Having closed the US Mint and halted production (blaming COVID-19) after a surge in demand for gold and silver coins, and warned of the danger of using bills (once again blaming the pandemic and choosing to “quarantine” cash for the sake of Americans’ health), Fed Chair Powell quietly admitted to lawmakers this week that The Fed will be rationing coins as the circulation of coins across the US economy ground to a halt due to the pandemic.

“What’s happened is that with the partial closure of the economy, the flow of coins through the economy … it’s kind of stopped,” Powell told lawmakers.

He said the shortage was due to the mass business closures that prevented people from spending their coins, as well as a lack of places that are open where people can trade coins for paper bills.

“We’ve been aware of it, we’re working with the Mint to increase supply, we’re working with the reserve banks to get the supply to where it needs to be,” Powell said, adding he expected the problem to be temporary.

Of course, Powell added that the problem would only be temporary, given the economy was reopening and establishments that traditionally deposit their cash into banks were beginning to restart operations.

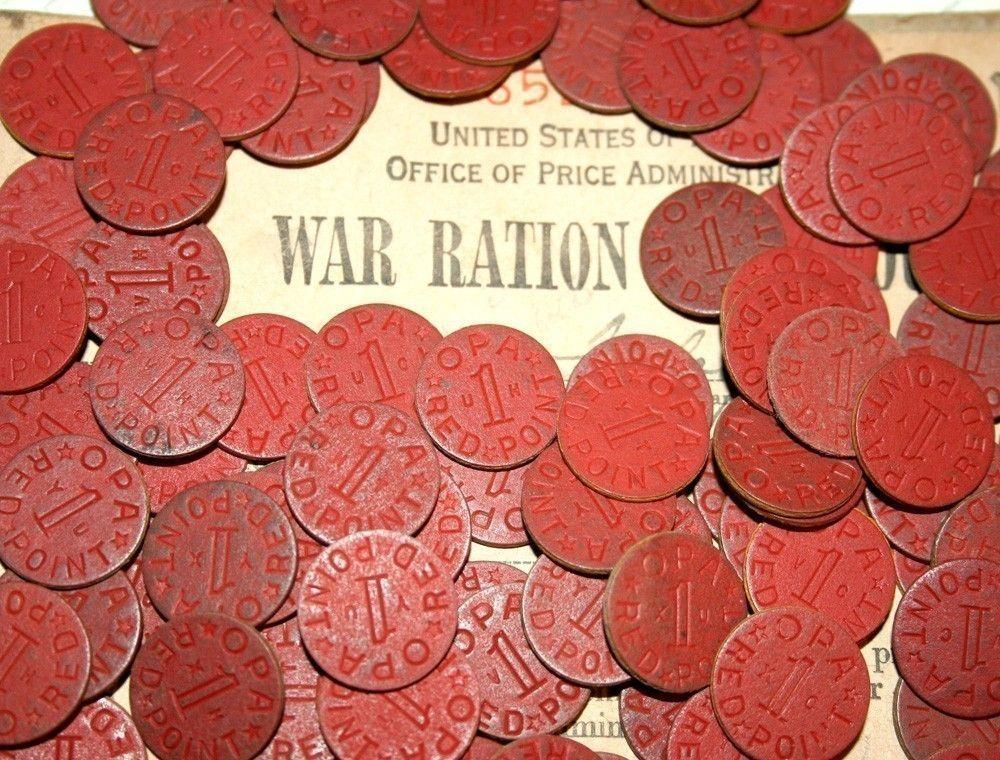

Until the shortage is resolved, the Fed is taking the unusual step of limiting the number of quarters, dimes, nickels, and pennies sent to banks “to ensure a fair and equitable distribution of coin inventory.” They issued a statement explaining the decision:

Temporary coin order allocation in all Reserve Bank offices and Federal Reserve coin distribution locations effective June 15, 2020

The COVID‐19 pandemic has significantly disrupted the supply chain and normal circulation patterns for U.S. coin. In the past few months, coin deposits from depository institutions to the Federal Reserve have declined significantly and the U.S. Mint’s production of the coin also decreased due to measures put in place to protect its employees. Federal Reserve coin orders from depository institutions have begun to increase as regions reopen, resulting in the Federal Reserve’s coin inventory being reduced to below normal levels. While the U.S. Mint is the issuing authority for the coin, the Federal Reserve manages coin inventory and its distribution to depository institutions (including commercial banks, community banks, credit unions, and thrifts) through Reserve Bank cash operations and offsite locations across the country operated by Federal Reserve vendors.

