With Europe’s benchmark interest rates still staunchly in negative territory, the long-suffering European banks, epitomized by fading German ‘national champion’ Deutsche Bank, have benefited from the surge in trading activity during the first half of 2020 that helped its Q1 results surprise to the upside.

But as DB CEO Christian Sewing explained in an interview with Bloomberg published Tuesday, that boost from trading revenues and the explosion of debt issuance that has provided some badly needed wiggle room to Sewing as he continues with his epic “turnaround” of Deutsche unfortunately wont’ last.

Deutsche Bank AG’s booming trading desks are set to see the frenetic activity of the first six months ease as the exceptional market situation created by the coronavirus ebbs, according to Chief Executive Officer Christian Sewing.

The German lender will see a slowdown in the second half after benefiting from continued momentum in markets through June, Sewing said during a webcast hosted by Bloomberg News on Tuesday. While the bank is on track or ahead on its restructuring plan despite the pandemic, he said, debt capital markets is one area that’s set to decelerate in the coming months.

Sewing is one year into a radical overhaul that rolled back much of Deutsche Bank’s aggressive expansion as a global investment bank to focus on its traditional business of corporate banking, though recently he’s relied more heavily on revenue from fixed-income trading. The lender had a strong start first half in its securities business as debt security issuance boomed and clients sought hedges in volatile markets.

“The investment bank is clearly on track,” Sewing said, adding that was also in part due to its change of emphasis and not just market volatility in the first six months. In the second half, “there will be for sure a little bit of slowdown” because not all factors that helped in the recent period will be repeated.

To try and mitigate the lapse, Sewing said the bank will continue to expand its IG credit business as the bank seeks to restore the franchise to its former glory, or at least some semblance of what it once was.

DB’s trading unit saw a 13% gain in revenue in Q1, though that was less than its US competitors.

Receive a daily recap featuring a curated list of must-read stories.

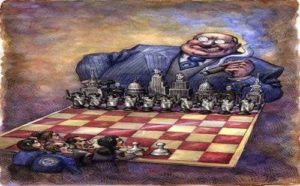

Of course, the real takeaway here, as one analyst pointed out, is that, if DB sees a pullback in trading revenue, it’s going to need to compensate for that in other areas. Which is where passing the costs of negative interests rates on to customers comes into play. Back in April, the bank finally broke and started adding charges to accounts over €100,000.

Bottom line: If the decline that Sewing’s warning about comes to pass, any Germans who haven’t already should consider buying a safe.

Source: ZeroHedge

StevieRay Hansen

Editor, BanksterCrime

God often uses men who are not of the best moral character. Pharaoh, Nebuchadnezzar, Cyrus, Herod, and Trump (amongst others), to accomplish His will in events He orchestrates during human history. We either trust the sovereignty of God or we don’t. Nothing happens apart from Him…

The best index to a person’s character is how he treats people who can’t do him any good, and how he treats people who can’t fight back…

The Birth Pains Are Growing Stronger….

One of the signs of ruling class collapse is when they can no longer enforce the rules that maintain them as a ruling class. When the Romans started making exceptions to republican governance, it was a matter of time before someone simply decided the rules no longer applied to them. Perhaps the robot historians will consider Obama our Marius or Sulla. Maybe that person is in the near future. Either way, the rule of law is over and what comes next is the rule of men.

“Don’t piss down my back and tell me it’s raining.” Outlaw Josey Wales

![]()