The Bankster’s hate bad press (lucky for them they own most of the mainstream media), so the situation was quickly rectified. This is but one of countless untold stories of a similar nature; and they all have one common thread among them. To the Banksters, humans are only good for profit, and once the profit is sucked out of us, we’re crushed and discarded like an empty can of Keystone Light.

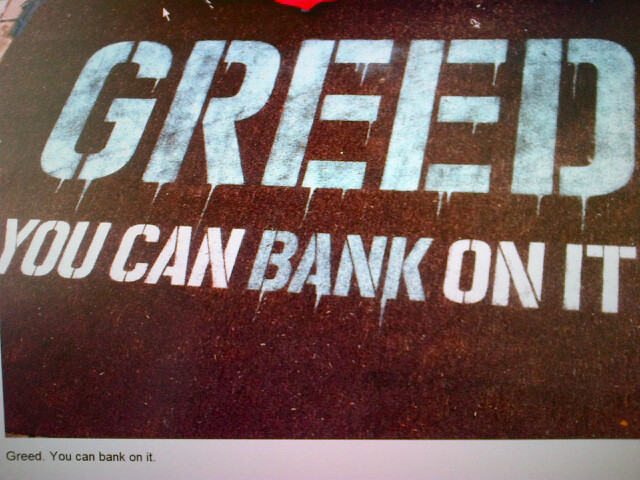

Greed and a desire for riches are traps that bring ruin and destruction. “The love of money is a root of all kinds of evil,” and Christians are warned, “Do not put your trust in wealth” (see 1 Timothy 6:9-10, 17-18). Covetousness, or having an excessive or greedy desire for more, is idolatry. Ephesians 5:5 says, “For of this you can be sure: No immoral, impure or greedy person – such a man is an idolater – has any inheritance in the kingdom of Christ and of God.” The principle to remember is contained in Hebrews 13:5: “Keep your lives free from the love of money and be content with what you have, because God has said, ‘Never will I leave you; never will I forsake you.’”

HNewsWire-“Bankster” has several other related terms:the New World Order (NWO) is yet another term similar to Bankster, Globalist, Collectivist, Technocrat, Monopoly Man, Evil Elitist Self-Centered Narcissists Hypocrites.

HNewsWire-“Bankster” has several other related terms:the New World Order (NWO) is yet another term similar to Bankster, Globalist, Collectivist, Technocrat, Monopoly Man, Evil Elitist Self-Centered Narcissists Hypocrites,If you take the time(and most consumers do not)to read their one-sided contracts,you’ll soon realize the bankstir are in complete charge and can make your life a living hell with the stroke of the pen, they can move your interest rate by simply informing you, it’s called an adjustable interest rate and the bank use this willy-nilly, if you don’t cooperate the bankster will just call the note, it’s called accelerating the note, don’t worry it’s all in the contract and perfectly legal, what they depend on is that the consumer does not carry a lawyer around in their pockets to read and understand the bankster complicated language within their standard contracts, or if you prefer- loan documents…

A Biblical Perspective Of The Brankster: A Sadducee Wrapped In A Pharisees Loincloth, A Nasty Greedy Self-Serving Corporation Or Individuals, How Does It Feel To Be Unequally Yoked With The Ungodly…

“I care not what puppet is placed upon the throne of England to rule the Empire on which the sun never sets. The man that controls Britain’s money supply controls the British Empire, and I control the British money supply”

– Baron Nathan Mayer Rothschild

“If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and the corporations which grow up around them will deprive the people of all property until their children wake up homeless on the continent their fathers conquered”

– Thomas Jefferson

” I have two great enemies, the Southern Army in front of me and the bankers in the rear. Of the two, the one at my rear is my greatest foe”

– Abraham Lincoln

“It is well enough that people of the nation do not understand our banking and monetary system; for if they did, I believe there would be a revolution before tomorrow morning”

– Henry Ford

For the most part our local banking community operates in the shadows of the mega banking cartels. In other words your small town banker has learned from the big brother mega banking cartels on how to use trickery and reassuring words that they are honest and care about their customers…

The elite of the world use [debt as a tool of enslavement]( The elite of the world use debt as a tool of enslavement, and central banking has allowed them to literally enslave the entire planet.)

