If there is one constant during earnings season, it is that no matter what the other banks do, Wells Fargo will always shit the bed, and this time was no different, with the stock sliding after reporting that Q3 earnings missed again as its Net Interest Margin dropped to a fresh all time low, while issuing an ominous warning that customer payment deferrals in the wake of the pandemic may delay the recognition of net charge-offs and delinquencies.

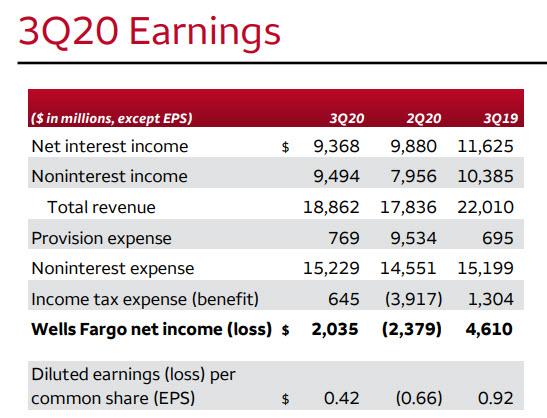

Wells reported Q3 EPS of just $0.42, down more than 50% from the 0.92 a year ago, and missing expectations of $0.45 even as Revenue of $18.862BN beat estimates of $18.0BN, but plunged 14% from $22BN a year ago. The bank reported Q3 net income of $2 billion, which was up $4.4 billion from the previous quarter, but down 56% from $4.6BN a year ago, on “lower provision expense and higher non-interest income on broad-based growth including higher mortgage banking income, partially offset by lower net interest income and higher noninterest expense, which included restructuring charges.”

