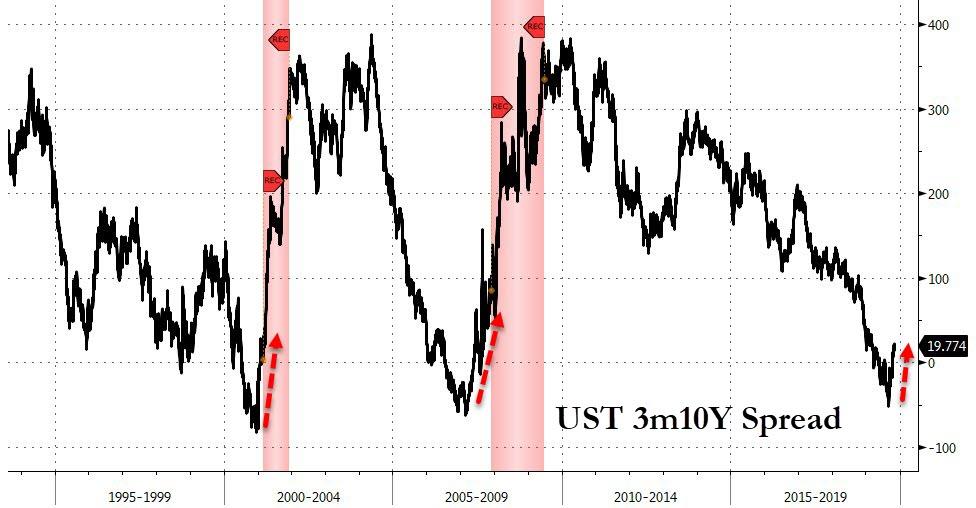

The yield curve steepened (today’s surge drove the week’s performance) bringing the market closer to recession…

Source: Bloomberg

Bond vol collapsed this week… (this is the biggest 2-week drop in bond vol since Summer 2013’s temper tantrum reaction)

Source: Bloomberg

The Dollar dumped lower on the week after Powell’s dovish comments (lowest weekly close since July)…

Source: Bloomberg

Source: Bloomberg

Cryptos were mixed on the week with Bitcoin and Bitcoin Cash outperforming…

Source: Bloomberg

Bitcoin managed to get back above $9,000 and traded among extremely technical levels…

Source: Bloomberg

Gold gained the most on the week and today’s surge in oil made it look less disastrous…

