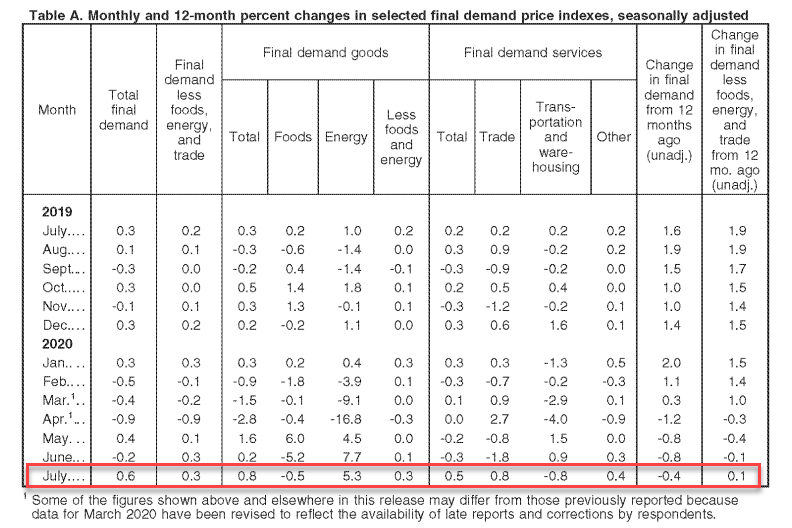

US Producer prices were expected to rise MoM following four declines in the last five months and they did, rising 0.6% MoM (double the expected 0.3% MoM rise). However, this was not enough to unwind the annual deflationary print (PPI -0.4% YoY)

Source: Bloomberg

This is the biggest MoM jump in headline PPI since Oct 2018.

Ex-food-and-energy, the beat was even more impressive with a 0.5% MoM spike vs 0.1% expected which lifted YoY Core PPI off its multi-year lows…

Source: Bloomberg

The biggest driver of this rebound was energy goods as food prices continue to slide.

However, even more stunning was a 7.8% surge in the index for portfolio management was a major factor in the

advance in prices for final demand services.

The indexes for machinery and vehicle wholesaling, automobiles and automobile parts retailing, long-distance motor carrying, legal services, and machinery and equipment parts and supplies wholesaling also moved higher. Conversely, prices for airline passenger

services decreased 7.0 percent. The indexes for automotive fuels and lubricants retailing and for guestroom rental also declined.

Over one-third of the July advance in the index for final demand goods is attributable to gasoline prices, which rose 10.1 percent. The indexes for diesel fuel, home heating oil, electric power, fluid milk products, and industrial chemicals also increased. Conversely, meat prices fell 8.0 percent. The indexes for residential natural gas and carbon steel scrap also decreased.

Pres. Trump has a price on his head, thanks to progressives like Nancy Pelosi and Chuck Schumer and the Hollywood pedophile elitist so every nutcase in the world wants to become famous by assassinating the president. What is so disturbing these progressives have actually encourage trumps demise

Source: ZeroHedge

StevieRay Hansen

Editor, BankstersCrime

God often uses men who are not of the best moral character. Pharaoh, Nebuchadnezzar, Cyrus, Herod, and Trump (amongst others), to accomplish His will in events He orchestrates during human history. We either trust the sovereignty of God or we don’t. Nothing happens apart from Him…

The best index to a person’s character is how he treats people who can’t do him any good, and how he treats people who can’t fight back…

The Birth Pains Are Growing Stronger….

One of the signs of ruling class collapse is when they can no longer enforce the rules that maintain them as a ruling class. When the Romans started making exceptions to republican governance, it was a matter of time before someone simply decided the rules no longer applied to them. Perhaps the robot historians will consider Obama our Marius or Sulla. Maybe that person is in the near future. Either way, the rule of law is over and what comes next is the rule of men.

“Don’t piss down my back and tell me it’s raining.” Outlaw Josey Wales

WE NOW LIVE IN A WORLD THAT IS PURE FABRICATION

![]()