…We can’t rule out the possibility that, at some point in the next few years, our economy will slow, perhaps significantly. How would the Federal Reserve respond? What tools remain in the monetary toolbox?

By Ben Bernanke

First steps for easing policy

…Given where we are today, how would the Fed respond to a hypothetical economic slowdown?

- Presumably the central bank’s first response, after dropping any plans to raise rates further, would be to cut short-term interest rates, perhaps to zero.

- Unfortunately, with the fed funds rate (the Fed’s target short-term rate) now between ¼ and ½ percent, and likely to remain relatively low, moving to zero provides much less firepower than in the past…

- With the fed funds rate near zero, the FOMC could next turn to forward guidance, that is, to communicate to markets and the public about the Fed’s policy plans.

- If the Fed can convince market participants that short-term rates will stay low for some time, it can “talk down” longer-term rates, such as mortgage rates, which are typically more important to consumers, businesses, and investors…The evidence suggests that forward guidance can be quite powerful, and if the amount of extra policy support needed is not too great.

- The rate cuts plus guidance might be all that is needed but what if not? The Fed could resume quantitative easing (QE), that is, purchases of assets (typically longer-term assets) for the Fed’s portfolio, financed by the creation of reserves in the banking system.

- Like forward guidance, the goal of QE is to reduce longer-term interest rates to encourage borrowing and spending. It appears to work through at least two channels.

- First, the Fed’s purchases push up the price and (equivalently) push down the yield of the assets it buys. That effect is transmitted through the system as investors who sold the assets shift into others (such as stocks or corporate bonds).

- Second, the Fed’s asset purchases can help signal its intention to keep rates low for a long time…[but] the FOMC might be reluctant to turn to it again.

- Like forward guidance, the goal of QE is to reduce longer-term interest rates to encourage borrowing and spending. It appears to work through at least two channels.

…[Given the above,], the Fed might want to consider other options. Negative interest rates are one possibility.

| Below is a table that shows the current yields on government bonds in nations around the world. The darker the red, the more negative the yield. |

Negative interest rates: general considerations

In practice, this means that, instead of receiving interest on the reserves they hold with the central bank, banks are charged a fee on reserves above a threshold. The expectation is that to avoid the fee, banks will shift to other short-term assets, which drives down the yields on those assets as well, possibly to negative levels.

- Ultimately, the efforts of banks and other investors to avoid negative returns on the shortest-term assets should lead to declines in a broad range of longer-term interest rates, such as mortgage rates and the yields on corporate bonds (though, generally, we’d expect these longer-term rates to remain positive, because of the extra compensation that investors demand for bearing credit risk and for tying up their money for longer periods).

- By putting downward pressure on the interest rates most relevant to borrowing and spending decisions, the introduction of negative interest rates should work through the same channels as more standard monetary policies.

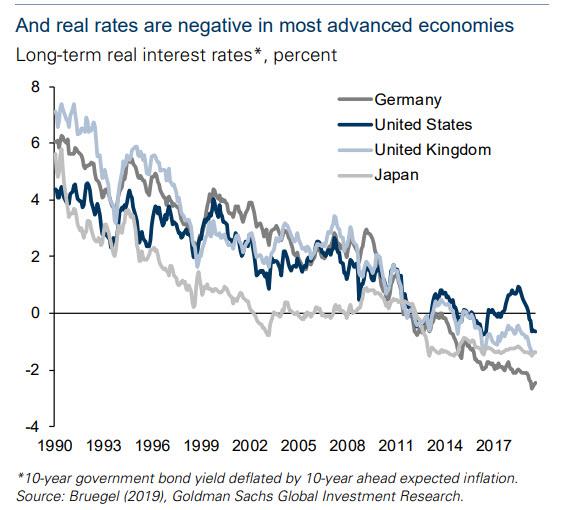

The idea of negative interest rates strikes many people as odd. Economists are less put off by it, perhaps because they are used to dealing with “real” (or inflation-adjusted) interest rates, which are often negative. Since the real interest rate is the sticker-price (nominal) interest rate minus inflation, it’s negative whenever inflation exceeds the nominal rate.