Source: Bloomberg

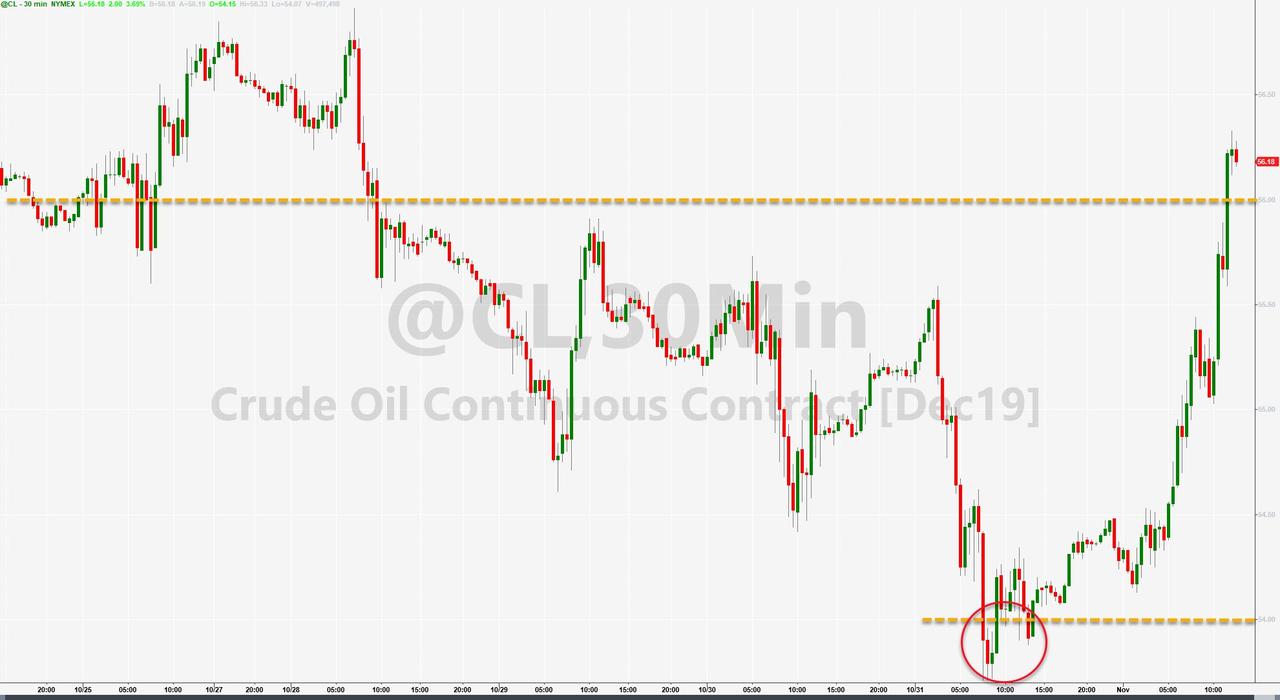

WTI scrambled back above $56 today (after testing a $53 handle)…

Gold surged after the Fed, back above $1500 to the top of the recent range…

Finally, we note that Elizabeth Warren is sliding in the money-odds (not polls) and Hillary is rising…

