HNewsWire:

By Pam Martens and Russ Martens: June20, 2023

Ever since 11 banks on March 16 donned the garb of heroic fire fighters, rushing to extinguish an inferno at a competitor bank before it spread further, we have been asking ourselves the question – why just this group of 11 banks.

We’re talking about the action on March 16 when 11 banks chipped in a total of $30 billion and bizarrely placed those funds as uninsured deposits into First Republic Bank – which was in full scale unraveling mode because of bond losses and – wait for it – too many uninsured deposits. Four banks contributed two-thirds of the total deposits with JPMorgan Chase, Bank of America, Citigroup and Wells Fargo ponying up $5 billion each. Morgan Stanley and Goldman Sachs deposited $2.5 billion each; while BNY Mellon, State Street, PNC Bank, Truist and U.S. Bank each deposited $1 billion, together making up the other one-third of the $30 billion.

According to the Federal Deposit Insurance Corporation, as of December 31, 2022 there were 4,706 federally-insured commercial banks and savings associations in the U.S. The 11 banks rushing to “rescue” First Republic Bank represent less than a fraction of one percent of the total banks.

Banking in the U.S. is not particularly regarded as an altruistic industry. In fact, it frequently resembles a blood sport. So why this uncanny display of generosity to a competitor and why were just these 11 banks involved?

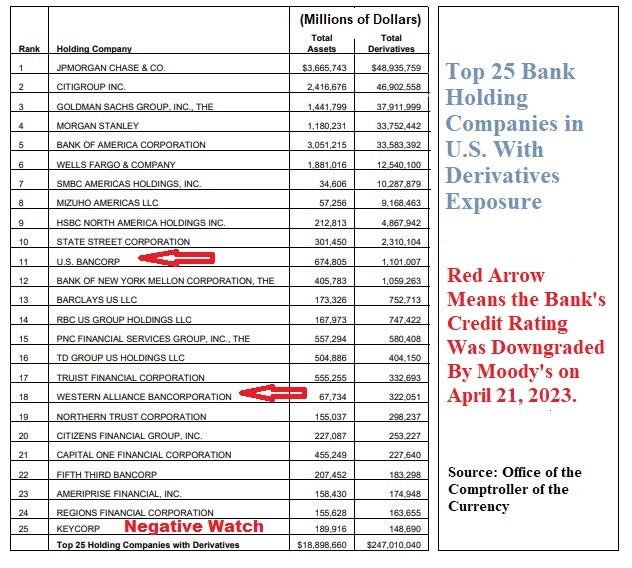

Yesterday, we had an epiphany. We pulled up the most recent table from the Office of the Comptroller of the Currency showing the 25 bank holding companies that have the largest exposure to derivatives. Sure enough, each of those 11 banks is on the list. (See page 19 at this link.) The data is as of December 31, 2022.

Equally noteworthy, the four banks that chipped in the giant sums of $5 billion each, control 58 percent of the total $247 trillion notional (face amount) in derivatives controlled by all 25 banks.

And if that wasn’t already plenty to raise one’s blood pressure, for many of these banks the dollar amount of derivatives is exponentially more than the total assets of the bank holding company. For example, SMBC Americas Holdings, Inc. has $34.6 billion in assets and $10.3 trillion in derivatives. (You can’t make this stuff up.)

It also caught our eye that three of the 25 banks on this list had their credit ratings impacted by the big action taken by Moody’s on April 21 when it downgraded the credit ratings of 11 banks on that date and put five more on negative watch. (See chart below.)

So let’s look back a little further at what was going on in terms of credit ratings during the two days just preceding that $30 billion display of goodwill toward First Republic Bank.

On Monday, March 13, Moody’s downgraded the entire U.S. banking system outlook to negative from stable. On that same date, a bank with ties to crypto customers, Metropolitan Commercial Bank, lost 44 percent of its market value and a California regional bank, Western Alliance Bancorp, lost 47 percent of its market value. By Wednesday morning, March 15, Dow futures were down more than 600 points just after 8:00 a.m. in New York; major banks in Europe had been temporarily halted from trading after steep selloffs; and Credit Suisse, with deep interconnections to the mega banks on Wall Street, had plunged to less than 2 bucks.

Also, on March 15, the Wall Street Journal ran this subhead: “JPMorgan, Bank of America, Citigroup and Wells Fargo have lost about $91 billion in market value over the past week,” indicating that the contagion had spread to the biggest banks.

To put it succinctly, the actions of those big derivative banks on March 16 might have had a lot more to do with white knuckles over the potential for this contagion to focus on the big derivative counterparty banks than a warm and fuzzy feeling toward First Republic Bank.

Bookmark the permalink.

![]()