Come now, you rich men, weep and howl for your miseries that shall come upon you. 2 Your riches are corrupted and your garments are moth-eaten. 3 Your gold and silver are corroded, and their corrosion will be a witness against you and will eat your flesh like fire. You have stored up treasures for the last days. 4 Indeed the wages that you kept back by fraud from the laborers who harvested your fields are crying, and the cries of those who harvested have entered into the ears of the Lord of Hosts. 5 You have lived in pleasure on the earth and have been wayward. You have nourished your hearts as in a day of slaughter.

So much of the time we focus on the other great sins that we see all around us, but the truth is that one of the greatest sins of all in our world today is the sin of greed.

Here’s some facts about Our honest bankster:

Take the collapse of Bear Stearns as a simple, recent instance of JP Morgan ‘luckily’ being at the right place at the right time. At the height of the real estate Ponzi-scheme, on January 17th, 2007, Bear Stearns’ closing price was $169.33 per share. A little more than a year later, their stock had lost half of its value, closing at $85.88 on February 27th, 2008. This was just the build-up; financial collapses always pick up momentum and ferocity, and in March of that year, facing collapse, Bear Stearns sold out to JP Morgan at $10 per share. Don’t forget the little tidbit about the initial price being $2 per share…but not even the Banksters thought they could get away with that level of plunder, so they ended up raising their bid. That’s a pretty good deal if you ask me, especially considering that the ill-effects of any toxic assets on Bear Stearn’s balance sheet would be wholly negated by the Federal Reserve and US Treasury through various forms of stimulus, ‘quantitative easing’, and banker bailouts.

I’m also a fan of the Washington Mutual acquisition, where JP Morgan paid $2.6 Billion for the bank (which had $327 Billion in assets)…not bad at all. I’m particularly keen on the fact that the CEO of WaMu ended up receiving his full $7.5 million signing bonus in addition to his $11.6 million golden parachute…all after 17 days on the job. Seriously, that’s pretty impressive, all in all it comes out to $46,813.73 per hour assuming a 24-hour workday and no weekends…not too shabby! Heck, JP Morgan even got some tax benefits for that purchase, that’s some slick accounting alright. To cut to the Chase (ha), JP Morgan is probably the most elite of the MegaBanks; it doesn’t have to get its hands too dirty, and it usually gets first dibs on the loot.

All you need to do is do some rudimentary research and you’ll see that JP Morgan has had a long history of working behind the scenes with the centers of power. It has been a chief financier of every war since World War I, when it established itself as the sole underwriter of war bonds for the United Kingdom in France. Who knows what type of cash flow the wars in Iraq, Afghanistan, and Libya are producing for this global banking conglomerate.

In addition to financing war, the bank (along with its former investment arm Morgan Stanley) is a primary dealer of US Treasuries to the private Federal Reserve. In layman’s terms, a company that is a primary dealer to the Fed has massive influence on monetary policy, which in turn can be used in a way similar to knowledge of inside information. Taking a quick look at some of the alumni of JP Morgan gives a great portrait of the power and influence the bank has throughout the world. This laundry list of Bankster alumni include former UK Prime Minister Tony Blair as well as former US Secretary of State George Shultz, who also served two years as the Treasury Secretary. Of more recent note, William M. Daley, youngest child of former Chicago Mayor Richard J. Daley, and brother to former Chicago Mayor Richard M. Daley, is the White House Chief of Staff in the Obama Administration. That’s change you can believe in.

Goldman Sachs

Everyone knows Goldman Sachs, and pretty much everyone hates them. Back when I was a kid in high school and college I always thought people were just hating on the big banks because they were jealous of their size and success. Then again, back then I was also proud to pay my taxes because I felt that my money would be used wisely to improve America…so you live, you learn. Now, why do people hate Goldman? Well, it’s true that they are the biggest and baddest, and it’s true that many aspiring business students dream of working there and may be miffed when they don’t receive an offer (trust me, I never applied). But there is much more to it than that.