Source: Bloomberg

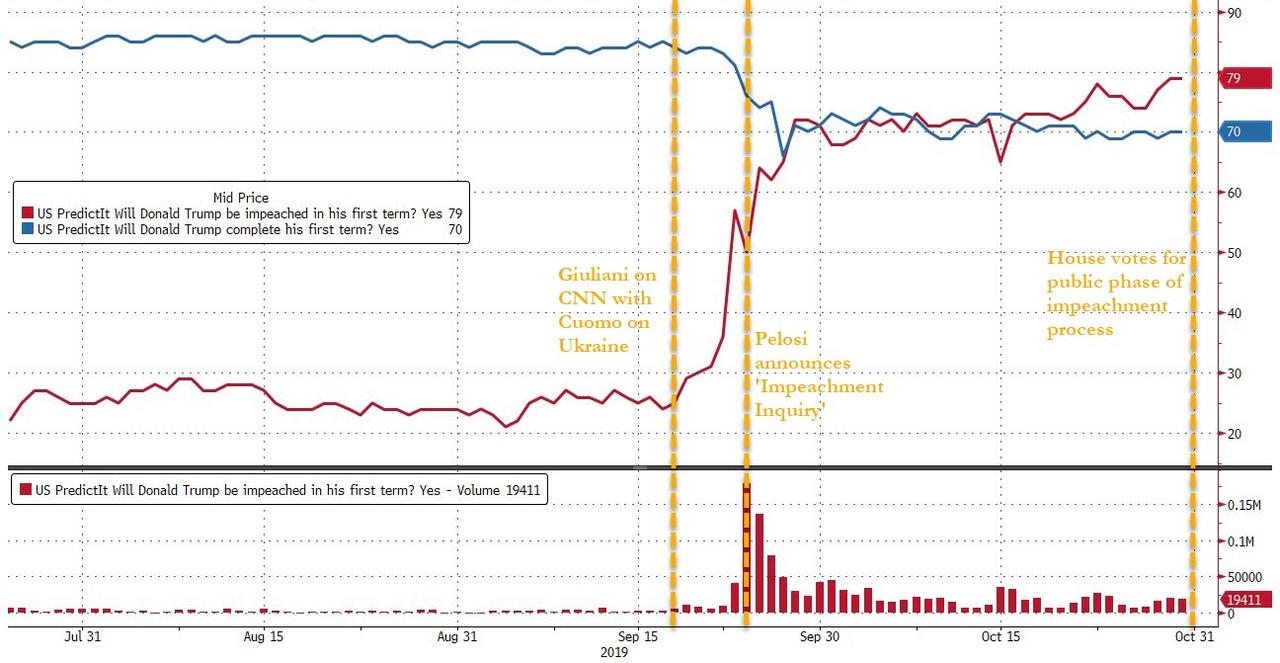

We also note that all the worry about the impeachment inquiry (odds of an impeachment now 79%) is apparently dismissed by the Senate as the odds of Trump completing his first term are 70%…