So far the Fed has had no need to implement a negative interest rate in order to ease policy:

- Until 2008, the nominal fed funds rate was always well above zero, so that ordinary interest rate cuts remained feasible when needed.

- Since late 2008, however, the fed funds rate has been barely above zero much of the time, so that achieving further reductions in the real fund’s rate would have required taking the nominal rate negative.

- In principle at least, how much extra pop could this policy have delivered? If during this period the Fed had decided (and been able) to lower the short-term nominal interest rate to, say, -0.5%, then it presumably could have achieved a real fed funds rate half a percentage point lower as well. The amount of extra stimulus generated by this further reduction in rates would not have been negligible by any means (roughly, it would have corresponded to two extra quarter-point rate cuts in more normal times), but neither would it likely have been a game-changer…

How negative?

The fundamental economic constraint on how negative interest rates can go is that, beyond a certain point, people will just choose to hold currency, which pays zero interest. It’s not convenient or safe for most people to hold large amounts of currency, but at a sufficiently negative interest rate, banks or other institutions could profit from holding cash, for a fee, on behalf of customers.

- Based on calculations of how much it would cost banks to store large quantities of currency in their vaults, the Fed staff concluded in 2010 that the interest rate paid on bank reserves in the U.S. could not practically be brought lower than about -0.35%.

- Moreover, for various reasons, the 0.35 percentage points would not be fully reflected as declines in other short-term and longer-term rates…[and, as such,] concluded that the monetary policy benefit of a negative rate would likely be small.

- Since 2010, however, several countries have implemented negative policy rates below the putative limit of -0.35% without triggering massive currency hoarding. For example, Switzerland’s policy rate is now at -0.75 percent, Sweden’s at -0.50 percent.

- [In addition,] negative rates have even spread to longer-term securities; in Germany, government debt carries a negative rate out to maturities of eight years.

The lack of currency hoarding in Europe is intriguing and suggests that the negative rates tool might be more powerful than thought. I’m skeptical, though, that U.S. rates could go as negative as in Switzerland or Sweden, at least not without causing significant disruptions to the functioning of some key financial markets and institutions [as discussed at length in the unedited ([ ]) or abridged (…) original article]. A general conundrum is that central banks need market participants to believe negative rates will be in place for a long time for there to be much effect on economically important long-term rates…If market participants believe that, they’ll have even more incentive to buy vault space and pay the other costs involved in hoarding cash….[For the effect of negative interest rates on:

- money market funds

- banks and their profits and

- some financial markets

please refer to the original article]

Conclusion on negative interest rates

The anxiety about negative interest rates seen recently in the media and in markets seems to me to be overdone.

- Logically, when short-term rates have been cut to zero, modestly negative rates seem a natural continuation; there is no clear discontinuity in the economic and financial effects of, say, a 0.1 percent interest rate and a -0.1 percent rate.

- Moreover, a negative interest rate on bank reserves does not imply that the most economically relevant rates, like mortgage rates or corporate borrowing rates, would be negative; in the US, they almost certainly would not be.

- Negative rates have some costs, in their effects on money market funds for example, but these ought to be manageable.

- On the other hand, the potential benefits of negative rates are limited, because rates that are too negative would trigger the hoarding of currency.

Although the European experience suggests that rates can be more negative than the Fed staff estimated in 2010, I don’t think U.S. rates could approach the extreme values seen in Switzerland or Sweden without becoming counterproductive.

Overall, as a tool of monetary policy, negative interest rates appear to have both modest benefits and manageable costs; and I assess the probability that this tool will be used in the U.S. as quite low for the foreseeable future. Nevertheless, it would probably be worthwhile for the Fed to conduct further analysis of this option.

We can imagine a hypothetical future situation in which the Fed has cut the fed funds rate to zero and used forward guidance to try to talk down longer-term interest rates…[yet] some additional accommodation is desired, but not enough to justify a new round of quantitative easing, with all its difficulties of calibration and communication. In that scenario, a policy of modestly negative interest rates might be a reasonable compromise between no action and rolling out the big QE gun.

By Ben Bernanke – The original article was edited ([ ]) and abridged (…) to provide a fast and easy read.