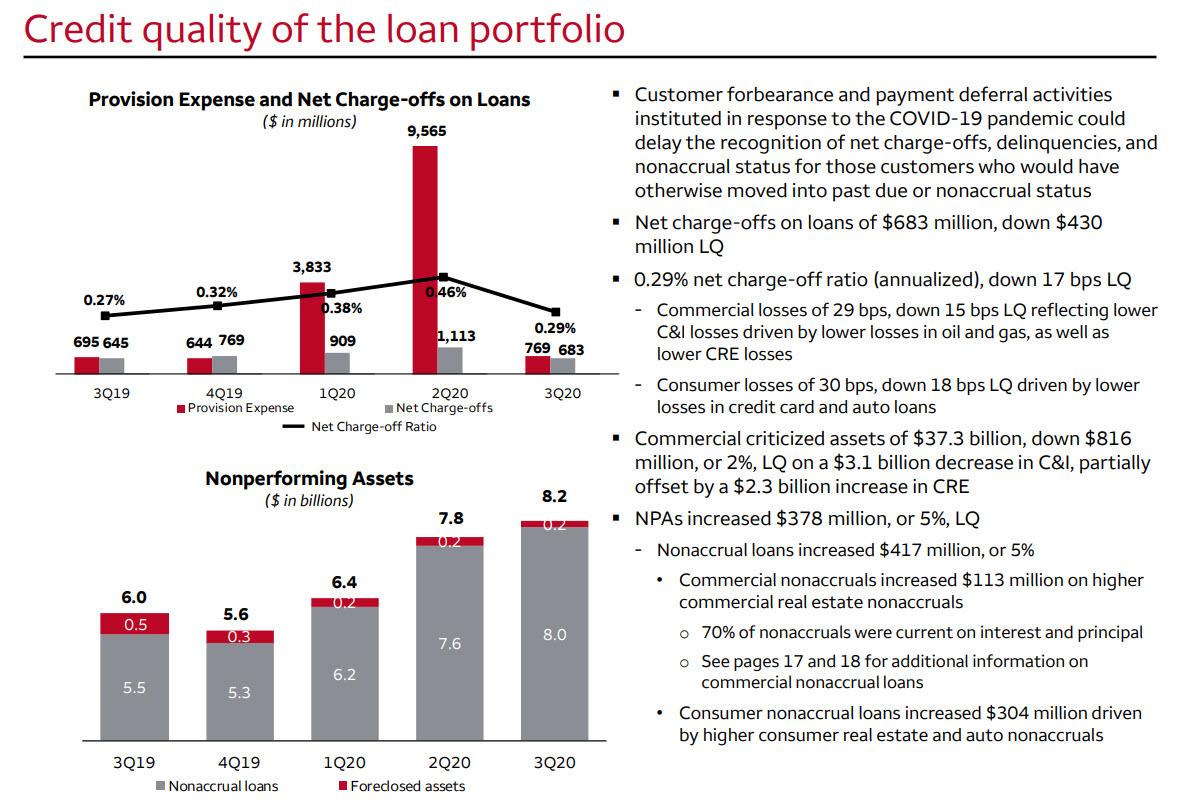

The bank missed EPS even though – like all the other banks – it set aside only $769MM in loan-loss provisions, far less than the $1.65BN expected, and charged off just $683MM (up 5.9% Y/Y, but down $430MM from Q2), also below the $1.38BN expected. Non-performing assets increased again, rising by $378 million, or 5%, to $8.2 billion, of which $417MM was due to an increase in nonaccrual loans at $8BN. Commercial nonaccruals increased $113 million “on higher commercial real estate nonaccruals” while consumer nonaccrual loans increased $304 million driven by higher consumer real estate and auto nonaccruals.

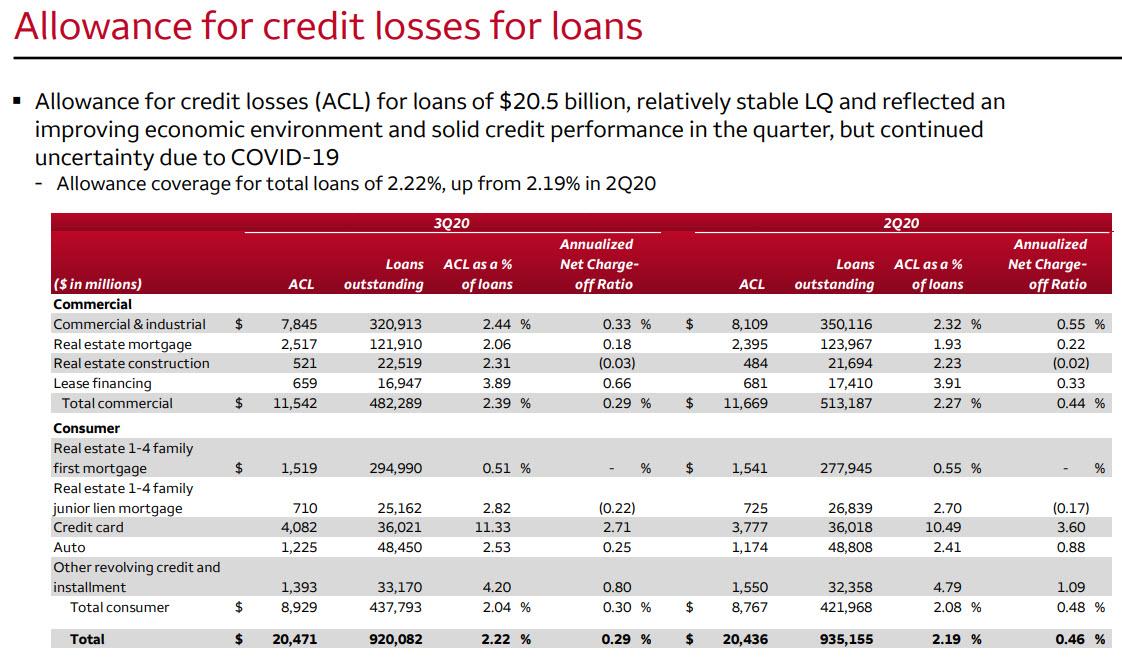

Wells also said that the net charge-off ratio of 0.29% was down 17 bps from Q2, as commercial losses of 29 bps, were down 15 bps “reflecting lower C&I losses driven by lower losses in oil and gas, as well as lower CRE losses” while “consumer losses of 30 bps, down 18 bps LQ driven by lower losses in credit card and auto loans.”