Source: Bloomberg

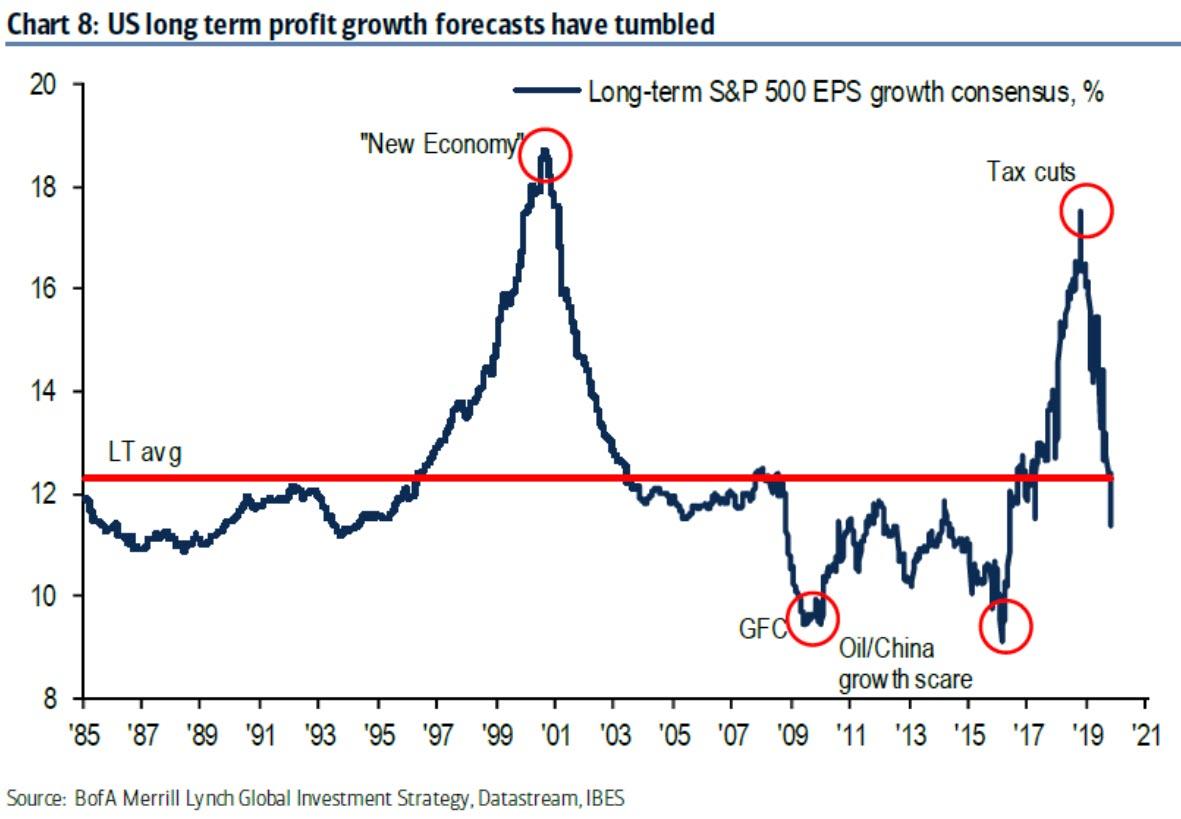

But, US long-term profits growth forecasts have collapsed…

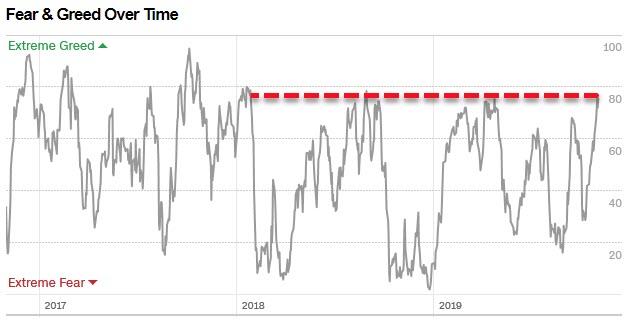

As markets surge to ‘Extreme Greed’… hasn’t ended well before!

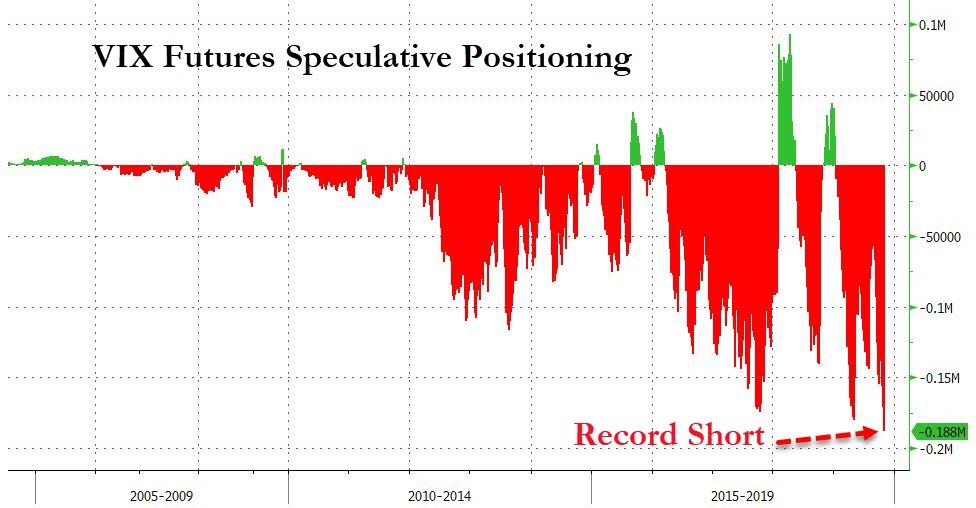

And with Greed at its peak, fear is at a record nadir (VIX Specs have never been more short volatility)…

Source: Bloomberg Source

StevieRay Hansen

Editor, Bankster Crime

MY MISSION IS NOT TO CONVINCE YOU, ONLY TO INFORM YOU…

The Birth Pains Are Growing Stronger….

“Unless God has raised you up for this very thing, you will be worn out by the opposition of man and devils”…

My name is Steve Meyers and I need to share a vision and warning that the Lord showed me back in April 2007….

Many of you will ask why I waited so long to share the warning. I didn’t. I shared the story with everyone that would listen from pastors to friends to family to colleagues. Immediately following the initial vision, I called a close friend. I told him to sit down that I had something to tell him. I needed it documented as I knew this was supernatural and from God. As I witness events unfolding today, I need to share the vision again.

The risk of loss in trading futures and options on futures can be substantial. The author does not guarantee the accuracy of the above information, although it is believed that the sources are reliable and the information accurate. The author assumes no liability or responsibility for direct or indirect, special, consequential or incidental damages or for any other damages relating or arising out of any action taken as a result of any information or advice contained in this commentary. The author disclaims any express or implied liability or responsibility for any action taken, which is solely at the liability and responsibility of the user.

![]()