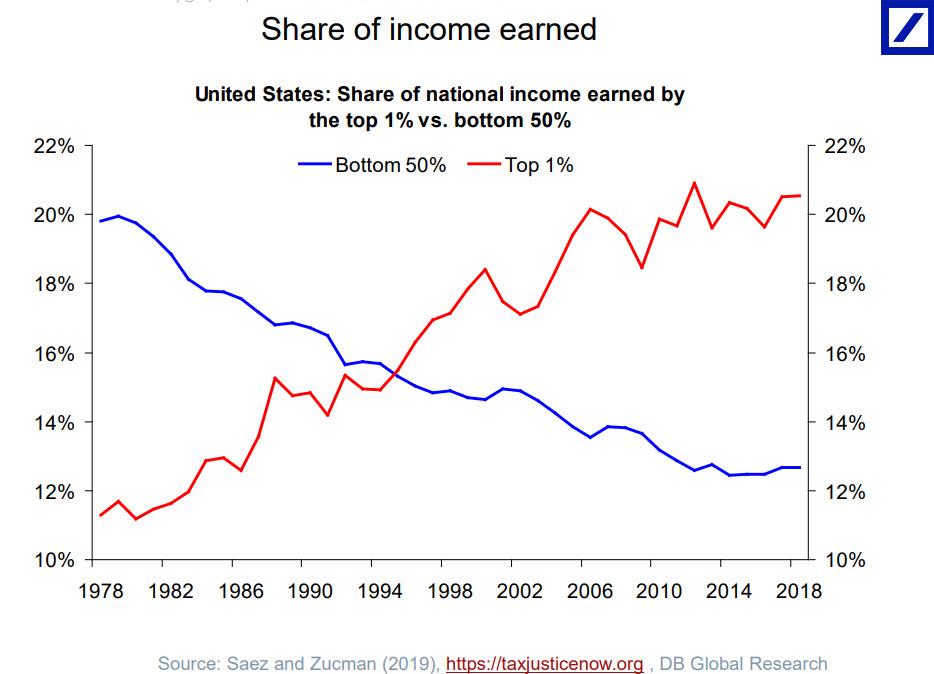

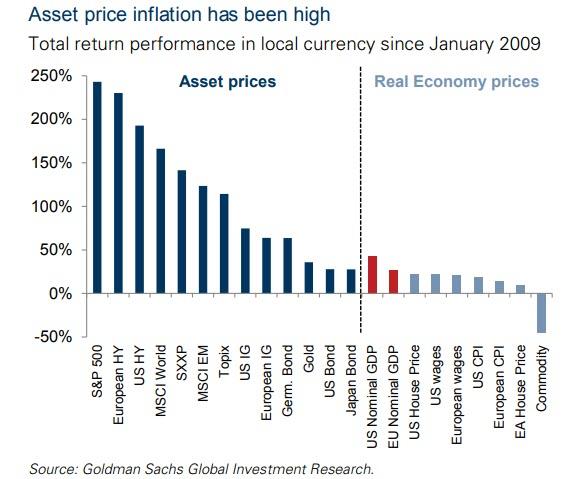

Nearly a decade after his now laughably idiotic prediction that the Fed could hike rates in “15 minutes if we have to” – which of course it could and it would then promptly crash markets as late 2018 showed which is also why the Fed will never be able to normalize monetary policy ever again – former Fed Chairman, who together with Alan Greenspan will be responsible for blowing the three biggest asset bubbles in history of which the current one may well be the last one as it will mark the end of central banking as we know it, Ben Bernanke delivered what he called “a relatively upbeat” assessment of the U.S. central bank’s ability to fight the next recession.

Ahead of his address to the American Economic Association’s annual meeting on Saturday, Bernanke wrote in a blog post that “the new policy tools are effective,” perhaps seeking to reassure himself and other central bankers rather than the population and commercial banks around the globe, which is reeling from an onslaught of populism in response to the historic wealth transfer programs initiated by central banks whose negative rate policies have brought the European financial sector to the edge of the abyss.

