BanksterCrime

A Wall Street Regulator Is Understating Margin Debt by More than $4 Trillion – Because It’s Not Counting Giant Banks Making Margin Loans to Hedge Funds

By Pam Martens and Russ Martens:

Most market watchers rely on the monthly margin debt figures published by Wall Street’s self-regulator, FINRA, as the reliable gauge in determining how much of securities trading on Wall Street is being done with borrowed money, known as margin debt.

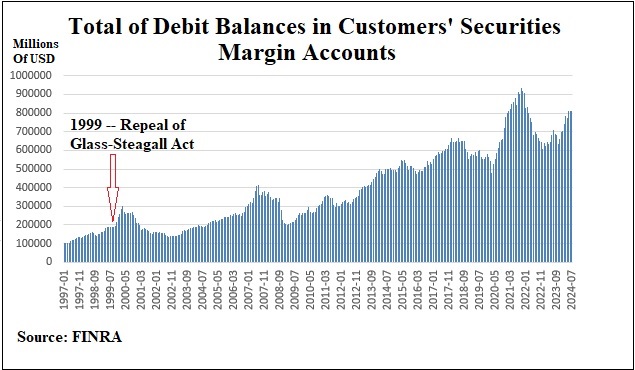

According to the FINRA data, as of March 31, 2024, margin debt stood at $784.136 billion.

Unfortunately, FINRA only has access to margin debt data filed by the brokerage firms it regulates (also known as brokers and dealers). Thanks to the repeal of the Glass-Steagall Act in 1999, which allowed federally-insured banks to be gobbled up by the trading casinos on Wall Street, the vast bulk of margin debt is now being loaned out not by brokerage firms but by giant banks where the U.S. taxpayer will be on the hook for a bailout if they go belly up from bad gambles – as occurred in the crash of 2008.

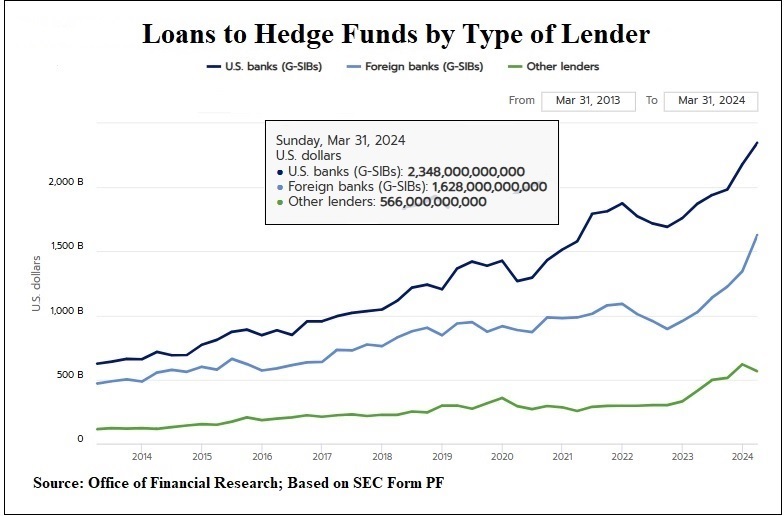

The U.S. Treasury’s Office of Financial Research (OFR) has posted a stunning graph showing that as of March 31, 2024, Global Systemically Important Banks in the U.S. (G-SIBs) had loaned out $2.348 trillion to hedge funds. Foreign Global Systemically Important Banks had loaned out another $1.628 trillion to hedge funds; and “Other Lenders” had loaned out an additional $566 billion to hedge funds. That brought the total of margin loans to just hedge funds on March 31, 2024 to a total of $4.542 trillion. (Put your cursor on the graph lines here or see the graph at the top of this page.)

OFR defines “Other Lenders” as “regulated banks that are not G-SIBs and nonbank lenders.”

There are eight U.S. G-SIBs: Bank of America Corporation, The Bank of New York Mellon Corporation, Citigroup Inc., The Goldman Sachs Group, Inc., JPMorgan Chase & Co., Morgan Stanley, State Street Corporation and Wells Fargo & Company. Each of these own large federally-insured banks in the U.S. which are backstopped by the U.S. taxpayer.

The Federal Reserve – a key federal regulator of the largest bank holding companies in the U.S. – is completely lost when it comes to tabulating out-of-control margin debt in the U.S. banking system — which is creating giant speculative bubbles.

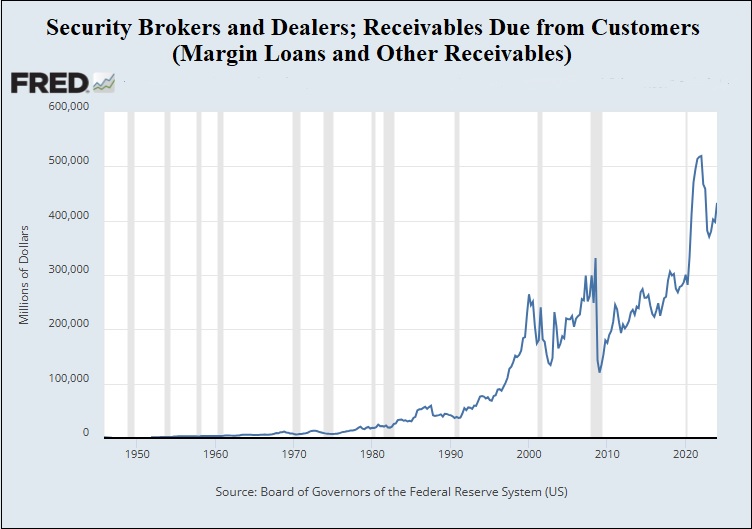

The Fed’s data shows that as of March 31, 2024, margin debt totaled a mere $432.83 billion. (Run your cursor over the line here or see graph below.) The Fed says it obtained its margin data from its Z1 Statistical Release and that it covers just brokers and dealers.

Why the Fed’s margin debt at broker dealers is $351 billion less than reported by FINRA and more than $4 trillion less than reported by the U.S. Treasury’s Office of Financial Research, buttresses our longstanding argument that the Fed is grossly incompetent when it comes to understanding Wall Street megabanks and a captured regulator when it comes to imposing critically-needed reforms.

What is noteworthy, however, on the Fed’s data chart on margin loans, is how dramatically the tally has spiked since the repeal of the Glass-Steagall Act in 1999, versus decades of much slower growth prior to that time. The same observation can be made on the FINRA graph above.

According to a March 4 report from the Bank for International Settlements (BIS), the Prime Broker operations of Goldman Sachs (GS), Morgan Stanley (MS), and JPMorgan Chase (JPM) were each servicing more than 1,000 hedge funds as of 2022. Prime Broker services include making margin loans to the hedge funds. The BIS reports also notes the following about these hedge fund clients:

“As for opaqueness, the assets of a quarter of hedge funds are not fully independently valued, comprising 38% of hedge fund assets, making it more difficult for PBs [Prime Brokers] to trust the fund’s stated asset values, especially in adverse market conditions.”

What could possibly go wrong?

![]()