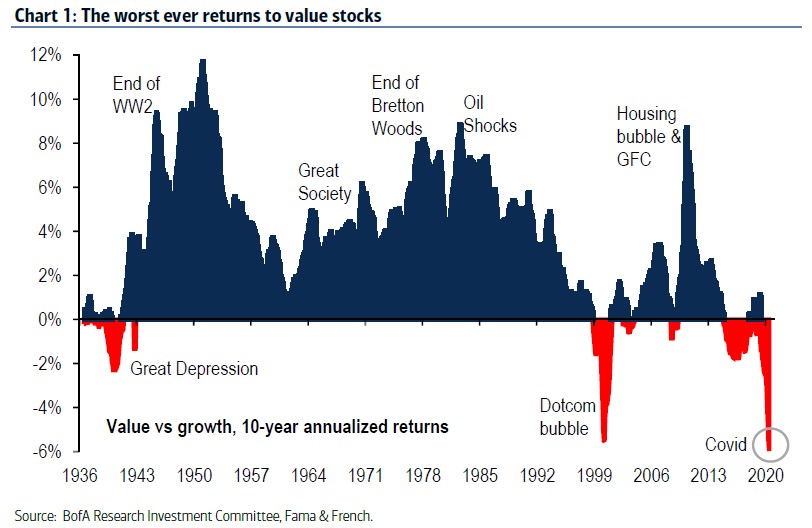

Last week, we brought you some of the latest musing from Bank of America’s Jared Woodard, who in the latest Research Investment Committee report discussed the reason why value investing is dead…

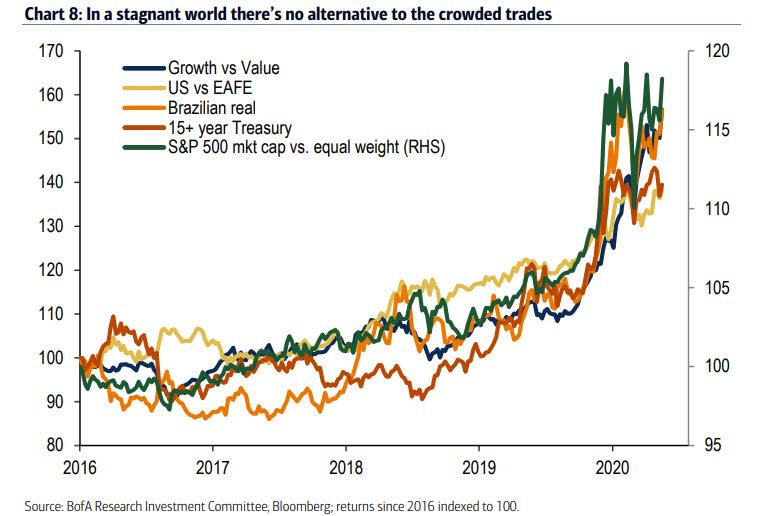

… attributing it to a recent transformation in the market where it is “all one trade” now:

However, besides the merely reflexive, where central bank liquidity, relentless momentum chasing, frenzied retail investing in out of the money calls and 3x levered ETFs coupled with the occasional institution forcing a marketwide gamma squeeze, combine into one explosive force propelling the “one trade” ever higher in the process leaving value in the dust, there is a far more tangible – or rather intangible – reason why “value” is no longer value in the conventional sense.

