Two years after former HSBC head of currency trading, Mark Johnson, became the first person to be convicted in a global crackdown of currency rigging and was sentenced to two years in a U.S. prison, moments ago a former JPMorgan trader became the second person to be sentenced to eight months in prison for his role in a foreign-exchange bid-rigging scheme.

Bloomberg reports that Akshay Aiyer was sentenced Wednesday by Manhattan District Judge John Koeltl. Last November, Aiyer was found guilty of conspiring with traders at other banks in chat rooms, on telephone calls and at social gatherings to coordinate bids and fix prices of African, European and Middle Eastern currencies while leading customers to believe they were competing with each other.

In 2017, Johnson was convicted of front-running a $3.5 billion client order, but as Bloomberg reminds us, a U.K. court declined to extradite Johnson’s underling, Stuart Scott, and three British traders accused of similar conduct were acquitted by a jury in New York in 2018. U.K. investigators dropped a criminal probe into individual traders after determining they didn’t have enough evidence.

Even though Aiyer’s sentence was lower than that sought by prosecutors, the conviction was a victory for the government, which has a mixed record of prosecuting foreign-exchange traders. In addition to the prison term, Aiyer was also sentenced to two years of supervised release and a $150,000 fine.

Aiyer, a native of India who worked at JPMorgan from 2006 until he was fired in 2015, had requested that the judge sentence him to a term of probation with a period of home confinement. His lawyers argued that he had no criminal history and was convicted of a crime in connection with conduct that was “widespread in the foreign-exchange industry.” So just like in the case of the gold rigging discussed earlier, we again learn that market manipulation were “widespread” begging the question – just what do regulators do all day?

Prosecutors had asked the judge to sentence Aiyer to as many as 46 months behind bars as recommended by federal sentencing guidelines, saying a prison term was necessary to “reflect his guilt of a serious crime.” They argued that he and his co-conspirators worked to rig the market “in order to line their own pockets, with no regard for the victims they left in their wake,” and that Aiyer had shown no remorse for his conduct. As Bloomberg adds, at his sentencing Aiyer asked the judge to show compassion, saying he has suffered a lot over the last six years and that the experience has been the worst of his life. “I’ve lost my job, I’ve ruined my career.”

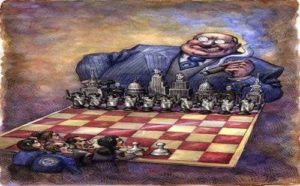

Johnson and Aiyer are just two of the more than half a dozen traders charged by the US in relation to misconduct in the currency markets; banks around the world have paid more than $10 billion in FX rigging penalties since the crackdown began. Citigroup, Barclays, RBS and JPMorgan all pleaded guilty in 2015 to rigging currency exchange rates and agreed to pay about $2.5 billion to the Justice Department as part of a $5.8 billion settlement with regulators.

Aiyer’s attorney, Martin Klotz, said prosecutors overstated the impact of his trading activity at nearly $277 million, saying Aiyer himself likely gained only thousands of dollars and any profits to JPMorgan probably coming in under $1 million.

In other words, steal $1 million on Wall Street and get a wrist-slap and a few months in Club Fed. Steal $1 million anywhere else, and get ready for an extended stay in Federal pound me in the ass prison.

Receive a daily recap featuring a curated list of must-read stories.

Prosecutors relied on testimony from two alleged conspirators, former Citigroup trader Christopher Cummins and ex-Barclays banker Jason Katz, who pleaded guilty and testified for the government. Defense lawyers argued that Cummins and Katz had been colluding with other traders for years before they even met Aiyer and were simply trying to avoid prison.

Source: ZeroHedge

StevieRay Hansen

Editor, BankstersCrime

God often uses men who are not of the best moral character. Pharaoh, Nebuchadnezzar, Cyrus, Herod, and Trump (amongst others), to accomplish His will in events He orchestrates during human history. We either trust the sovereignty of God or we don’t. Nothing happens apart from Him…

The best index to a person’s character is how he treats people who can’t do him any good, and how he treats people who can’t fight back…

The Birth Pains Are Growing Stronger….

One of the signs of ruling class collapse is when they can no longer enforce the rules that maintain them as a ruling class. When the Romans started making exceptions to republican governance, it was a matter of time before someone simply decided the rules no longer applied to them. Perhaps the robot historians will consider Obama our Marius or Sulla. Maybe that person is in the near future. Either way, the rule of law is over and what comes next is the rule of men.

“Don’t piss down my back and tell me it’s raining.” Outlaw Josey Wales

WE NOW LIVE IN A WORLD THAT IS PURE FABRICATION

![]()