“Central bank purchases of longer-term financial assets, popularly known as quantitative easing or QE, have proved an effective tool for easing financial conditions and providing economic stimulus when short rates are at their lower bound. The effectiveness of QE does not depend on its being deployed during a period of market turbulence.”

“Quantitative easing and forward guidance can provide the equivalent of about 3 additional percentage points of short-term rate cuts.” By which he meant that the Fed, which is currently engaging in QE4, can boost markets to even recorded highs, at which point trickle down may finally happen… although it won’t, and instead the rich will get even richer as the US become an even greater Banana republics thanks to people like Bernanke.

9

While the Fed has limited room to cut short-term interest rates because they’re already so low – and negative across Europe and Japan – Bernanke argued that quantitative easing and forward guidance could provide enough extra punch to combat a future economic contraction.

Anticipating that the next market crash will test the central bank’s liquidity injecting skills (and reputation) like never before, Bernanke said the Fed should also consider adopting the same “tools” employed by other central banks, including purchases of private securities, negative interest rates, funding for lending programs, and yield curve control. More importantly, the man who in 2005 said on TV he did not think US housing could ever decline, urged the Fed against ruling out the possibility of pushing short-term interest rates below zero, a very clear hint of what awaits the US during the next recession.

“The Fed should also consider maintaining constructive ambiguity about the future use of negative short-term rates, both because situations could arise in which negative short-term rates would provide useful policy space; and because entirely ruling out negative short rates, by creating an effective floor for long-term rates as well, could limit the Fed’s future ability to reduce longer-term rates by QE or other means.”

And yes, Bernanke did also commend banks such as the ECB for purchasing corporate bonds, just so everyone is on the same page as to what happens when corporate bonds sporing record leverage, finally crater in the next recession.

Then there was an amusing tangent on helicopter money and MMT, which as Bernanke explained, has been going on for quite a while now: “the risk of capital losses on the Fed’s portfolio was never high, but in the event, over the past decade the Fed has remitted more than $800 billion in profits to the Treasury, triple the pre-crisis rate.”

Just in case it wasn’t clear why the Fed is a socialist’s best friend…

That said, no matter if the Fed has to buy equities first, or cut rates to, say, -10% and threaten to make all paper currency illegal in order to fight future market drops, pardon recessions, longer-term yields will probably spend extended periods of time at zero or below, according to Bernanke, now a Distinguished Fellow at the Brookings Institution in Washington, who appears to realize that reliance on the Fed’s monetary policy has pushed the entire world into a twilight zone of negative real rates, from which there is no escape, but at least forces even more disastrous monetary policy which makes the rich even richer, at least until the next civil war erupts and the poor masses retake what they believe is theirs.

There was one moment when the prevailing idiocy of Bernanke’s blog actually gave way to fact, namely when he admitted that pervasive negative rates pose risks to financial stability. “Monetary easing does work in part by increasing the propensity of investors and lenders to take risks,” Bernanke said, perhaps eyeing the fact that the Fed had no choice but to inject $100 billion per month in the last quarter of 2019 just to push stocks to new all time highs.

“Vigilance and appropriate policies, including macro-prudential and regulatory policies, are essential”, he added without a dose of sarcasm, perhaps hoping that none of those who read his steaming pile of dogshit were alive when he said that “subprime is contained.”

Bernanke was also kind enough to point out that the Fed’s grossly erroneous inflation metric will never be fixed to accurately capture true inflation, which is not just within the economy but also among asset prices. Because to the Fed, the latter is mysteriously a non-issue.

