Well, it’s official: there won’t be any “Buy American” op-eds by the Oracle of Omaha this time around. In fact, if anything, they will be titled simply “Sell.“

Warren Buffett, who turns 90 in 4 months, had an unpleasant surprise for the Perma bullish Berkshire faithful during their annual pilgrimage to Omaha live-stream of Berkshire’s annual meeting: one month after Berkshire surprised investors by selling parts of its Delta and Southwest Airlines stakes – both of which had previously been above a 10% ownership level and speculation was rife that Berkshire could purchase an airline outright in the near future – the Oracle of Omaha said that 4 years after Berkshire took major stakes in the four largest US airlines, he had liquidated the sold the entirety of its equity position in the U.S. airline industry which included $6.5 billion worth of stock in United, American, Southwest and Delta Airlines.

Assuring that Monday will be a bloodbath for Trannies (that would be the transportation stocks you perverts), Buffett justified his decision as follows: “The world has changed for the airlines. And I don’t know how it’s changed and I hope it corrects itself in a reasonably prompt way,” he said. “I don’t know if Americans have now changed their habits or will change their habits because of the extended period.”

But “I think there are certain industries, and unfortunately, I think that the airline industry, among others, that are really hurt by a forced shutdown by events that are far beyond our control.”

“When we bought [airlines], we were getting an attractive amount for our money when investing across the airlines,” he said. “It turned out I was wrong about that business because of something that was not in any way the fault of four excellent CEOs. Believe me. No joy of being the CEO of an airline.”

““I don’t know that 3-4 years from now people will fly as many passenger miles as they did last year …. you’ve got too many planes.”

Realizing that he won’t be alive by the time a turnaround eventually happens, he clarified that he made the decision and that he lost money on his investments. “That was my mistake.”

Highlight: “The value of certain things has decreased,” Warren Buffett says. “Our airline’s position was a mistake. Berkshire is worth less today because I took that position… There are other decisions like that.” #YFBuffett3728:01 PM – May 2, 2020Twitter Ads info and privacy153 people are talking about this

Asked by CNBC’s Becky Quick to clarify if Berkshire had sold all of its airline holdings, Buffett answered “yes” and explained: “When we sell something, very often it’s going to be our entire stake: We don’t trim positions. That’s just not the way we approach it any more than if we buy 100% of a business. We’re going to sell it down to 90% or 80%.”

“The airline business — and I may be wrong and I hope I’m wrong — but I think it’s changed in a very major way,” Buffett said. “The future is much less clear to me.”

As Bloomberg reminds us, Buffett has had a complicated relationship with the airline industry over the years. After a troublesome investment in USAir, Buffett joked that he would call an 800 number to declare he was an “air-o-holic” if he ever got the urge to invest in airlines again. Then in 2016, Berkshire dove into the industry again, amassing stakes in the four largest airlines. His renewed faith in the industry prompted speculation that he might one day own one of the carriers.

There is a more simplistic explanation of Buffett’s style of investing at least in recent years: he will buy the stock of companies that engage in massive buybacks, such as Apple, even though his annual letter bashes companies that buybacks stocks and he will dump all companies that halt buybacks, of which IBM is the most famous example. And since the quasi-bailed out airlines won’t be repurchasing stock for years and years to come, it was only a matter of time before Buffett dumped them.

It also means that Buffett may soon liquidate many more sector holdings, starting with the banks which have also suspended buybacks for the near future and may be forced to extend said suspension indefinitely unless there is a V-shaped recovery in the global economy. The banks will then be followed by consumer discretionary, railroads, and many more. In fact, it would explain why unlike 2008, Buffett has not only not been buying any stocks despite major “bargains” but has actually been aggressive in liquidating his holdings, hardly an endorsement of the broader market.

Amusingly, after wasting much digital ink bashing buybacks in his annual letters, Buffett went off on a rant defending buybacks during the annual videocast: “It’s very politically correct to be against buybacks now,” he said. “There’s a lot of crazy things being said about buybacks. Buybacks are so simple. It’s a way of distributing cash to shareholders,” especially when that shareholders is Warren Buffett. The “oracle” then noted that share repurchase programs should be executed in a price and need-sensitive manner, but “when the conditions are right, it should also be obvious to repurchase shares and there shouldn’t be the slightest taint to it any more than there is to dividends.” Yes, well, good luck with all that Warren because for the next 2 years, you can kiss buybacks goodbye from all companies except perhaps the FAAMGs.