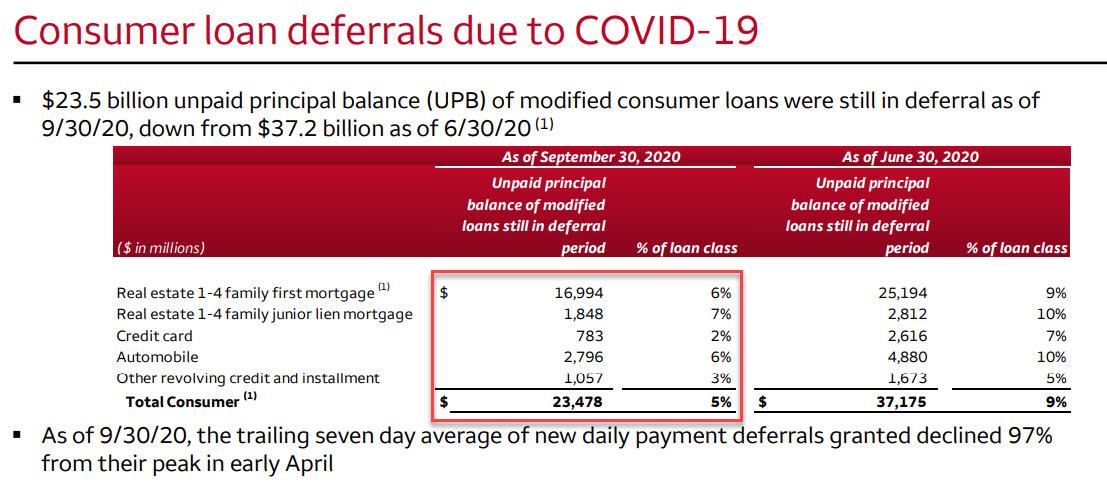

Expect these numbers to get far worse, as the bank implicit admitted when it warned that “customer forbearance and payment deferral activities instituted in response to the COVID-19 pandemic could delay the recognition of net charge-offs, delinquencies, and nonaccrual status for those customers who would have otherwise moved into past due or nonaccrual status.“

Specifically, Wells revealed that $23.5 billion in unpaid principal balance of modified consumer loans were still in deferral as of 9/30/20, which while down from $37.2 billion as of 6/30/20, suggests that the charge-offs could get far worse especially since those who remain in forbearance are unlikely to revert to non-deferral.

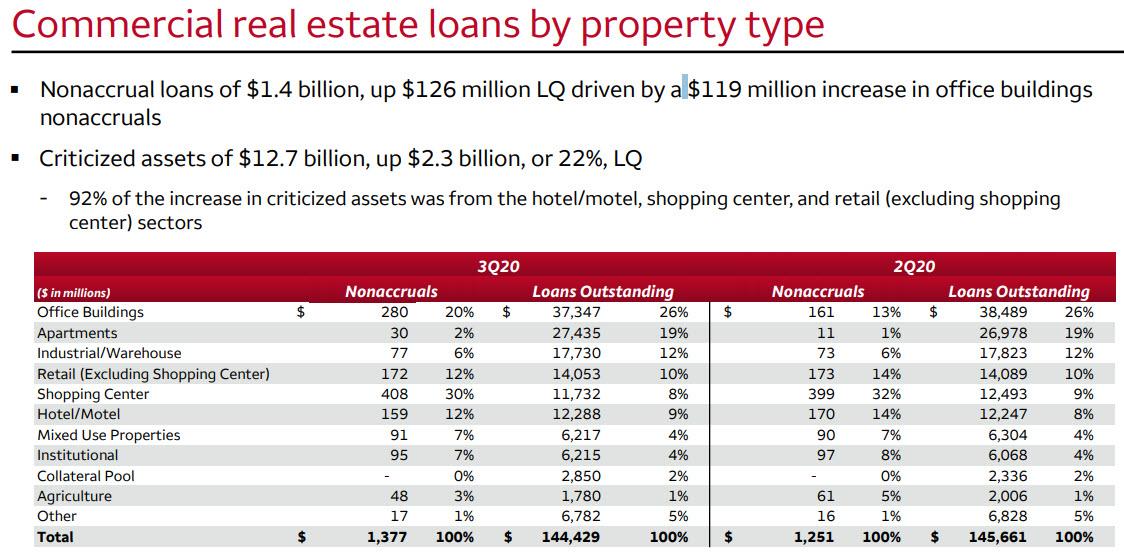

Wells Fargo was also kind enough to break out its exposure of loans by type, starting with CRE, where nonaccrual loans of $1.4 billion, rose by $126 million driven by a $119 million increase in office buildings nonaccruals as criticized assets of $12.7 billion, rose $2.3 billion, or 22%…

