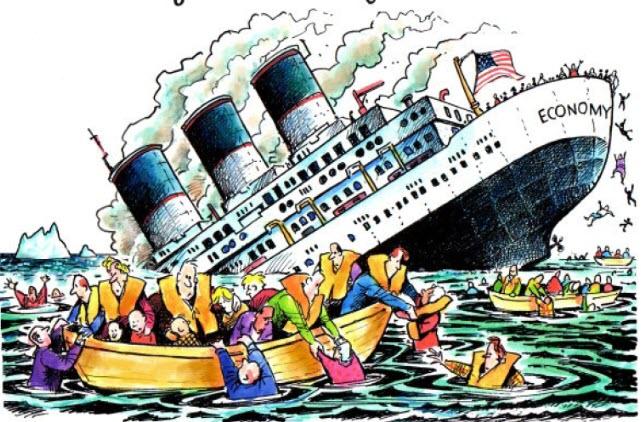

Unthinkable doesn’t mean unsinkable.

As we all know, the “unsinkable” Titanic suffered a glancing collision with an iceberg on the night of April 14, 1912. A half-hour after the iceberg had opened six of the ship’s 16 watertight compartments, it was not at all apparent that the mighty vessel had been fatally wounded, as there was no evidence of damage topside. Indeed, some eyewitnesses reported that passengers playfully scattered the ice left on the foredeck by the encounter.

00:20 / 00:37

But some rudimentary calculations soon revealed the truth to the officers: the ship would sink and there was no way to stop it. The ship was designed to survive four watertight compartments being compromised, and could likely stay afloat if five were opened to the sea, but not if six compartments were flooded. Water would inevitably spill over into adjacent compartments in a domino-like fashion until the ship sank.

We can sympathize with the disbelief of the officers, and with their contradictory duty to simultaneously reassure passengers and attempt to goad them into the lifeboats. Passengers were reluctant to heed the warning because it was at odds with their own perceptions. With the interior still warm and bright with lights, it seemed far more dangerous to clamber into an open lifeboat and drift off into the icy Atlantic than it did to stay onboard.

The evidence was undeniable, but humanity’s first response is denial, regardless of the evidence. The evidence that the coronavirus is contagious is undeniable, as is the evidence that carriers who have no symptoms can transmit the virus to others.

Just as the eventual sinking of Titanic could be extrapolated from the basic facts (six watertight compartments were flooding), so the eventual spread of the coronavirus can be extrapolated from these basic facts.

But the official global response is “these facts don’t matter,” and so hundreds of airline flights continue to leave cities swept by the disease. That once the virus spreads globally it will impact the global economy is easily extrapolated, but few want to consider the sinking of the unsinkable, so they don’t.

As a result, the first lifeboats left the doomed ship only partially full. Only when it became undeniable that the ship was doomed did people attempt to get on a lifeboat, but by then it was too late: the lifeboats had all been launched.

This may be an appropriate analogy to the U.S. stock market, which is widely considered “unsinkable” due to the Federal Reserve’s unlimited ability to create “liquidity” (cash) out of thin air.

The stock market just had a minor collision with the coronavirus, and few are heeding the warnings, preferring to heed the reassurances that thanks to the omnipotent Federal Reserve, the market is unsinkable, and the party in the First Class deck will continue indefinitely.

The lifeboats are already leaving, but few have escaped the doomed ship, i.e. sold all their equities.

When the crowd partying in First Class awakens to the inevitability of the stock market sinking, it will be too late to get on the lifeboat, i.e. sell out at the top.

A half-hour after the fatal collision, the reassurances are so comforting and credible: how could this great ship sink? Indeed, how could a stock market racing so confidently to Dow 30,000 sink to Dow 20,000 or even 10,000? It’s unthinkable.

Unthinkable doesn’t mean unsinkable.

Why Our Financial System Is Like the Titanic (March 15, 2016)

Here are some informative science-based links on the coronavirus, courtesy of longtime correspondent Cheryl A.:

Another Decade, Another Coronavirus

Map of Global Case of Wuhan Coronavirus

Coronavirus contagious even in incubation stage, China’s health authority says

Preliminary Risk Assessment of Coronavirus Spreading

How fast can biotech come up with a vaccine for the latest outbreak?

DNA sleuths read the coronavirus genome, tracing its origins and looking for dangerous mutations

* * *

My recent books:

Audiobook edition now available:

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World ($13)

(Kindle $6.95, print $11.95) Read the first section for free (PDF).

Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic ($6.95 (Kindle), $12 (print), $13.08 ( audiobook): Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake $1.29 (Kindle), $8.95 (print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 (Kindle), $15 (print) Read the first section for free (PDF).

* * *

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

StevieRay Hansen

Editor, Bankster Crime

MY MISSION IS NOT TO CONVINCE YOU, ONLY TO INFORM YOU…

Fraud Banks Money Corruption Bankers

“Have I therefore become your enemy by telling you the truth?”

Tagged Under: Fraud,Banks,Money,Corruption,Bankers

![]()