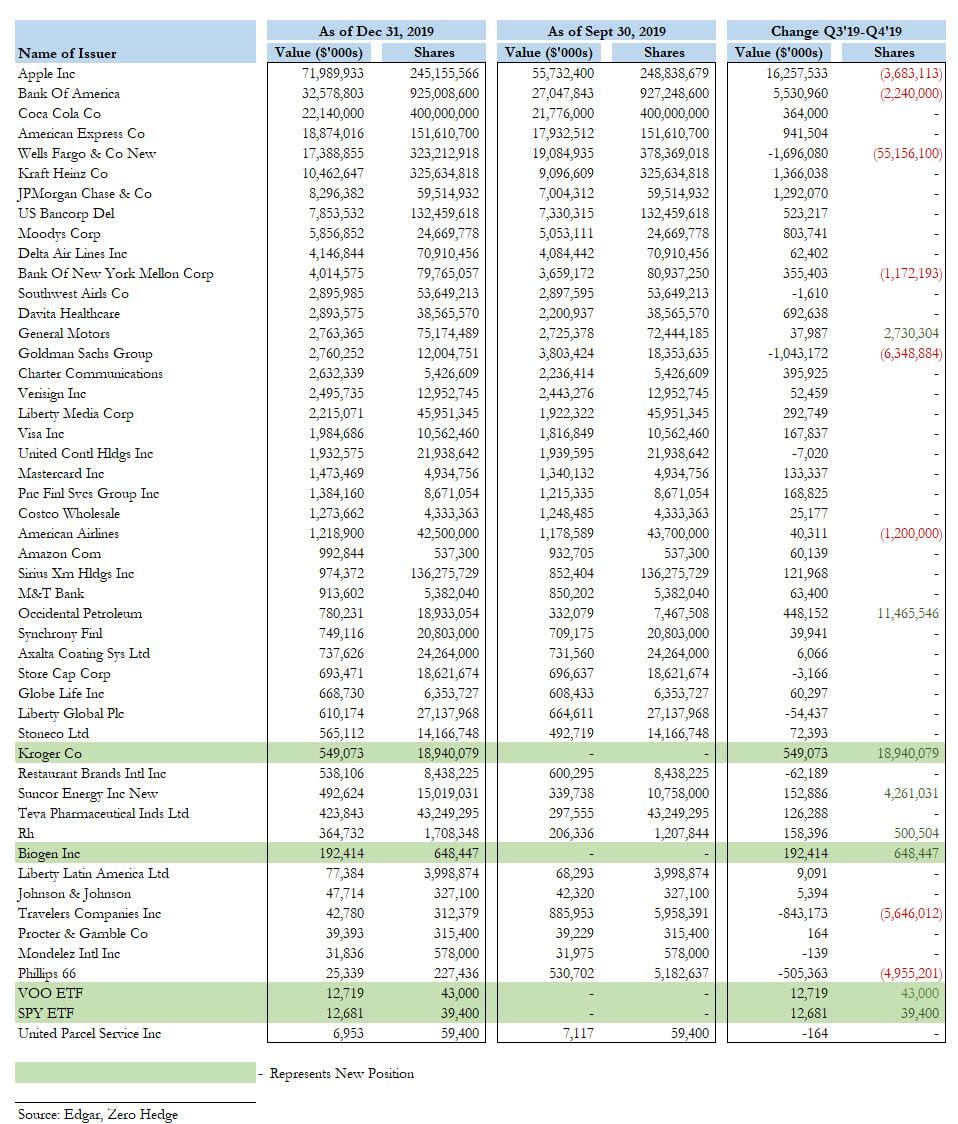

For those curious what Buffett will sell next, here is a full summary of Berkshire’s most recent equity holdings:

“If we like a business, we’re going to buy as much of it as we can and keep it as long as we can,” he added. “And when we change our mind we don’t take half measures.”