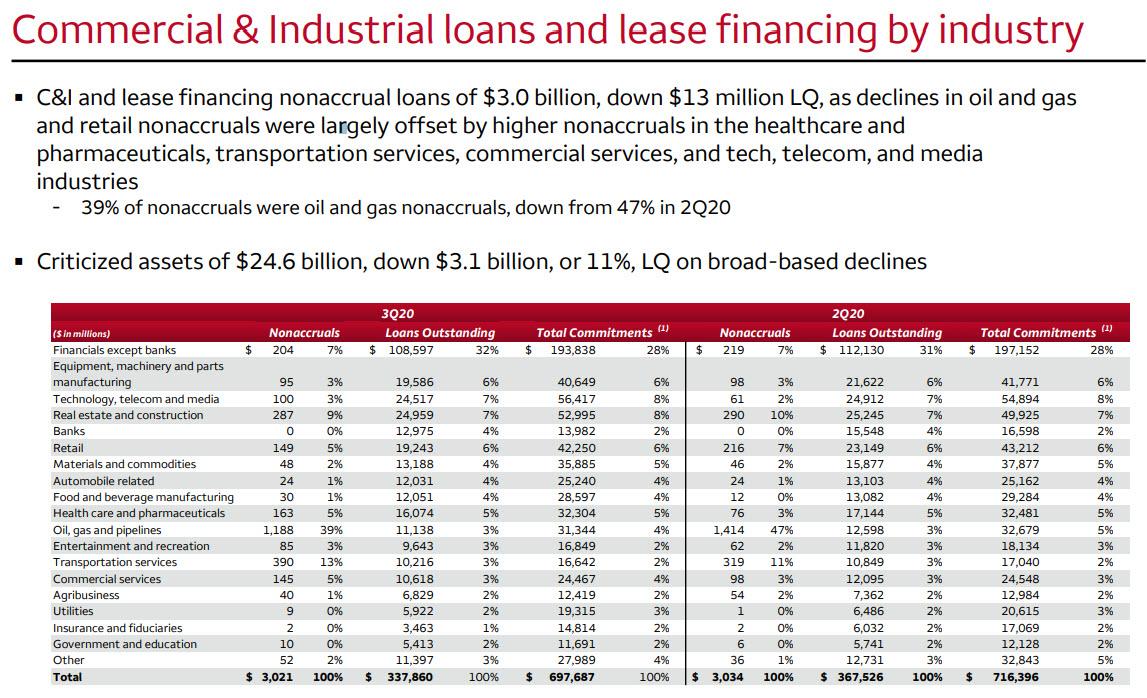

… while C&I and lease financing nonaccrual loans of $3.0 billion, were down $13 million Q/Q as declines in oil and gas and retail nonaccruals (39% of nonaccruals were oil and gas nonaccruals, down from 47% in 2Q20) were largely offset by higher nonaccruals in the healthcare and pharmaceuticals, transportation services, commercial services, and tech, telecom, and media industries. Total C&I criticized assets of $24.6 billion, were down $3.1 billion.

In total, Wells’ allowance for credit losses (ACL) for loans was $20.5 billion, unchanged from last quarter, and “reflected an improving economic environment and solid credit performance in the quarter, but continued uncertainty due to COVID-19.” On a percentage basis, the allowance coverage for total loans was 2.22%, up from 2.19% in 2Q20, due to a decline in total loans.

In short, Wells’ headaches on its massive loan book are nowhere near over.

