The last few months have seen the dollar dive and crypto thrive…

Source: Bloomberg

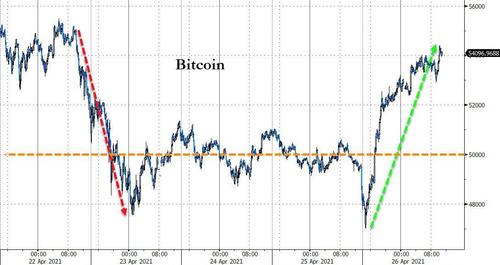

And the last few days have been no different…

Source: Bloomberg

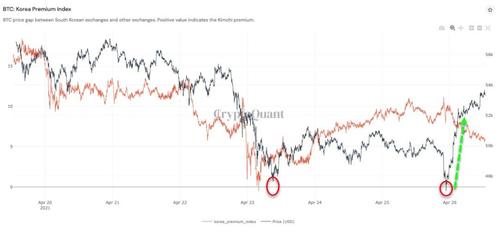

With bitcoin helped overnight by the Koreans (the Kimchi premium tagged zero then soared)…

Joe Lonsdale, Palantir co-founder explained succinctly why crypto is performing so well (and perhaps why the dollar is not so much)…

“Bitcoin is a bet against a centralized financial system run by crazy people… it is a bet that the emperor has no clothes.”

Echoing Kyle Bass’ infamous comments about gold from a decade ago…

“Buying gold is just buying a put against the idiocy of the political cycle. It’s That Simple”

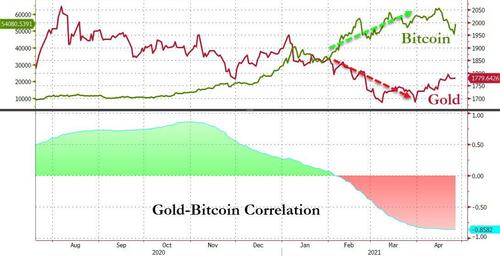

For now, it seems the market has a preference for one over the other (or one is being suppressed, take your pick)…

Source: Bloomberg

Although the last week or two have seen that swing back the other way a little…

Source: Bloomberg

Away from that malarkey, Small Caps outperformed Big-Tech for the 4th straight day as all major US indices but the Dow managed gains today…

At 1530ET, all hell broke loose in stock land with a sudden, massive-volume puke that came out of nowhere…

This was a major sell program…

TSLA (whose earnings are tonight) went just a little bit turbo during that period too (ARKK was up over 3% today)…

DISCA (think Archegos) surged during this broad index puke.

After stopping perfectly at January’s lows, Small Caps have surged higher relative to Mega-Cap DJIA in the last week or two…

Source: Bloomberg

Growth outperformed Value today

Source: Bloomberg

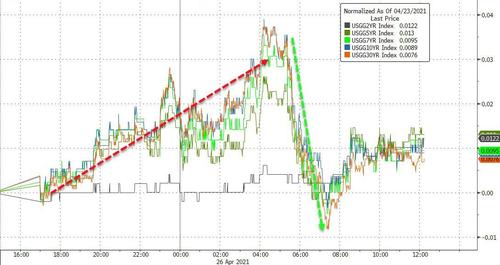

Despite equity gains, Treasuries ended the day practically unchanged…

Source: Bloomberg

10Y Yields remain in a very narrow range…

Source: Bloomberg

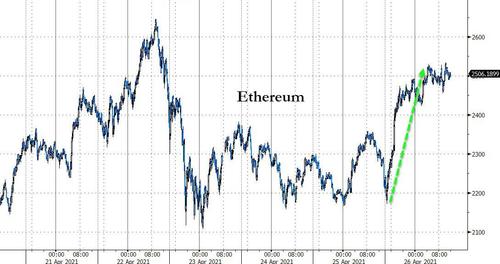

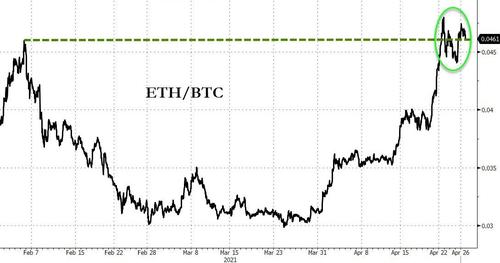

Bitcoin wasn’t the only crypto to see a huge rebound. Ether surged from below $2200 to over $2500…

Source: Bloomberg

ETH is hovering near its highs relative to BTC from February…

Source: Bloomberg

After Friday’s clubbing, (and this morning’s smaller slam), gold managed gains on the day…

Oil prices ended lower, despite a wild intraday swing…

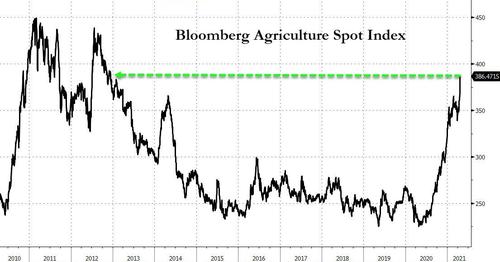

Finally, the price of agricultural commodities is literally exploding…

Source: Bloomberg

“Transitory” of course!

And financial conditions have never… ever… been this easy…

Source: Bloomberg

How much longer are you going to enable this Mr.Powell? Perhaps Mr. Lonsdale is right – “crazy people” are running the system.60

![]()