BanksterCrime

As Trump Launches a Crypto Firm, FBI Reports Crypto Fraud Has Exploded to $5.6 Billion; Representing Almost 50 Percent of All Financial Fraud.

By Pam Martens and Russ Martens:

Last Thursday, the Senate Banking Committee held a hearing on combating financial frauds against consumers. During the hearing, Senator Jon Tester of Montana held up his mobile phone and said: “Every day, every day, I either get an email or a phone call from somebody who’s trying to screw me out of my money.”

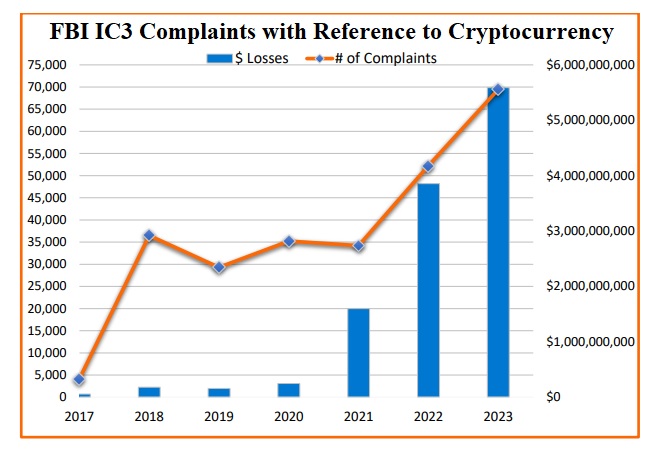

According to the FBI, it is highly likely that a large number of the people trying to screw both you and Senator Tester out of your money are crypto fraudsters. On September 9, the FBI released its 2023 report on crypto fraud, which made the following findings:

“In 2023, the Federal Bureau of Investigation (FBI) Internet Crime Complaint Center (IC3) received more than 69,000 complaints from the public regarding financial fraud involving the use of cryptocurrency, such as bitcoin, ether, or tether. Estimated losses with a nexus to cryptocurrency totaled more than $5.6 billion.”

“While the number of cryptocurrency-related complaints represents only about 10 percent of the total number of financial fraud complaints, the losses associated with these complaints account for almost 50 percent of the total losses.”

“The decentralized nature of cryptocurrency, the speed of irreversible transactions, and the ability to transfer value around the world make cryptocurrency an attractive vehicle for criminals, while creating challenges to recover stolen funds.” (Bold emphasis on the word “irreversible” was added by Wall Street On Parade.)

“Once an individual sends a payment, the recipient owns the cryptocurrency and often quickly transfers it into an account overseas for cash out purposes.”

Elsewhere in the report, the FBI delves a little deeper into why the irreversible nature of crypto transactions makes them a magnet for criminals. It writes:

“Irrevocable Transactions that Move Quickly: A cryptocurrency transfer can occur anywhere. The only requirements for transmitting funds from a particular address is the associated private key (which functions like a password or a PIN) and an Internet connection. Third parties do not sit between, or authorize, transactions and transactions are irrevocable – meaning they cannot be reversed. Criminal actors connected to the Internet from anywhere in the world can also exploit these characteristics to facilitate large-scale, nearly instantaneous cross-border transactions without traditional financial intermediaries that employ anti-money laundering programs.”

Let that sink in for a moment: no anti-money laundering compliance personnel that are required at banks in the U.S.; no ability to reverse transactions as banks can do to correct errors. This would seem to be an ideally formatted platform for criminals.

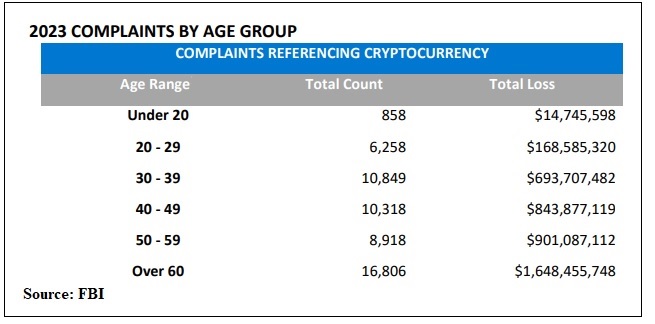

The FBI report breaks down the amount of financial fraud by age group, with the finding that people over 60 years of age are the number one target for crypto fraudsters. These seniors account for $1.6 billion of the $5.6 billion lost to crypto fraud in 2023, or 29 percent of the total.

Given the increasing role that crypto is playing in fraud against the most vulnerable citizens in the U.S., one has to seriously question Republican presidential candidate Donald Trump’s decision last evening to announce that he and his family are launching a crypto firm called World Liberty Financial.

CNBC reported the following about the new crypto firm yesterday:

“A copy of an early internal report, known as a white paper and obtained by CoinDesk, listed Barron [Trump] as ‘Chief DeFi Visionary,’ Eric and Donald Jr. as ‘Web3 Ambassadors,’ and Trump Sr. as ‘Chief Crypto Advocate.’

“But while the Trumps will receive compensation from the project, the platform itself is ‘not owned, managed, operated or sold’ by members of the Trump family.

“[Steve] Witkoff, a real estate investor, and Eric Trump, executive vice president of the Trump Organization, are the two people calling the shots at World Liberty Financial, according to a person familiar with the project. Both are new to the crypto industry.”

Witkoff was the individual who was playing golf with Trump at his golf club in West Palm Beach, Florida on Sunday when there was an attempted assassination of Trump – the second attempt since July.

For more background on what’s behind Trump’s recent embrace of crypto, see our report: Donald Trump Gives a Speech on Not Letting China Win the Crypto Race – Not Realizing China Banned Crypto Mining and Transactions Four Years Ago.

![]()