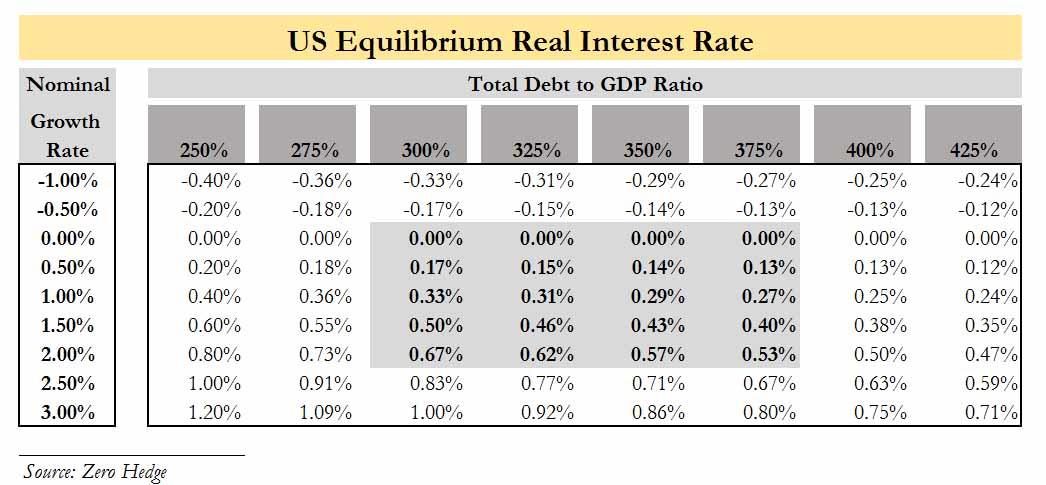

While Bernanke’s blog post was unfortunately devoid of any moments of factual or truthful insight unlike his oddly honest and accurate May 2014 prediction that “there would be no rate normalization” in his lifetime, Bernanke did admit that his entire monetary policy dogma is predicated on a crucial hypothesis: that the neutral level of short-term rates which neither spurs nor restricts economic growth is between 2% and 3%. According to Bernanke, if the equilibrium rate is much below that then QE and forward guidance won’t be sufficient to fight off a downturn. “In that case, other measures to increase policy space, including raising the inflation target, might be necessary,” he said.

Of course, as we first warned back in December 2015 when the Fed’s QT was just starting, the Fed’s balance sheet shrinkage would prove to be a giant mistake precisely because soaring US debt and slowing US growth meant precisely that: the equilibrium rate is now roughly zero.

Of course, four years later, we know that this was also spot-on: the Fed’s attempt to “normalize” rates resulted in the first and only mini bear market of the post-crisis era and the central bank had to quickly cut rates while launching “NOT QE.”

So besides negative rates and purchases of bonds, and eventually stocks, what does Bernanke believe will happen in the next downturn? His first policy prescription should come as no surprise: echoing virtually every other talking head over the past year, Bernanke said that fiscal policy may also have to play a more central role in countering a contraction. This is better known as the “it takes debt to undo the consequences of record debt and a debt crisis.” How it actually works out and leads to a happy ending is anyone’s guess.

That’s not all: going back to his famous November 2002 speech in which he first hinted at helicopter money, Bernanke said that central banks in Europe and Japan face even greater difficulties, largely because inflation expectations there have fallen too far. “In those jurisdictions, fiscal as well as a monetary policy may be needed to get inflation expectations up. If that can be done, then the monetary policy, augmented by the new policy tools, should regain much of its potency.”

Naturally, such a JV between fiscal and monetary policy, which is where the central bank officially monetizes the government’s debt, is also known as helicopter money, and it’s only a matter of time before it arrives.

In parting, Bernanke reminded everyone of the farce that defined his entire tenure, saying that unlike Volcker’s days, the problem is not that inflation is too high, “it’s the risk that it’s too low.”

“Low inflation can be dangerous,” Bernanke wrote in his blog. “Consistent with their declared ‘symmetric’ inflation targets, the Federal Reserve and other central banks should defend against inflation that is too low as least as vigorously as they resist inflation that is modestly too high.”

While we would challenge Bernanke (or his acolyte Neel Kashkari) to show up at anywhere in public and tell the struggling consumers drowning in credit card debt that inflation is not too high, it is in fact too low, we know this will never happen, and instead, we urge the former Fed Chair to highlight to us which asset class he deems as having “too low” inflation ever since he launched QE1… and QE2… and QE3. Source ZeroHedge

StevieRay Hansen

Editor, Bankster Crime

MY MISSION IS NOT TO CONVINCE YOU, ONLY TO INFORM…

“Have I therefore become your enemy by telling you the truth?”

Tagged Under: fed, easing policy , #Fraud #Banks #Money #Corruption #Bankers

![]()