If JP Morgan is the head of the Bankster’s commercial banking arm, Goldman is the King of investment banks. If you want to do a big time transaction, you have Goldman on the phone. If you think JP Morgan had a nice list of alumni, wait to you see some of them from Goldman: Former Secretary of the Treasury Henry Paulson, former Secretary of the Treasury Robert Rubin, current World Bank President Robert Zoellick, and President of the Federal Reserve Bank of New York, William C. Dudley, to start. If you make it past the intense screening process, drink the Goldman kool-ade, and donate 80-90 hours of your life per week for a decade, you can really go place with Goldman Sachs.Much like JP Morgan, Goldman also serves as a primary dealer of US Treasuries to the private Federal Reserve.

In all, it’s probably fair to say that Goldman has more political and economic influence than JP Morgan, while using its power in a more subtle way. The thing is, just because the average Joe doesn’t interact with Goldman or some of these other Bankster organizations doesn’t mean that the banking cartel doesn’t directly affect his life. In reality, that’s my primary purpose behind this blog; exposing these Banksters is what I do now.

Goldman serves as the grand conductor of finance for the Fortune 500. There are a few other MegaBanks with the knowledge, know-how, and connections, but if you’re serious about doing it big, you’re doing it with Goldman Sachs. Try this exercise: Write down the name of 5 large companies (I chose Google, Ford, Wal-Mart, Microsoft and GE) and search “Goldman Sachs + (company name)”. I can pretty much guarantee you that all five searches return a large number of results about both the various finance deals struck between the two entities, and Goldman’s public outlook or forecast of ABC Company’s future stock price.

That goes to the heart of what Goldman is all about; it makes the inside deals with the corporate conglomerates, while at the same time giving investment advice about said corporate conglomerates. Conflict of interest anyone? Don’t forget that this MegaBank also does a very large amount of business with municipalities and States; if there’s a major market, you can be sure that Goldman has a tentacle or three in it.

Goldman Sachs really showed its true colors leading up to the Financial Crisis of 2008. It has been caught in ‘ethically questionable’ practices hundreds of times, but my personal favorite was the surfacing of an internal E-Mail written by a top Goldman executive that labeled a financial deal backed by mortgage-backed securities a, well, “shitty deal” (I just realized that this article is quickly just becoming a collection of my favorite stories…too bad). In the months following the distribution of this E-Mail, Goldman went on to sell hundreds of millions of dollars worth of these derivative products to investors, while at the same time making massive bets on the failure of those products. Yes, in case you didn’t know, Goldman Sachs is pretty evil.

Bank of America, CitiGroup, Wells Fargo, et al

Before I go any further I’d like to once again mention that 90% of the employees at these companies are so heavily compartmentalized and bogged down with corporate red tape that they can’t even tell which way is up. However, as the Nuremberg trials showed us, using the defense of ‘I was just following orders’ isn’t going to save you from the firing squad when you have been caught red-handed performing heinous crimes. Goldman may be a bit of an exception since it’s much more tightly knit, but at the vast majority of companies the common worker is unaware of the purpose of his or her work product.

I’m not saying that the customer service representative at your local branch who signed off on fraudulent mortgages deserves a decade of hard time, but perhaps the Regional Vice President who ordered the Branch Manager to push Jumbo loans off on people making $40,000 per year needs some lovin from Bubba. While the decisions are made at the very top, the true power of each organization, and the Banksters and NWO as a whole, comes from the hundreds of thousands of underlings who put policy into effect; either willingly and of their own accord, or unknowingly through what they see as their harmless 9-5 office job.

Now, back to the MegaBanks. Truth be told, if I wrote a profile on every Bankster organization I could easily fill a 400-page book without trying very hard. So, in the interest of keeping this post somewhat ‘blog friendly’, I’ll briefly discuss a few more of these scumbags. One good example to start us off on was a 2010 incident involving Bank of America wrongfully foreclosing on a couple’s home in Florida. The MegaBank broke into the home, seized belongings, and changed the locks.