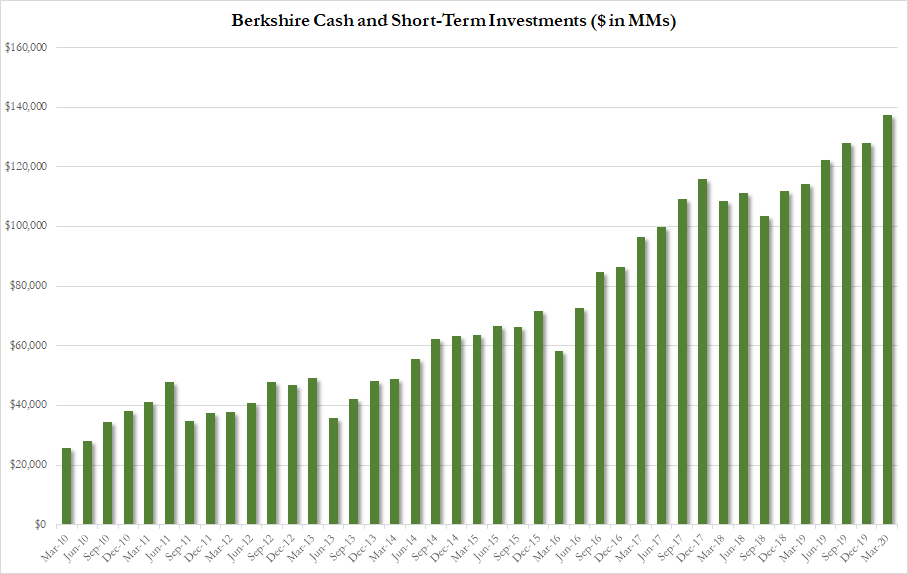

His comments Saturday afternoon came after Berkshire reported a $50 billion Q1 loss and only nibbled at equities during the violent stock market rout in March, mostly on his investment portfolio, even as the conglomerate’s cash stockpile rose to a record $137BN (more net cash than AAPL has) and up $10 billion from the $127 billion it reported at the end of 2019.

As we reported earlier, the company spent just $1.8 billion buying stocks and just $1.7 billion repurchasing Berkshire Hathaway shares during the first quarter of 2020, suggesting not only that Buffett could not find any of his hallmark bargain, value opportunities in the market sell-off, which took the S&P 500 down more than 30%, but that Buffett sees the current market rebound as nothing more than a dead cat bounce as he prepares to snap up the real bargains after the next crash.

peterpauldevries@peterpaul_vries

#WarrenBuffett sold $6.5 inequities in April 20, mostly Airlines and admits: “I was wrong” on the sector. He bought very little & didn’t buy back any shares in #BRKH. Meaning: #Buffett (a long term bull) is NOT very bullish on stocks right now! #berkshire2020 #BerkshireHathaway

625:45 PM – May 2, 2020Twitter Ads info and privacy24 people are talking about this

Explaining why he didn’t repurchase more Berkshire Hathaway shares during the sell-off in the first quarter, Buffett said: “the price has not been at a level where it really feels way better to us than other things, including the option value of money, to step up in a big way.” Which is a long way of saying it remains too expensive?

Receive a daily recap featuring a curated list of must-read stories.

Worse, explaining why he still hasn’t made a major acquisition despite the recent 35% drop in the market, the billionaire investor said “we have not done anything because we haven’t seen anything that attractive,” adding that “we are not doing anything big obviously. We are willing to do something very big. I mean you could come to me on Monday morning with something that involved $30, or $40 billion or $50 billion. And if we really like what we are seeing, we would do it.”

The fact that he hasn’t done it yet means one thing: Buffett, or rather the banks that advise the soon-to-be-90-year-old investor are convinced that a next leg lower in stocks is coming, and he should conserve his ‘dry powder’ for when it comes.

And what may be scariest for the bulls, is that in justifying his lack of buying, Buffett practically blamed the Fed, saying that “the Fed acted too quickly and too strongly for Berkshire to may any big deals right now.” Not only that, but even Buffett – whose entire fortune is the result of enjoying sequential bailouts from either governments or central banks time and again – appears to be becoming a measured Fed skeptic: “you can look at the Fed’s balance sheet and you will see some extraordinary changes there in the last 6 or 7 weeks. And we don’t know the consequences of that.” And while he adds that Powell took Draghi’s “whatever it takes squared… we are prepared at Berkshire that maybe the Fed will not have a chairman that acts like that” which explains Berkshire’s $137 billion in cash, which in other words is a hedge for when the Fed finally fails to prop up stocks.

Highlight: “We do know the consequences of doing nothing,” Warren Buffett says. “That would’ve been the tendency of the Fed many years past… We do never wanna be dependent on the not only the kindness of strangers but the kindness of friends.” #YFBuffett505:41 PM – May 2, 2020Twitter Ads info and privacy27 people are talking about this

Translation: according to none other than the most admired investor in the world, the Fed’s unprecedented bailout of capital markets has not only disconnected prices from fundamentals but has led to a market so overvalued that there are still no bargains despite the recent crash (and subsequent dead cat bounce).

We were all waiting for Buffett to buy preferred stock in the airlines or Boeing as he did in some banks in ‘08. He didn’t. Does it mean he thinks this crisis is far worse than the Great Recession and not easily reversible? My bet is absolutely yes.1,1278:45 PM – May 2, 2020Twitter Ads info and privacy416 people are talking about this

And now we prepare for the Monday bloodbath in the trannies, and perhaps across the entire market, as investors – notorious for being unable to think for themselves and always blindly following the actions of a 90-year-old man – furiously imitate what Berkshire has already done. And, if the bulls are unlucky, the selling could be the catalyst for the next major market drop… which would, of course, be delightfully ironic if Buffett’s own actions catalyze the crash that he hopes to benefit from and finally put his record cash hoard to use.

StevieRay Hansen

Editor, Bankster Crime

MY MISSION IS NOT TO CONVINCE YOU, ONLY TO INFORM YOU…

Fraud,Banks,Money,Corruption,Bankers

![]()