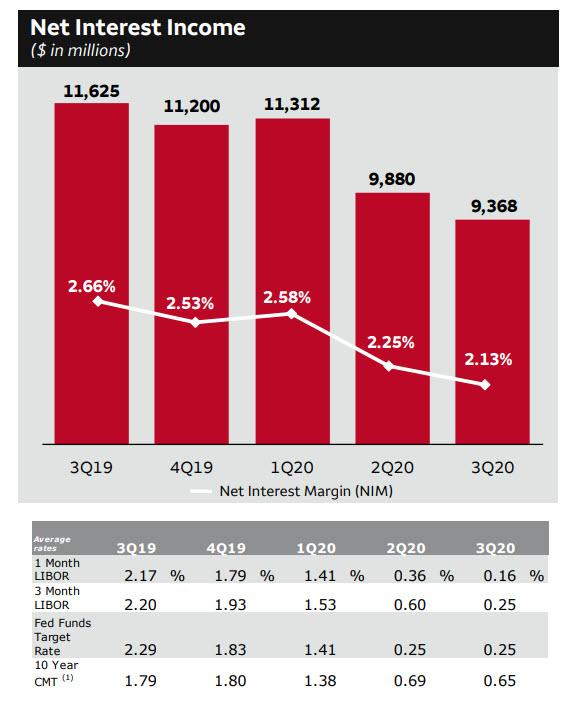

And unfortunately, this was visible in its Net Interest Income, which plunged by 19% Y/Y, or $2.3 billion, to just $9.4BN, missing expectations of $9.6BBN, and “reflecting the lower interest rate environment.” Net interest income also decreased $512 million, or 5%, Q/Q “reflecting balance sheet repricing resulting from the lower interest rate environment, balance sheet mix shifts into lower yielding earning assets including the impact of lower commercial loans.”

And, as expected at a time of record low rates, Wells’ Net Interest Margin tumbled to a new all time lows of 2.13%, down 12bps Q/Q, and missing the estimate of 2.19% due to i) (11) bps from balance sheet repricing and mix; ii) (3) bps from MBS premium amortization; iii) (1) bp from hedge ineffectiveness accounting results; and iv) 3 bps from variable sources of income.

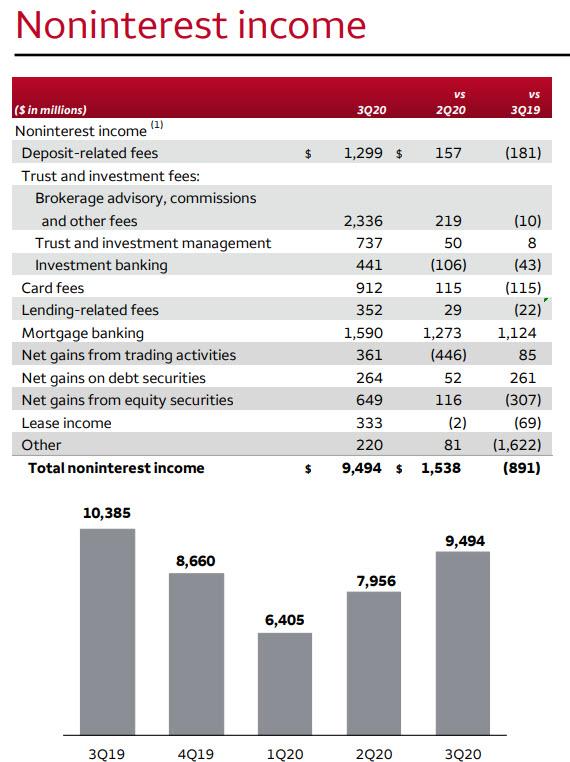

Noninterest income was slightly better, rising $1.5BN Q/Q but down nearly $900MM Y/Y, due to the following:

- Deposit-related fees up $157 million, or 14%, Q/Q on higher transaction volumes, one additional day in the quarter, and higher treasury management fees; Consumer was 56% and commercial was 44% of total

- Trust and investment fees up $163 million, or 5%, Q/Q on brokerage advisory, commissions and other fees up $219 million on higher retail brokerage advisory fees (priced at the beginning of the quarter); Trust and investment management fees up $50 million on higher asset-based fees; Investment banking fees down $106 million from record 2Q20 investment grade results.

- Card fees up $115 million, or 14%, Q/Q on higher interchange income driven by higher debit and credit card POS volumes

- Mortgage banking up $1.3 billion Q/Q as net gains on mortgage loan originations were up $243 million and included higher origination volumes and a higher gain on sale margin, while Servicing income was up $1.0 billion from a 2Q20 that included negative market-related MSR valuation changes.