The only problem? The couple had purchased the home five years earlier, in full, with cash. Not only was Bank of America never involved in that transaction, it never even had a connection to any of the previous owners. A simple ‘coding error’ led to the ransacking of the dream home of two law-abiding citizens. Should the analyst who made this error be strung up for his mistake? As a risk analyst myself I’d prefer to not have that precedent set, because sometimes mistakes are made, but it gets much better…Bank of America continued the foreclosure process for weeks after the mistake had been found, and, despite the insistence of its own realtor, the bank didn’t give up the wrongly seized house until the local Sheriff’s office entered a local branch and threatened to take the money owed to the family out of the bank’s vault.

The Bankster’s hate bad press (lucky for them they own most of the mainstream media), so the situation was quickly rectified. This is but one of countless untold stories of a similar nature; and they all have one common thread among them. To the Banksters, humans are only good for profit, and once the profit is sucked out of us, we’re crushed and discarded like an empty can of Keystone Light.

Now it’s time for my favorite bedtime story, I can’t wait to someday tell it to my children. It goes like this:

Once upon a time in a land far, far away, there was a little bear named Wachovia. The little bear was sad because it couldn’t keep up on the hunts with the big bears. One day, a big bear named Wells Fargo took pity on Wachovia and asked him to join his family. Little Wachovia was sooooo excited. The two bears lived happily ever after, laundering a total of $378.3 Billion in drug money from Mexico and Latin America over a four year period. The End.

Ok, that’s enough. Just go Google this for real. Search “Wells Fargo launders drug money”. Do some research on CitiGroup and Bank of America. Throw in UBS for the hell of it, maybe some Morgan Stanley. It’s easy. If you can read and tie your shoes, you know all these companies are shiesty. Unfortunately, a lot of people A) Can’t read and tie their shoes, and/or B) Don’t care because they are totally zombified by TV, Call of Duty, Pop Culture, and a solid diet of McDonald’s, Krispy Kremes, and prescription pills. I mean, that sounds fun to me sometimes too, I could certainly enjoy a Big Mac and some Xanies right now, but I kind of hate being robbed by a bunch of Bankster, so I think I’ll have to choose option C) Being The Resistance. I hope you will too, but that’s on you. Source

The beast is here :

A former Bank of England economist has called for a total ban on cash and its replacement with credit accounts controlled directly by governments.

In a column for the London Telegraph, fund manager Jim Leaviss all but advocates economic fascism as a means of enabling authorities to respond to financial crises better by implementing a “cashless society.”

“Forcing everyone to spend only by electronic means from an account held at a government-run bank would give the authorities far better tools to deal with recessions and economic booms,” states the introduction to Leaviss’ article.

If you think that sounds authoritarian enough, it gets worse. Leaviss then suggests that your hard earned money be “monitored, or even directly controlled by the government,” with authorities then working to “encourage us to spend more when the economy slows, or spend less when it is overheating.”

Once wonders what form this ‘encouragement’ will take. A tax on bank deposits? Negative interest on savings? Limits on how much you can spend each month?

That’s precisely what Leaviss advocates when he calls for a “transaction tax” that would penalize people for spending their own money.

Under this system, commercial banks would stop taking any money from depositors, instead relying on central banks to provide all their funds. The black market would also cease to exist.

“If notes and coins were abolished and the only way to hold money was through a government-controlled bank, there would be no escape,” writes Leaviss,…

Coming Soon,Chokehold Specialist: How one midsize bank takes a perfectly good company and try and loot the company into bankruptcy, put another way, the greedy bankers done their best to foreclose when there was no good sensible reason to foreclose, “just greed”

http://www.hnewswire.com/bankers-and-tech-executives-know-the-collapse-of-society-is-coming/

StevieRay Hansen

HNewsWire Editor

![]()

1 COMMENTS