BanksterCrime

By Pam Martens and Russ Martens:

Hedge Fund Manager, Scott Bessent, Is Trump’s Nominee for U.S. Treasury Secretary

Last Friday, in a flurry of announcements of cabinet nominees, President-elect Donald Trump dropped the name that the entire world had been waiting to hear: his pick for U.S. Treasury Secretary. The man Trump chose, Scott Bessent, is the founder and majority owner of the hedge fund, Key Square Capital Management LLC.

If confirmed by the Senate, Bessent will inherit sprawling powers. He will sit at the helm of a federal agency that includes the IRS; the Office of the Comptroller of the Currency, which regulates national banks and reports on their hundreds of trillions of dollars in derivatives; the Bureau of Engraving and Printing; the U.S. Mint; the Financial Crimes Enforcement Network (FinCEN) which is tasked with combating money laundering but has failed miserably in the job; and numerous other units.

In addition, legislation passed by Congress will put Bessent in charge of the slush fund known as the Exchange Stabilization Fund; make him Chair of the Financial Stability Oversight Council; and, thanks to stealthy legislation passed during the first Trump administration, the Treasury Secretary is now a permanent member of the National Security Council (NSC).

The National Security Council was created in 1947. For the next 70 years the Treasury Secretary was invited to sit on the NSC at the invitation of the President. Donald Trump’s Treasury Secretary in his first term, Steve Mnuchin, who came to that role after serving as National Finance Chairman of Trump’s presidential campaign, became the first Treasury Secretary to be a permanent part of the NSC thanks to a provision added to the 2018 Foreign Investment Regulatory Review Modernization Act. That provision is now codified into law at 50 U.S. Code § 3021.

Also, as a result of the 2010 Dodd-Frank financial reform legislation, the Treasury Secretary is permitted to take the Federal Reserve hostage during a financial crisis. Section 1101 of the Dodd-Frank Act provides that the Federal Reserve Board, “may not establish any program or facility under this paragraph without the prior approval of the Secretary of the Treasury.” The referenced paragraph pertains to the Fed’s ability to enact emergency lending facilities during a financial crisis. In other words, assuming Bessent is confirmed, the Federal Reserve must now say “may I” to a career hedge fund manager (who has lots of powerful hedge fund pals on Wall Street) before structuring or implementing any new emergency lending programs. So much for Fed independence.

Despite the sprawling duties and demands of the U.S. Treasury Secretary, Trump has chosen a man with no prior government experience. According to the most recent filings with the Securities and Exchange Commission (SEC), his hedge fund employs less than 25 people. The U.S. Treasury has more than 100,000 workers.

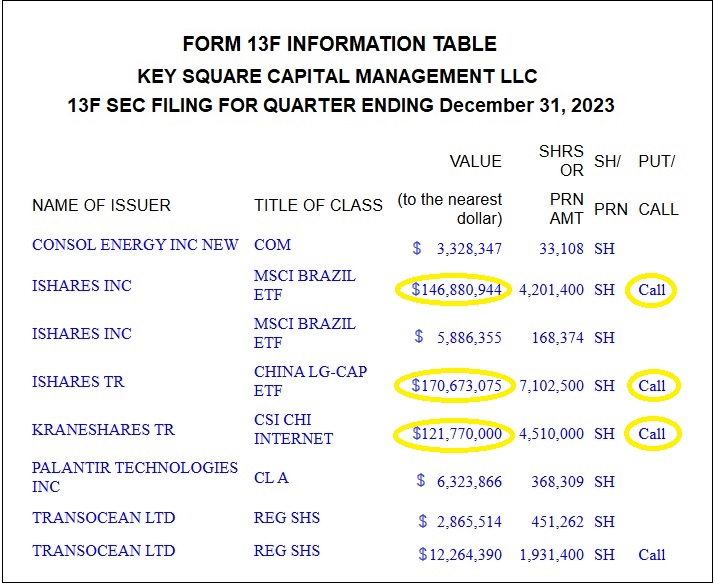

Equally troubling, Bessent’s hedge fund has made large, erratic bets over the past year according to the 13F forms it has filed with the SEC.

When Key Square Capital Management filed its 13F form for year-end 2023, it had a portfolio value of $469,992,491. It had taken massive stakes in Chinese stocks – not a particularly patriotic thing to do for an American. Bessent had invested more than $170.7 million in call options in an iShares China Large Cap Exchange Traded Fund (ETF) and more than $121.8 million in call options in KraneShares CSI China Internet ETF, which invests in Chinese Internet companies. The long positions in Chinese stock exposure represented 62 percent of the hedge fund’s positions.

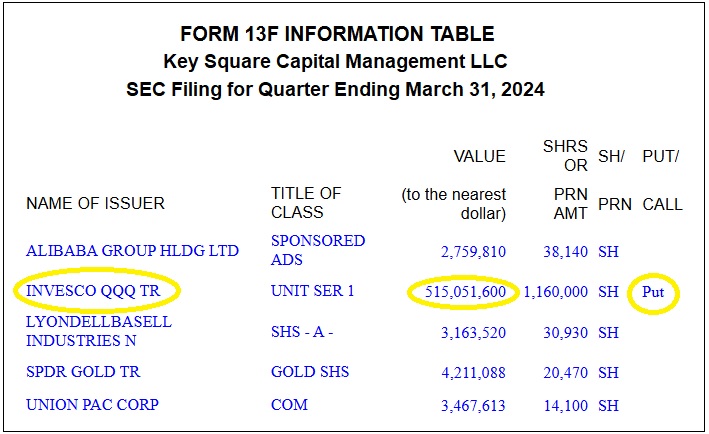

Just three months later, when Key Square filed its next 13F form with the SEC for the quarter ending March 31, 2024, the long exposure to Chinese stocks was gone and, instead, Bessent was now shorting the U.S. stock market – also not a very patriotic thing to do. The 13F shows that out of a portfolio of $528,653,631, Bessent had a put option (betting on a decline) in the Nasdaq stock market via Invesco’s QQQ ETF. That put option was valued at $515 million on March 31, representing an astonishing 97 percent of the Key Square portfolio.

We don’t know how Bessent’s positions worked out this year because the public isn’t informed as to when positions are bought and sold by hedge funds. But we do know this: in years past, Bessent managed billions of dollars. By June 30 of this year, his 13F showed just $14 million invested. By September 30, Key Square was showing zero invested.

![]()