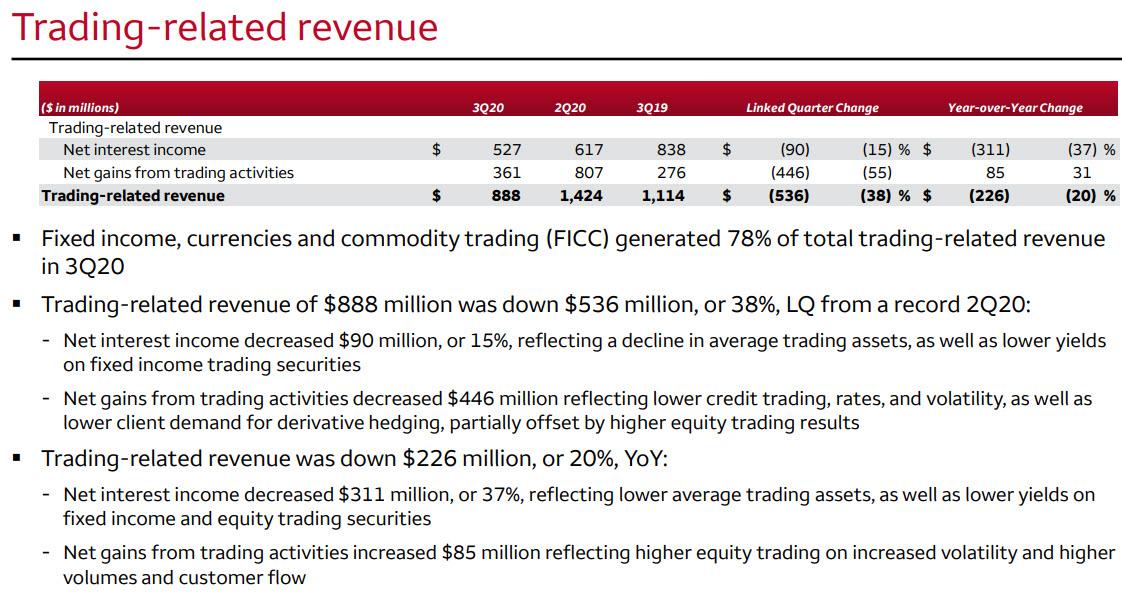

One remarkable – and recurring – aspect of Wells’ revenues is just how poor its sales and trading performs compared to other banks. Perhaps Wells should hire the 50 best Robinhood traders to beef it up? Here are the details:

- Fixed income, currencies and commodity trading (FICC) generated 78% of total trading-related revenue in 3Q20;

- Trading-related revenue of $888 million was down $536 million, or 38%, Q/Q from a record 2Q20: Net interest income decreased $90 million, or 15%, reflecting a decline in average trading assets, as well as lower yields on fixed income trading securities; Net gains from trading activities decreased $446 million reflecting lower credit trading, rates, and volatility, as well as lower client demand for derivative hedging, partially offset by higher equity trading results

- Trading-related revenue was down $226 million, or 20%, YoY: Net interest income decreased $311 million, or 37%, reflecting lower average trading assets, as well as lower yields on fixed income and equity trading securities; Net gains from trading activities increased $85 million reflecting higher equity trading on increased volatility and higher volumes and customer flow.