The Federal Reserve is working on several fronts to mitigate the effects of low coin inventories. This includes managing the allocation of existing Fed inventories, working with the Mint, as issuing authority, to minimize coin supply constraints and maximize coin production capacity, and encouraging depository institutions to order only the coin they need to meet near‐term customer demand. Depository institutions also can help replenish inventories by removing barriers to consumer deposits of loose and rolled coins. Although the Federal Reserve is confident that the coin inventory issues will resolve once the economy opens more broadly and the coin supply chain returns to normal circulation patterns, we recognize that these measures alone will not be enough to resolve near‐term issues.

Consequently, effective Monday, June 15, Reserve Banks and Federal Reserve coin distribution locations began allocating coin inventories. To ensure a fair and equitable distribution of existing coin inventory to all depository institutions, effective June 15, the Federal Reserve Banks and their coin distribution locations began to allocate available supplies of pennies, nickels, dimes, and quarters to depository institutions as a temporary measure. The temporary coin allocation methodology is based on historical order volume by coin denomination and depository institution endpoint, and current U.S. Mint production levels. Order limits are unique by coin denomination and are the same across all Federal Reserve coin distribution locations. Limits will be reviewed and potentially revised based on national receipt levels, inventories, and Mint production.

This coin rationing occurs as Americans are hoarding cash in record amounts due to the COVID crisis. As Decrypt reports:

Banks have more cash than ever before – largely due to the coronavirus pandemic, figures from the Federal Reserve show.

Deposits have never been so high—growing by $865 billion in April alone, CNBC reported. Deposits in total have increased by $2 trillion since January after record amounts of cash were pumped into US bank accounts to help with COVID-19 chaos. Money in bank accounts now stands at a whopping $15.4 trillion, June figures show.

The flood of money is due to the US government doling out trillions of dollars to help its citizens with the economic hardships brought on by COVID-19 lockdowns; an unlimited bond-buying program by the Federal Reserve; and people hoarding money because of uncertain times.

That money is sitting in bank accounts. The biggest US banks—JPMorgan Chase, Bank of America and Citigroup—have experienced astronomical growth, CNBC reported. But there is such a surplus of cash, CNBC reports, that banks don’t quite know what to do with it.

We have already seen sly moves to ban cash transactions in favor of the universal use of credit cards on the flimsy excuse that handling cash may spread the coronavirus.

As Viv Forbes warns at The Epoch Times, don’t let our cash money become the biggest COVID casualty. Swapping paper money for a monopoly of electronic money is a bad deal.

We should always be free to save our cash and protect the value of our savings by investing in real assets or sound money like gold and silver.

Real money is always measurable by weight, such as pounds, grams, pennyweight, and ounces of gold and silver, or carats of gemstones. It cannot be counterfeited or corrupted easily. But the value of fiat money relies on the honesty and openness of the rulers.

…

Fiat money allows politicians to secretly steal your savings to fight yet another war on someone or something. Next, we will see a war on “speculators,” or “hoarders,” and calls for a world currency.

U.N. one-worlders will not let this COVID crisis go to waste. They dream of a one-world government (the “National Cabinet” writ large) with no circulating cash and mandatory use of digital money (credit card currency). The climate alarmists would also like to use a digital money monopoly to promote their war on carbon. They could control and ration what we buy and consume—lettuce, tofu, bicycles, and green energy only, with no overseas trips and no secret buying of diesel, bacon, or beef.

We have already seen the start of their war on cash—digital money will join mulberry money, shinplaster, and cubic currency in the long history of failed political money. While people are focused on social distancing and contact tracing, one-worlders are secretly planning to recall banknotes and abolish cash. Then they can ration the “money” available to each of us each month (cutting it off for white males once they reach their “use by date”?).

For many people in the world, a store of gold coins, silver coins, gemstones, or a bit of productive land has allowed them to survive or escape when their government became too oppressive or lost a war, and the local fiat money became a cubic currency.

Unless, of course, history repeats…Gold confiscation? Maybe…

Source: ZeroHedge

StevieRay Hansen

Editor, Bankster Crime

![]()