Just when you thought it was safe to buy any stock – selected at random via Scrabble letters – on any dip, with levered money you can’t afford to lose, COVID-19 reappears in size to steal the jam out of your donut.

Last Friday saw surges in COVID cases across many states and news that Apple would be re-closing stores in a handful of states. That sent stocks tumbling. Today – after a few days of exuberant dip-buying, those same states hitting new record highs (and more Apple store closures) sparked an even more impressive plunge (and was not helped by The IMF’s downbeat forecast for the global economy)…

- 0905ET California COVID-19 cases rise 3.9% or +7,149 to 190,222 (up from +5,019)

- 0938ET Texas reported a 7.3% rise in Covid-19 hospitalizations to 4,389 from 4,092 yesterday.

- 1033ET *FLORIDA COVID-19 CASES RISE 5.3% VS. PREVIOUS 7-DAY AVG. 3.7%

- 1130ET *HOUSTON-AREA INTENSIVE CARE UNITS ARE AT 97% OF CAPACITY: CITY

- 1140ET *NEW YORK, N.J. AND CONNECTICUT ORDER VISITORS TO QUARANTINE

- 1400ET *CALIFORNIA HOSPITALIZATIONS UP 29% IN 14 DAYS, NEWSOM SAYS

- 1440ET *APPLE TO RE-CLOSE 7 STORES IN HOUSTON, TX ON COVID-19 SPIKE

All building on one another to slam stocks lower (led by Small Caps) ending the 8-day win streak in Nasdaq (there was a late-day bounce on chatter of $1 trillion stimulus again but a $3bn MoC ruined that fun and games)…

And the result – a collapse below the Navarro lows, back To Friday’s lows…

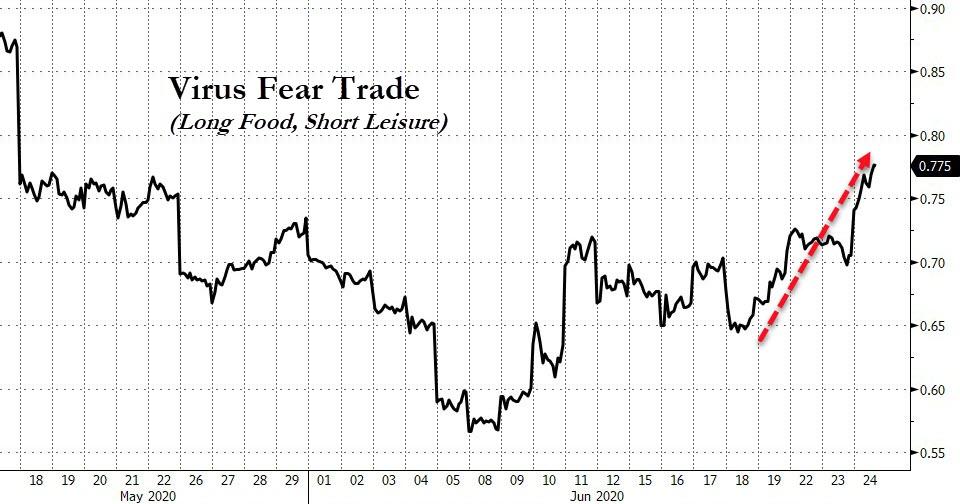

As Virus fears surge to one-month highs…

Source: Bloomberg

The S&P fell back towards its 50DMA…

And the Dow failed once again to break above its 50DMA…

Momentum continued its rabid bounce back today – after perfectly reversing at unchanged for 2020…

Source: Bloomberg

The dollar was bid today…

Source: Bloomberg

Treasury yields tumbled 405bps at the long-end today…

Source: Bloomberg

Are stocks about to catch down to bond’s reality?

Source: Bloomberg

Or profits…

Source: Bloomberg

And while bonds saw safe-haven bids, bitcoin did not…

Source: Bloomberg

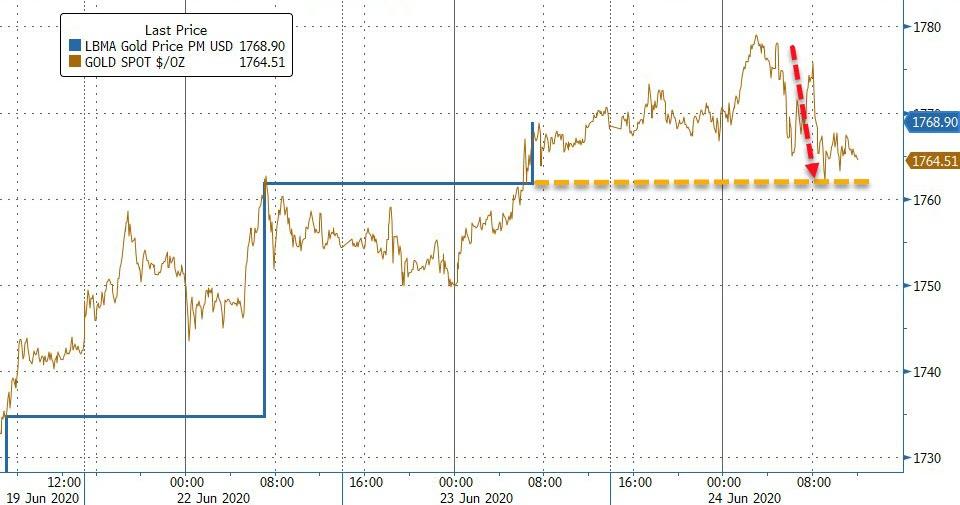

And gold was monkeyhammered too around the London Fix (after failing to break $1800)…

But note that gold’s tumble stalled at yesterday’s fix…

NEVER MISS THE NEWS THAT MATTERS MOST

ZEROHEDGE DIRECTLY TO YOUR INBOX

Receive a daily recap featuring a curated list of must-read stories.

Source: Bloomberg

Silver was hit harder. busting back below $18…

Oil prices tumbled as COVID (demand) and inventory/production (supply) concerns smacked WTI back to a $37 handle…

Finally, we wonder just how far stocks will fall this time?

Source: Bloomberg

And just how quickly The Fed will need to restart its money-printing malarkey…

Source: Bloomberg ZeroHedge

StevieRay Hansen

Editor, Bankster Crime

![]()