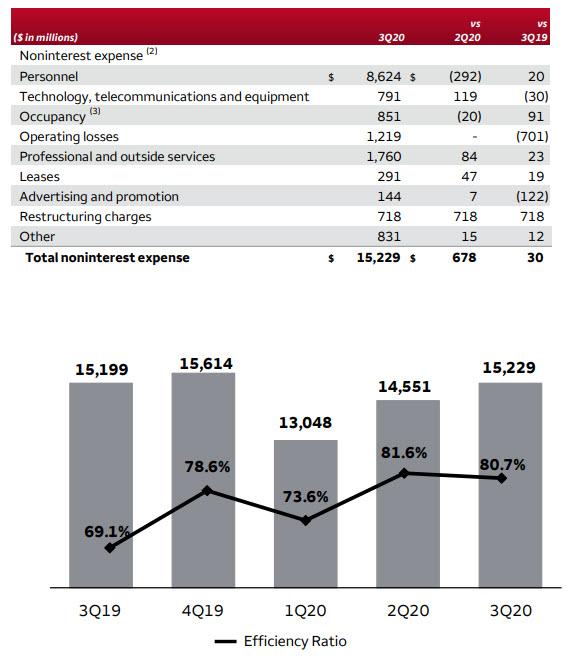

Away from revenues, the bank posted a surprise increase in third-quarter expenses which rose by $30MM Y/Y even as total revenues tumbles, as it set aside $961 million for customer remediation and $718 million in restructuring charges. That countered the abovementioned sharp drop loan-loss provisions that came in at less than half what analysts had expected. Some more details:

- Personnel expense down $292 million and included: i) $344 million lower deferred compensation expense; ii) $163 million decline in expenses in response to COVID-19 from a 2Q20 that included bonus payments and premium pay for certain customer-facing and support employees, as well as child care services benefits; iii) Higher salaries expense driven by one additional day in the quarter, and higher revenue-based incentive compensation.

- Technology, telecommunications and equipment expense up $119 million from a 2Q20 that included the reversal of an accrual for software expense.

- Operating losses remained at an elevated level and included $961 million of customer remediation accruals for a variety of matters reflecting expansion of populations, time periods, and/or amount of reimbursement

- Restructuring charges of $718 million, predominantly severance expense associated with expense reduction initiatives

As Bloomberg notes, in his first year atop Wells Fargo, CEO Charlie Scharf has been working to move the firm past a series of scandals. He’s tasked with making harmed customers whole, repairing relations in Washington and improving the firm’s earnings. He’s repeatedly lamented the firm’s high costs, pledging to ultimately shave $10 billion off annual expenses.

Quarterly results “reflect the impact of aggressive monetary and fiscal stimulus on the U.S. economy,” and were helped by “strong mortgage banking fees, higher equity markets, and declining sequential charge-offs,” CEO Charlie Scharf said in the bank’s statement. At the same time, “historically low interest rates reduced our net interest income and our expenses continued to remain elevated.”

- 15 Most Recent Bank Failures

- The US Bank Regulator Is Mulling Legal Action Against Former SVB Executives

- Donald Trump’s Treasury Nominee Made Big Bets this Year on Chinese Stocks and a Big Short on the U.S. Market

- Matt Gaetz Case Has Echoes of the Justice Department’s Failure to Prosecute Jeffrey Epstein’s Sex-Trafficking Ring

- (no title)

“The trajectory of the economic recovery remains unclear as the negative impact of Covid continues and further fiscal stimulus is uncertain.” He added that Wells Fargo’s “top priority continues to be the implementation of our risk, control, and regulatory work”, as he clearly wants to avoid any more trips for Wells Fargo to the Capitol.

Receive a daily recap featuring a curated list of must-read stories.