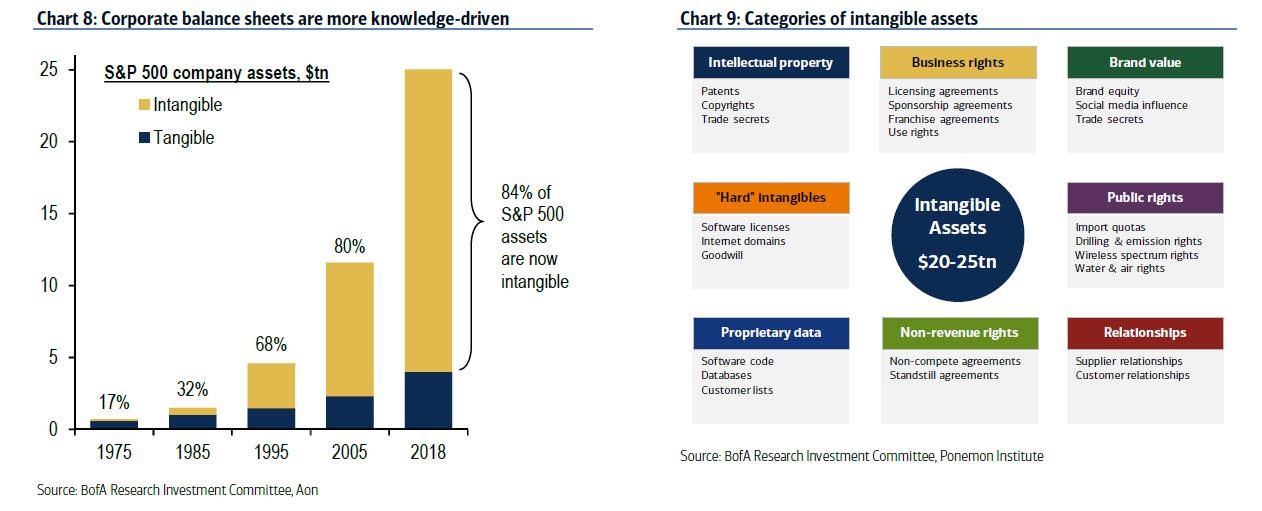

As BofA writes, investors should simply reconsider the definition and meaning of “value.” Take the price-to-book ratio, a favorite metric from the days of Graham & Dodd, and which to this day remains a key input to all major value indexes and factors. As BofA notes, investors should be aware that traditional book value (assets minus liabilities) ignores many of the resources that are most important to companies today.

This means that market leaders – such as enterprise software firms – generate cash flows in ways not easily recognized by conventional valuation metrics. At the same time, research & development performed by a company is recognized only as an expense, and investments in the skills of employees have conventionally only been recognized as administrative expenses.

But, BofA asks, what’s more intuitively valuable to a company like Google: the physical buildings and the network servers inside them, or the intangible algorithms running on those servers? In other words, whereas traditional book value makes sense in an economy composed of factories, farms, and shopping malls, it is increasingly irrelevant in an economy driven by intangibles like patents, licensing agreements, proprietary data, brand value, and network effects.

And the punchline: from just 17% in 1975, the total value of corporate intangibles has risen to over $20 trilion, representing a record 84% of all S&P assets! A breakdown of this divergence is shown below:

What does this mean for investors? As BofA’s Woodard concludes, “recent academic literature shows that an adjusted book value measure accounting for intangible assets can produce significantly better returns.” An adjusted valuation ratio would add the following to tangible book value:

- Reported intangible assets ex-goodwill;

- Research & development: expenses depreciated at sector-average rates; and

- Organizational capital: 30% of SG&A expenses depreciated at 20%/year

Receive a daily recap featuring a curated list of must-read stories.

There is already scientific backing for such a portfolio shift: Park (2019) found that an intangible-adjusted value strategy improved average annual returns by 260bps per year versus a benchmark. So for all those wondering why their value strategy isn’t working, don’t forget to account for the intangibles. Source: ZeroHedge

StevieRay Hansen

Editor, BankstersCrime

God often uses men who are not of the best moral character. Pharaoh, Nebuchadnezzar, Cyrus, Herod, and Trump (amongst others), to accomplish His will in events He orchestrates during human history. We either trust the sovereignty of God or we don’t. Nothing happens apart from Him…

The best index to a person’s character is how he treats people who can’t do him any good, and how he treats people who can’t fight back…

The Birth Pains Are Growing Stronger….

One of the signs of ruling class collapse is when they can no longer enforce the rules that maintain them as a ruling class. When the Romans started making exceptions to republican governance, it was a matter of time before someone simply decided the rules no longer applied to them. Perhaps the robot historians will consider Obama our Marius or Sulla. Maybe that person is in the near future. Either way, the rule of law is over and what comes next is the rule of men.

“Don’t piss down my back and tell me it’s raining.” Outlaw Josey Wales

WE NOW LIVE IN A WORLD THAT IS PURE FABRICATION

![]()