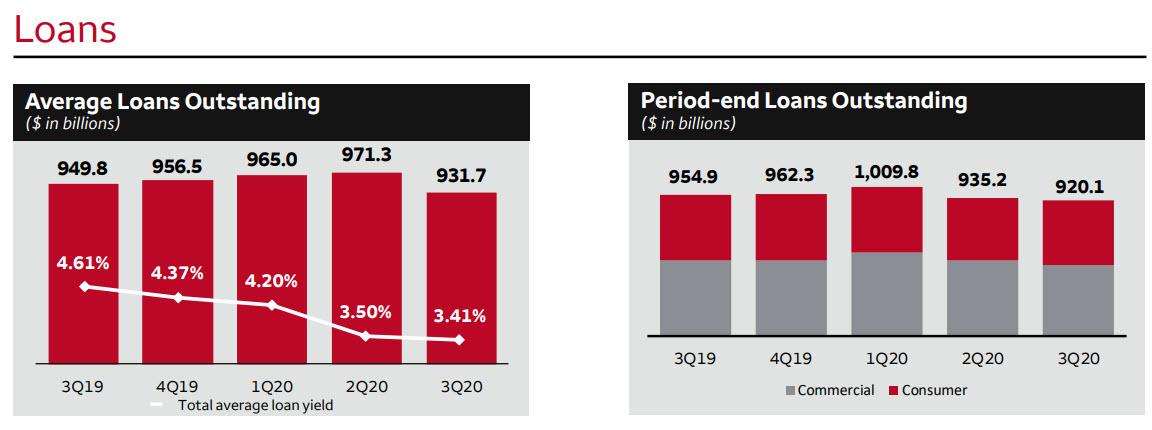

Finally, and perhaps the last nail in the coffin, Wells period-end loans continued to shrink, tumbling to $920.1 billion, down 4% or $34.8 billion year-over-year (YoY) “driven by lower commercial and industrial loans”…

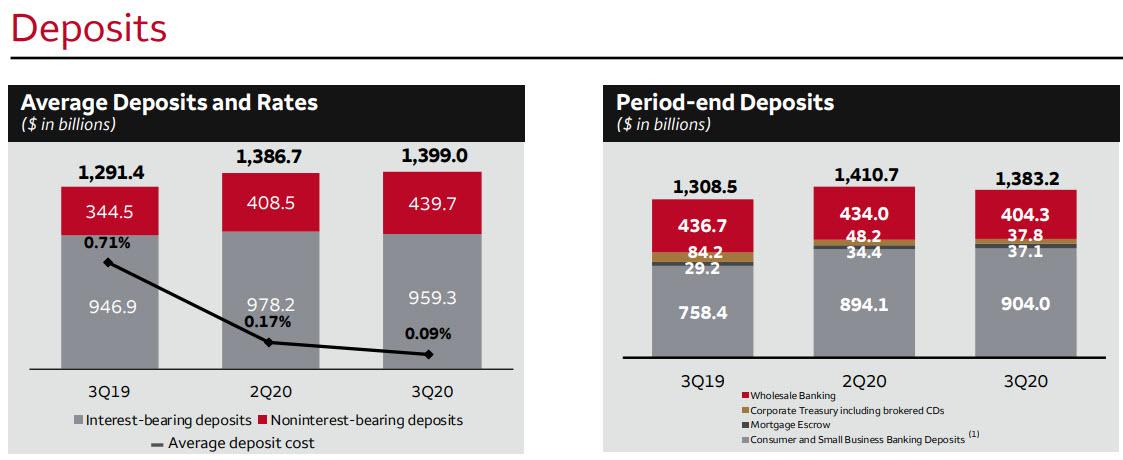

… meanwhile as we noted yesterday, deposits across the banking sector continued to rise, and hit $1.4TN on an average basis (if declining slightly to $1.383TN on a period end-basis largely due to a decline in Wholesale Banking deposits of $29.7 billion, or 7%,

due to actions taken to manage under the Asset Cap) due to an increase in consumer and small business banking deposits “reflecting customers’ preferences for liquidity due to COVID-19.”

Not surprising after all this, the stock was sharply lower on the latest dismal earnings report by Wells. Wells shares have plunged 54% so far in 2020, worse than the 31% drop in the KBW Bank Index.

The full Wells earnings report is below (pdf link)

Third Quarter 2020 Earnings… by Zerohedge

Source: ZeroHedge

StevieRay Hansen

Editor, BankstersCrime

God often uses men who are not of the best moral character. Pharaoh, Nebuchadnezzar, Cyrus, Herod, and Trump (amongst others), to accomplish His will in events He orchestrates during human history. We either trust the sovereignty of God or we don’t. Nothing happens apart from Him…

The best index to a person’s character is how he treats people who can’t do him any good, and how he treats people who can’t fight back…

The Birth Pains Are Growing Stronger….

One of the signs of ruling class collapse is when they can no longer enforce the rules that maintain them as a ruling class. When the Romans started making exceptions to republican governance, it was a matter of time before someone simply decided the rules no longer applied to them. Perhaps the robot historians will consider Obama our Marius or Sulla. Maybe that person is in the near future. Either way, the rule of law is over and what comes next is the rule of men.

“Don’t piss down my back and tell me it’s raining.” Outlaw Josey Wales

WE NOW LIVE IN A WORLD THAT IS PURE FABRICATION

![]()